Wealth Wednesday - Markets Soar on Earnings Momentum Amid Fuel Price Wars and Global Trade Shocks

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. This newsletter captures strong earnings momentum across Nigerian and U.S. markets. In Nigeria, FCMB, Dangote Cement, and MTN drove a market cap surge to ₦87.19 trillion, while UAC’s acquisition of Chivita and petrol price wars signal strategic shifts in key sectors. Sectoral indices remain robust, except Oil & Gas. Globally, U.S. GDP grew 3%, but trade risks intensified as Trump imposed a 25% tariff on India, raising market caution amid strong energy prices and steady Wall Street performance.

Nigerian News & Market Update

FCMB Group records N529.2bn in gross earnings:

FCMB Group reported strong growth for H1 2025, with gross earnings rising 41.3% to ₦529.2billion, driven by higher interest income and loan book expansion. Profit after tax grew 23.4% to ₦73.4billion, despite a drop in trading income and rising operating costs. Customer deposits rose 39.9% to ₦4.54trillion, while total assets reached ₦7.54trillion. However, EPS declined to ₦3.70 from ₦6.00 due to capital restructuring. - Punch

Marketers drop petrol prices below Dangote’s cost:

Fuel importers in Nigeria have started selling petrol below Dangote Refinery’s prices, with some depots offering it at ₦815/litre compared to Dangote’s ₦820/litre, sparking a price war. While marketers praise this as the benefit of a liberalized market, Aliko Dangote is calling for a ban on fuel imports, citing unfair competition and dumping of cheap, substandard fuel. Marketers oppose the ban, urging the government to maintain open competition to ensure fair pricing and supply. - Punch

Coca-Cola Sells Hollandia, Chivita To UAC:

UAC of Nigeria has announced its acquisition of Chivita/Hollandia (CHI Limited), a leading dairy and juice company, marking a major strategic move to deepen its presence in Nigeria’s fast-moving consumer goods (FMCG) sector. The deal aligns with Coca-Cola’s strategy to maintain a flexible, asset-light model and focus on scalable brands. Coca-Cola reaffirmed its $1 billion investment commitment to Nigeria over five years, dependent on a stable business environment. Both UAC and CHI Limited management expressed confidence in the company’s future growth, highlighting the strength of CHI’s brands and workforce. - Channels

Market Capitalization Up N1.74trn to N87trn Historic High:

The Nigerian stock market surged by ₦1.74 trillion to reach a record ₦87.19 trillion in market capitalization, driven by strong H1 2025 earnings. Major boosts came from Dangote Cement and MTN Nigeria. The NGX index rose 2.03%, with Year-to-Date returns at +34%. Most sectors gained, while market sentiment remained positive with more advancers than decliners. Trading activity also increased, with Fidelity Bank leading in volume. Analysts expect the rally to continue as earnings results fuel investor interest. - Thisday

