Trading Tuesday - Nigeria’s Economy Strengthens as Capital Market Shifts to T+2 Amid Global Energy and Inflation Developments

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap. This edition highlights Nigeria’s strong economic momentum, with Q3 GDP growth of 3.98%, a Purchasing Managers’ Index (PMI) of 56.4, and the historic shift to a T+2 settlement cycle, alongside broad-based gains in the stock market. Globally, investors can track energy sector developments, rare earth exports, and inflation trends in major economies, all shaping market sentiment.

Nigerian News & Market Update

Nigeria completes shift to T+2 settlement, targets T+1:

Nigeria’s capital market has officially moved from a T+3 to a T+2 settlement cycle, enhancing efficiency, liquidity, and investor confidence, with T+1 expected next year. - Punch

FG Offers 50 Oil Blocks, Targets $10billion Investments In 2025 Licensing Round:

Nigeria has launched a 50-oil-block licensing round aiming to attract $10billion in investments and boost reserves, production, and jobs. - Channels

Expansion in economic activities persists as PMI index hits 56.4pts – CBN:

Nigeria’s economy strengthened further in November as the Purchasing Managers’ Index (PMI) rose to 56.4, marking a year of continuous expansion across industry, services, and agriculture. - Vanguard

Nigeria’s GDP rose by 3.98% in Q3 2025:

Nigeria’s GDP grew 3.98% in Q3 2025, driven by stronger agriculture, industry, and non-oil sector performance. - TheNation

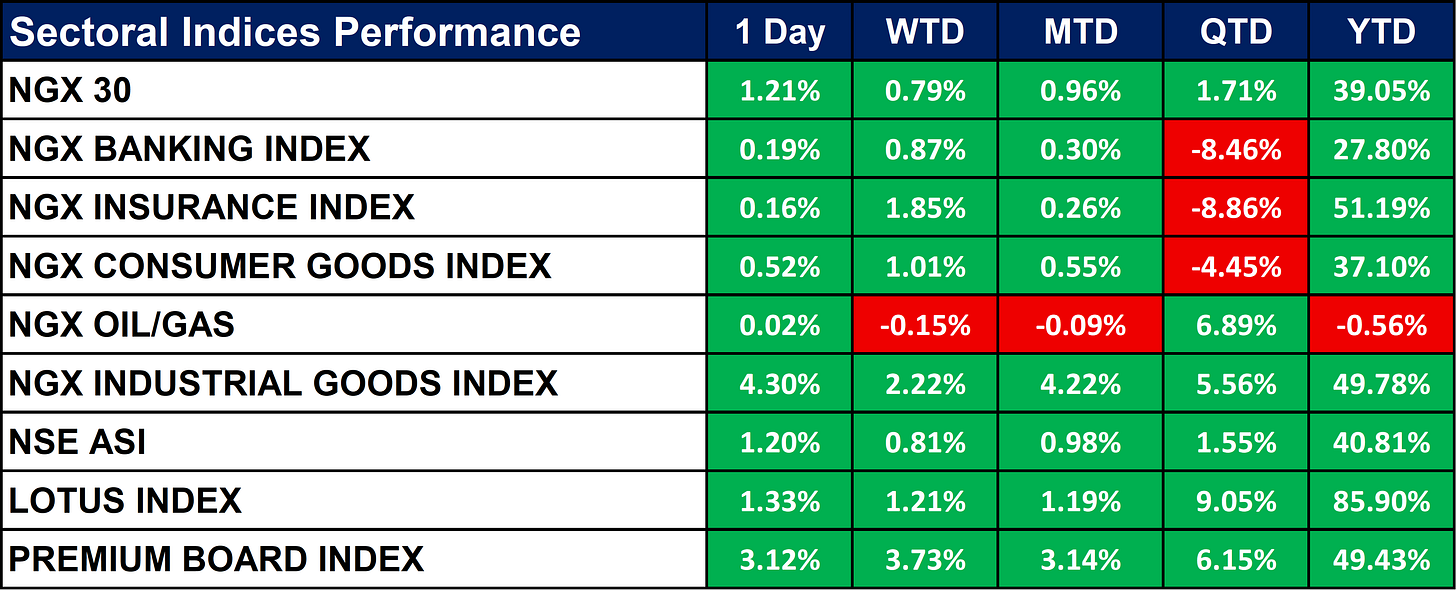

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian stock market showed broad-based gains, with the NGX 30 up 1.21% and the NSE ASI rising 1.20% for the day.

The Industrial Goods Index led sectoral performance, surging 4.30%, while Banking and Insurance indexes posted modest daily gains of 0.19% and 0.16%, respectively. Year-to-date, the Lotus Index remains the top performer with an 85.90% gain, while Oil & Gas is slightly negative at -0.56%.

