Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

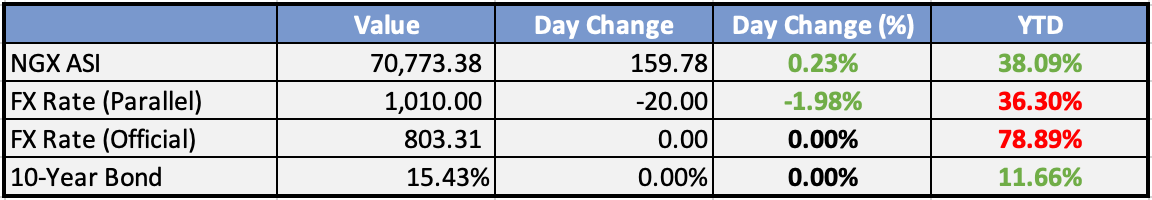

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

NPA Launches Audacious $1.1bn Plan to Rehabilitate 100-year old Tincan Island Port, Others - This Day

The Nigerian Ports Authority (NPA) has unveiled a $1.1 billion plan to rehabilitate and upgrade the Tin Can Island Port and other key ports in the country. This ambitious project aims to enhance the efficiency and capacity of these ports to meet the demands of modern shipping and trade, as well as boost economic growth in Nigeria.

Tinubu’s Economic Policies Will Shock FX Speculators, Dollar Hoarders - This Day

The Nigerian presidency expressed confidence in Bola Tinubu's economic policies, asserting that these strategies would unsettle foreign exchange speculators and individuals stockpiling dollars. The proclamation aimed to inspire faith in Tinubu's economic plans, potentially deterring dollar hoarders and speculators in the foreign exchange market.

NNPCL unveils new crude grade, ships 1.9m/b in October - Punch

The Nigerian National Petroleum Corporation (NNPC) introduced a new crude oil grade known as Anyalu Blend, shipping approximately 1.9 million barrels in October. This addition seeks to diversify the country's crude grades for export, improving the revenue generated by the NNPC.

Global

US crude oil prices fall below $78 a barrel to their lowest level since July CNBC

Oil prices plunged to their lowest levels since July as concerns about a broader regional conflict eased and weak Chinese economic data dampened demand. U.S. crude oil (WTI) fell below $78 a barrel, while Brent crude settled at $81.61. China's exports fell more than expected in October, indicating slowing global demand and putting downward pressure on oil prices.

Credit card balances spiked in the third quarter to a $1.08T record - CNBC

Americans' credit card debt has soared to a record $1.08 trillion, driven by rising spending, higher interest rates, and dwindling savings. Credit card delinquency rates are also on the rise, particularly among millennials. Experts urge cardholders to contact their issuers if they are struggling to make payments.

US 30-year mortgage rate plunges by most in nearly 16 months - Reuters

Mortgage interest rates plummeted last week, reaching their lowest point in a month, due to a rally in the Treasury market. This decline in rates is the largest since late July 2022 and follows a period of rising rates driven by higher yields on the 10-year Treasury note.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian stock markets experienced downturns, with significant losses in Singapore triggered by a substantial drop in SingTel shares. Japan’s Topix index also performed poorly, while South Korea’s Kospi index faced losses but remained higher week-to-date (WTD).Initial gains in markets such as India were reduced, while Australia and Taiwan saw moderate increases. Mainland China’s markets fared relatively better, though they still ended lower, and Hong Kong’s Hang Seng index reversed early gains.

Recession concerns persisted due to tightening financial conditions and weaker US economic data. Japan’s market felt the impact of a more cautious investor sentiment, with some profit-taking observed, whereas South Korea’s market volatility continued following the recent ban on short selling.

Hong Kong’s market dipped, but property stocks gained on news that Ping An might increase its stake in Country Garden.

The Reuters Tankan survey indicated that Japanese manufacturers’ confidence improved for the first time since August, and the services sector sentiment also saw enhancement. However, the future outlook remained uncertain.

China’s central bank governor expressed optimism about achieving the GDP growth target for 2023. South Korea plans to invest nearly $60 billion to strengthen trade financing as exports show signs of recovery, with plans to open its onshore forex market by July.

US Treasury Secretary Yellen is scheduled to meet with Chinese officials, and President Xi is set to engage with US business leaders ahead of a meeting with President Biden, signaling potential developments in US-China relations.

Europe, Middle East, Africa:

European stock markets exhibited a mixed performance, reflecting a continuation of the mostly negative trend from Tuesday. In contrast, Australia and Taiwan’s markets traded higher.

Investor risk appetite was dampened following the previous week’s market rebound. The bond market recovered as recent comments from Federal Reserve officials suggested a more dovish stance, leading to speculation that further rate hikes might be unlikely.

The European Union is set to evaluate Ukraine’s reforms necessary for accession talks. ECB’s Nagel emphasized the need for caution despite a downward inflation trend, while other ECB officials commented on interest rates and inflation management. BOE Governor Bailey highlighted risks of market fragmentation.

Eurozone finance ministers are scheduled to meet to discuss inflation and policy coordination, amid signs of easing German inflation and increased consumer inflation expectations according to an ECB survey. Eurozone retail sales continued to decline in September.

The Americas:

The market’s focus is now on Federal Reserve Chair Powell’s upcoming comments to assess the likelihood of the end of rate hikes in the US.

Powell will be the main highlight at 09:15, though comments will be made at the Fed’s Division of Research and Statistics Centennial Conference, and no Q&A is expected. Cook, Barr, and Jefferson are also scheduled to speak today.

Some indicators suggest that bullish market conditions are back, such as the breadth thrust observed last week. However, analysts warn that expectations for rate cuts in 2024 are overly optimistic. At MacroVisor, we agree and believe that 100 bps of cuts next year is a bit extreme unless something significant happens.

Bulls focused on peak Fed policy, “Goldilocks” econometrics, contrarian signaling from some key positioning/sentiment indicators, positive seasonality trends, and corporate buybacks and stable 2024 earnings estimates.

Bears instead focused on the recent history of premature dovish policy expectations, recession fears from weakening global economic data, and lagged effects of financial conditions tightening and Fed rate hikes, the pickup in softer demand and macro uncertainty messaging from earnings transcripts, significant reductions to Q4 earnings estimates, diminishing earnings revisions breadth, and risks to 2024 earnings from disinflation compressing margins.

In addition, a $40B 10-year note auction with results due after 1:00 pm EST is expected to receive significant attention following the better takeaways from last week’s refunding details. This will set the tone for the market’s appetite for US sovereign duration.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Thursday:

Unemployment Claims (US)

Friday:

GDP m/m (UK)

Prelim UoM Consumer Sentiment (US)

Investment Tip of The Day

Stay Informed About Regulatory Filings: For investments in publicly traded companies, monitor their regulatory filings, including quarterly and annual reports. These filings provide insights into financial health and potential risks.