Wealth Wednesday - CBN Policy Shift, Energy Sector Reforms, and Global Rate Expectations Shape Market Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update, where we unpack key developments shaping Nigeria’s financial landscape and the broader global markets. This edition highlights major policy shifts from the CBN, sector performance on the NGX, and critical moves in global energy and commodities. Investors can expect a concise breakdown of market-moving headlines and sector trends to guide informed decision-making.

Nigerian News & Market Update

CBN announces new withdrawal limit, removes deposit cap:

CBN revises cash policies, removing cumulative deposit limits and setting new weekly withdrawal caps of ₦500,000 for individuals and ₦5 million for corporates. - Punch

Seplat Energy Completes Inlet Gas Exchanger Replacement Project:

Seplat Energy completes replacement of Inlet Gas Exchanger on the East Area Project (EAP) platform, boosting NGL production and efficiency offshore. - Dmarketforces

Nigeria’s oil content board unveils $100 million equity fund to support local producers:

The Nigerian Content Development and Monitoring Board (NCDMB) launches $100million equity scheme to boost local energy participation and to enforce stricter compliance from January 2026. - BusinessDay

Cadbury Nigeria announces MD’s retirement, appoints finance director as interim head:

Cadbury Nigeria’s MD Oyeyimika Adeboye retires after 17 years, with Finance Director Folake Ogundipe appointed as interim MD. - PremiumTimes

Nigeria To Host African Petroleum Regulators, Komolafe Elected Chair:

Nigeria is named the African Petroleum Regulators Forum (AFRIPERF) headquarters, with NUPRC’s Engineer Gbenga Komolafe elected as Forum chairman. - Channels

Nigeria Sectoral Indices Performance

The table below shows that the NGX market closed mostly positive, with key indices like NGX 30, Banking, Consumer Goods, and Industrial Goods posting gains across all major timeframes. Oil & Gas and Insurance lagged, recording declines in WTD, MTD, and QTD performances. Year-to-date, overall market sentiment remains strong, led by the Lotus Index (+85.74%), Insurance (+51.59%), and Industrial Goods (+50.48%).

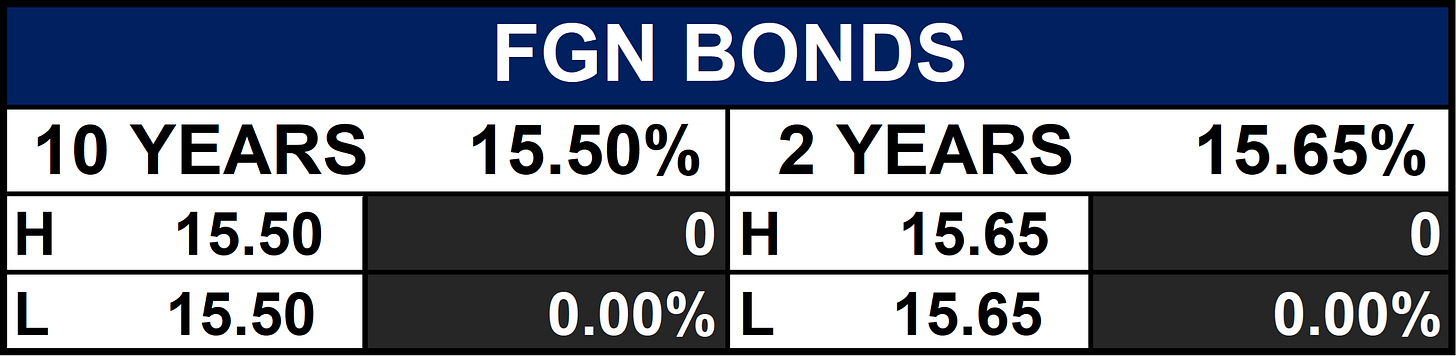

Fixed Income (FGN Bonds)

Global News & Market Update

EU to introduce export restrictions on rare earth magnet waste in early 2026:

The EU will restrict exports of rare earth magnet waste from early 2026 to boost domestic recycling and reduce reliance on China. - Reuters

Russian central bank seen cutting key rate by 50 bps to 16% at December meeting:

Analysts expect Russia’s central bank to cut its key rate by 50 bps to 16% on Dec. 19 as inflation slows faster than anticipated. - Reuters

WLF to launch real-world asset products in January:

Trump-linked crypto firm World Liberty Financial will launch its real-world asset products in January, after its USD1 stablecoin was used in an Abu Dhabi-backed investment in Binance. - Reuters

Spain announces $1.5 billion package to boost electric vehicle market:

Spain will invest nearly €1.3 billion in 2026 to boost EV production, infrastructure, and consumer adoption as it targets 95% domestic EV manufacturing by 2035. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global indices show mixed performance, with U.S. markets slightly down while European and Asian indices post modest gains. Energy and commodity prices mostly strengthen, especially cocoa, orange juice, and precious metals, though corn and copper decline sharply. Major currencies trade narrowly, with mild movements across EUR, GBP and commodity-linked currencies.

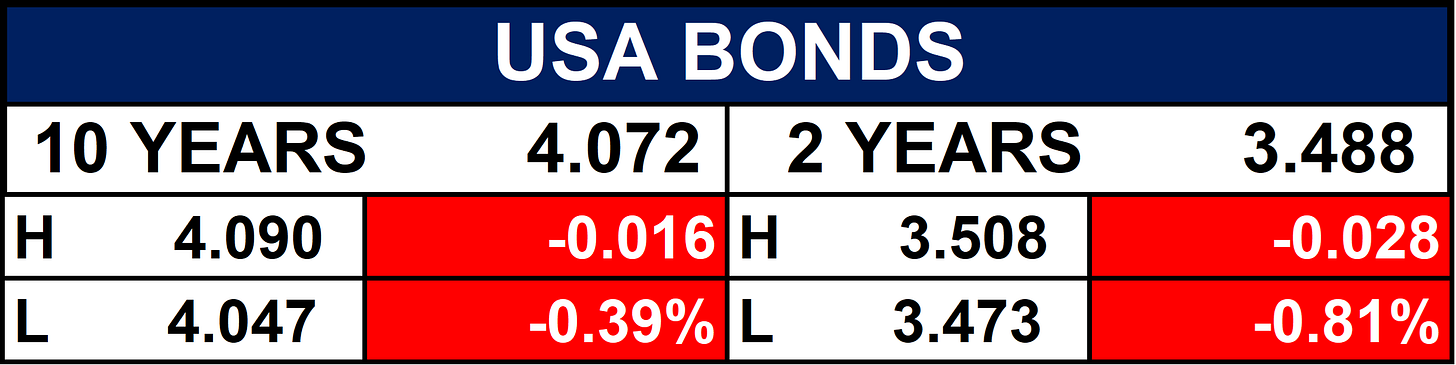

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian markets may see increased liquidity and sector rotation as new CBN cash policies take effect and energy-sector reforms accelerate. Globally, shifting rate expectations and commodity price volatility could drive mixed sentiment, requiring investors to stay nimble and focused on macro signals. Continued monitoring of policy changes, earnings outlooks, and global supply-chain shifts will be crucial for navigating the next market cycle.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.