Trading Tuesday - Nigerian Markets Steady on Strong Reserves, as Global Investors Weigh Fed Policy, Geopolitical Tensions, and Energy Volatility

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigerian markets held a cautious tone, with bond yields flat and the naira firming at ₦1,506/$1 on improved FX liquidity and rising reserves. While local investors weighed the impact of the proposed 5% fuel surcharge and sectoral shifts, global markets were shaped by anticipation of U.S. inflation data, fresh geopolitical tensions in the Middle East, and a weaker dollar following sharp U.S. job revisions. Commodity markets reflected safe-haven demand, with gold touching new highs and oil edging up despite oversupply concerns.

Nigerian News & Market Update

Nigerian Bonds Investors Hold Positions, Yields Steady:

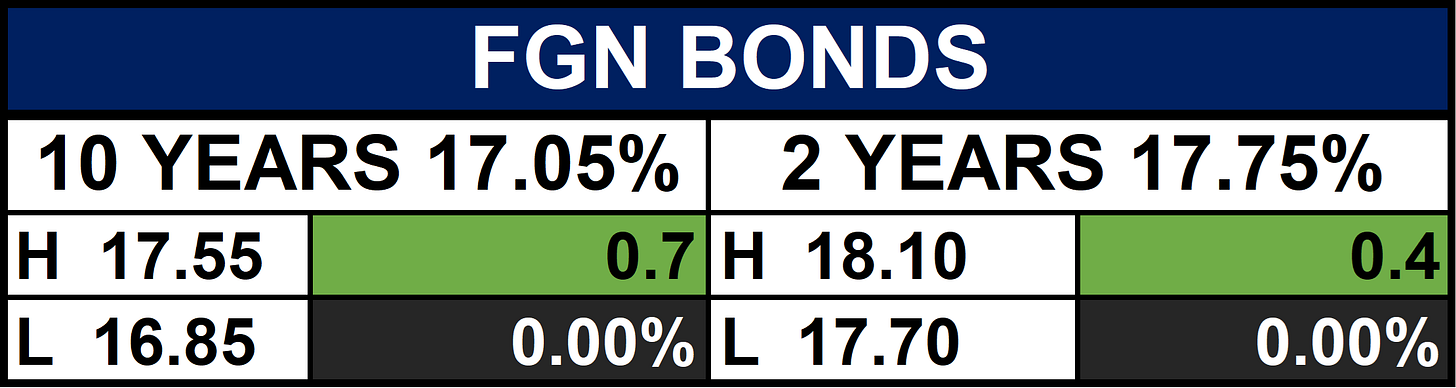

Nigeria’s bond market was largely quiet, with average yields closing flat at 16.97%. Short-term bonds saw slight profit-taking, while mid-tenor papers like the 2031s and 2033s attracted buying, pushing their yields lower. Treasury bills traded bearish, with average yields up 8bps to 18.72%, led by the actively traded 1-year paper. The CBN raised ₦1.205trillion from the Open Market Operations (OMO) and T-bill sales, though some bids were rejected. Analysts expect trading to stay subdued and yields elevated in the near term. - dmarketforces

Naira appreciates at ₦1506 amidst reduced FX pressure:

The naira appreciated to ₦1,506/$1 at the official window, supported by reduced FX pressure and improved dollar liquidity. Foreign reserves rose to $41.5billion, boosted by inflows from oil revenue and portfolio investments. Total FX inflows stood at $567.2million, led by FPIs (32.5%) and CBN interventions (30.5%). In the parallel market, the naira held steady at ₦1,540/$1. Meanwhile, Brent crude fell 3.85% to $65.5/bbl, extending its year-to-date decline to over 12%. Analysts expect the naira to remain relatively firm in the near term. - DailyTrust

External Reserves Hit $41.5billion As NEFM Records $2.8billion Inflow:

Nigeria’s external reserves rose for the ninth straight week to $41.5billion, boosting the naira’s appreciation at both official (₦1,514.87/$1) and parallel (₦1,538/$1) markets. In August, FX inflows dropped 26.9% MoM to $2.8billion, as foreign inflows hit a four-month low on weaker FPI and FDI, though corporate inflows surged. Domestic inflows also fell, except for sharp increases from individuals and the CBN. Analysts say steady reserve growth strengthens the CBN’s ability to stabilize FX markets, though pressure remains in the forwards market, where the naira weakened across all tenors on longer-term caution. - Leadership

FG defends 5% fuel surcharge, says not to burden Nigerians:

