Trading Tuesday - Nigeria’s Markets Reignite: Corporate Gains, Bullish Bonds & Global Uncertainty Shape Investor Focus

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s investment climate shows renewed strength as Eterna Plc rebounds to profitability, and the FG bond auction exceeds expectations, reflecting strong investor confidence. The withdrawal of Dangote’s ₦100billion lawsuit eases regulatory tension in the oil sector. Equities are broadly positive, led by consumer goods and banking, while oil & gas lags. Globally, markets await the Fed’s rate decision, with energy prices rising and safe-haven currencies gaining. Overall, local sentiment is improving, though global caution persists.

Nigerian News & Market Update

Eterna’s Revenue Jumps 71% to ₦313.6billion, Firm Ratifies New Leadership:

Eterna Plc reported a strong financial rebound in 2024, with revenue rising 71% to ₦313.6 billion and gross profit up 136% to ₦39.9 billion. The company posted a ₦4.48 billion pre-tax profit, reversing a ₦11.9 billion loss from 2023. At its 32nd AGM, shareholders approved key board decisions and praised the company’s strategic direction. Chairman Dr. Gabriel Ogbechie attributed the turnaround to decisive leadership, operational discipline, and a focus on innovation and growth across the energy value chain. - Thisday

FG Records Bullish Investors Demand In July’s ₦186billion Bond Auction:

At the July 2025 FGN bond auction, the DMO raised ₦185.93 billion, exceeding its offer size. The 5-Year APR 2029 bond attracted ₦39.08 billion in subscriptions, with ₦13.43 billion allotted at a 15.69% marginal rate. The 7-Year JUN 2032 bond drew ₦261.60 billion in bids, with ₦172.50 billion allotted at a 15.90% marginal rate. Despite coupon rates of 19.30% and 17.95%, the lower marginal rates suggest declining yield expectations. A total of 149 bids were received; 74 succeeded. Interest is paid semi-annually, with principal repaid at maturity. - Channels

Dangote Refinery Withdraws ₦100bn Lawsuit Against NNPCL(Nigerian National Petroleum Company Limited), NMDPRA(Nigerian Midstream and Downstream Petroleum Regulatory Authority), Others:

Dangote Refinery has withdrawn its ₦100 billion lawsuit against the NMDPRA, NNPC Ltd, and five other petroleum marketers, ending a legal dispute over the issuance of fuel import licenses. The suit alleged that NMDPRA violated the Petroleum Industry Act by allowing imports despite Dangote's refining capacity, which the company claimed undermined local refining and encouraged monopolistic practices. The defendants countered that the licenses were necessary due to supply shortfalls and that Dangote sought to monopolize the sector. No official reason or settlement was disclosed for the withdrawal. - Channels

