Trading Tuesday - Nigeria’s Policy Steadiness, Energy Expansion, and Global Trade Shifts Set the Tone for Market Direction

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where we unpack the major developments shaping Nigeria’s economic, corporate, and policy landscape. In this edition, we spotlight key regulatory decisions, energy-sector expansions, and corporate moves influencing investor sentiment. We also track global trade measures, commodity flows, and currency shifts that may guide near-term market positioning.

Nigerian News & Market Update

CBN Policy Committee Keeps Benchmark Interest Rate at 27%:

The CBN’s Monetary Policy Committee kept the benchmark interest rate at 27% to sustain ongoing disinflation and maintain economic stability. - Dmarketforces

Dangote Partners With Honeywell To Expand Refinery Capacity To 1.4mb/d By 2028:

Dangote has partnered with Honeywell to support its plan to double refinery capacity to 1.4 million barrels per day by 2028 and boost polypropylene production. - Channels

NNPC/Seplat JV Inaugurates Power System, Underground Cabling Project:

The NNPC/Seplat JV has commissioned an advanced integrated power and underground cabling system at the NOGAPS industrial park in Cross River to support uninterrupted operations and boost local industrial capacity. - Thisday

Hilal Takaful Insurance appoints Olanrewaju as MD/CEO:

Hilal Takaful Nigeria Limited has appointed Hassan Olanrewaju as its new MD/CEO to drive ethical, innovative, and customer-focused growth. - Punch

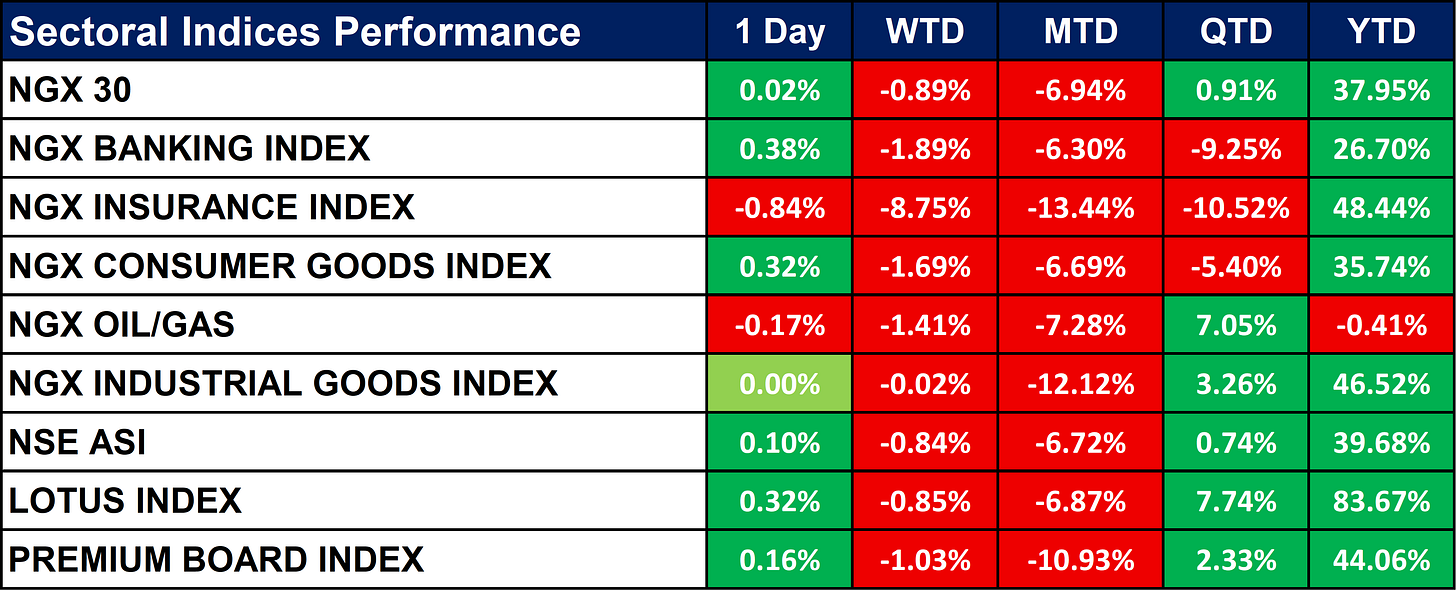

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities saw mild gains on the day, with most sector indices closing slightly positive despite broad month-to-date losses.

Banking, consumer goods, and the wider market (NSE ASI) posted small advances, while Insurance and Oil/Gas dragged.

Year-to-date performance remains strong across board, led by the Lotus Index (+83.67%), Industrial Goods (+46.52%), and Premium Board (+44.06%).

