Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

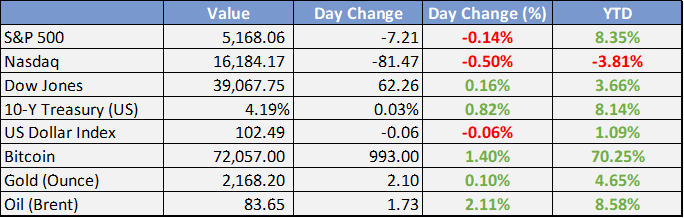

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

The US dollar saw modest gains against approximately half of the G10 currencies, remaining relatively stable against the others. The EUR/USD showed minimal change, holding steady at 1.0925 within its narrow daily range. The GBP/USD curtailed its losses, dropping just 20 pips to 1.2790. Following the release of CPI data, the USD/JPY surged to 148.12 before settling with a 0.5% increase, or 70 pips, at 147.65.

In the US, the February headline Consumer Price Index (CPI) rose by 0.4% month-over-month, aligning with expectations and resulting in a year-over-year increase of 3.2%, slightly above the anticipated 3.1%. The core CPI, excluding food and energy, also increased by 0.4% month-over-month, surpassing the 0.3% forecast and reaching a 3.8% year-over-year rate. Key contributors to the headline CPI increase included shelter and gasoline prices, together accounting for around 60% of the rise, with motor insurance also being a significant factor. Additionally, the February NFIB Small Business Optimism Index in the US dropped to 89.4, nearing cycle lows and indicating softness in new orders and investment.

The UK's January/February labor market report came with a quality advisory due to low response rates. Unemployment in January edged up to 3.9%, with employment decreasing by 21,000 contrary to the expected 5,000 increase. Average hourly earnings excluding bonuses grew by 6.1% year-over-year, slightly below the anticipated 6.2%.

In Germany, the final February CPI confirmed preliminary figures, maintaining a 2.5% year-over-year rate. ECB member and known hawk Robert Holzmann voiced concerns about premature policy easing, particularly before any similar action by the US Federal Reserve, and advised against an interest rate cut in April, emphasizing the need for a data-driven approach towards a potential easing in June. Bank of England Governor Andrew Bailey expressed worries about enduring inflationary pressures and the tight labor market despite progress toward the inflation target.

Interest Rates:

The US 2-year Treasury yield experienced an increase, rising from 4.51% to 4.59%, while the 10-year yield also climbed, moving from 4.08% to 4.15%. Market expectations indicate that the Federal Reserve's funds rate, set at 5.375%, is likely to remain unchanged on 20 March, but there's an 80% probability of a rate reduction by June.

In the credit markets, indices tightened in response to the positive sentiment in equities, with both the Main and CDX indices narrowing by approximately 1 basis point to 52 and 48.5, respectively. U.S. investment-grade (IG) cash credit improved by 1-2 basis points. Despite a slowdown in issuance, the markets remained active against the backdrop of the Consumer Price Index (CPI) data release. In Europe, four non-sovereign, supranational, and agency (ex-SSA) issuers successfully accessed the market, raising approximately EUR 2.8 billion. Meanwhile, in the US, four issuers were able to price a total of USD 5.1 billion.

Commodities:

Crude oil markets were influenced by supply dynamics, with the OPEC monthly report indicating that Iraq is producing approximately 200,000 barrels per day above its quota. Concurrently, Bloomberg's tanker tracking data suggested an increase in Russian crude exports for March. As a result, the April West Texas Intermediate (WTI) contract decreased by 0.24% to $77.74, and the May Brent contract dropped by 0.17% to $82.07. OPEC maintained its world oil demand growth forecast at 2.25%, expecting a substantial year-over-year increase of 1.8 million barrels per day (mbpd) in 2025, with significant contribution from Asia. The U.S. Energy Information Administration (EIA) raised its projection for U.S. crude production to 13.19 mbpd for this year and 13.65 mbpd for the next, marking a 1.2% increase from previous estimates. Additionally, the American Petroleum Institute (API) reported notable declines in gasoline and distillate inventories. In a geopolitical development, Ukraine launched extensive attacks inside Russia, targeting energy facilities and a major oil refinery, as Russian crude exports reportedly reached a yearly high.

In the metals market, copper remained stable at $8,648, while nickel increased by 0.78%, reaching a new high since October. In contrast, zinc experienced a 0.66% decrease to $2,550. Reports indicated that the China Nonferrous Metals Industry Association is urging its members to enhance aluminium exports to counter domestic consumption slowdowns. Following an agreement in which Alcoa will acquire an Australian company, alumina prices surged by up to 7.7%. In the U.S., legislators are preparing to introduce a bill advocating for deep-sea mining, promoting responsible seabed resource utilization.

Iron ore markets demonstrated some stabilization, buoyed by positive developments among Chinese construction firms. The April Singapore Exchange (SGX) contract slightly declined by 25 cents to $107.35, while the 62% Mysteel index increased by $2.20 to $110.75. Despite some positive movement, iron ore port inventories have consistently grown, marking a 30% rise from a three-year low last September. Iron ore prices have fallen about 25% from early January peaks. In corporate news, while Country Garden missed a bond payment, China Vanke engaged in debt-equity swap discussions to avoid its first bond default, with Moody's subsequently downgrading Vanke to junk status.

Investment Tip of The Day

Leverage the benefits of compounding by reinvesting earnings such as dividends and interest. This practice allows your wealth to grow exponentially over time as you earn returns on both your initial investment and the accumulated earnings. Starting this process early can significantly enhance the growth potential of your investments.