The Federal Government defended its planned 5% fuel surcharge, saying it will fund road repairs rather than burden Nigerians. Committee chair Taiwo Oyedele admitted inflation concerns but argued poor roads drive high transport and food costs. He said the levy will be timed to limit impact and funds ring-fenced for infrastructure, with room for private sector support. The TUC, however, has threatened a nationwide strike if the tax is not scrapped. - Punch

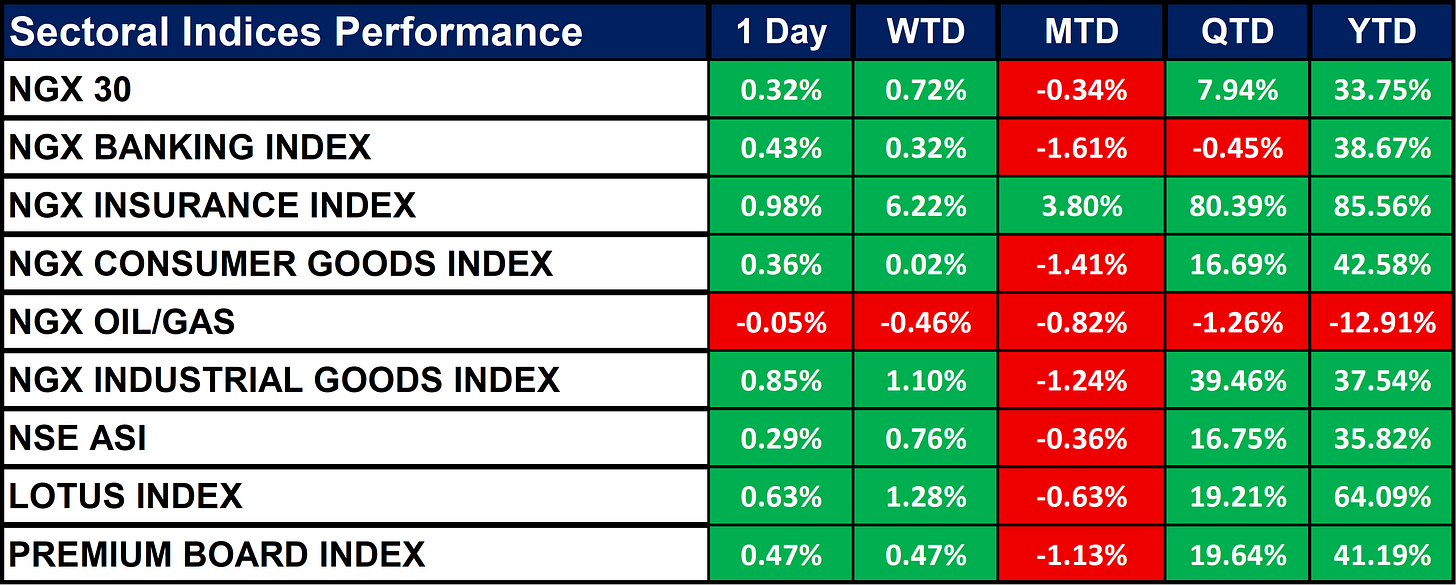

Nigeria Sectoral Indices Performance

The table below shows that the NGX sector indices show broad strength YTD, led by Insurance (+85.56%) and the Lotus Index (+64.09%), while Oil & Gas (-12.91%) is the main laggard. Most sectors posted small 1-day gains, with Insurance (+0.98%) and Industrial Goods (+0.85%) leading, though monthly (MTD) performance is slightly negative across most indices. Overall, the market remains strongly positive in 2025, with only Oil & Gas underperforming.

Fixed Income (FGN Bonds)

