Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

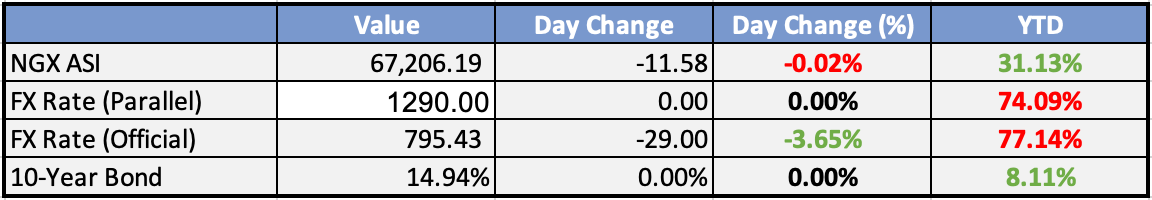

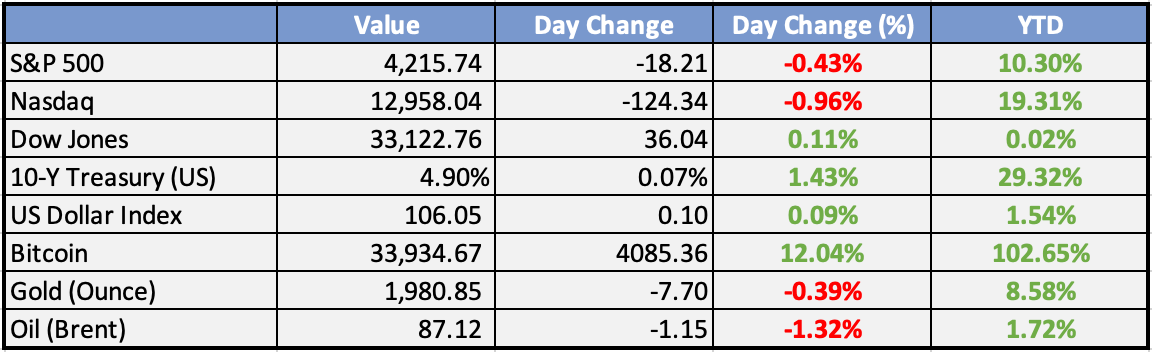

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Naira devaluation lifts Unilever’s export revenue to 7yr high - Business Day

Naira devaluation has boosted Unilever Nigeria's export revenue to a seven-year high. The company's export revenue rose to 7.88 billion naira in the first half of 2023, marking a significant increase compared to the prior year. The devaluation of the naira has rendered locally produced goods more competitive internationally, encouraging companies like Unilever to expand their exports.

Cross River workers reject contributory pension scheme, wants immediate implementation of N35,000 minimum wage - The Sun

Workers in Cross River State, Nigeria, have rejected the proposed contributory pension scheme and are demanding the immediate implementation of the 35,000 naira minimum wage. They argue that the contributory pension system would adversely affect their financial stability upon retirement.

FG seeks $10bn to fund SDGs - The Sun

The Nigerian federal government is seeking $10 billion in funding to support the Sustainable Development Goals (SDGs). This financial boost is intended to help Nigeria make progress towards achieving the SDGs, addressing issues like poverty, health, education, and gender equality.

Global

US Mortgage Rate Nears 8%, Further Suppressing Housing Demand - Bloomberg

Mortgage applications to finance home purchases slid to the lowest level since 1995 as mortgage rates approached 8%. The MBA survey showed a 2.2% decrease in the week ended Oct. 20 to 127, the lowest level since 1995. This is due to mounting affordability challenges as mortgage rates have soared more than 1.5 percentage points since April.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities ended mixed on Wednesday. Markets in Greater China started the day on a positive note due to news related to sovereign bonds but closed well below their peak levels. Japan and Taiwan saw gains, while South Korea and India experienced losses. Southeast Asia had a mixed performance, and Australia closed a few points lower.

Australia’s inflation saw a rebound on a quarterly basis, partly due to rising fuel costs. The Q3 Consumer Price Index (CPI) rose by 1.2% quarter-on-quarter, surpassing the consensus of 1.1% and marking an increase from 0.8% in the previous quarter. This translated to a 5.4% year-on-year increase, exceeding the consensus of 5.3% and improving from 6.0% in the prior period.

The new Governor of the Reserve Bank of Australia recently indicated their readiness to raise interest rates again if inflation came in stronger. However, one inflation print might not be sufficient to prompt immediate rate hikes, as higher rates could impact the Australian property market significantly.Mitsubishi Motors made a decision to cease vehicle production in China, reflecting broader pressures on Japanese automakers. This downsizing initiative is an addition to Mazda’s plans to reduce its local dealership network by approximately 10% compared to FY22 levels. Toyota previously cut 1,000 staff at a Chinese joint venture in July, while Honda and Nissan have scaled back production at their local joint venture factories.

Other news:

South Korea experienced a third consecutive month of declining consumer sentiment amid an economic slowdown.

The Japanese government is considering a ¥40,000 income tax cut as a measure to alleviate inflationary pressures.

The Malaysian Ringgit hit a new record low against the Singapore dollar, with further depreciation anticipated.

The Bank of Japan (BOJ) is closely monitoring yields and considering potential tweaks to its yield curve control approach.

Europe, Middle East, Africa:

European equity markets displayed a mixed performance after rebounding from earlier lows. Real estate, retail, and travel/leisure sectors lagged, while basic resources and technology were the main outperformers.

The German Ifo business climate survey improved in October, reaching a reading of 86.9, surpassing the consensus of 85.9. This positive development marks the first improvement in sentiment following five consecutive months of decline.

Eurozone’s M3 money supply growth fell by 1.2% year-on-year in September, which was below the consensus for a 1.7% drop and an improvement from the previous month’s 1.3% contraction. The three-month average decrease was 1.0%. However, credit dynamics in the Eurozone remain weak. The annual growth rate of credit to Eurozone residents dropped by 0.5%, compared to a 0.2% drop previously. Adjusted loans to the private sector also decreased to 0.3% from August’s 0.7% gain.

ECB President Lagarde informed EU officials that the fight against inflation is progressing well, but the lack of a fiscal deal poses challenges for the region. She added that the Eurozone economy faces stagnation for the next few quarters with downside risks, though inflation developments are more balanced.

The Americas:

US PMI numbers exceeded expectations, with the manufacturing data showing the most significant surprise by entering expansionary territory, registering above 50. While new orders and output improved, manufacturing employment fell into contractionary territory at 49.8, down from 51.9.

Visa reported a slowdown in US payment volume growth for September and October. However, the company attributed this slowdown to days mix impacts and declining fuel prices in October. Visa also pointed out that, excluding these factors, payment volume growth remained relatively stable from September to October. The company noted that consumer spending across all segments, from high to low spending, has remained stable since March, and its data has not indicated any significant behavioral changes across consumer segments.

The Week Ahead:

Monday:

Tuesday:

US Flash Manufacturing Purchasing Managers' Index (PMI) was slightly higher than forecast, at 50 versus 49.5

Wednesday:

UK Consumer Price Index rose by 6.3%

Thursday:

Advance GDP (US)

Unemployment Claims (US)

Friday:

Core PCE Price Index m/m (US)

Revised UoM Consumer Sentiment

Investment Tip of The Day

Regularly Reevaluate Investment Expenses: Continuously assess the expenses associated with your investments. Seek cost-effective options that don't compromise performance.