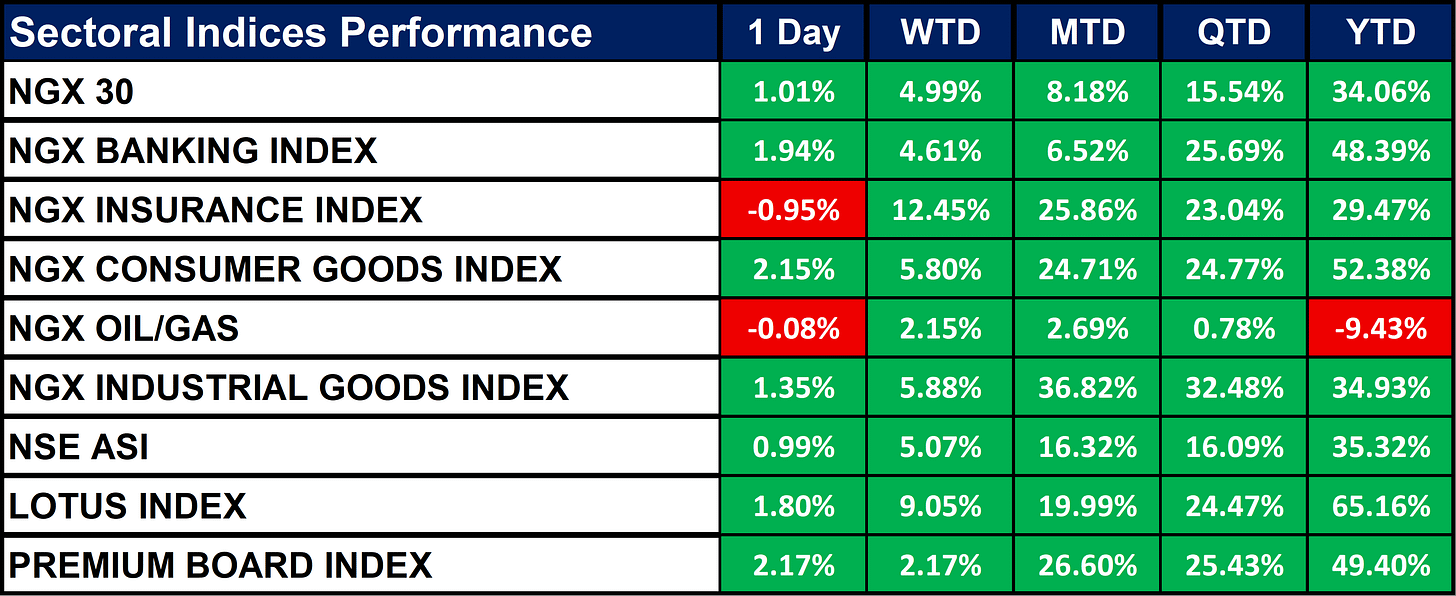

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian market continued its broad-based rally with strong daily gains in the Consumer Goods (+2.15%), Banking (+1.94%), and Premium Board (+2.17%) indices. Most sectors recorded solid weekly and monthly growth, especially Insurance, which despite a daily dip of -0.95%, posted +12.45% WTD and +25.86% MTD. Year-to-date, Lotus Index (+65.16%), Consumer Goods (+52.38%), and Banking (+48.39%) lead the market. The only sector in negative territory remains Oil/Gas (-9.43%), showing continued underperformance. Overall, investor sentiment remains upbeat, with momentum strongest in consumer-facing and Sharia-compliant stocks.

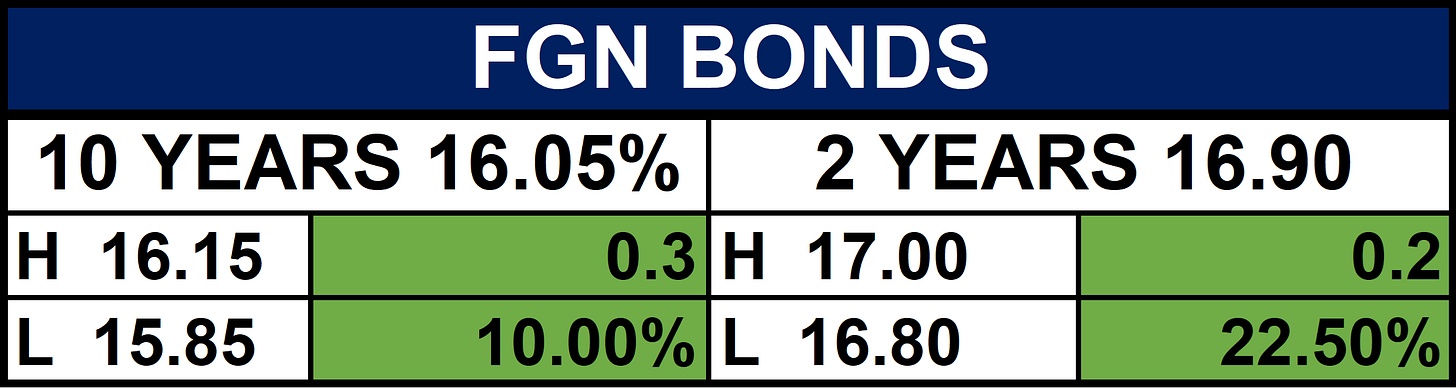

Fixed Income (FGN Bonds)

