Wealth Wednesday - Market Rallies on Cement Earnings & Capital Inflows as Global Tariffs Stir Uncertainty

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. The Nigerian market closed higher amid strong corporate earnings and upbeat investor sentiment. Parthian Partners’ successful ₦10billion bond redemption, alongside surging capital inflows into the banking sector, signal growing investor confidence. Meanwhile, cement giants reported record-breaking profits, fueling the industrial sector’s momentum. On the global front, U.S. markets gained modestly on Fed rate cut hopes, even as fresh tariff tensions introduced renewed caution.

Nigerian News & Market Update

Parthian Partners redeems ₦10billion bond:

Parthian Partners Limited has successfully repaid its ₦10 billion three-year bond, completing its short-term debt programme launched in 2022. The bond, issued at a 13.50% rate, was fully subscribed and praised for timely payments. This milestone highlights Parthian’s financial strength, investor trust, and ongoing commitment to Nigeria’s capital markets. - Punch

Banking booms with $3.1billion foreign inflows in three months:

Capital importation into Nigeria rose to $5.64billion in Q1 2025, up 67.1% year-on-year. The banking sector led with $3.13billlon, while the manufacturing sector declined by 32.3% to $129.92million due to economic reforms and investor caution. Portfolio investments dominated, making up over 92% of total inflows. Abuja and Lagos were top destinations, and the UK was the largest source. Experts remain cautiously optimistic about future investment in manufacturing. - Punch

Gains in 52 stocks push up capitalization by ₦458 billion:

The Nigerian equities market rose by ₦458 billion as the All-Share Index gained 0.5% to close at 144,796.37 points, driven by strong demand in BUA Cement and 51 other stocks. Market sentiment remained positive, with 52 gainers and 22 losers. Top gainers included BUA Cement, AIICO Insurance, and SUNU Assurance, each up 10%. Trading volume increased by 26.7% to over 1 billion units, valued at ₦22.84 billion across nearly 39,000 deals. Analysts expect continued bullish momentum, especially in large-cap stocks. - Guardian

Cement firms’ profit up by 229% on FX stability as revenue hits ₦3.2trillion:

In H1 2025, Dangote Cement, BUA Cement, and Lafarge Africa posted a combined profit of ₦833.2billion a 229% increase from last year driven by FX stability and rising demand. Revenue rose 28% to ₦3.2trillion. Reduced exchange losses and improved macroeconomic conditions boosted performance, positioning the cement sector for a strong financial year. - Guardian

