Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

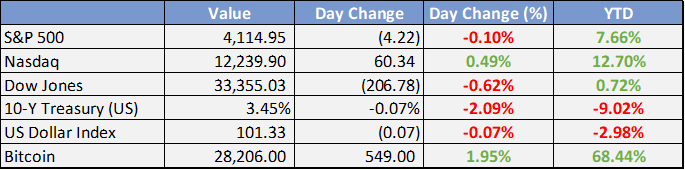

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

New Guidelines for Foreign Banks in Nigeria's Dollar Loans - Guardian

The Central Bank of Nigeria now require foreign banks offering dollar loans to Nigerian companies to pay a non-refundable N5 million application fee and N10 million licensing fee. The guidelines aim to maintain financial stability and enable the promotion of parent company services, research activities, and connections with foreign markets.

NCC approves MTN’s spectrum lease transaction from NTEL – Punch

MTN Nigeria secures a two-year spectrum lease transaction from Natcom Development and Investment Limited, covering 19 states. The lease includes 5HMz and 10HMz spectrums, costing N4.25 billion. This milestone supports MTN's Ambition 2025 strategy, enhancing their 3G and 4G user experience.

Banks Demand Tax Clearance Certificate on FX Transactions – This Day

Commercial banks and government agencies in Nigeria must enforce a valid Tax Clearance Certificate (TCC) requirement for business transactions. The regulation covers loans, vehicle registration, contracts, and more. TCCs must be verified. Non-compliance faces strict sanctions. Banks now require TCC for foreign exchange, including school fees and remittances.

Global

Goldman, Microsoft, CBOE and Others Team Up to Launch Blockchain Network - Bloomberg

The network aims to provide improved privacy, controls, and scalability for financial institutions. Participants include Digital Asset, ASX, BNP Paribas, and Moody's. Canton Network enables connection between different blockchain systems and allows creators to retain control, facilitating the integration of separate systems like asset registries and cash payment systems.

Wall Street Leaders Warn of ‘Unthinkable’ Fallout If US Defaults - Bloomberg

Wall Street experts and financial executives caution against the "unquantifiable" consequences of a US government default on debt. They advocate for repealing the borrowing limit altogether and raising it promptly. Amid ongoing banking turmoil, they argue that debating the debt limit while financial markets are volatile is reckless.

Mortgage demand surged after Fed signaled potential pause in rate hikes – CNBC

US mortgage rates slightly dropped as the Federal Reserve hinted at a pause in interest rate hikes. Refinancing demand increased by 10%, while applications for home purchases rose by 5%. However, high home prices continue to offset the benefits of lower rates. Mortgage rates may be influenced by upcoming economic data, such as the consumer price index report.