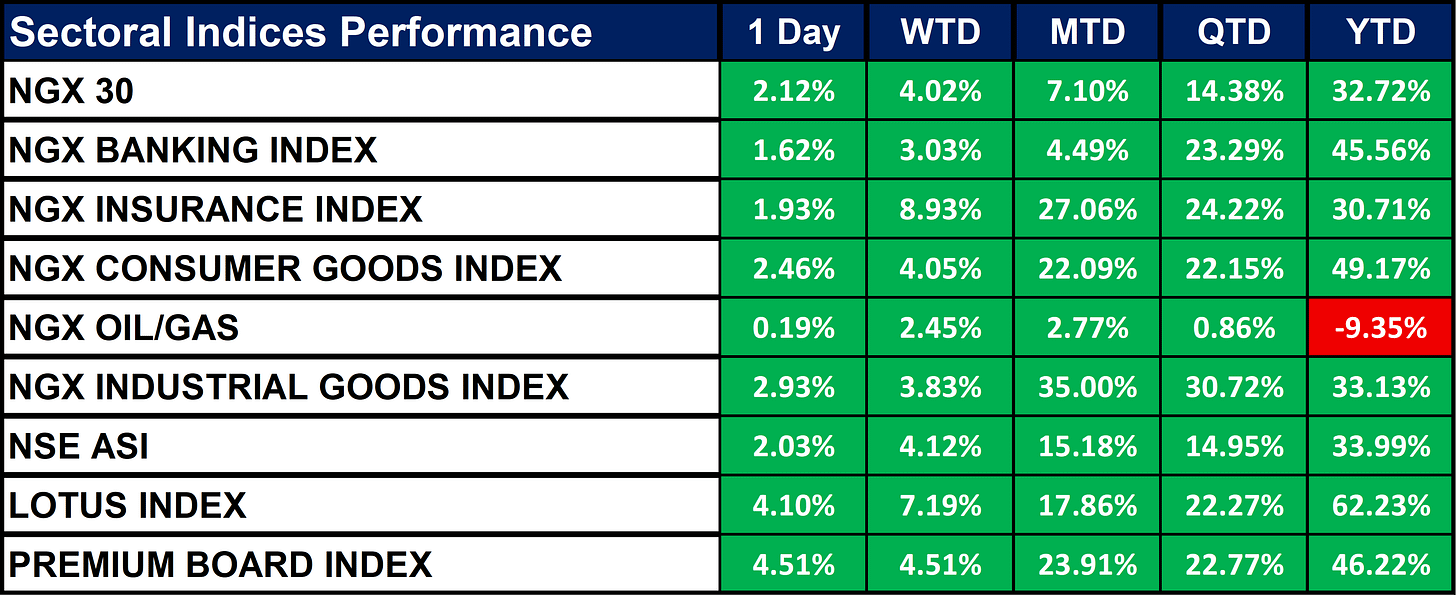

Nigeria Sectoral Indices Performance

The table below shows that he NGX sectoral indices showed broad positive performance across all timeframes, with Consumer Goods (+49.17%), Banking (+45.56%), and Lotus Index (+62.23%) leading year-to-date (YTD) gains. The Oil/Gas sector is the only laggard, down -9.35% YTD. The Premium Board and Lotus Index posted the highest 1-day gains at +4.51% and +4.10%, respectively, indicating strong investor interest in top-tier and Shariah-compliant stocks.

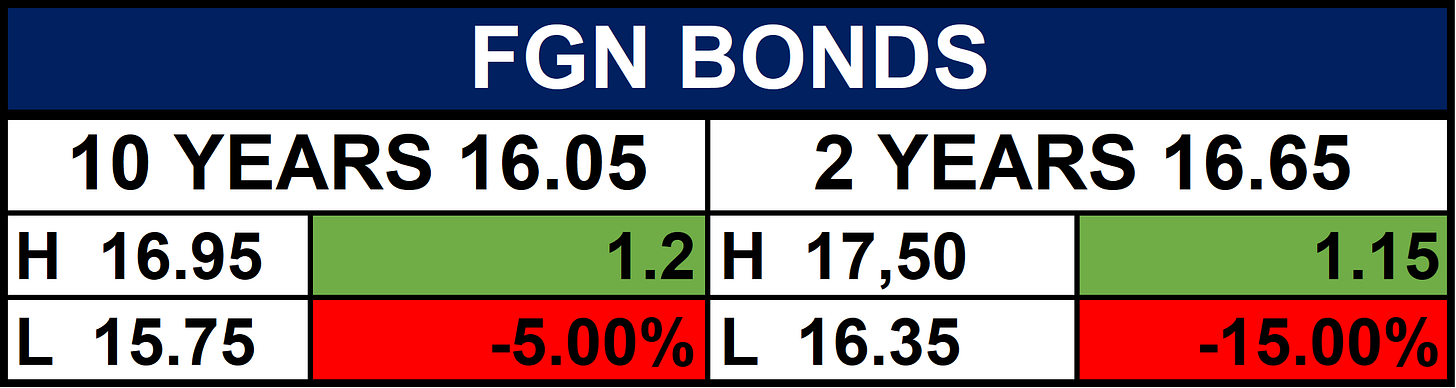

Fixed Income (FGN Bonds)