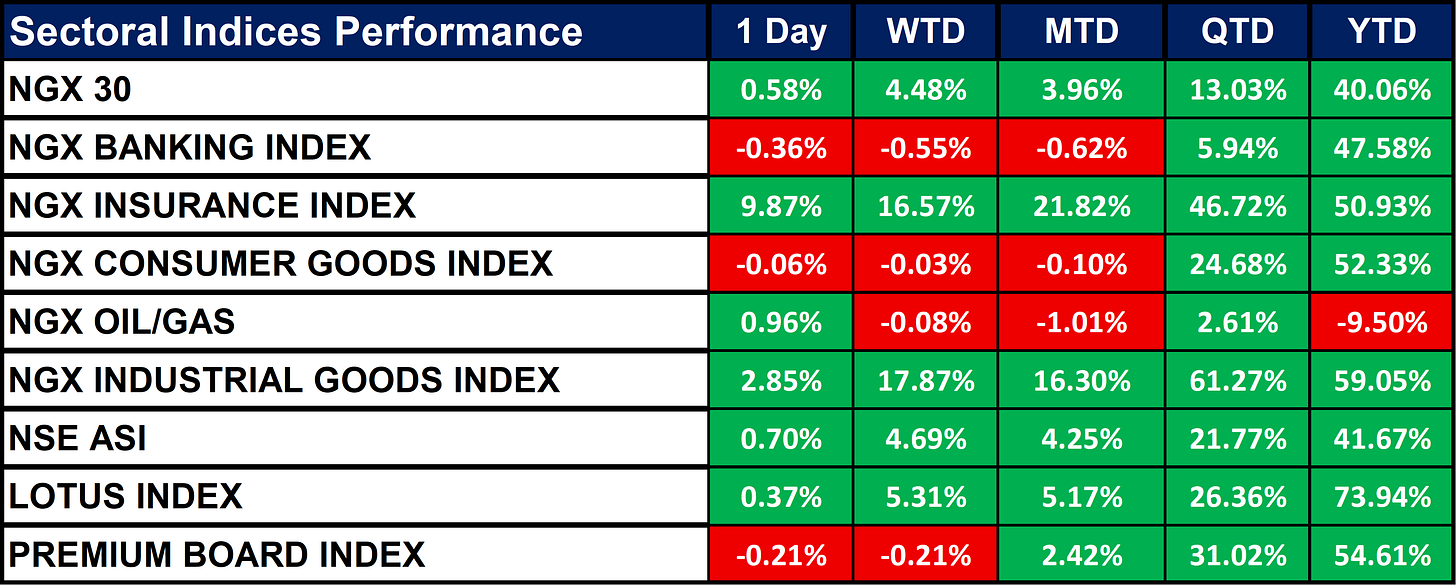

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equity market continues to show broad-based strength led by Industrial Goods, Insurance, and Sharia-compliant stocks (Lotus Index). However, Oil & Gas remains under pressure. Investor sentiment appears strong, with most indices posting double-digit growth for the quarter and year.

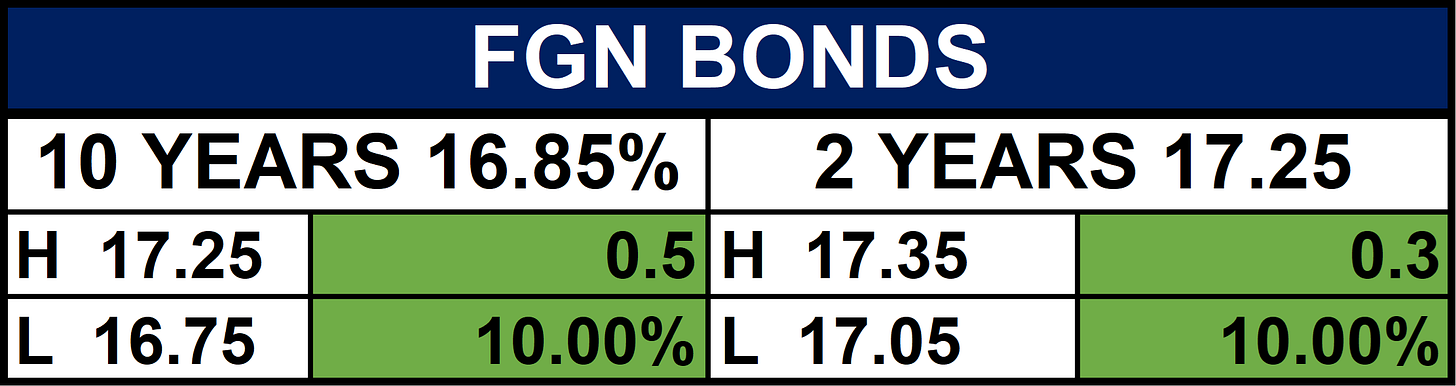

Fixed Income (FGN Bonds)

Global News & Market Update

Trump raises India tariffs to 50% over Russian oil purchases:

The White House has announced an additional 25% tariff on Indian imports, raising the total U.S. tariff on India to 50%. President Donald Trump justified the move by citing India's continued importation of Russian oil, which he claims supports Russia's war efforts. The tariff is part of broader penalties, including consequences for India’s purchase of Russian military and energy supplies. Trump emphasized the urgency of the action, stating he would raise tariffs “very substantially” within 24 hours due to India's ties with Russia. - CNBC

S&P 500 and Nasdaq lifted by earnings, Fed hopes:

