Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Buhari kicks off oil drilling in Chad Basin- Punch

President Buhari virtually flagged off the oil drilling campaign in Chad Basin, Borno State, aiming to increase reserves, energy security, and prosperity. The Nigerian National Petroleum Company Limited is committed to commercial discoveries of hydrocarbons and expanding energy access for economic growth.

CBN Revokes Operating Licences of 183 MFBs, PMBs - This Day

The Central Bank of Nigeria revoked licenses of 179 Microfinance Banks and 4 Primary Mortgage Banks for non-compliance. The Nigeria Deposit Insurance Corporation assured depositors of prompt payment and emphasized the stability of the banking system.

Nigeria recorded $15.3bn FX supply via official window –CBN- The Sun

In 2022, Nigeria's foreign exchange supply through the CBN official window rose to $15.3 billion, primarily driven by the I&E window. Factors contributing to the increase included improved crude oil prices, remittance inflows, and the reopening of international borders and airports.

CBN raises interest rate to 18.5 per cent amid rising inflation - Daily Post

The Central Bank of Nigeria's Monetary Policy Committee has raised the interest rate to 20.5% from 18%, aiming to address rising inflation. Despite previous increases, Nigeria's inflation reached 22.22% in April 2023, according to the National Bureau of Statistics.

GDP Growth Slows to 2.31% Due to Cash Crunch - Punch

Nigeria's Q1 2023 real GDP growth was 2.31%, down from 3.52% in Q4 2022, attributed to the impact of a cash crunch. The Agricultural sector experienced negative growth (-0.90%), while the Services sector grew by 4.35%, with the financial sector showing the fastest growth (21.37%) since Q1 2022.

Global

DeSantis Set to Announce 2024 Run on Twitter With Elon Musk - The New York Times

Florida Governor Ron DeSantis plans to announce his 2024 presidential campaign on Twitter in a live conversation with Elon Musk, giving him access to a large online audience. This unexpected collaboration adds an element of risk and competition with former President Donald Trump.

