Trading Tuesday - Recapitalisation, Bonds and Infrastructure Deals Highlight Nigeria’s Market Resilience as Global Liquidity Outlook Improves

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where we highlight key developments shaping Nigeria’s financial landscape amid ongoing regulatory reforms, capital raising activities, and banking sector recapitalisation, alongside major global policy and market moves. This edition covers notable corporate actions, leadership changes, and funding transactions that signal resilience and investor confidence despite a tight monetary environment. We also review global trends influencing capital flows, liquidity conditions, and infrastructure investment.

Nigerian News & Market Update

Tinubu names new boards for oil regulators;

President Tinubu has nominated Magnus Abe and other industry professionals to new boards of Nigeria’s oil regulators, reinforcing governance reforms under the Petroleum Industry Act pending Senate confirmation. - Punch

RMB leads Champion Breweries’ historic ₦30billion bond:

Champion Breweries has successfully issued a ₦30bn five-year bond led by Rand Merchant Bank marking the first bond issuance in Nigeria’s breweries sub-sector and highlighting strong investor confidence despite a high interest rate environment. - Punch

IEI converts ₦2billion deposit to equity:

International Energy Insurance Plc has converted a ₦2billion deposit from Norrenberger Advisory Partners into equity and approved plans to raise up to ₦17.5billion, strengthening its capital base ahead of regulatory recapitalisation requirements. - Punch

Rand Merchant Bank Nigeria meets CBN recapitalisation threshold:

Rand Merchant Bank Nigeria has met the CBN’s new minimum capital requirement ahead of the March 2026 deadline, strengthening its regulatory compliance and positioning the bank for continued growth in Nigeria’s financial sector. - Punch

LOTUS Bank Names Ajani-Lawal Chief Executive Officer:

LOTUS Bank has appointed Dr. Isiaka Ajani-Lawal as its new Managing Director/CEO, succeeding founding CEO Mrs. Kafilat Araoye, as the bank enters its next growth phase in Nigeria’s non-interest banking sector. - Dmarketforces

RMB Secures $285million Financing For BlueCore InfraCo:

Rand Merchant Bank has secured a $285million acquisition financing for BlueCore InfraCo to acquire Axxela Limited, supporting indigenous ownership and advancing Nigeria’s gas and power infrastructure. - Leadership

FirstBank meets ₦500 billion regulatory capital requirement:

FirstBank has met the CBN’s ₦500billion minimum capital requirement ahead of schedule, strengthening its balance sheet and positioning the group for growth, innovation, and expanded support for Nigeria’s real sector. - TheNation