U.S. markets edged up on Wednesday, driven by strong corporate earnings and rising hopes for a Fed rate cut in September. The S&P 500 and Nasdaq gained, while the Dow stayed flat. Stocks like Apple, McDonald’s, and Arista Networks rose, but AMD and Super Micro dragged tech shares down. Market sentiment was boosted by weak economic data, raising the likelihood of a rate cut to 89.4%, but Trump’s new tariff threats added uncertainty. Mixed market breadth saw more gainers on the NYSE but more losers on the Nasdaq, which recorded 25 new highs and 46 new lows. - Reuters

Trump announces trade agreement with South Korea ahead of August 1 tariff deadline:

The U.S. and South Korea have reached a new trade deal imposing a 15% tariff on South Korean goods. In exchange, South Korea will invest $350 billion in U.S.-controlled projects, including $150 billion for shipbuilding and funds for tech and energy sectors. The deal, reached ahead of Trump’s August 1 tariff deadline, avoids harsher 25% tariffs. South Korea also agreed to buy $100 billion in U.S. energy, but resisted opening its agricultural market. The agreement provides economic relief for South Korea while aligning with Trump’s trade priorities. - CNN

US requires Zambia, Malawi citizens to pay up to $15,000 bond for some visitor visas:

Starting August 20, 2025, the U.S. will require some tourist and business visa applicants from Zambia and Malawi to post refundable bonds of $5,000 to $15,000 under a new pilot program. The bonds, set at the visa interview, aim to reduce visa overstays and will be refunded if the traveler complies with visa terms. Travelers must enter and exit through Boston Logan, JFK New York, or Washington Dulles airports, or risk penalties. The program is part of the Trump administration’s broader efforts to tighten immigration controls and could be expanded to other countries with high overstay rates. - Reuters

