Trading Tuesday - Nigeria’s Fiscal Boost and Strong Market Participation Stand Out Amid Global Energy and Commodity Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where we spotlight key developments shaping Nigeria’s financial landscape from rising foreign reserves and robust state bond demand to sector-level equity performance.

We also unpack major corporate updates, regulatory actions, and notable shifts in global energy, commodity, and geopolitical markets. This edition provides a concise snapshot of how local and international trends may influence sentiment, liquidity, and investment opportunities in the days ahead.

Nigerian News & Market Update

Nigeria’s Foreign Reserve Rises To $46billion:

Nigeria’s foreign reserves have surged past $46 billion for the first time since 2018, driven by Eurobond proceeds and stronger FX inflows despite lingering investment challenges. - Channels

Lagos ₦200 Billion Bond Oversubscribed By 55%:

Lagos State’s ₦200 billion bond issuance was oversubscribed by 55%, reflecting strong investor confidence and supporting major infrastructure and sustainability projects under the state’s agenda for the Traffic Management & Transportation, Health & Environment, Education & Technology, Making Lagos a 21st Century Economy, Entertainment–Tourism & Culture, Security & Governance, plus Social Inclusion, Gender Equality, and Youth Engagement (THEMES+) - Dmarketforces

International Energy Insurance MD resigns:

IEI’s MD resigned as the company begins recapitalisation efforts and resumes normal trading after clearing a long-standing ₦14billion debt. - Punch

FIRS appoints Xpress Payment as TSA collecting agent:

Xpress Payment Solutions has been appointed as an official FIRS collecting agent, enabling taxpayers to make TSA-based tax payments seamlessly through its digital and in-branch platforms. - TheNation

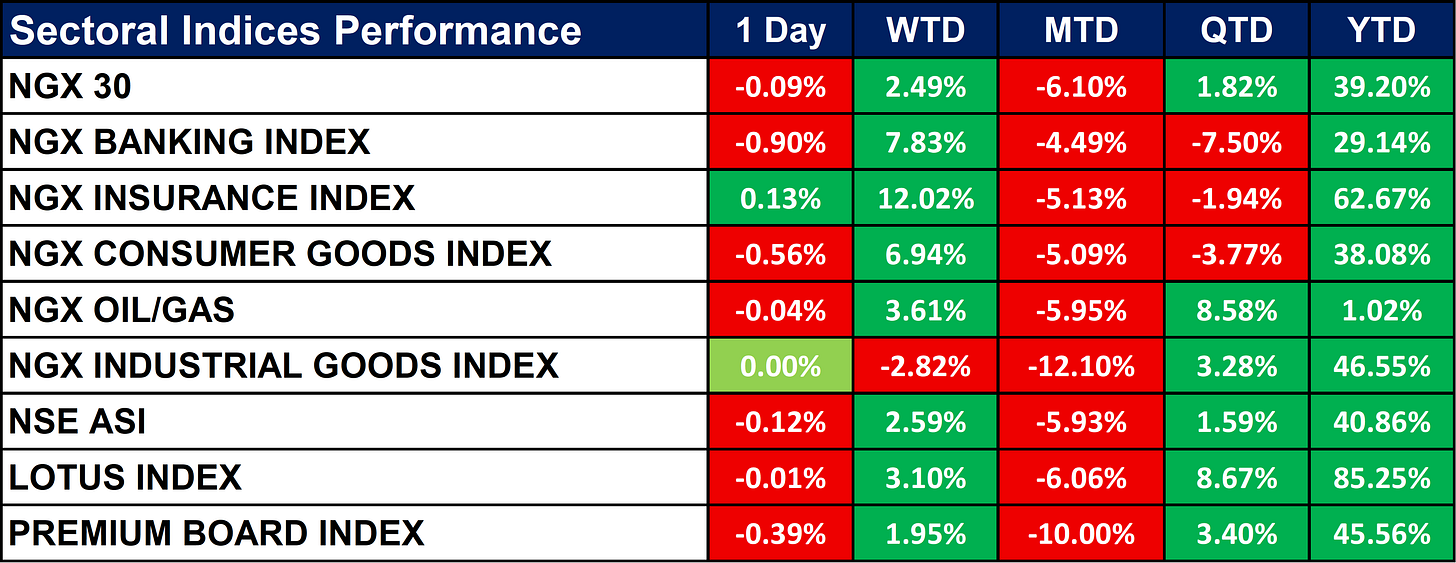

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities were broadly negative on the day, with most sectoral indices posting mild declines, led by Banking (-0.90%) and Consumer Goods (-0.56%). Despite the daily pullback, weekly performance remains positive across sectors, supported by strong gains in Insurance (+12.02% WTD) and Banking (+7.83% WTD). Month-to-date performance is weak across the board, but year-to-date returns remain firmly positive, with Lotus (+85.25% YTD), Insurance (+62.67% YTD), and Industrial Goods (+46.55% YTD) leading.

