Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

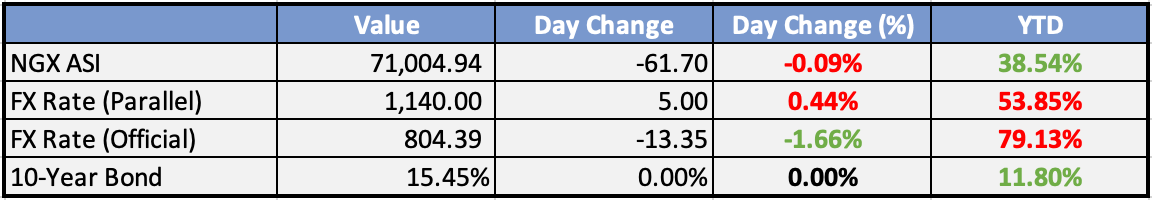

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

AfDB hybrid capital note could launch before end-November - Nigeria Business News

The African Development Bank (AfDB) could launch its debut hybrid capital note, sized between $500 million and $1 billion, before the end of the month if market conditions are right, the bank’s acting treasurer said.

EBID extends $50m to Wema Bank to support agro-industry in Nigeria - Nigeria Business News

The ECOWAS Bank for Investment and Development (EBID) has signed an agreement with WEMA Bank Plc, Nigeria providing a $50 million line of credit to support Small and Medium Enterprises (SMEs) in the agro-business sector in the Federal Republic of Nigeria.

FG revokes 1,633 mining licences - Nigeria Business News - Nigeria Financial News

Minister of Solid Minerals Development Dele Alake has said that the federal Government had revoked 1,633 minerals titles of defaulter mining companies. He said this at a press briefing in Abuja.

Reps pass 2024-2026 budget framework with $73.96 crude oil benchmark, N700 to dollar next year - Nigeria Business News

Nigeria’s House of Representative has passed the medium-term expenditure framework for 2024-2026 with $73.66 per barrel crude oil benchmark in 2024, $73.76 in 2025 and $69.90 in 2026.

Global

Sam Altman to return as OpenAI CEO - Reuters

Sam Altman is set to return as the CEO of OpenAI, according to Reuters. This development comes after the recent firing of Altman over disputes regarding product development speed and focus. Microsoft CEO Satya Nadella announced that Altman and ousted OpenAI Chairman Greg Brockman would lead a new advanced AI research team at Microsoft.

Oil tumbles nearly 4% as OPEC+ meeting delayed - Reuters

Brent crude oil price fell below $80 due to the delay of OPEC+ meeting, which raises questions about the future of oil production. Saudi Arabia expressed dissatisfaction with other members about their output numbers. Analysts had predicted that OPEC+ was likely to extend or even deepen oil supply cuts into next year.

US Mortgage Rates Rise for Second Straight Week, Hitting 7.19% - Bloomberg

U.S. mortgage rates rose for the second consecutive week, reaching an average of 7.19% for a 30-year fixed loan, according to Freddie Mac. This marks the sixth consecutive week with rates above 7%, impacting housing affordability. The cost of financing a typical listed home has doubled in the past three years due to high rates and home prices, leading to a cooling off of housing demand.

Gold hovers near $2,000 level as Fed pause bets lend support - CNBC

Gold prices slipped below the $2,000 level as the U.S. dollar halted its recent decline. The precious metal, often considered a hedge against inflation, faced pressure as the dollar index stabilized. The dollar's strength contributed to the downward movement in gold, which has experienced volatility amid concerns about inflation, monetary policy shifts, and economic uncertainties.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities concluded Wednesday with a mixed performance as volumes tapered off ahead of holidays. Japan’s main boards, Singapore, and South Korea were among the gainers, while Taiwan ran out of steam, and India extended early losses. Greater China was lower, with Shenzhen notably underperforming, and Hong Kong finishing flat. Australia also closed flat.

Chinese government advisers are set to recommend economic growth targets for next year. Five out of seven polled favor a target of around 5%, matching this year’s goal. Forecasts from various banks are tracking growth below 4.5% for China in 2024, with Goldman projecting 4.8%.

Country Garden is among the developers on China’s 50-company list for receiving financial aid, signaling potential state support for struggling developers.

The Bank of Japan (BoJ) is reducing asset purchases as expectations for policy normalization grow. This flexibility allows them to balance asset purchases ahead of Q1 purchases from banks, insurers, and pension funds. The recent reduction prompted a bounce in 10-year yields from a two-and-a-half-month low of 0.690%.

The Reserve Bank of India’s Governor notes the moderation in India’s core inflation but highlights that headline inflation remains vulnerable to food price shocks. The RBI maintains a hawkish stance, focused on the 4.0% inflation target.

Europe, Middle East, Africa:

European markets rallied on the open following a lower close on Tuesday.

Oil trader Pierre Andurand suggests OPEC+ may need to consider deeper cuts as the U.S. increases production. Seasonal supply tends to be higher this time of year, but additional production from the Permian basin raises questions about sustainability.

ECB President Lagarde and Executive Board member Schnabel push back against rate-cut bets, citing ongoing labor market adjustments and rising wages despite eased supply disruptions and energy prices.

Hedge fund short sellers have suffered nearly $43 billion in losses over the past few weeks, particularly impacting those betting against technology, healthcare, and consumer discretionary sectors.

The Americas:

Canada’s headline CPI came in cooler than expected at 3.2% YoY. Services inflation accelerated to 4.6%, driven by travel rent and property taxes. Rental prices rose at a faster rate in October. Canadian equities finished lower on Tuesday.

The Fed’s meeting minutes reveal ongoing concerns about upside surprises in inflation, emphasizing a cautious approach. The market is confident that there will be no further rate hikes.

Jeff Bezos is expected to be “aggressive” in selling more shares of Amazon, possibly selling $1 billion worth of stock.

BofA’s head of equity strategy expects the S&P 500 to reach 5000 by year-end 2024, citing valid arguments, but acknowledging uncertainties in the outcome.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

US initial jobless claims down 22,000 to 209,000

Revised UoM Consumer Sentiment (US)

Thursday:

Flash Manufacturing PMI (UK)

Flash Services PMI (UK)

Friday:

Flash Services PMI (US)

Flash Manufacturing PMI (UK)

Investment Tip of The Day

Review Global Debt Levels: High levels of global debt, encompassing government, corporate, and household debt, can create systemic risks within the financial system. Monitor trends in global debt to gauge the potential impact on financial markets.