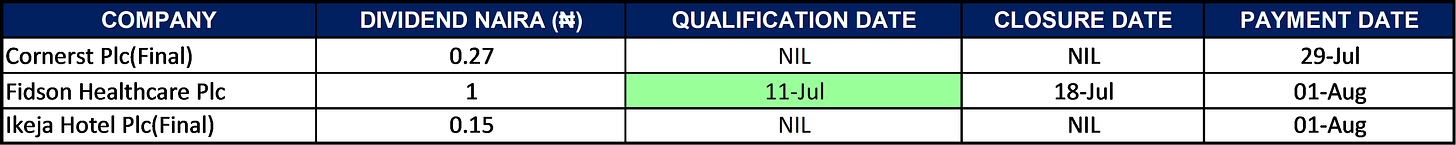

Dividends

Global News & News Update

S&P 500 is little changed as traders digest earnings, Fed decision looms:

U.S. markets were mostly flat despite the S&P 500 and Nasdaq hitting new records, as investors digested mixed earnings and awaited key economic data. Major tech companies are set to report this week, and the Fed’s rate decision on Wednesday is in focus. Corporate results were mixed, with strong reports from P&G and Boeing, while UPS and Whirlpool disappointed. Markets remain cautious ahead of Friday’s U.S. jobs report and ongoing trade discussions. - CNBC

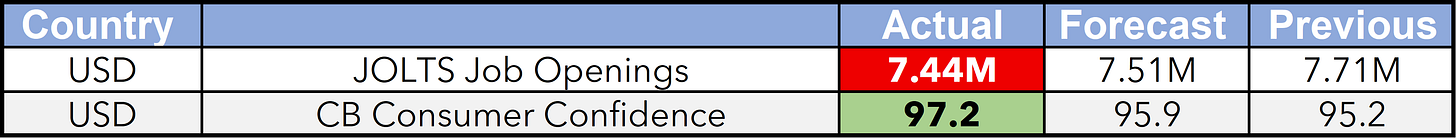

US consumer confidence rises modestly in July:

U.S. consumer confidence rose slightly in July to 97.2, but the improvement was less than expected, and perceptions of job availability hit their lowest since March 2021, signaling a softening labor market. While pessimism about the future eased, concern about current job conditions continues to grow. - Reuters

