Wealth Wednesday

Ranora Daily - Your daily source for reliable market analysis and news.

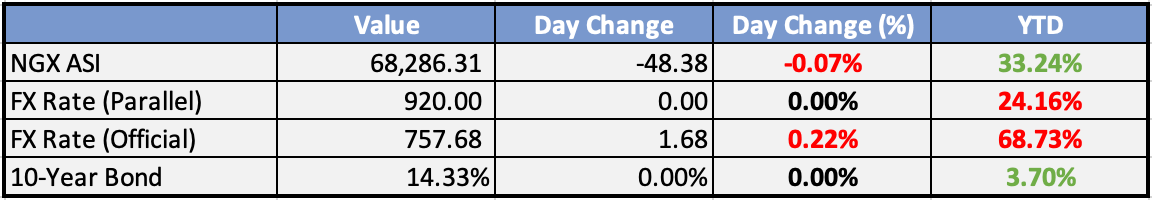

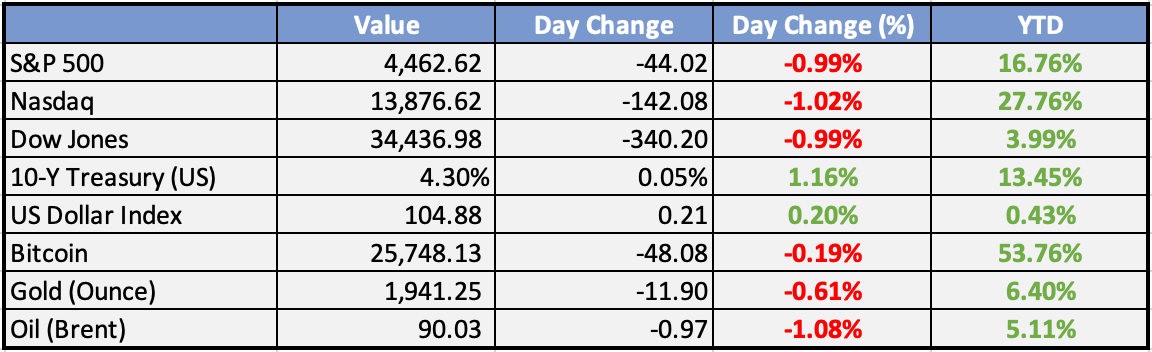

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Dollar debts: CBN repays banks next week, naira may rebound - Punch

The Central Bank of Nigeria (CBN) is set to repay $4 billion in dollar debts owed to banks next week, which could help to stabilize the Naira. The CBN had borrowed the money from banks to support the currency, which has been under pressure due to a shortage of dollars and rising inflation. The repayment is expected to boost the supply of dollars in the market and could lead to a rebound in the Naira.

AfDB commits $25bn to African climate fund - Punch

The African Development Bank (AfDB) has committed $25 billion to the African Climate Fund (ACF), which will support climate adaptation and mitigation projects across the continent. The ACF is expected to help mobilize $100 billion in climate finance for Africa by 2025. The fund will support projects that help African countries to reduce their greenhouse gas emissions.

World Bank delays $8.6bn loan to Nigeria - Punch

The World Bank has delayed a $8.6 billion loan to Nigeria due to concerns about the country's debt sustainability. The loan was intended to help Nigeria finance its budget deficit and invest in infrastructure. The World Bank is concerned that the loan would add to Nigeria's already high debt levels and could make it more difficult for the country to repay its debts in the future.

COP28 plans $4.5bn funding for African clean energy - Punch

The COP28 Presidency-Designate, the United Arab Emirates, has announced plans to provide $4.5 billion in funding for African clean energy projects. The funding will be provided through the Clean Energy Fund for Africa (CEFA), which was launched at the COP26 climate summit in Glasgow last year.

CBN to clear FX backlog in 2 weeks, urges BDCs to adopt technology in service execution - The Sun

The Central Bank of Nigeria (CBN) plans to clear all forex demand backlogs from various sectors like manufacturers, businesses, importers, and exporters within the next two weeks. The Acting Governor of the CBN, Folashodun Shonubi, encouraged the adoption of electronic payment methods among Bureaux de Change (BDCs).

PENGASSAN rejects NAOC sale, plans shutdown - Punch

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) threatens to withdraw its members from offices and oil fields due to the purchase of Eni Nigeria and Nigerian Agip Oil Company Limited by Oando Plc, without informing the union. Over 3,000 indigenous workers could potentially lose their jobs.

Global

Goldman Cuts US Recession Chances to 15% on Improved Inflation - Bloomberg

Goldman Sachs has reduced the likelihood of a US recession in the next 12 months from 20% to 15%. This adjustment is attributed to positive inflation and labor market data. The investment bank anticipates a reacceleration in real disposable income in the coming year due to strong job growth and rising real wages.

Saudis, Russia Extend Their Oil-Supply Curbs to Year-End - Bloomberg

Saudi Arabia and Russia have extended their oil supply cuts by three months, signaling a commitment to stabilizing global markets. Saudi Arabia will continue its production cut of one million barrels per day until December, while Russia will maintain its export reduction of 300,000 barrels per day for the same duration.

Weekly Investment Watchlist

The Week Ahead:

Monday:

Tuesday:

Wednesday:

ISM Services PMI (US) 54.5

US Employers added 187k jobs last month, unemployment rose to 3.8%.

Thursday:

Unemployment Claims (US)

Friday:

Investment Tip of The Day

Factor Investing: Explore factor-based investing, focusing on attributes like value, growth, or momentum to tailor your investment approach.