Wealth Wednesday - Markets Maintain Momentum Amid Oil Volatility and Global Trade Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Today’s update covers the Nigerian market’s bullish trend, NNPC’s revenue drop, ExxonMobil’s new Nigeria MD, and strong sectoral gains led by Consumer Goods and Banking. Globally, SAP posted mixed results, while a U.S.-Japan trade deal boosted autos. Commodities weakened overall, but equities stayed firm. Key highlight: GTCO crossed ₦100 per share.

Nigerian News & Market Update

Bullish trend continues as stock market gains N396bn:

The Nigerian stock market extended gains on Tuesday, adding ₦396billion in market capitalization as the All-Share Index rose 0.71% to 99,793.71 points, driven by large-cap stocks like Dangote Cement, BUA Cement, and MTN Nigeria. 36 stocks gained, led by Dangote Sugar (+10%), while 34 declined, with Ellah Lakes (-10%) topping losers. Trading volume fell 47.7% to 408.62 million shares valued at ₦7.83billion. The Industrial Goods Index led sectoral gains, up 2.87% weekly and 28.23% YTD. - Punch

NNPCL’s June Revenue Slips Amid Global Oil Volatility:

NNPC’s oil revenue fell 23.9% to ₦4.57trillion in June, down from ₦6trillion in May, due to declining global oil prices amid geopolitical tensions, weak Asian demand, and OPEC uncertainties. Brent crude dropped 0.75% to $68.69, while WTI fell 0.76% to $66.69 on Tuesday. - Channels

ExxonMobil Nigeria Names New Chairman/Managing Director:

ExxonMobil has appointed Jagir Baxi as Chairman, MD, and Lead Country Manager in Nigeria, succeeding Shane Harris. Baxi, an Australian with extensive global oil and gas experience, aims to strengthen partnerships and drive offshore deepwater growth in Nigeria. - Channels

Fixed Income (FGN Bonds)

Nigeria Sectoral Indices Performance

The NGX market below shows strong momentum, led by Lotus Index (+51.44%), Consumer Goods (+44.02%), and Banking (+41.90%). Oil & Gas remains the weakest sector, down -11.34% YTD.

This week, Industrial Goods surged (+19.53% WTD), while Banking and Insurance declined due to likely profit-taking.

Global News & Market Update

Europe’s most valuable firm SAP flags U.S. trade slowdown but says Japan deal gives ‘hope’:

SAP reported 9% revenue growth and a 22% rise in cloud backlog in Q2, but deal-signing slowed due to trade uncertainties. CFO Dominik Asam noted the recent U.S.-Japan deal offers some hope. Despite growth, shares opened lower Wednesday as macro uncertainty and euro strength against the dollar weighed on earnings. - CNBC

Trump strikes tariff deal with Japan, auto stocks surge:

President Trump struck a major trade deal with Japan, cutting auto tariffs from 27.5% to 15% in exchange for a $550billion U.S.-bound investment package, 100 Boeing plane orders, and increased defense spending. The deal boosted Japan’s Nikkei by nearly 4%, with Toyota and Honda shares surging. U.S. automakers criticized the deal for favoring Japanese imports. The agreement also includes more U.S. agricultural exports and plans for semiconductor and medicine tariff negotiations. - Reuters