Fixed Income (FGN Bonds

Global News & News Update

Exxon in talks with Iraq about buying Lukoil stake in giant West Qurna 2 oilfield:

Exxon Mobil is in talks to acquire Lukoil’s majority stake in Iraq’s giant West Qurna 2 oilfield as sanctions push the Russian firm to sell. - Reuters

China issues first batch of streamlined rare earth export licences:

China has issued new rare earth export “general licences” to ease supply disruptions and accelerate shipments after trade-war controls halted parts of the auto supply chain. - Reuters

India’s October-November sugar output rises 43% on higher recovery rates:

India’s sugar output jumped 43% early in the 2025/26 season, creating an exportable surplus despite regional disruptions. - Reuters

Euro zone inflation ticks up, pointing to steady ECB rates:

Eurozone inflation inched up to 2.2% in November, reinforcing expectations that the ECB will delay further rate cuts. - Reuters

South Korea headline inflation at 2.4% y/y, bolstering case for rate pause:

South Korea’s inflation rose to 2.4% in November on higher food and services costs, reinforcing expectations that the Bank of Korea will keep rates unchanged for longer. - Reuters

OPEC+ members to undergo annual oil capacity audit under new plan:

OPEC+ will conduct annual oil production capacity assessments starting in 2026 to align quotas with actual output and improve market credibility. - Reuters

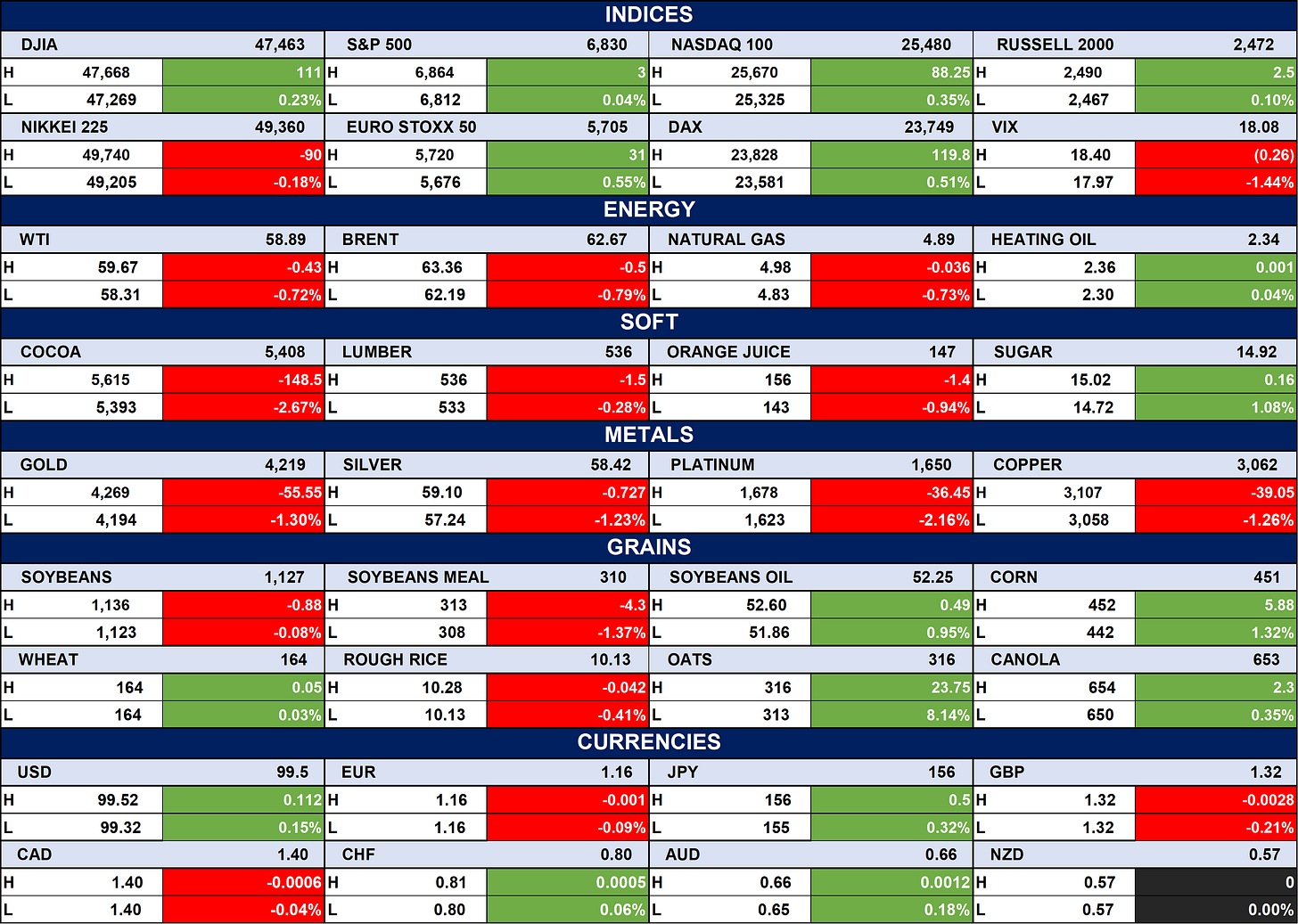

Indices, Commodities & Currencies

Global equity markets showed mixed gains, with the S&P 500, NASDAQ 100, DAX, and Euro Stoxx 50 posting modest positive moves, while the Nikkei 225 declined slightly. Energy and metals largely retreated, with WTI, Brent, natural gas, gold, silver, platinum, and copper all posting losses, while heating oil saw minimal gains.

Grains and soft commodities were mixed, with corn, oats, canola, and soybean oil up, while cocoa, lumber, orange juice, and soybean meal fell; currencies were mostly stable, with slight gains in USD and minor losses in GBP.

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian markets may benefit from faster post-trade settlements, ongoing oil block investments, and continued industrial and non-oil sector growth, while global inflation and energy developments could influence commodity and equity markets. Investors should monitor liquidity trends, policy shifts, and cross-border opportunities to position strategically in an evolving market landscape.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.