Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

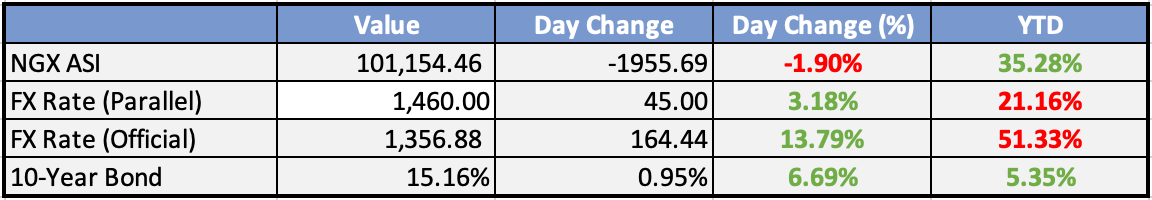

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Naira plunges in ‘official market’, CBN warns forex dealers - Punch

The naira plunged further at the official window on Tuesday, closing at an all-time-low of N1,482 against the United States dollar.

Nigeria: IMF foresees weaker growth - Punch

The International Monetary Fund has downgraded Nigeria’s economic growth projections for 2024 to 3.0 per cent from 3.1 per cent in its October forecast.

NNPCL woos S’Korean investors for gas projects - Punch

The Nigerian National Petroleum Company Limited has held talks with a South Korean consortium led by Daewoo E & C on the development of gas projects in Nigeria.

Wema Bank doubles profit - Punch

Wema Bank grew profit by over 105 per cent to N23.36bn in 2023 from N11.35bn in the prior year. According to the lender’s unaudited financial statement filed with the Nigerian Exchange Limited on Tuesday, revenue rose by 61.36 per cent to N181.87bn.

Global

Walmart Announces 3-for-1 Stock Split - WSJ

Walmart announces 3-for-1 stock split to make shares more accessible for employees, aiming to boost participation in company's stock purchase plan. Split expected to take effect in late February, increasing total shares to 8.1 billion from 2.7 billion.

Market Commentary:

Overview

Bond yields surged following robust US jobs and consumer confidence data. FX movements were limited. Key events today include, China January PMIs, US Q4 employment costs, the FOMC decision, and Chair Powell's press conference.

Currencies/Macro:

The US dollar showed little net change against G10 FX.

EUR/USD rose 10 pips to 1.0840, while GBP/USD dipped to 1.2640, later trimming losses to 1.2690.

USD/JPY jumped from 147.10 to 147.93 following US data, steadying with a 15-pip gain at 147.65.

US JOLTS job openings data for December and January Conference Board consumer confidence were strong.

Eurozone GDP in Q4 remained flat at 0.0%q/q and +0.1%y/y, with varying outcomes for individual countries.

Interest Rates:

The US 2yr treasury yield jumped from 4.29% to 4.39%, steadying around 4.36%, while the 10yr yield rose 6bp to 4.10%, later easing to 4.06%.

Markets expect the Fed funds rate, currently 5.375% (mid), to remain unchanged at today's meeting, with a 35% chance of a cut in March.

Markets anticipate the RBA cash rate to be unchanged on February 6, with a 70% chance of a cut in August.

Commodities:

Crude markets saw modest gains as US President Biden hinted at a response to a drone attack. The March WTI contract is up 1.3% at $77.79, and the March Brent contract is up 0.44% at $82.76.

Metals had a stronger bias, with copper up 1% to $8,642, nickel and zinc up 0.6% at $16,545 and $2,568.

Iron ore markets slipped due to the Evergrande liquidation order, with the March SGX contract down $2.95 at $132.05, and the 62% Mysteel index falling $2.70 to $135.15.

Day Ahead:

Eurozone:

Germany's CPI in January is estimated to have risen 0.1%m/m and 3.0%y/y.

US:

US ADP private sector employment in January is estimated to have risen 150k.

The Federal Reserve is expected to keep the Fed funds rate on hold at 5.375%, with close scrutiny of communications for signals of future rate cuts.

The Week Ahead:

Monday:

Tuesday:

US CB Consumer Confidence rose in January to 114.8

US JOLTS Job Openings surged by 101,000 from the previous month to 9.026 million

Wednesday:

US ADP Non-Farm Employment Change increased by 107,000 jobs in January

Employment Cost Index q/q increased 0.9 percent

US Federal Funds Rate remain steady at 5.5

Thursday:

Unemployment Claims (US)

ISM Manufacturing PMI (US)

Friday:

Average Hourly Earnings m/m (US)

Non-Farm Employment Change (US)

Unemployment Rate (US)

Revised UoM Consumer Sentiment (US)

Investment Tip of The Day

Assess Social Media Influence on Stock Prices: Social media can influence stock prices. Be aware of trends and sentiments on platforms like Twitter and Reddit that may impact your investments.