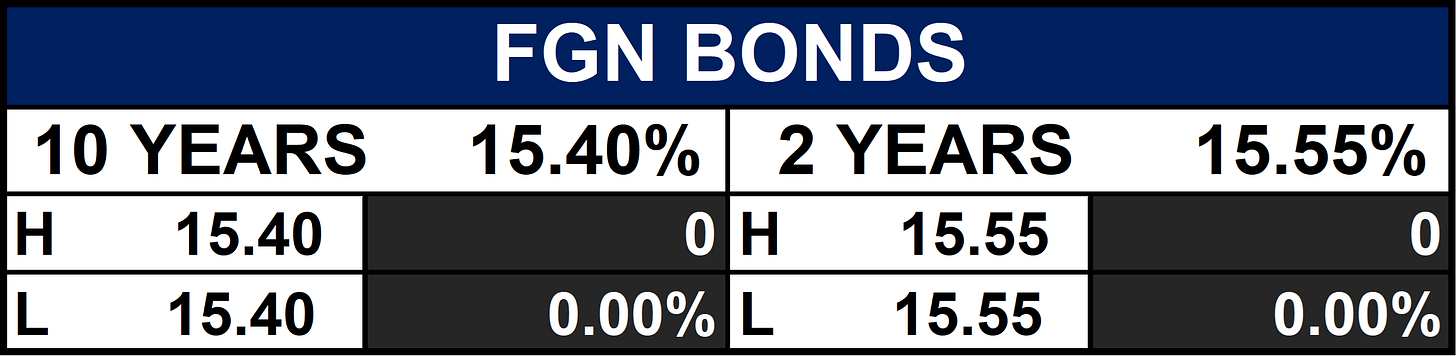

Fixed Income (FGN Bonds

Global News & News Update

UK to impose anti-dumping duties on Chinese biodiesel imports:

Britain has imposed anti-dumping duties on Chinese biodiesel imports after determining they were sold below fair prices and harmed UK producers. - Reuters

China’s October net gold imports via Hong Kong fall about 64% from September:

China’s net gold imports via Hong Kong plunged 64% in October as domestic demand weakened amid high prices and shifting tax policies. - Reuters

Brazil’s foreign direct investment through October surpasses 2024 total:

Brazil’s FDI inflows have already surpassed last year’s total, putting the country on track for a record year even as its current account deficit widens. - Reuters

India’s Russian oil binge to end in December as sanctions bite, sources say: India’s Russian oil imports are set to drop to a three-year low in December as refiners curb purchases to avoid breaching tightened Western sanctions. - Reuters

