Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

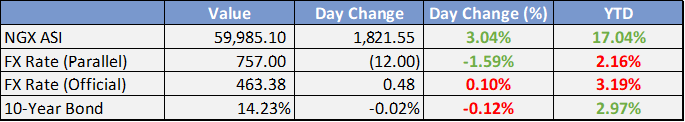

Local

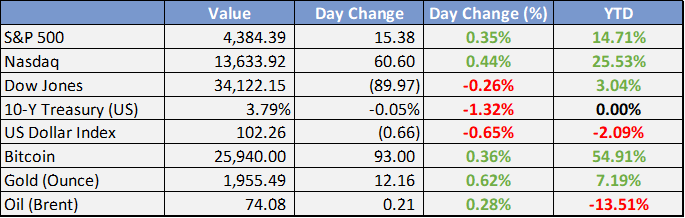

Global

*Data as of 6pm WAT

Market News

Local

FG issues two oil export terminal licences, eyes $11bn – Punch

The Federal Government, on Tuesday, issued and signed licences for the establishment of two crude oil export terminals, capable of generating $11bn revenue annually to the country.NUPRC: Nigeria’s Crude Oil Output Increased By 185,000bpd to 1.18m Daily in May - This Day

After a dismal outing in April, newly-released data from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) yesterday, indicated that Nigeria’s crude oil output grew by 185,000 barrels per day to hit 1.183 million barrels daily output in May this year.IOC, NNPCL report oil discovery in OML 102 – Punch

Nigeria’s oil and gas output may get a boost as the TotalEnergies EP Nigeria and the Nigerian National Petroleum Company Limited Joint Venture have reported oil discovery in offshore Oil Mining License 102. In a statement on Tuesday, the IOC said OML 102 is located in shallow waters, 60 km off the southeast coast of Nigeria

Global

Inflation rose at a 4% annual rate in May, the lowest in 2 years - CNBC

The consumer price index increased just 0.1% for the month and 4% from a year ago, the latter being the lowest level in about two years.

Excluding food and energy, core CPI rose 0.4% and 5.3%, respectively.

All the numbers were in line with consensus estimates.

Following the release, markets priced in a nearly 100% chance that the Federal Reserve will not raise interest rates this week.

US junk loan defaults surge as higher interest rates start to bite - Financial Times

Defaults in the $1.4tn US Junk Loan Market have limbed sharply this year as the Federal Reserve’s aggressive campaign of interest rate rises increases the pressure on risky companies with “floating” borrowing costs.

China cuts key policy rate as post-Covid recovery fizzles; yuan hits 6-month low - CNBC

China’s central bank cut its seven-day reverse repurchase rate by 10 basis points from 2% to 1.9%.

The onshore Chinese yuan weakened 0.25% to 7.1618 against the U.S. dollar following the move.

The nation’s largest banks cut deposit rates last week, signaling that further monetary easing lies ahead.

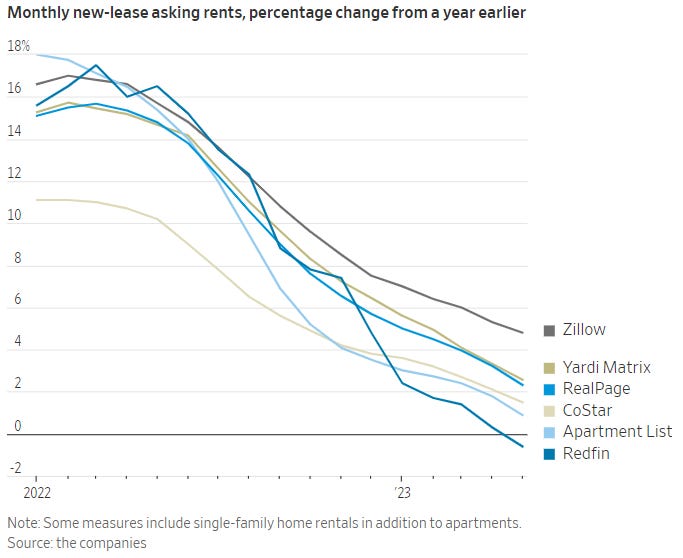

Shelter is still the biggest driver for inflation and remains stubbornly high.

That’s good news, however, because the index tends to be a lagging indicator and is expected to ease in the coming months.

Based on real-time gauges, shelter prices are already coming down:

According to Zillow’s All-House Rent Index, rental inflation has fallen below 5% for the first time since 2021.

By Redfin’s measure, nationwide rents declined 1% from a year earlier in May for the largest drop and first annual decline since March 2020

Weekly Investment Watchlist

Market Commentary

Asia and Australia

China's PBOC may cut key policy rate Thursday, according to local press, Reuters survey

China state planner launches measures to reduce business costs like VAT exemption, lowering interest on loans

South Korean import and export prices fall the most since 2020 (Yonhap) as the unemployment rate falls to a record low

Bloomberg economist survey showed New Zealand GDP growth may have contracted for the second consecutive quarter in Q1 placing economy into a technical recession. Economists forecast Q1 GDP fell 0.1% from Q4's 0.6% contraction

The yen now only major currency with a negative yield as the dovish stance continues

Europe, Middle East, Africa

Eurozone industrial production posted partial recovery in April, increasing 1.0% m/m versus consensus 0.8% after dropping 3.8% in March revised up from 4.1%.

Retailers and the film industry help the UK economy deliver slightly higher growth in April. UK monthly activity data showed the economy registered a modest 0.2% expansion in May, in line with consensus, after contracting -0.3% in the prior month.

Some ECB officials are concerned about looming TLTRO repayments. Smaller Italian lenders are the biggest concern, with Greek banks not far behind. Italian banks may tap the repo market to repay TLTROs

The Americas

Amazon Web Services considering using new AI chips from AMD

US plans to purchase ~12M barrels of oil this year as it starts to refill SPR

US judge grants temporary block of Microsoft's acquisition of Activision Blizzard

US lawmakers propose to end tariff exemption for China e-commerce shipments.

The Week Ahead:

Tuesday: May CPI inflation: 4.0%

Wednesday: Price Producer Index (PPI); MBA mortgage applications; US Fed FOMC meeting

Thursday: US initial weekly jobless claims; Retail sales data; Philadelphia Business outlook

Friday: OPEX expirations; New York Fed services business activity; University of Michigan sentiment and inflation expectations

Investment Tip of The Day

Periodically rebalance your portfolio to bring it back in line with your target asset allocation. Selling high-performing assets and buying underperforming ones can help maintain your desired risk profile and capture potential opportunities.