Trading Tuesday - Nigeria’s Liquidity Boost Drives Treasury Rally as Tinubu Approves ₦4tn Power Bond; Global Markets Mixed Amid Energy and Trade Headwinds

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s markets were mixed as strong liquidity lowered T-bill yields and equities saw gains in insurance and industrial goods amid profit-taking in banking and oil/gas. Government reforms advanced with a ₦4trillion power bond and $500million African Development Bank (AfDB) loan plan. Globally, energy markets were volatile as India’s fuel demand dipped to a one-year low, while geopolitical risks persisted with Ukraine’s gas infrastructure attacks. Trade imbalances weighed on Canada, and budget concerns rose in the Czech Republic, adding to overall investor caution.

Nigerian News & Market Update

Nigerian Treasury Bills Yield Dips, Excess Liquidity Fuels Rally:

Nigerian Treasury bill yields fell as strong demand and excess liquidity drove buying ahead of Q4 issuances. Investors expect lower rates after the CBN’s rate cut. Overall yield dropped 13bps to 17.8%. - dmarketforces

CBN Turns Down 97% of ₦4.1 Trillion OMO Bills Subscription:

CBN rejected 97% of ₦4.1trillion Open Market Operations (OMO) bids, allotting ₦998.1billion at 20.1%. Strong investor demand persisted, and secondary market yields fell 3bps to 20.5%. - dmarketforces

Tinubu approves ₦4trillion bond to clear GenCos debts – Power minister:

Tinubu approved a ₦4trillion bond to clear GenCo and gas debts, stabilising Nigeria’s power sector. Adelabu said reforms are boosting investment and revenue, which rose 70% to ₦1.7trillion in 2024. Ongoing projects aim to add 7,000MW to the national grid. - Punch

FG Eyes $500million Budget Support From AfDB:

Nigeria plans to secure a $500million African Development Bank (AfDB) loan to support Tinubu’s economic reforms. It’s part of a $1billion two-year budget support programme. Approval is expected before year-end. - Punch

