Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

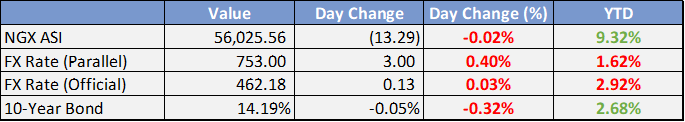

Local

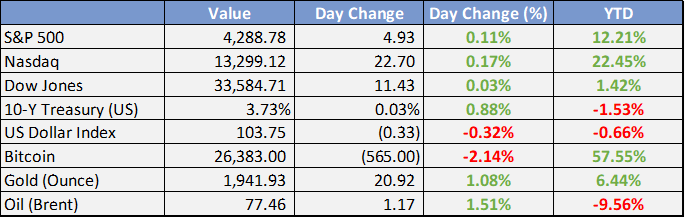

Global

*Data as of 6pm WAT

Market News

Local

BUA signs $500m facility with IFC - Business News Report

BUA Cement has secured a $500 million loan facility to support the expansion of its cement plants in Sokoto State, Nigeria. The International Finance Corporation led the loan deal, with participation from development banks such as the African Development Bank and Africa Finance Corporation.

Global

The World Bank released its latest Economic Prospects report yesterday.

Strong consumer spending in the US and a faster reopening in China prompted the institution to lift its outlook for global economic growth in 2023 to 2.1% from January’s 1.7% forecast.

That resilience, however, is seen slowing in the second half of the year and into 2024, where it now expects growth of 2.4%, down from initial estimates of 2.7%.

It warned that high inflation, rising interest rates, and Russia’s invasion of Ukraine still pose headwinds that skew risks to the global economic outlook to the downside.

The crackdown of US regulators on the crypto industry is heating up.

After filing a lawsuit against the world’s largest crypto exchange Monday, the SEC wasted no time in hitting its next target: the largest crypto exchange in the US.

The SEC sued Coinbase yesterday, alleging it has—since 2019—been operating as an unregistered exchange, broker, and clearinghouse.

In addition to listing 13 crypto assets available on Coinbase as “crypto asset securities”, the agency said it also considers the firm’s staking program as an unregistered security.

Coinbase has said it will continue to operate its business as usual until regulatory clarity emerges.

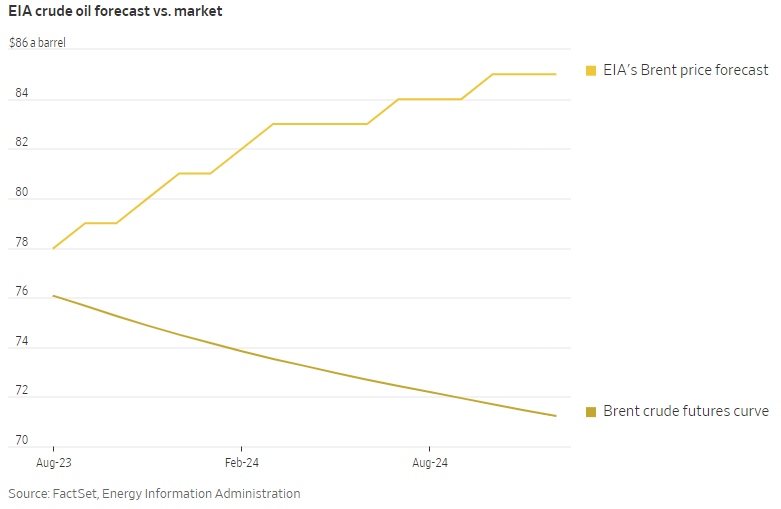

Saudia Arabia’s plan to curb oil output is not having the desired effect on prices.

That’s due largely to weaker demand from China and slowing oil consumption growth in the US, both of which are overshadowing Saudi’s pledge to cut supply.

Meanwhile, the Energy Information Administration (EIA) raised its forecast for oil prices to account for OPEC’s latest actions.

The agency lifted its price prediction for the second half of the year by $1 to $79 a barrel while raising its target for 2024 prices by $9 to $84 a barrel.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

China's trade surplus shrinks as exports see a bigger-than-expected drop. Exports fell 7.5% y/y in dollar terms, compared to a consensus drop of 1.8%, and follows an 8.5% growth in the prior month. Imports shrank 4.5%, versus the consensus of an 8% drop and the surprising 7.9% drop in the previous month.

Australia GDP posts weakest growth since 2021 Covid lockdown. Q1 GDP expanded 0.2% q/q, compared to the consensus of 0.3%, and follows the revised 0.6% in the previous quarter.

S&P ratings say China's property liquidation risk is heightened by the delisting threat

US VC giant Sequoia to split off China business

Europe, Middle East, Africa

German Industrial Production for April missed expectations at 0.3% m/m vs 0.6% expected

UK Halifax house price data shows a flat reading in May, but on an annual basis prices fell 1%

ECB April Consumer Expectations Survey suggested inflation over the next 12 months seen at 4.1% vs 5.0% prior.

The Americas

Bulls in the Investor's Intelligence report pushed up to 51.3% in the week-ended 6-Jun from 47.9% in the prior week, above the 50.7% mid-April peak and the highest since the "danger level" reading of 57.2% in November 2021.

The Week Ahead:

Monday: US May ISM Services index comes in at 50.3; est 51.8.

Tuesday: IBD/TIPP economic optimism, API crude oil stock change

Wednesday: US trade deficit, EIA stocks change, consumer credit change

Thursday: Initial jobless claims, wholesale inventories

Friday: WASDE report

Investment Tip of The Day

Research company fundamentals. When investing in individual stocks, take the time to research and analyze the fundamental aspects of the companies you're interested in. Consider factors such as revenue growth, earnings potential, competitive advantages, and management quality.