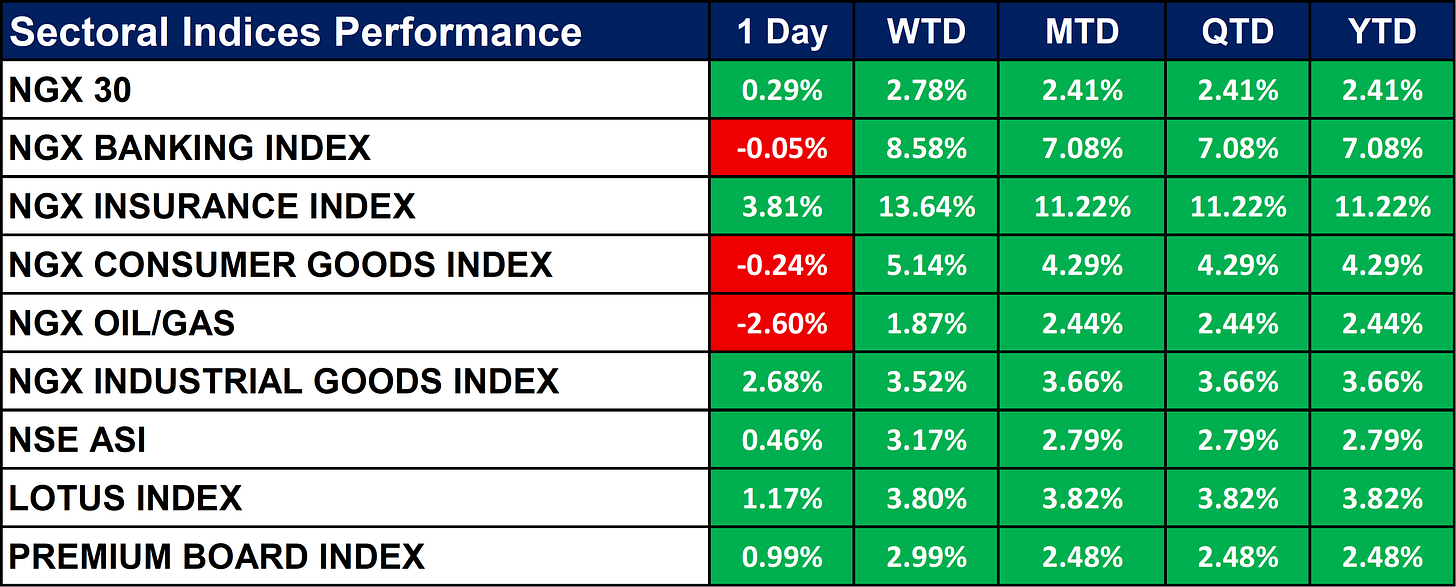

Nigeria Sectoral Indices Performance

The table below shows that the NGX Insurance and Banking indices lead performance, posting the strongest gains across WTD, MTD, QTD, and YTD, with Insurance up over 11% MTD. Industrial Goods and Consumer Goods show steady positive momentum, while Oil & Gas underperformed with a notable 1-day decline. Overall market indices (NGX 30, NSE ASI, Lotus, and Premium Board) remain positive, reflecting broad but moderate market growth.

Global News & News Update

Saudi Arabia to open financial market to all foreign investors next month:

Saudi Arabia will fully open its financial markets to all foreign investors from February 1, scrapping the Qualified Foreign Investor rule to boost capital inflows and liquidity. - Reuters

India’s EXIM Bank kicks off 2026 with $1 billion dollar bond issue:

India’s EXIM Bank launched 2026 with a $1 billion dual-tranche dollar bond, pricing aggressively after strong demand for its 10-year and 30-year issues. - Reuters

China’s central bank pledges to cut RRR, interest rate in 2026:

China’s central bank pledged to cut banks’ reserve requirements and interest rates in 2026 to keep liquidity ample and support steady economic growth. - Reuters

Microsoft works with major US electric grid operator to modernize the Midwest power system:

Microsoft is partnering with the Midcontinent Independent System Operator to deploy AI and digital tools to modernize the Midwest power grid and meet surging electricity demand from data centers. - Reuters