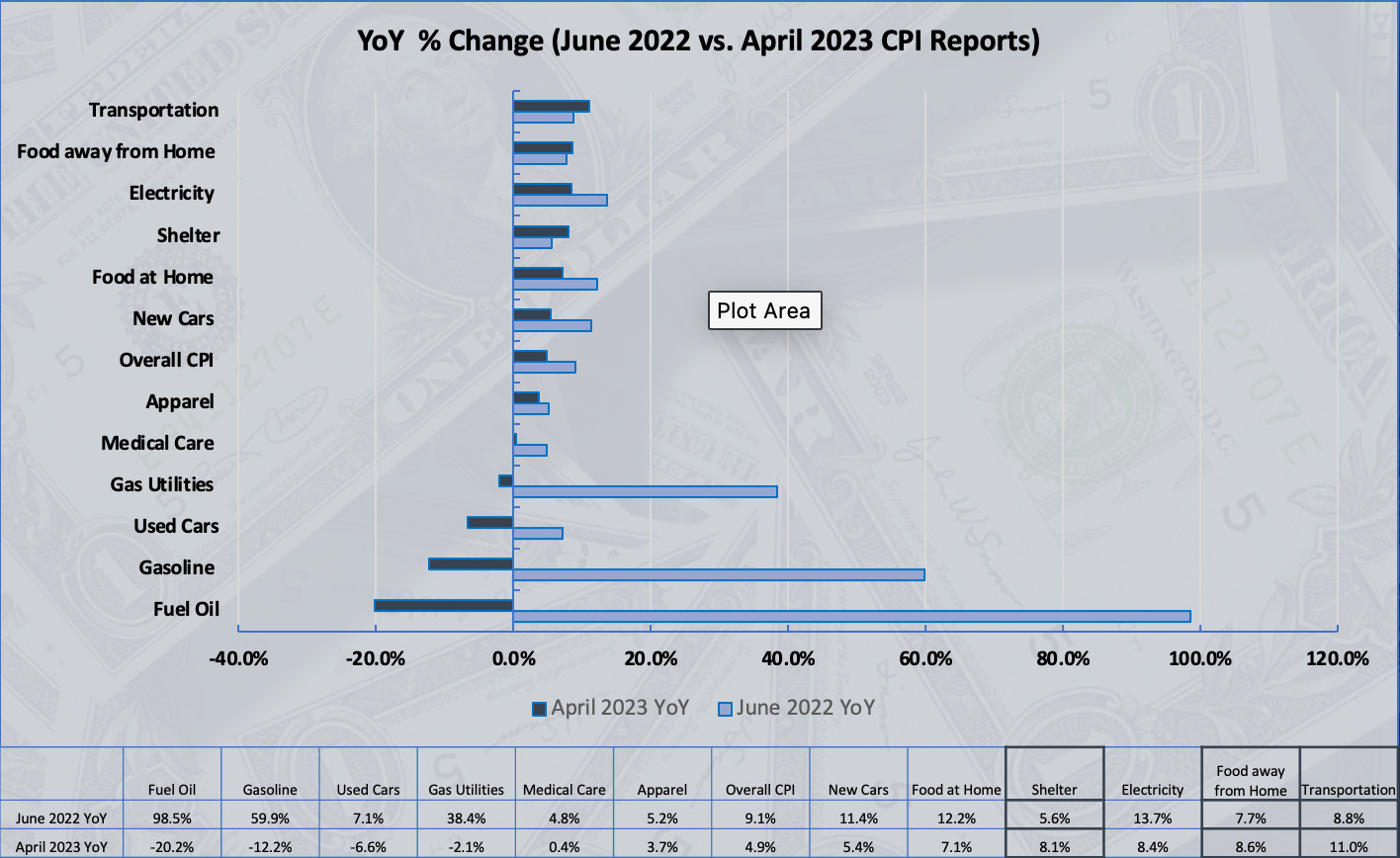

Inflation rate eases to 4.9% in April, less than expectations - CNBC

The recent decline in inflation can be attributed to lower rates in key areas such as Fuel Oil, Gasoline, Used Cars, Gas Utilities, Medical Care, Apparel, New Cars, Food at Home, and Electricity. While rates of inflation in Transportation, Food Away From Home, and Shelter have seen increases since last June.

The consumer price index rose 0.4% last month, pushed higher by rising shelter, used vehicle and gas prices. The increase was in line with Wall Street expectations.

On an annual basis, the inflation rate was 4.9%, slightly less than the estimate and providing some hope that the trend is lower.

For workers, real average hourly earnings, adjusted for inflation, rose 0.1% for the month but were still down 0.5% from a year ago.

Weekly Investment Watchlist

Bank Failures

Economic data calendar

May 8: Fed senior loan officer survey; whole sale inventories

May 9: NFIB small business optimism

May 10: MBA Mortgage applications; consumer price index, monthly budget statement

May 11: Producer Price Index; jobless claims

May 12: Import and export price indexes, University of Michigan sentiment survey

Investment Tip of The Day

Staying informed about the latest news and events that could impact the markets is essential for risk management. Set up alerts for key market indicators, keep an eye on economic data releases, and follow the latest developments in the industries and companies you're invested in.