Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

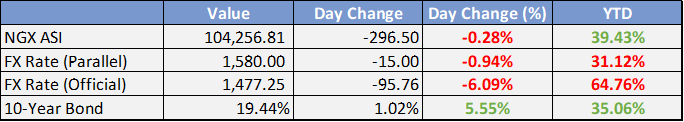

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Local manufacturing, exports best bet to tackle forex crisis

FG to address underutilisation of Eastern ports, commissions 4.8km road, six mooring boats in Rivers

Savannah Energy buys out partners’ 49% stake in Nigeria oilfield

Banks show signs of illiquidity, borrow over N24tr from CBN in three months

CBN lifts restrictions on FX access for importation of dairy products

Senate extends 2023 supplementary budget implementation to June

Global

Disney backed by big names at critical time in activists' battle

Boeing CFO says made decision to keep 737 production below 38/month

Intel prepares for $100 billion spending spree across four US states

Hindenburg shorts data center firm Equinix alleging inflated profit metric

China's Tencent posts weak revenue growth, plans to double buybacks

Market Commentary:

Currencies/Macro:

The US dollar experienced gains against the dollar bloc currencies and the Japanese yen but remained relatively stable against European currencies. The USD/JPY pair notably surged to 150.96, a four-month peak, marking a 1.2% increase throughout the day. The EUR/USD saw fluctuations between 1.0865 and 1.0835 before returning to its starting point, while the GBP/USD experienced minor dips and recoveries, ultimately showing negligible net change at 1.2720.

In the United States, housing starts for February demonstrated a robust 10.7% increase, surpassing the 8.2% expectation and rebounding from the previous month's 12.3% decline. Building permits also showed positive momentum, rising by 1.9% against a modest 0.5% forecast.

Conversely, Canadian CPI data for February indicated a weaker inflation rate than anticipated, with the headline CPI dropping to 2.8% year-over-year, below the expected 3.1% and the previous 2.9%. The core median CPI also decreased to 3.1% year-over-year, against both the forecasted 3.3% and the preceding rate. Following this data release, the USD/CAD pair initially rose from 1.3570 to 1.3610 before settling back to 1.3565, with the Canadian dollar ending the day 0.25% lower.

In Europe, the March ZEW investor surveys showed more optimism than anticipated. German expectations improved to 31.7, well above the 20.5 forecast and the earlier 19.9 figure, while the assessment of current conditions improved to -80.5, slightly better than the -82.0 expectation. Eurozone investor expectations also saw an uplift, reaching 33.5 from the previous 25.0.

Interest Rates:

The US 2-year Treasury yield decreased from 4.73% to 4.69%, and the 10-year yield dropped from 4.33% to 4.29%. Market expectations indicate that the Federal Reserve's funds rate, currently at a midpoint of 5.375%, is likely to remain unchanged at today's meeting, with a 40% probability of a rate reduction by June.

In the credit market, there has been a continued tightening ahead of the upcoming index rollovers, with the Main index improving by half a basis point to 52 and the CDX index tightening by a basis point to 48. U.S. investment-grade (IG) cash showed minimal changes, firming up slightly as primary market activities persisted in anticipation of central bank decisions, starting with the Federal Reserve's announcement this evening. In Europe, 10 issuers (excluding supranational, sub-sovereign, and agency [SSA] entities) accessed the market, raising a total of EUR 8.6 billion, whereas in the U.S., 9 issuers managed to raise USD 18.2 billion.

Commodities:

Crude oil markets reached October peak levels, buoyed by the repercussions of attacks on Russian refineries and Iraq's intentions to adjust for prior overproduction. The April West Texas Intermediate (WTI) contract increased by 0.8% to $83.40, while the May Brent contract rose by 0.55% to $87.37. The repercussions of Ukrainian drone strikes on Russian refineries are becoming increasingly evident, with escalated estimates of the affected capacity. Gunvor, a commodity trading firm, approximated that around 600,000 barrels per day (bpd) of Russia's refining capacity were impacted. Energy Aspects suggested that 850,000 bpd are currently non-operational with an additional risk to 1.9 million bpd, whereas JP Morgan indicated that around 900,000 bpd might be offline, introducing a $4 risk premium to oil pricing. They further suggested that this capacity could be out of service for an extended period, potentially several weeks or months.

Morgan Stanley updated its Brent crude price prediction to $90 by the third quarter, up from $80, citing tightening supply-demand dynamics. Oil consumption is anticipated to ascend by around 1.5 million bpd this year, slightly surpassing the usual trends. Concurrently, Bloomberg's tanker tracking data indicated that two vessels transporting Russia's primary Urals crude have been stationary off India's west coast for over three weeks, with the precise reasons still uncertain. However, the intensification of Western sanctions seems to be complicating the logistics for the fleet that transports Russian oil. In the U.S., gasoline futures have achieved six-month highs, and fuel prices at filling stations are witnessing the highest seasonal average observed in two years.

Investment Tip of The Day

Invest in personal and professional development opportunities to increase your earning potential. Education, skill-building, and networking can open new career paths, promotions, or entrepreneurial ventures, directly contributing to wealth accumulation. This investment in yourself is often overlooked but can yield significant returns by enhancing your capacity to generate income and manage wealth effectively.