Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

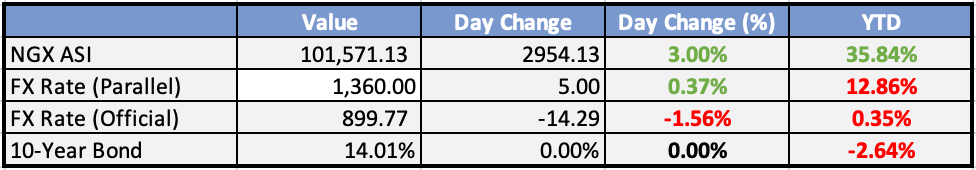

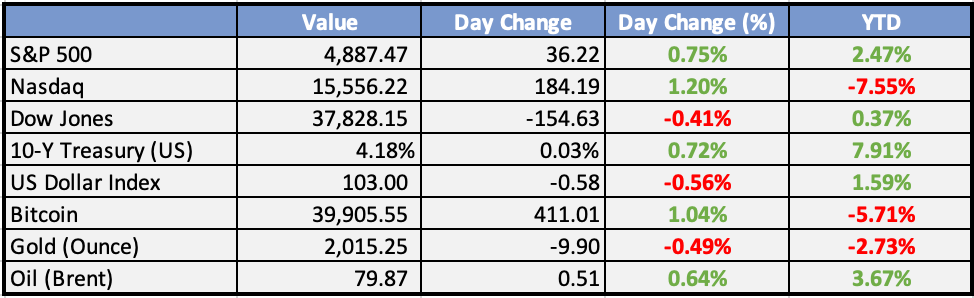

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

External debt servicing gulped $3.07bn in 10 months (CBN) - The Sun

This represents a 38 per cent increase, higher than the $2.22 billion spent in the corresponding period of 2022, thus highlighting a persistent strain on Nigeria’s foreign exchange resources

FG to sell five power plants for $1bn - Punch

The Federal Government through the Bureau of Public Enterprises is currently carrying out transactions for the sale of five power plants under the National Integrated Power Projects at a cost of about $1.15bn, it was gathered on Tuesday.

Global

Microsoft Hits $3 Trillion Value - Bloomberg

Morgan Stanley sees Microsoft reaching $3 trillion valuation by next year, fueled by AI growth and OpenAI integration. Analysts raise price target to $415, citing strong AI positioning and reasonable valuation. Overall, Wall Street overwhelmingly bullish on Microsoft, with only few analysts predicting $3 trillion by year-end.

Apple Dials Back Car’s Self-Driving Features and Delays Launch to 2028 - Bloomberg

Apple delays self-driving EV launch to 2028, scales back features like steering wheel-less mode, due to technical challenges and board pressure. Project Titan, in development since 2014, still years away with Level 2+ autonomous capabilities. Investors unfazed as Apple shares stay steady.

India Tops Hong Kong as World’s Fourth-Largest Stock Market - Bloomberg

India’s stock market surpasses Hong Kong’s to become world’s fourth largest, fueled by strong retail investors, foreign inflows, and China’s struggles with regulations and economic woes. Hong Kong losing luster as IPO hub, while India attracts capital seeking alternative to China.

Market Commentary:

Overview:

Currency and stock markets exhibited a blend of performance in a session characterized by limited significant news. The day's agenda includes the release of flash January Purchasing Managers' Index (PMIs), particularly noteworthy in Europe, along with the Bank of Canada's policy decision.

Currencies/Macro:

US dollar saw modest changes against G10 FX, within -0.3% to +0.1%.

EUR fell 35 pips to 1.0845, GBP/USD trimmed losses to -0.2% at 1.2680.

USD/JPY dipped to 146.99 during BoJ Governor Ueda’s press conference but later rallied to 148.40.

AUD/USD traded within a range of 0.6552-0.6612, net flat at 0.6575. NZD/USD fell to a two-month low at 0.6062 but steadied at 0.6085.

In the US, January Richmond Fed manufacturing survey index fell to -15, and the Philadelphia Fed manufacturing survey fell to -3.7.

Interest Rates:

US 2yr treasury yield rose from 4.37% to 4.41%, then returned to 4.37%.

The 10yr yield rose from 4.09% to 4.13%.

Markets expect the Fed funds rate to be unchanged in the next meeting, with a 40% chance of a cut in March.

Australian 3yr government bond yields rose from 3.76% to 3.81%, with a 70% chance of an RBA cut in August.

New Zealand rates markets price the OCR to be unchanged on 28 February, with a 70% chance of a rate cut in May.

Credit spreads drifted in line with softer bond/equity markets.

Main widened to 60.5, CDX out half a bp to 55.5, and US IG cash remained flat to a bp wider.

Commodities:

Crude markets torn between rising Middle East tension and record supply/waning demand.

March WTI contract down 0.3% at $74.53, March Brent contract down 0.33% at $79.73.

Metals saw a jump, led by aluminium, amid considerations of EU sanctions on Russian aluminium.

Iron ore markets pushed higher above $130 on hopes of demand returning post the LNY holiday.

Day ahead:

Eurozone:

US:

Flash January Markit/S&P Global PMIs in various jurisdictions, highlighting a fragile manufacturing sector in Eurozone and UK.

US January S&P Global PMIs expected to reflect underlying softness in demand conditions.

New Hampshire presidential primary results expected during Sydney trading session.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

UK Flash Manufacturing PMI climbed to 47.3

UK Flash Services PMI climbed to 53.8

US Flash Manufacturing PMI came in at 50.3

US Flash Services PMI came in at 52.9

Thursday:

Main Refinancing Rate (EA)

Advance GDP q/q (US)

Unemployment Claims (US)

Friday:

Core PCE Price Index m/m (US)

Investment Tip of The Day

Assess Brand Reputation Risks: A company's brand reputation is a valuable asset. Monitor how companies manage and protect their brand, as reputational risks can impact stock prices.