Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

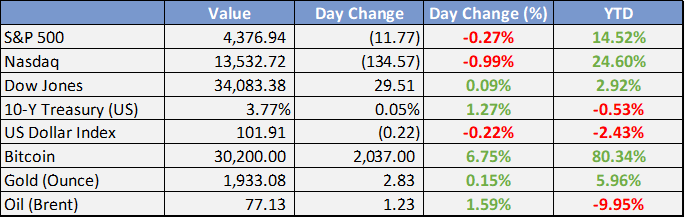

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Naira Achieves Convergence as Official, Parallel Rates Close at N756 – This Day

The naira’s official and parallel rates converged yesterday, after days of volatility sparked by the Central Bank of Nigeria’s (CBN) move to allow the market freely determine the price of Nigeria’s currency.Naira devaluation pushes Nigeria’s export to N42tn – Punch

The value of Nigeria’s export may rise to at least N41.99tn per year following the Central Bank of Nigeria float of the naira. It said, “The Central Bank of Nigeria wishes to inform all authorized dealers and the general public of the following immediate changes to operations in the Nigerian Foreign Exchange Market: Abolishment of segmentation.Subsidy removal: NEITI probes petrol consumption figure - Punch

The Federal Government should not go back on its decision to halt subsidy on Premium Motor Spirit, popularly called petrol, despite the opposition against the move, the Nigeria Extractive Industries Transparency Initiative stated on Tuesday.FG, Labour fix eight weeks for conclusion of subsidy removal talks - Guardian

Organised labour yesterday, demanded that grey areas must be addressed before reaching an agreement on implementation framework to be adopted as fallout of the petrol subsidy removal, while it agreed to eight weeks for conclusion of talks over subsidy removal

Value of FGN Bonds down by 93.2% to N183bn – Vanguard

The value of listed Federal Government of Nigeria, FGN, Bonds on the Nigerian Exchange Limited, NGX, has declined drastically by 93.2 percent to N183 billion in the first five months of this year from N2.7 trillion in the corresponding period of 2022.Nigeria’s Foreign Reserves Fall Ahead of Eurobond Payment - MFA

Foreign Reserves in Nigeria decline ahead of Eurobond repayment schedule for July 2023. The nation’s foreign reserves recorded a further decline, last week, trending below $35 billion, according to data from the Central Bank of Nigeria (CBN).

Global

The S&P earnings yield, corporate bonds and treasury bills are all offering the same yield of 5.3%.

So a medium risk, low risk and no risk asset is offering the exact same yield

Student loan repayments are set to resume in October.

The announcement from the Department of Education comes after a 3-year pause on payments.

Still unknown are the amounts borrowers will owe.

That will be answered this month once the Supreme Court decides on the validity of President Biden’s plan to cancel up to $20k in student debt for borrowers.

According to Barclays, the restart of payments could lead to a monthly decrease of $15.8 billion in household spending (or $190 billion per year)

Risk appetite for stocks is at its highest since 2021

Net positioning in the S&P, according to Citi, is at its “most extended ever”.

According to Goldman Sachs’ Equity Sentiment Indicator, positioning is at its most stretched since April 2021.

UK inflation exceeds expectations in May, piling pressure on the government and Bank of England - CNBC

U.K. inflation came in hotter than expected in May, as consumer prices rose by an annual 8.7%, unchanged from the previous month.

Economists polled by Reuters had projected an annual rise in the headline consumer price index of 8.4%.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

China unveiled a CNY520B ($72.3B) tax break package to boost sales of EVs and other green cars up to 2027.

BOJ board member Adachi said inflation running faster than he had expected but it’s too early to normalize policy.

South Korean exports rose 5.3% y/y in the first 20 days of June, partly on one extra working day, but semiconductors shipments fell sharply again.

Europe, Middle East, Africa

UK inflation data for May unexpectedly rose. Both headline and core measures came in higher than expected. Headline 8.7% y/y vs 8.4% expected and 8.7% prior. Core 7.1% y/y vs 6.8% expected and 6.8% prior.

The London Times shadow MPC has voted 6-3 in favor of a BoE rate hike of 50 bps to fight back against stubbornly high inflation - the BoE rate decision is tomorrow. Swaps are still pricing in a 55% probability of a 0.25% rate hike.

The Ifo Institute published its latest economic update and said the German recession will be sharper than it previously expected. Expected GDP to decline by 0.4% this year, blaming the impact of high inflation on consumption due to squeeze on real incomes.

The Americas

Biden says Xi wants a relationship with the US, but diplomatic thaw will take time; dictator remark causes tensions

Investment Tip of The Day

Stay informed about emerging technologies. Stay up-to-date with emerging technologies and trends that could disrupt industries and create new investment opportunities. Understanding technological advancements can help you identify potential growth areas for your portfolio.