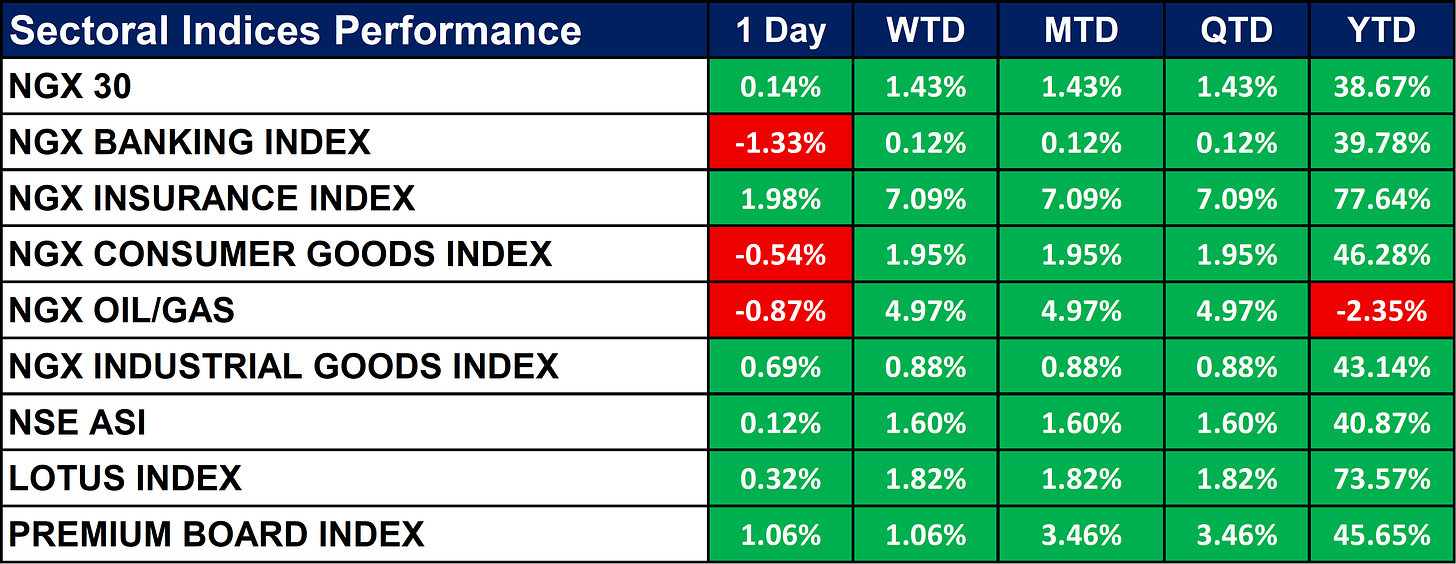

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities closed mixed as the NGX Banking (-1.33%), Consumer Goods (-0.54%), and Oil/Gas (-0.87%) indices declined.

Insurance (+1.98%) and Industrial Goods (+0.69%) led gains, driving a mild overall uptick in the All-Share Index (+0.12%). Year-to-date, Insurance (+77.64%) and Lotus (+73.57%) remain the best performers, while Oil/Gas lags at -2.35%.Fixed Income (FGN Bonds)

Global News & News Update

India’s September fuel demand drops to one-year low:

India’s fuel demand fell 0.5% in September to a one-year low of 18.63million tons but rose 7% year-on-year. Diesel use increased, petrol declined, and LPG edged up.

Monsoon slowed demand, though exports and Russian supply stayed strong. - ReutersCzech election winner flags potential higher 2026 budget deficit:

Czech 2026 budget deficit may exceed 286billion crowns as Babis cites a 60billion funding gap. He warned projects could stall without new financing.

A provisional budget is likely if government talks delay approval. - ReutersCanada’s August trade deficit widens more than forecast as exports drop:

Canada’s trade deficit widened to C$6.32billion in August as exports fell 3% and imports rose 0.9%. Declines in gold, lumber, and machinery exports drove the drop. Analysts linked the weakness to U.S. tariffs and trade disruptions. - Reuters

Ukraine wants to increase gas imports by 30% after Russian attacks:

Ukraine plans to raise gas imports by 30% after Russian strikes damaged energy infrastructure. Priority is securing supplies for the winter months.

Import needs depend on recovery speed and further attacks. - Reuters

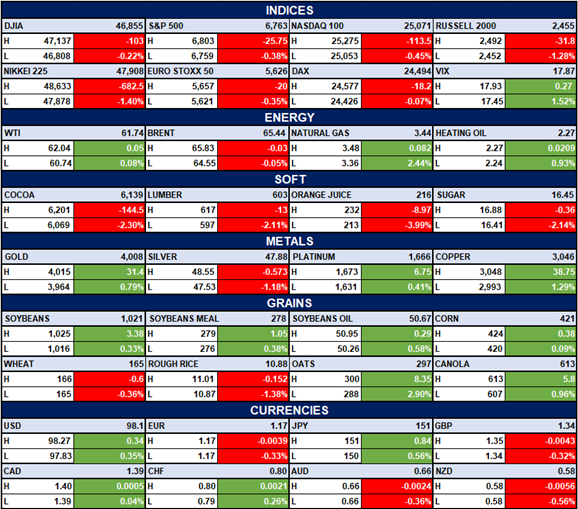

Indices, Commodities & Currencies

The table below depicts that the Global markets closed mixed. U.S. and European indices fell slightly, led by Nasdaq (-0.45%) and Nikkei (-1.4%). Energy prices was mixed, with Brent down (-0.05%) and Natural Gas gaining 2.44%. Most commodities declined, especially Cocoa (-2.3%) and Silver (-1.18%), while the USD strengthened broadly against major currencies.

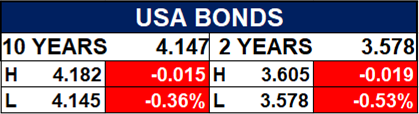

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian markets may see continued bullish sentiment in fixed income due to high liquidity and expectations of further yield moderation. Equities could trade mixed as investors rebalance positions ahead of Q4 earnings and fiscal policy developments. Globally, caution may dominate amid slowing demand indicators, trade deficits, and geopolitical tensions keeping energy and commodity prices on edge. Investors should watch for policy signals from the CBN and fiscal updates that could shape near-term opportunities across sectors.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.