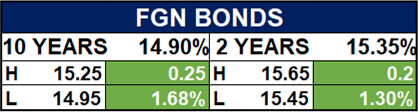

Fixed Income (FGN Bonds)

Global News & News Update

EU approves $2 billion subsidy for German coal exit:

The EU has approved Germany’s €1.75 billion compensation to LEAG for closing its coal plants by 2038 as part of the country’s transition toward climate neutrality. - Reuters

China refiner Yanchang buys crude from UAE, Kazakhstan, instead of Russia, trade sources say:

Chinese refiner Yanchang Petroleum has shifted from Russian crude to buy 3 million barrels from the UAE and Kazakhstan amid heightened sanctions risks. - Reuters

India set for record wheat planting as soil moisture and prices rise:

Indian farmers are expanding wheat planting by about 5% to a record high, driven by better soil moisture, higher prices, and favourable weather, boosting prospects for increased output and lower prices. - Reuters

Ukraine’s DTEK imports its first US LNG via Lithuania:

Ukraine’s DTEK has imported its first U.S. LNG cargo via Lithuania to boost regional energy security and offset production losses from Russian attacks. - Reuters

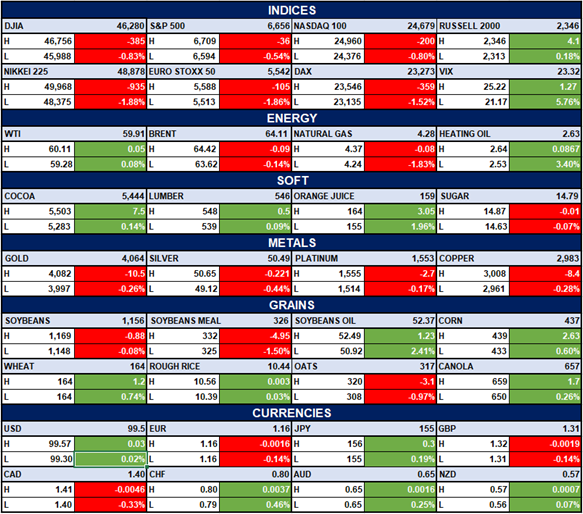

Indices, Commodities & Currencies

The table below depicts that the Global equities mostly traded lower, with major indices like the S&P 500, Nasdaq 100, Euro Stoxx 50, and DAX posting declines, while volatility (VIX) ticked higher. Commodities showed mixed performance: crude oil was slightly down, natural gas dropped sharply, while soft commodities like cocoa and orange juice gained. Currencies were broadly stable, with minor moves across USD, EUR, GBP, and JPY, showing no major directional shift.

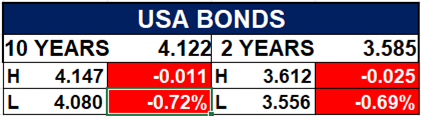

Fixed Income (USA Bonds)

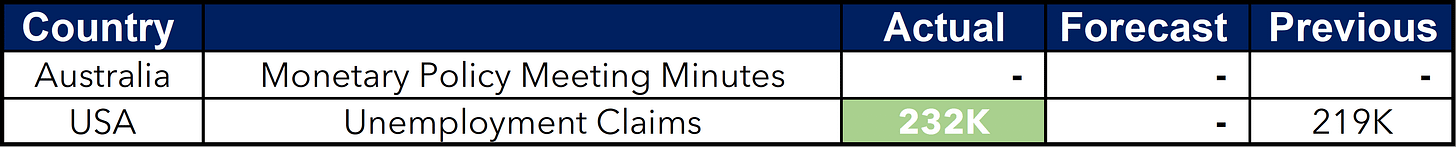

Events

Conclusion

As markets digest Nigeria’s strengthening reserves, heightened investor confidence, and global shifts in energy and commodity flows, short-term volatility may continue but underlying fundamentals remain supportive. Sector rotation is likely as investors reassess opportunities in Insurance, Industrial Goods, and high-yield fixed income amid evolving macro signals. Globally, developments in energy supply, agricultural output, and geopolitical realignments may guide risk sentiment, offering investors both caution and new entry points across asset classes.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.