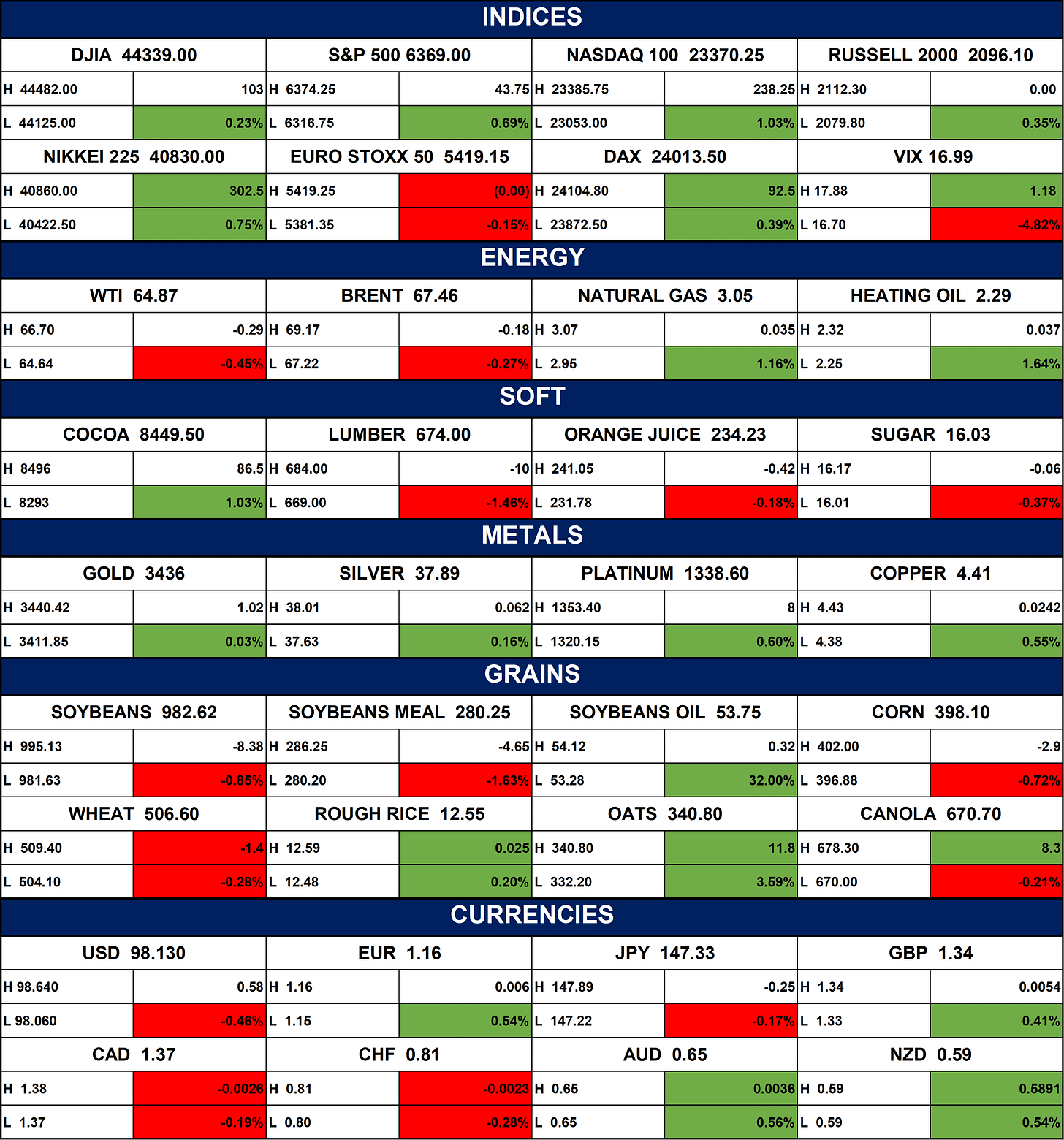

Indices, Commodities & Currencies

The table below depicts that the Global markets edged higher, with major indices like the S&P 500, Nasdaq 100, and Nikkei 225 posting gains. Energy prices were mixed, with natural gas and heating oil up, while crude oil dipped. Cocoa and oats led commodity gains, while soybeans, corn, and lumber declined. Metals saw modest gains across the board. The U.S. dollar weakened, while other major currencies showed slight movements.

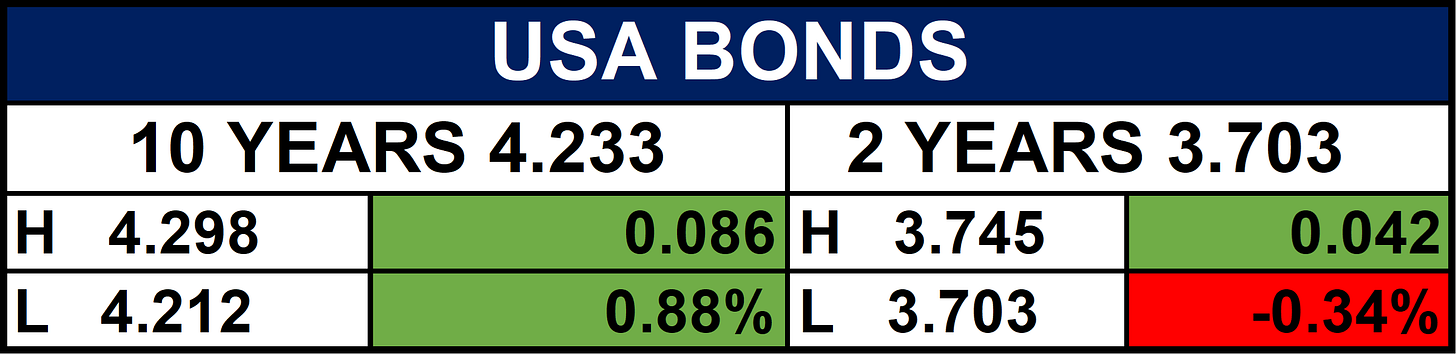

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian equities may continue their upward trend, buoyed by strong corporate results, FX stability, and rising investor inflows. However, global trade tensions and tariff uncertainty especially between the U.S. and key partners like India and South Korea could spark volatility. Investors should watch for macroeconomic cues, earnings releases, and geopolitical shifts that may shape short-term market direction.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.