Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

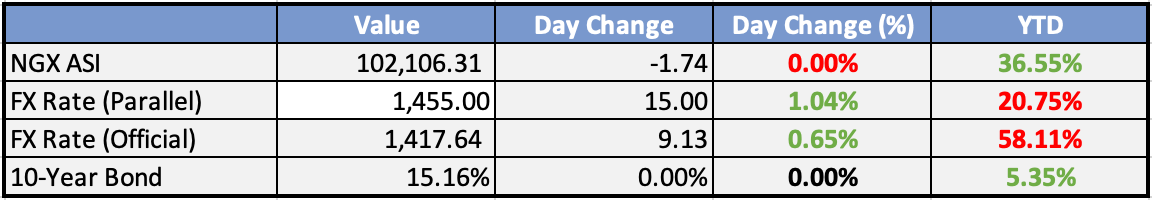

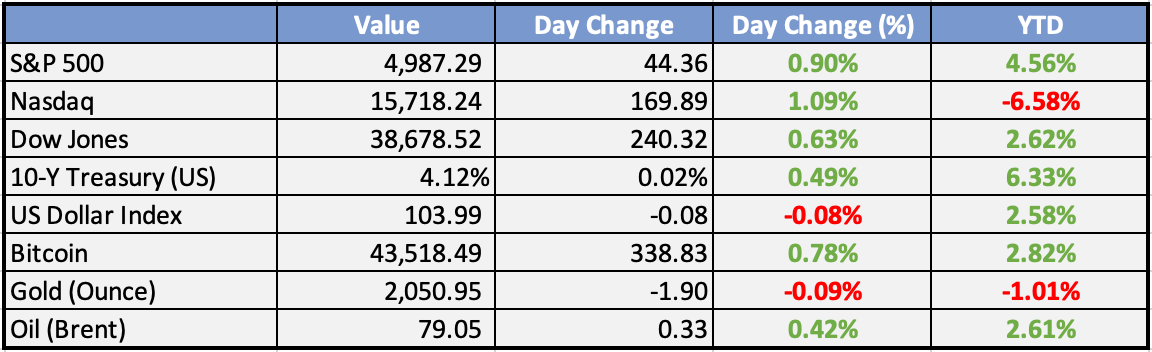

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

NCC wants states to cut telecom taxes - Punch

The Nigerian Communications Commission has appealed to states and local government councils across the country to cut taxes imposed on telecom companies, asserting that excessive taxation will be counterproductive to the growth of the industry.

BUA Cement, Sterling HoldCo, other drag equity market by N849bn - Punch

Losses recorded by BUA Cement, Sterling Financial Holding Company, Consolidated Hallmark Holdings, UPDC and The Initiates caused the Nigerian Exchange dipped on Tuesday.

Dangote to list refinery, fertiliser companies (NGX Group chair) - Punch

The Chairman of Nigerian Exchange Group, Dr Umaru Kwairanga, has disclosed that two companies in the Dangote Industries Group will be listed on the exchange soon.

Global

US trade deficit up to $62.2B in December - BEA

In December 2023, the U.S. monthly international trade deficit rose to $62.2 billion from a revised $61.9 billion in November, driven by increased imports outpacing exports. The goods deficit expanded by $0.7 billion to reach $89.1 billion, while the services surplus grew by $0.4 billion to $26.9 billion, as reported by the U.S. Bureau of Economic Analysis and the U.S. Census Bureau.

US mortgage applications up 3.7% - Tele Trader

Mortgage applications in the United States rose by 3.7% for the week ending February 2, as reported by the Mortgage Bankers Association's Weekly Mortgage Applications Survey. The 30-year fixed-rate mortgage interest rate increased slightly from 6.78% to 6.80%. The Purchase Index decreased from 154.5 to 153.5, while the Mortgage Refinance Index grew from 445.6 to 500.2.

Market Commentary:

Overview:

Bond yields and the US dollar experienced a decline amid limited major news flow and mixed Fedspeak. European and US equities closed moderately higher as Shanghai surged. Today’s global data calendar is thin, but there will be additional insights from the Fed.

Currencies/Macro:

The US dollar relinquished some of its recent strong gains.

EUR/USD ranged between 1.0723 and 1.0762, showing a slight overall firming.

GBP/USD rallied 60 pips or 0.5% to 1.2595.

USD/JPY fell from 148.70 to 147.90.

Mester, a FOMC voter until her retirement in June, appeared less hawkish but emphasized the need for more information before adjusting rates.

ECB’s Consumer Expectations Survey Showed 1yr Inflation expectations falling to 3.2% from 3.5%. 3yr expectations remained steady at 2.5% (prior 2.4%).

German factory orders in December appeared strong at +8.9%mm (est. -0.2%), distorted by large transport-related orders.

Interest Rates:

The US 2yr treasury yield fell from 4.48% to 4.38%, while the 10yr yield fell from 4.17% to 4.08%.

Markets assign a 15% chance of a March rate cut and an 80% chance of a cut by May.

Australian 3yr government bond yields (futures) fell from 3.72% to 3.63%, with the 10yr yield falling from 4.19% to 4.11%.

Markets currently project the RBA cash rate to remain unchanged at the next meeting on March 19, with an 80% chance of a cut in August.

Credit spreads remained quiet with Main and CDX unchanged at 59.5 and 55.5, respectively.

Primary activity continued with banks in focus, witnessing 6 issuers pricing ~EUR6.2bn in Europe and 4 issuers pricing USD10bn in the US.

Commodities:

Crude markets experienced fluctuations between losses and gains, influenced by developments in the Israeli-Hamas peace process and US responses to attacks.

The March WTI contract is up 1.1% at $73.58, and the April Brent contract is up 1.05% at $78.81.

BP CEO Auchincloss noted continued strong oil demand and diesel market shortages due to refinery shutdowns.

Russia’s weekly oil-processing rates dropped to the lowest in almost two months due to drone attacks and fires.

The Feb ARA gasoil contract rose 3.1%, and Goldman raised its forecast for the crack spread due to "structural tightness in the market."

Bloomberg BNEF suggested that tepid LNG import demand in Japan and South Korea would exert downward pressure on Asian spot prices.

The March Japan Korea marker remained below $10/MMBtu since mid-January, while the US March Henry Hub contract traded below $2.

Metals received a boost as China attempted to stabilize equity markets.

Copper was up 0.5% to $8,401, and aluminium was up 0.75% to $2,229.

Codelco’s CEO Alvarado expects to produce more copper in 2024 than 2023, marking the start of a recovery.

Alcoa Corp's shares suffered their worst day in 10 months amid concerns about potential trade tensions with China.

Iron ore markets remained close to 3-month lows as China attempted to support equity markets ahead of the LNY holiday.

The March SGX contract is up 20c from the same time yesterday at $125.00, while the 62% Mysteel index is down another $1.55 at $126.55.

Day Ahead:

US:

The trade deficit trend is expected to persist in December (market f/c: –$62bn).

December consumer credit growth is seen easing to $15.9bn.

The post-FOMC speaking calendar features Harker, Kugler, Collins, Barkin, and Bowman.

Eurozone:

The Week Ahead:

Monday:

Tuesday:

ISM Services PMI (US)

Wednesday:

Thursday:

Unemployment Claims (US)

Friday:

Investment Tip of The Day

Stay Mindful of Concentrated Shareholdings: Be cautious of companies with highly concentrated shareholdings. This can lead to volatility if large shareholders decide to sell their stakes.