US debt ceiling talks still in progress with no resolution as of now - CNBC

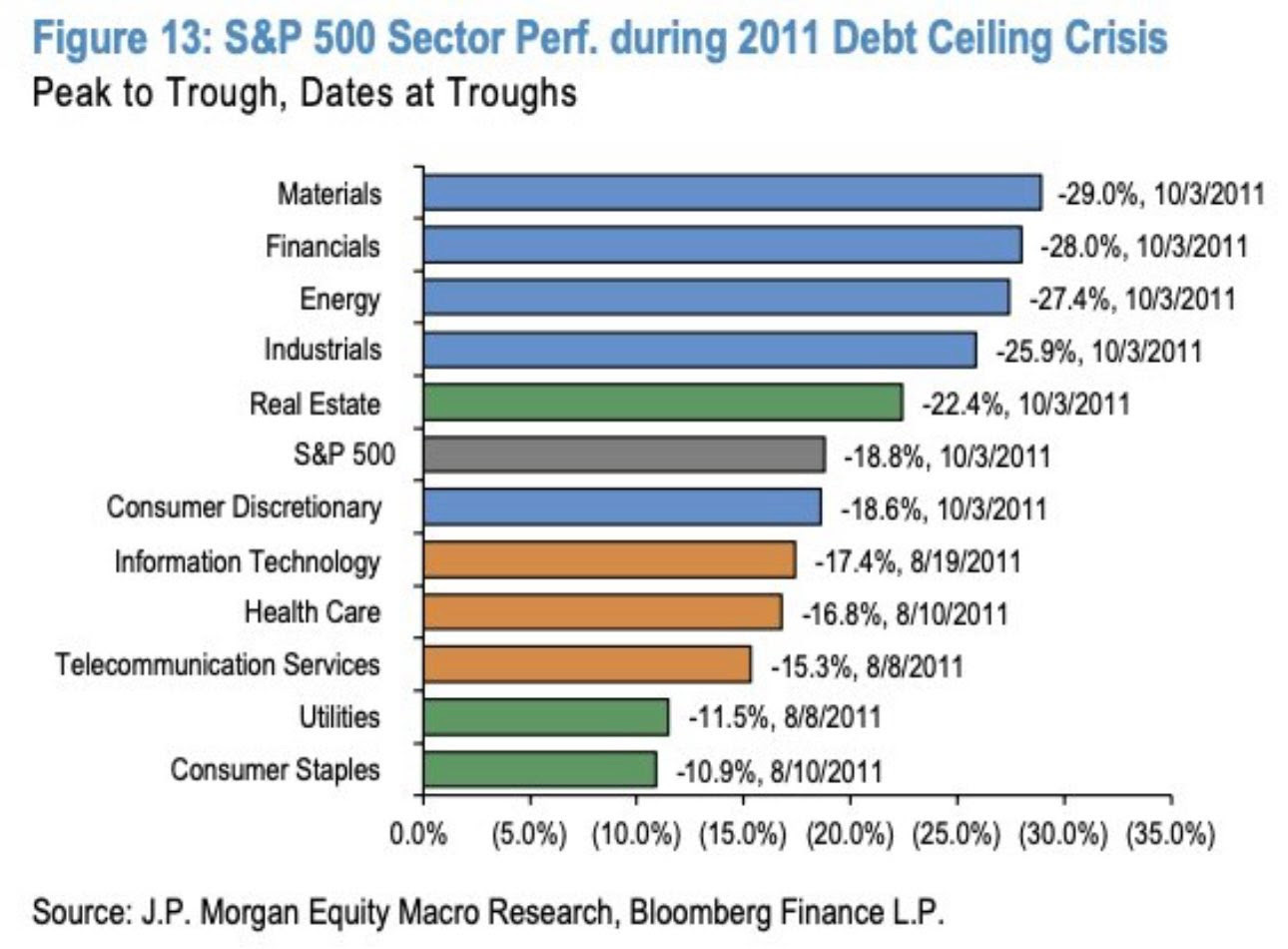

During the debt ceiling crisis of 2011 the S&P 500 dropped 18%. JPMorgan is saying this time might be worse. They are telling their big clients to short small caps and go long volatility as they think it will spike.

Republicans question June 1 debt ceiling deadline as talks zero in on potential trade-offs - CNBC

House Republicans raised questions Tuesday about comments by Treasury Secretary Janet Yellen setting a June 1 deadline to avoid a potential U.S. debt default.

Meanwhile debt ceiling negotiators are zeroing in on a small list of key issues after President Joe Biden and House Speaker Kevin McCarthy met Monday afternoon.

The issues still on the table include reforms to energy permitting, new work requirements for some forms of federal aid and the redistribution of unused Covid-19 emergency funds.

Apple and Broadcom have struck a multiyear, multibillion-dollar deal.

The latter will provide the former with 5G components and parts for its devices.

The partnership is part of Apple’s commitment to diversify its supply chain (i.e., reduce its dependence on China) and source more chips from the US.

For Broadcom, the deal strengthens its relationship with its biggest customer which accounts for some 20% of sales.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

RBNZ raised OCR by 25 bp to 5.50% as expected; maintained its forecast for a peak OCR of 5.50%, contrasting with consensus for a higher terminal rate.

Europe, Middle East, Africa

UK inflation eased in April but surprised to the upside with an 8.7% y/y outturn versus consensus 8.2% and prior 10.1%. The fall was entirely down to electricity and gas prices. Core inflation remains at its highest since March 1992

Latest German Ifo business climate survey missed expectations. May headline index at 91.7 versus consensus 93.0 and prior 93.4

The Americas

Treasury Department has asked federal agencies whether they can make upcoming payments at a later date

Treasury bills due in early June around potential default continue to include significant yield premium

PacWest reaches deal to sell real-estate lending division

The world’s 1,200 biggest public companies collectively issued $326.7bn in dividends in the first quarter of 2023, a rise of 12 per cent on the same period a year ago, according to a quarterly report from fund manager Janus Henderson.

The Week Ahead:

Monday: Fed talk - Bullard, Barkin, Bostic, Daly

Tuesday: US Manufacturing PMI comes in at 48.5; est: 50.2, US new homes sales come in at 683k; est: 663k.

Wednesday: FOMC minutes

Thursday: Initial jobless claims, GDP growth, pending home sales

Friday: Core PCE, personal income & spending, durable goods orders, Michigan consumer sentiment

Investment Tip of The Day

Consistently contributing to your investments, even in small amounts, can have a significant impact on your long-term returns. Set up automatic contributions to ensure a disciplined approach.