Global News & News Update

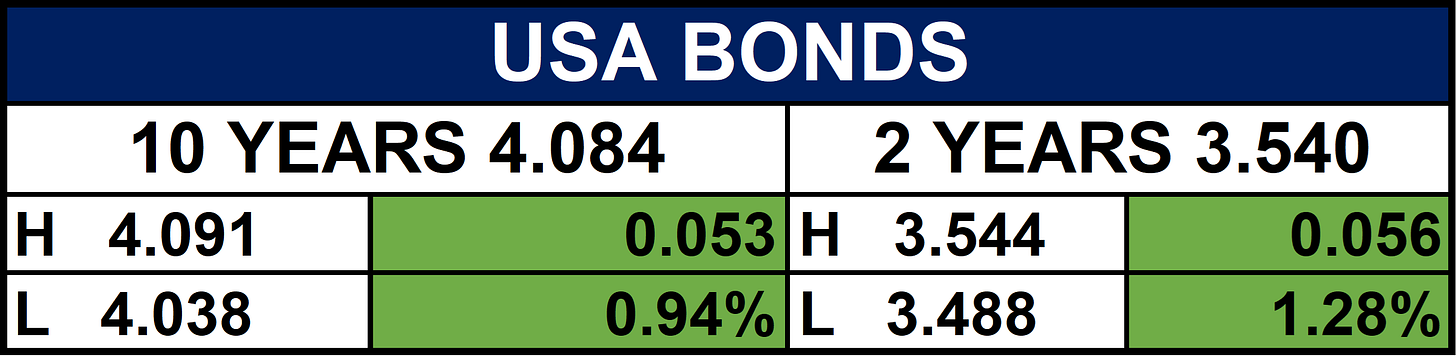

Treasury yields hold steady ahead of key inflation reports:

U.S. Treasury yields were little changed as investors awaited key inflation data the PPI on Wednesday and CPI on Thursday ahead of the Fed’s Sept. 16–17 meeting. The 10-year yield rose 2 bps to 4.05%, while the 2-year climbed to 3.52%. Markets expect a 25 bps Fed rate cut next week after weaker job growth and a sharp payrolls revision. Analysts noted that 10-year yields are oversold and could rebound, though failure to hold support may push them toward April’s low of 3.9%. - CNBC

Ethiopia opens Africa's largest hydroelectric dam to Egyptian protest:

Ethiopia has inaugurated the Grand Ethiopian Renaissance Dam (GERD), Africa’s largest hydroelectric project, now generating 5,150 MW of power. The $5 billion project is a source of national pride and will expand electricity access and exports. However, it has heightened tensions with Egypt which relies on the Nile for 90% of its water and Sudan, both of which fear reduced water flows. Ethiopia insists the dam will not harm its neighbors, but it remains a regional flashpoint over water security. - Reuters

Oil spikes, gold hit fresh record after Israel attacks in Qatar:

Gold hit a record high and oil rose to $67/bbl as investors rushed to safe-haven assets after Israel said it struck Hamas leaders in Qatar, raising geopolitical tensions. The yen also gained, while equities showed little reaction. Analysts noted gold’s surge and oil’s spike were expected, but suggested crude’s rally may fade as fundamentals of oversupply resurface. Markets remain cautious, awaiting clarity on whether the conflict will escalate further. - Reuters

US dollar drops after huge number of jobs wiped out in 12-month period:

The U.S. dollar slipped 0.3% to ¥147.03 after new data showed the economy lost 911,000 jobs from April 2024 to March 2025, a much larger downward revision than expected. The report signaled a weaker labor market, while the dollar index held modestly higher at 97.59. - Reuters

GASTECH Asian demand for US LNG unshaken by China-Russia pipeline plans, says Venture Global CEO:

Venture Global’s CEO said China’s new gas deals with Russia won’t reduce Asian demand for U.S. LNG, stressing strong long-term contracts and rising needs from Europe and Asia as they move from coal to gas. He downplayed oversupply risks, citing Qatar’s expansion as positive for developing markets, and reaffirmed that Venture Global will stay price competitive despite ongoing legal disputes with buyers. - Reuters

Indonesia's new finance minister plans liquidity measures with central bank to boost growth:

On Sept. 9, 2025, Indonesia’s new finance minister Purbaya Yudhi Sadewa vowed to boost liquidity with the central bank while keeping the budget deficit capped at 3% of GDP. His sudden appointment, replacing Sri Mulyani Indrawati, rattled markets, with stocks, bonds, and the rupiah falling. Protests over government spending and governance continued, fueling concerns about fiscal credibility under President Prabowo Subianto’s populist agenda. - Reuters

Indices, Commodities & Currencies

The table below depicts that Global markets were mixed: the Dow Jones rose, but the S&P 500, Nasdaq, and DAX slipped, while the Nikkei fell sharply. Oil prices gained (WTI and Brent up), but natural gas declined. Soft commodities like cocoa, sugar, and orange juice rose, while metals weakened (gold, silver, platinum down). Grains were mixed, with small gains in soybean meal and rice, but soybeans and wheat eased. The U.S. dollar strengthened, while the euro, yen, and pound weakened slightly.

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigeria’s FX stability should hold on strong reserves and portfolio inflows, though the fuel surcharge may lift inflation risks. Globally, Fed policy, geopolitical tensions, and energy volatility will guide sentiment, keeping investors defensive. Nigeria’s solid reserves and equities support cautious optimism, but fiscal policy and external shocks remain key drivers.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.