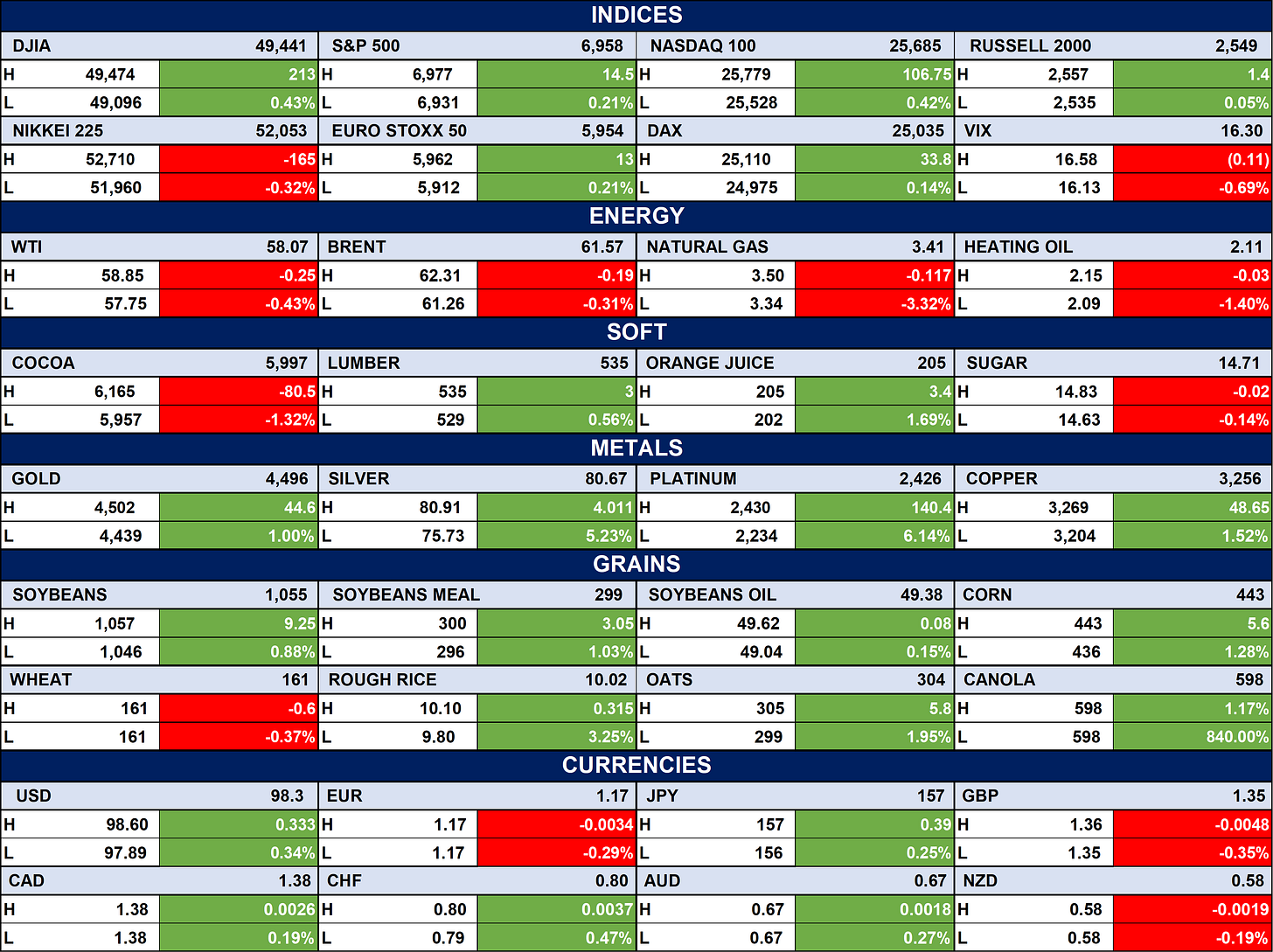

Indices, Commodities & Currencies

The table below depicts that the US indices mixed was DJIA up 0.43%, S&P 500 up 0.21%, NASDAQ 100 strong gain of 0.42%, while Russell 2000 edged up 0.05%; Nikkei 225 down 0.32%, Euro Stoxx 50 +0.21%, DAX +0.14%. Energy markets softer with WTI and Brent down ~0.3–0.4%, Natural Gas sharply down 3.3%, while metals surged—Platinum +6.14%, Silver +5.23%, Gold +1.0%. Grains mostly up, led by Canola +840%, Soybeans +0.88%, Corn +1.28%; USD strengthened slightly vs major currencies, EUR and GBP weaker, JPY and CAD modest gains.

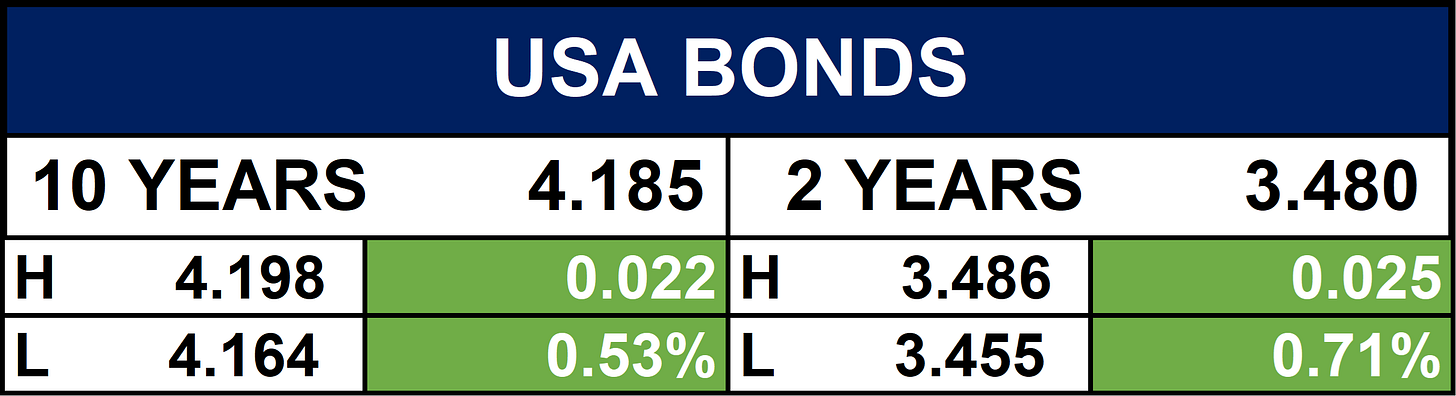

Fixed Income (USA Bonds)

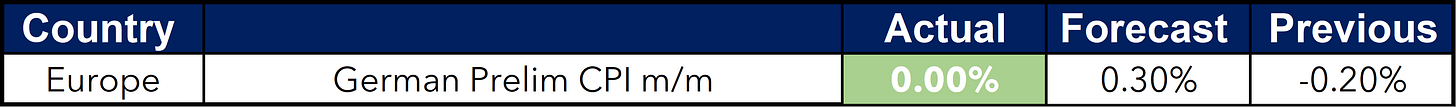

Events

Conclusion

Looking ahead, sustained reforms, improved capital buffers, and active deal-making are likely to support market stability in Nigeria. Globally, easing monetary signals from China, increased market access in Saudi Arabia, and strong demand for bonds and infrastructure investment could improve risk sentiment and cross-border capital flows. Investors should watch policy execution, liquidity conditions, and earnings momentum as key drivers of near-term market direction.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.