Wealth Wednesday - FTSE Upgrade Plan Boost Nigeria’s Outlook and CBN Tightens Liquidity Amid Global Market Volatility

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. Nigeria’s outlook brightens as FTSE Russell eyes a Frontier Market upgrade, the CBN raises ₦3trillion via Open Market Operations (OMO) bills, and plans emerge to refinance a $1.1billion Eurobond. Globally, Argentina battles peso pressure, Russia stabilizes oil output, and Germany boosts its 2025 growth forecast. Reforms and strong liquidity moves position Nigeria for renewed investor confidence heading into Q4 2025.

Nigerian News & Market Update

FTSE Russell to Upgrade Nigeria to Frontier Market Status:

FTSE Russell placed Nigeria on its Watch List for upgrade to Frontier Market status. The move follows eased FX controls and improved investor access.

Final decision expected by September 2026. - dmarketforcesCBN Floats OMO Bills, Raises ₦3trillion from ₦4.4trillion Subscription:

CBN held a ₦600billion OMO auction to mop up excess liquidity over ₦6trillion.

Investors subscribed ₦4.4trillion, with ₦3trillion allotted at ~19.5% rates.

It’s the third auction since Friday, showing strong demand for naira assets. - dmarketforcesNigeria to refinance its $1.1 billion Eurobond due November:

Nigeria plans to raise $2.3billion, including reissuing its $1.1billion Eurobond and a $500million Sukuk by Q4 2025. Lower yields and investor confidence make conditions favorable. Funds will help refinance debt and boost investment. - Businessday

Eko DisCo Registers Excel Electricity Distribution Coy As Subsidiary:

Eko DisCo formed Excel Electricity Ltd to manage its Lagos operations under new state regulations. The move complies with the Electricity Act 2023.

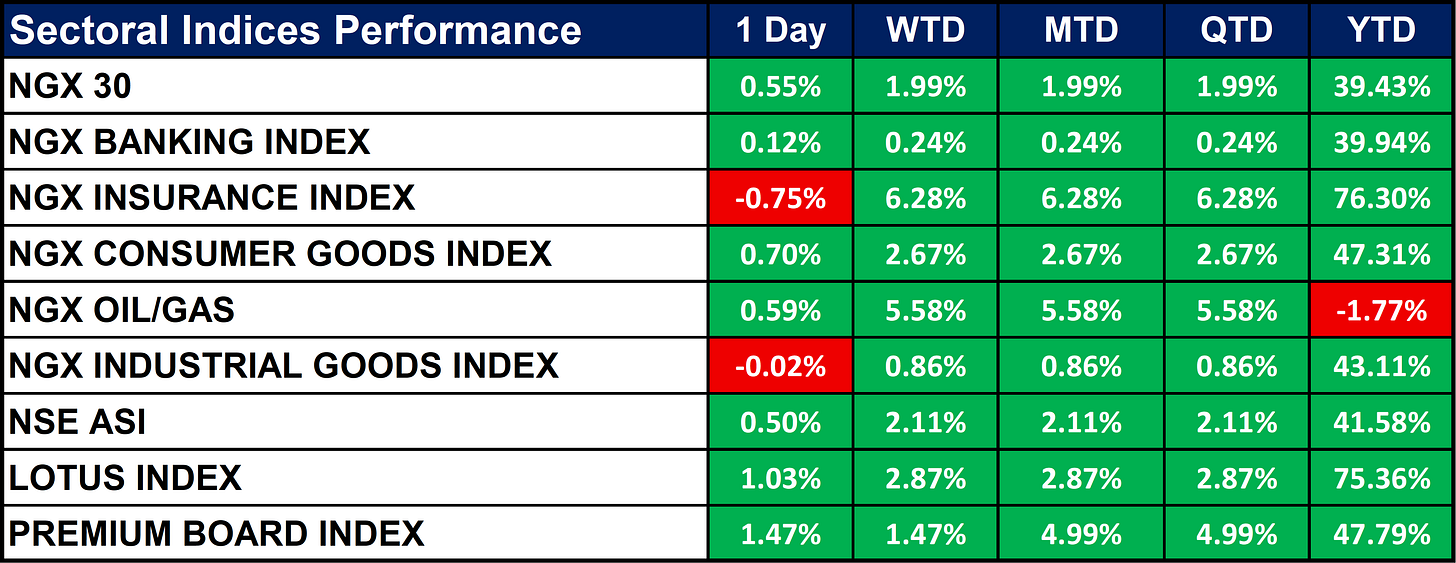

Eko DisCo remains a holding company and hasn’t been sold. - LeadershipNigeria Sectoral Indices Performance

The table below shows that the Nigerian market remained broadly positive, with most sectoral indices positive across all timeframes. Insurance (+76.3% YTD) and Lotus (+75.4% YTD) lead performance, reflecting strong investor sentiment. Only the Oil & Gas sector (-1.77% YTD) remains negative, despite a recent 5.6% weekly rebound.