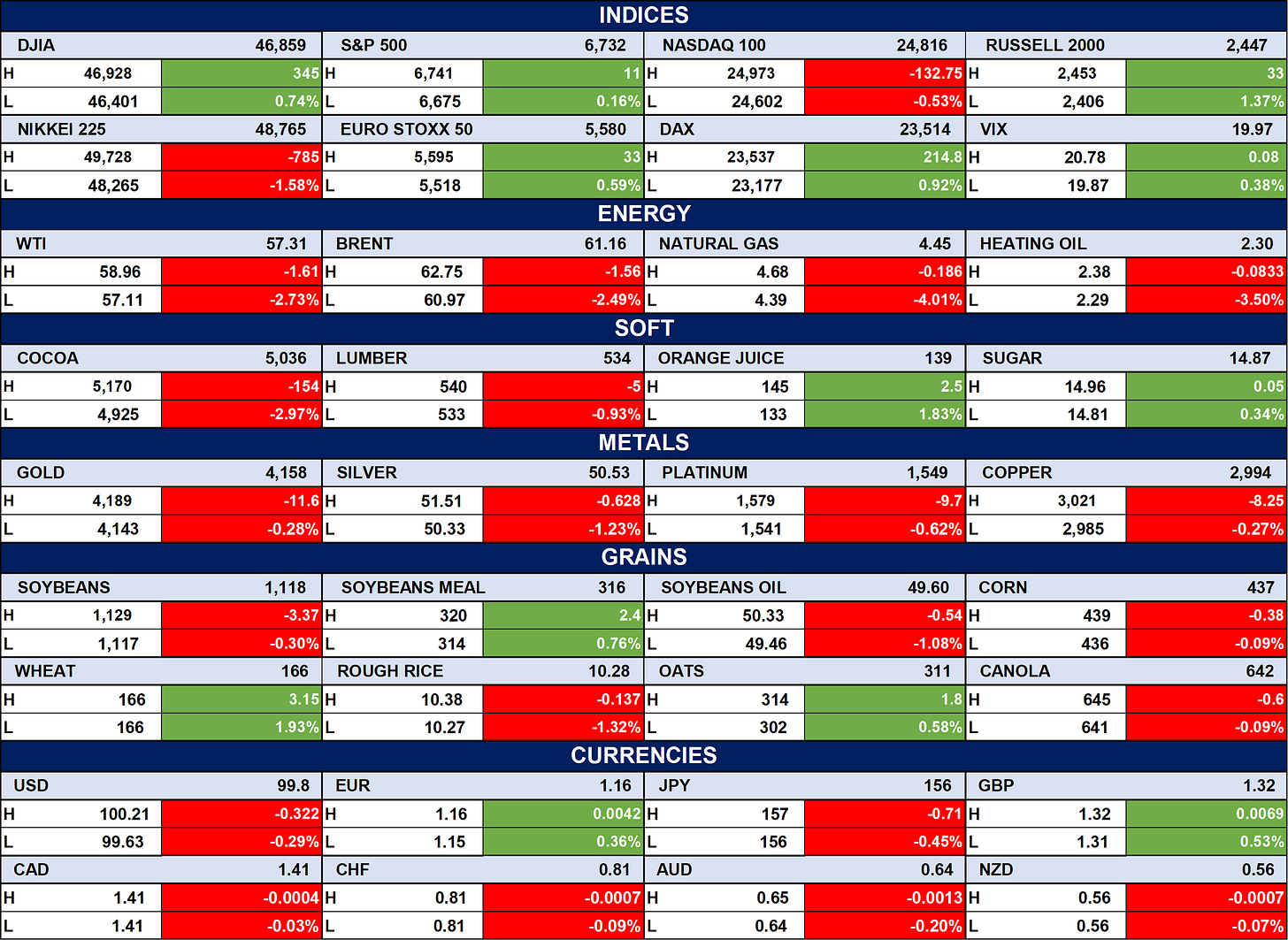

Indices, Commodities & Currencies

The table below depicts that the Global indices show mixed performance, with the S&P 500 and DAX slightly up while the Nasdaq 100 dipped. Energy commodities mostly declined, particularly natural gas and heating oil, while metals and soft commodities showed varied movement. Major currencies traded within narrow ranges, with slight strength in the EUR and weakness in the USD and YEN.

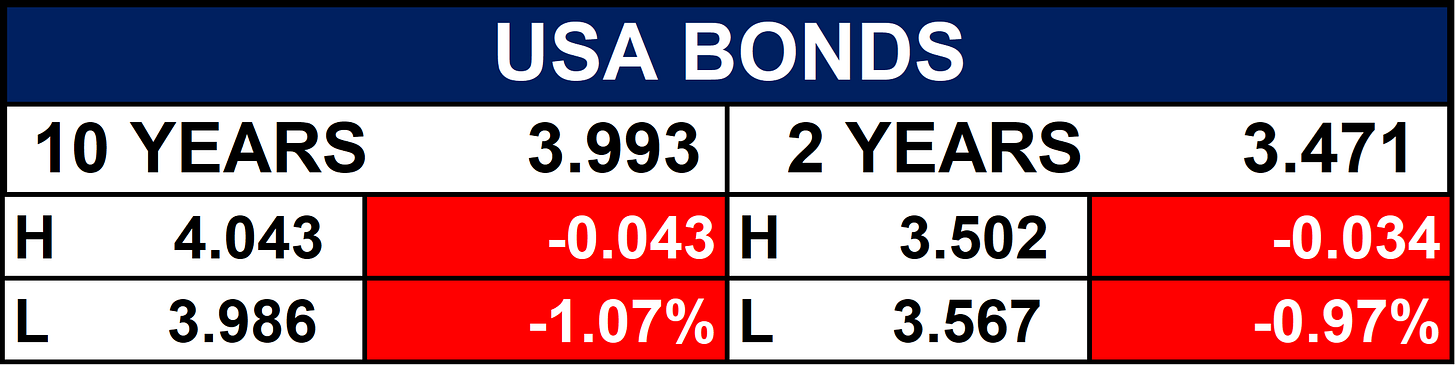

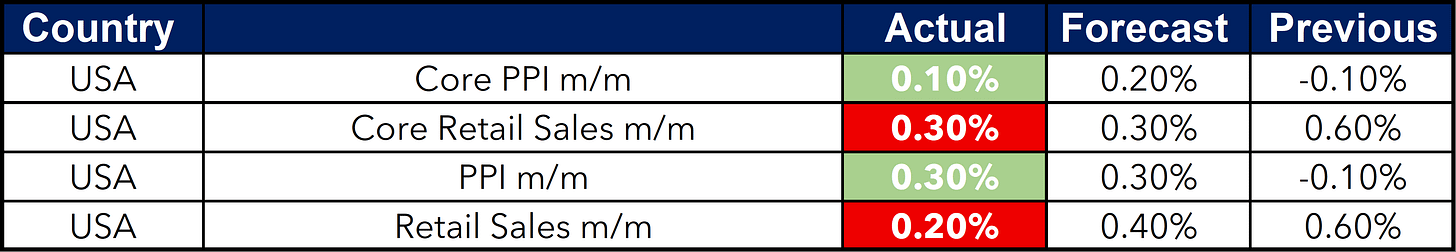

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, investors should monitor the CBN’s tight policy stance, refinery expansion milestones, and sectoral rotation across Nigerian equities. Globally, shifting trade dynamics, softer commodity imports, and evolving sanctions could drive volatility across energy and metals markets. Overall, disciplined positioning and close tracking of macro signals will be crucial in navigating the weeks ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.