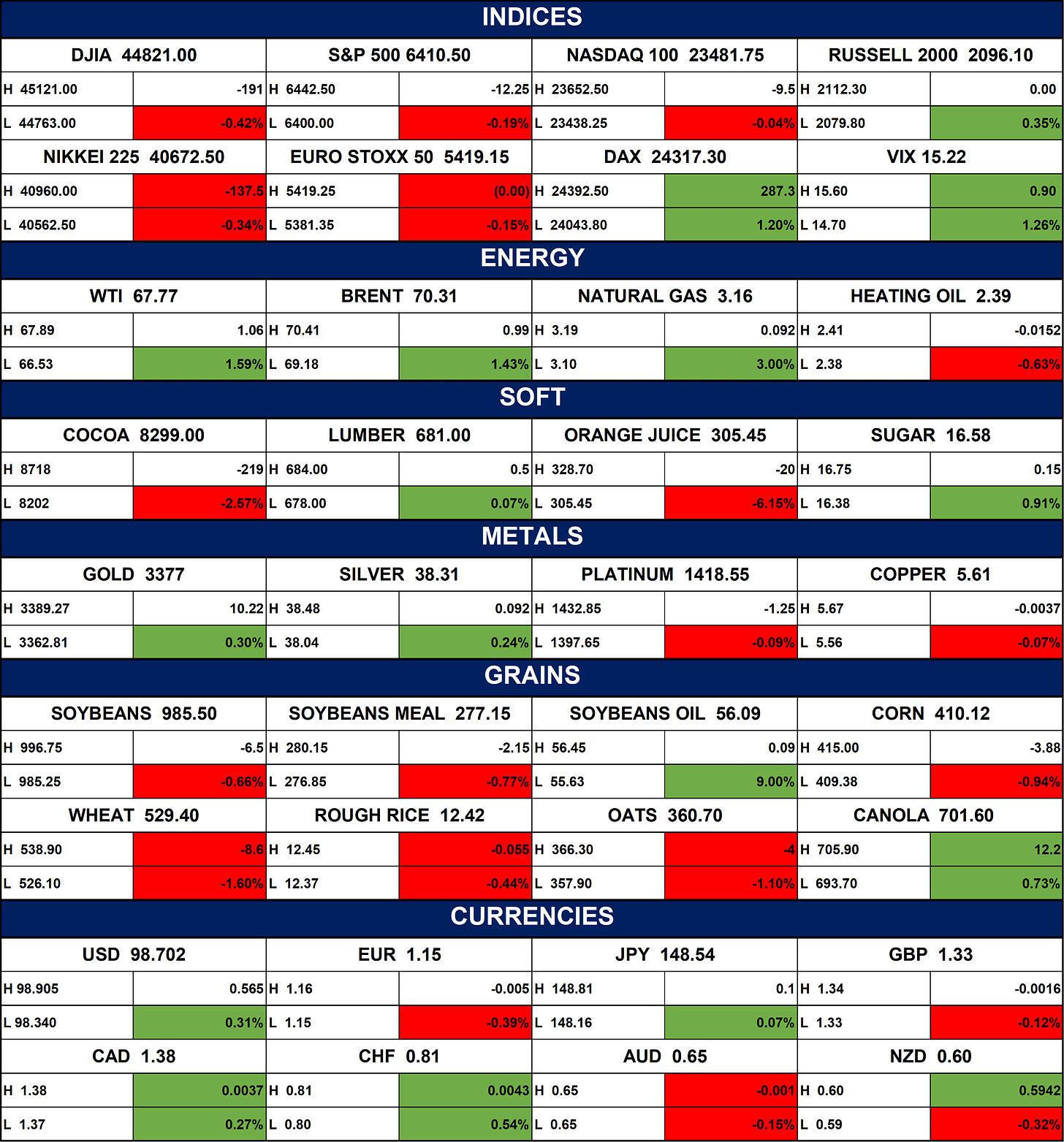

Indices, Commodities & Currencies

The table below depicts that markets were mixed with a slight downturn in major indices and a rise in volatility (VIX +1.26%). Energy prices climbed, led by natural gas (+3.00%) and WTI crude (+1.59%). Softs and grains were mostly lower, except for a sharp +9.00% gain in soybean oil. Gold and silver posted small gains. In currencies, the U.S. dollar and Swiss franc strengthened, while euro, pound, and kiwi dollar weakened.

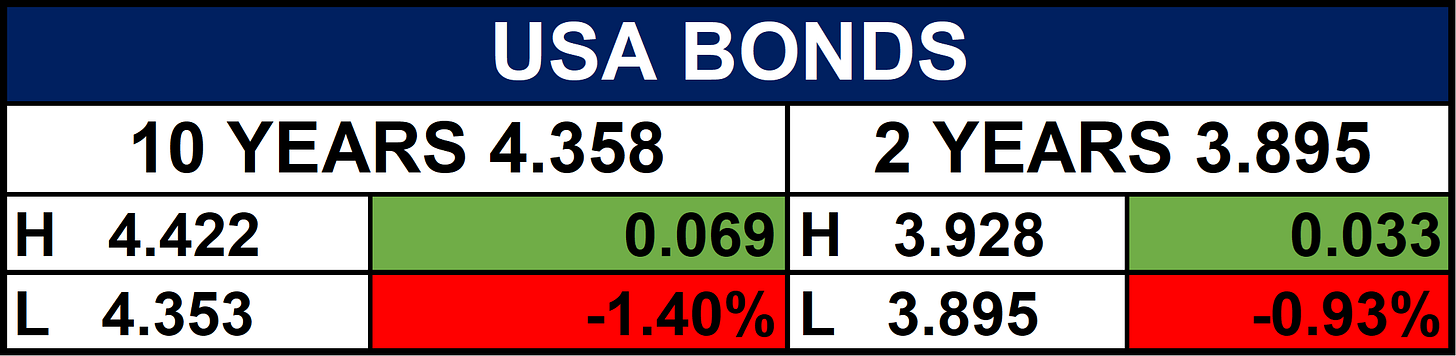

Fixed Income (USA Bonds)

Events

Conclusion

Nigeria’s market shows positive momentum, supported by strong earnings, bond demand, and easing regulatory risks. While local equities especially in consumer goods, banking, and Shariah-compliant sectors offer growth potential, oil & gas remains uncertain. Global risks from U.S. monetary policy may affect capital flows. Investors should stay diversified, monitor macro signals, and balance domestic opportunities with global caution.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.