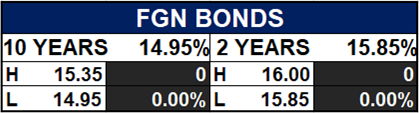

Fixed Income (FGN Bonds)

Global News & Market Update

Argentine Treasury struggles to contain peso slide, awaits US support:

Argentina’s Treasury sold over $1.6 billion to defend the peso as exporter inflows fade ahead of elections. Economy Minister Caputo seeks U.S. aid, possibly a $20 billion swap. Markets expect a freer exchange rate after the vote. - Reuters

Russia has been gradually increasing its oil output, Deputy PM Novak says:

Russia’s oil production neared its OPEC+ quota despite Ukrainian attacks, causing brief fuel shortages. The government extended fuel export bans but says supply is now stable. Deputy PM Novak confirmed no major domestic fuel issues remain. - Reuters

US postpones sanctions on Serbia’s Russian-owned NIS oil company for one week:

The U.S. delayed sanctions on Serbia’s Russian-owned NIS oil firm by one week to October 15. A related license extension allows Croatia’s JANAF to finish crude deliveries to Serbia. The move gives NIS time to secure supplies before sanctions disrupt long-term operations. - Reuters

German economy ministry lifts 2025 growth forecast to 0.2%:

Germany lifted its 2025 growth outlook to 0.2%, driven by a €500billion spending plan, but exports remain weak due to trade tensions. Growth will depend on domestic demand and consumption instead of foreign trade. - Reuters

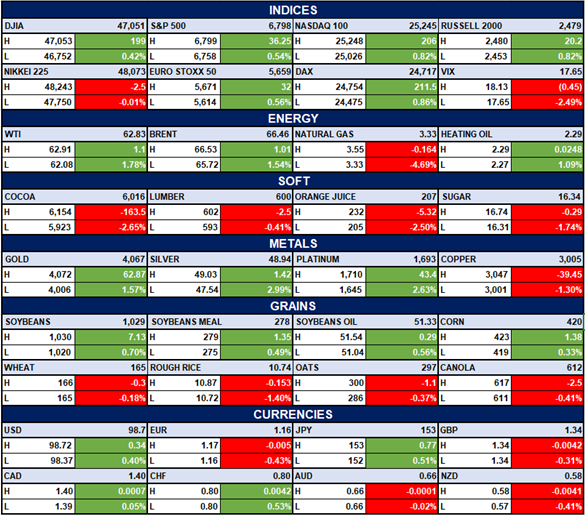

Indices, Commodities & Currencies

The table below depicts that the Global markets are mixed U.S. indices (S&P 500, Nasdaq) show small gains while Asia (Nikkei) is slightly lower.

Energy prices are up, with Brent up 1.54% and WTI at 1.78%, signaling firm oil demand. Commodities are uneven: gold and silver rise, but softs like cocoa and orange juice fall; the U.S. dollar strengthens modestly against most currencies.

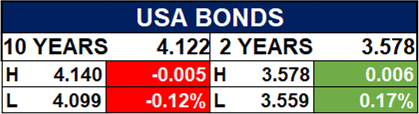

Fixed Income (USA Bonds)

Events

Conclusion

Going forward, investors could expect continued liquidity tightening by the CBN, supporting naira stability and attractive yields in the short term. Improved foreign access through the FTSE Russell upgrade watch and reforms in the power sector could attract fresh capital inflows. Globally, oil price resilience and fiscal expansion in major economies may sustain demand for emerging market assets like Nigeria’s. In essence, the near-term outlook favors selective positioning in energy, banking, and defensive consumer sectors, as global inflation trends and local reforms shape capital flows into Q4 2025.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.