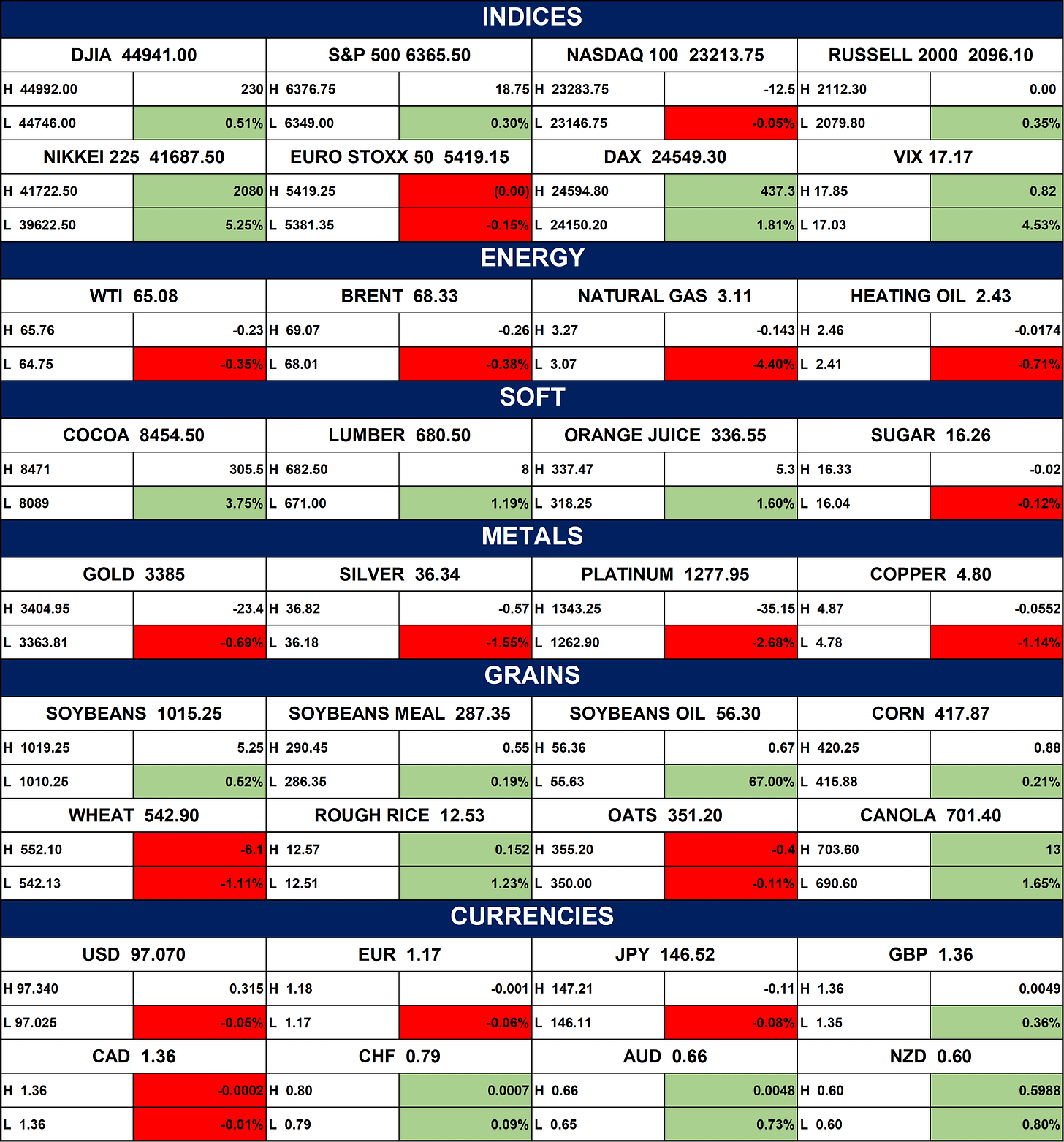

Indices, Commodities & Currencies

The table below depicts that the global stocks were mostly higher, led by a strong Nikkei gain. Energy and metals prices dropped, while soft commodities rose, especially cocoa. Grains were mixed, and the US dollar was slightly weaker, with minor gains in AUD and NZD. Overall, equities stayed firm despite broad commodity weakness.

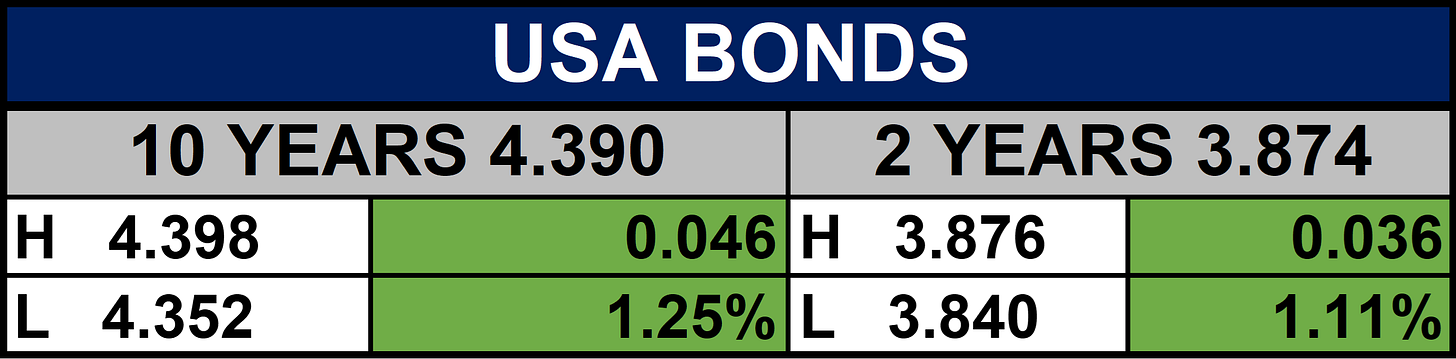

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, markets may continue to reflect positive domestic investor sentiment, especially if industrial and banking sector momentum persists. However, global oil price volatility and trade uncertainties could influence market direction. Investors should watch upcoming earnings releases, policy signals, and global economic trends for cues on potential market adjustments or sustained rallies in the coming days.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.