Trading Tuesday - Nigeria’s Policy Shifts and Strengthening Bonds Spark Portfolio Re-Positioning as Global Economic Pressures Keep Investors Cautious

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Today, we unpack key developments shaping Nigeria’s financial landscape from fresh regulatory charges and bank recapitalisation progress to shifts in the bond market and government financing plans. We also spotlight major global policy and energy updates that could influence capital flows, inflation, and investor sentiment in the coming weeks.

Nigerian News & Market Update

Fresh travel tax scheme worth $1billion sparks protest:

Nigeria’s aviation regulator will introduce a new $11.50 Advance Passenger Information System (APIS) security levy on all international tickets from December 2025, sparking backlash over rising travel costs and multiple charges. - Punch

Standard Chartered meets ₦200billion recapitalisation ahead of deadline:

Standard Chartered Bank Nigeria has met the CBN’s ₦200billion recapitalisation requirement ahead of the 2026 deadline, reinforcing its long-term commitment to the Nigerian market. - Punch

Investors Rally Nigerian Bonds after Failed Auction Bids:

Investors boosted secondary-market demand for Nigerian bonds after a restrained Debt management Office (DMO) auction, pushing yields lower amid expectations of a final rate cut in 2025. - dmarketforces

2025 Budget: Tinubu seeks Senate’s approval for ₦1.15trillion loan:

President Tinubu has asked the Senate to approve a ₦1.15trillion domestic loan to close the funding gap in the expanded ₦59.9trillion 2025 budget. - Businessday

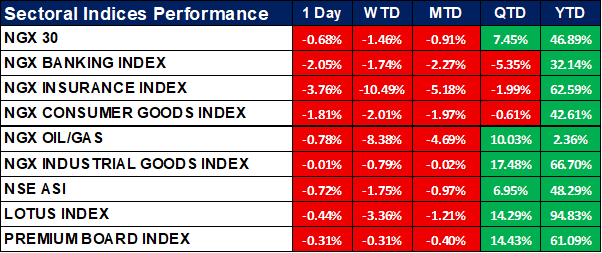

Nigeria Sectoral Indices Performance

The table below shows that the market closed broadly negative across sectors, with the NGX Banking and Insurance indices leading the day’s decline at -2.05% and -3.76% respectively. All indices posted losses WTD and MTD, reflecting sustained bearish sentiment in the short term. Despite near-term weakness, QTD and YTD performance remain strongly positive, led by Industrial Goods (+66.70% YTD) and Lotus Index (+94.83% YTD).

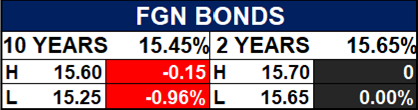

Fixed Income (FGN Bonds)

Global News & News Update

Turkish fuel supplier raises diesel prices, citing Russia sanctions:

A major Turkish fuel supplier has hiked diesel prices after U.S. sanctions on Russian oil firms disrupted supply and raised import costs. - Reuters

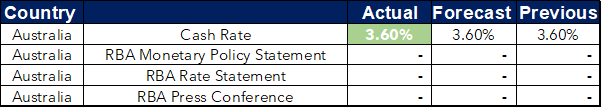

Australia’s central bank sees core inflation stuck above target out past mid-2026:

Australia’s central bank expects stubbornly high core inflation until mid-2026, limiting room for further rate cuts despite recent economic strength. - Reuters

Brazil tightens minimum capital requirement rules, could impact 500 firms:

Brazil has raised minimum capital requirements for financial institutions to 9.1bn reais, a move that could force consolidation among about 500 firms as new rules tighten oversight, especially for fintechs. - Reuters

Pakistan cancels Eni LNG cargoes, seeks to renegotiate Qatar supplies:

Pakistan has agreed to cancel 21 LNG cargoes from Eni for 2026–27 to reduce surplus gas imports as demand falls and renewables rise. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global equities mostly traded lower, with major indices like the Dow, S&P 500 and Nasdaq closing in the red, while the VIX edged higher. Energy was mixed as WTI and Brent dipped slightly, but natural gas gained; soft commodities saw notable spikes in orange juice and cocoa.

Metals and grains broadly declined, whereas most major currencies declined against the USD.

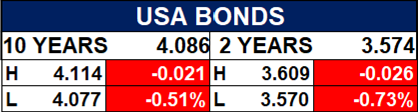

Fixed Income (USA Bonds)

Events

Conclusion

With fresh policy changes, rising fiscal borrowing, and renewed interest in fixed income, investors could expect near-term volatility across equities as the market digests higher costs and shifting yield dynamics. Globally, tighter financial regulation and energy-driven inflation risks may keep risk appetite cautious, reinforcing a selective and defensive investment approach. Positioning in fundamentally strong sectors and monitoring policy-driven catalysts will be key to navigating the weeks ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.