Global News & Market Update

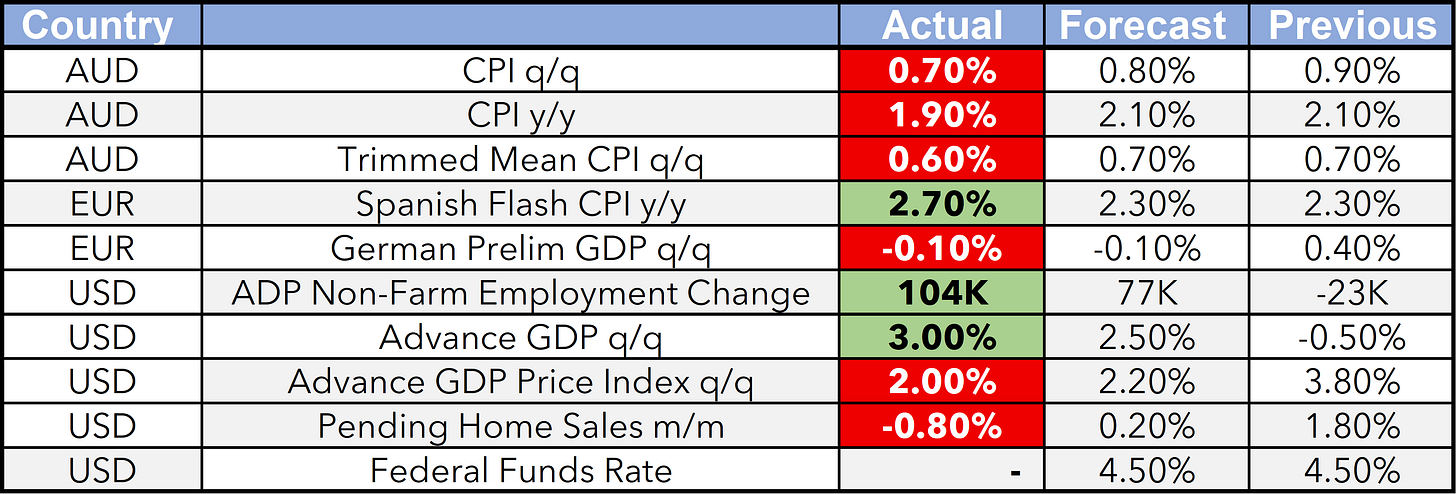

U.S. economy grew at a 3% rate in Q2, a better-than-expected pace even as Trump’s tariffs hit:

U.S. GDP grew by 3% in Q2, beating the 2.3% forecast and rebounding from a 0.5% decline in the previous quarter. Consumer spending rose 1.4%, up from 0.5%. While exports fell 1.8%, imports dropped sharply by 30.3%, reversing a previous surge. In response, President Trump renewed calls for the Federal Reserve to cut interest rates. -CNBC

Trump announces 25% tariff on India plus ‘penalty’ for trade with Russia:

President Donald Trump announced a 25% tariff on India starting August 1, citing high tariffs and strict trade barriers. He also hinted at an unspecified additional “penalty.” Trump criticized India’s trade practices as among the most restrictive globally, despite calling the country a friend. - CNBC

Wall St holds firm after strong GDP report; Fed, tech earnings in focus:

Wall Street held steady as strong U.S. GDP growth and solid earnings boosted sentiment, but concerns over weak domestic demand and rising trade tensions added caution. The Fed is now less likely to cut rates in September. Investors await earnings from major tech firms, while Trump’s new 25% tariff on Indian imports and ongoing trade talks with China and South Korea added to market uncertainty. - Reuters

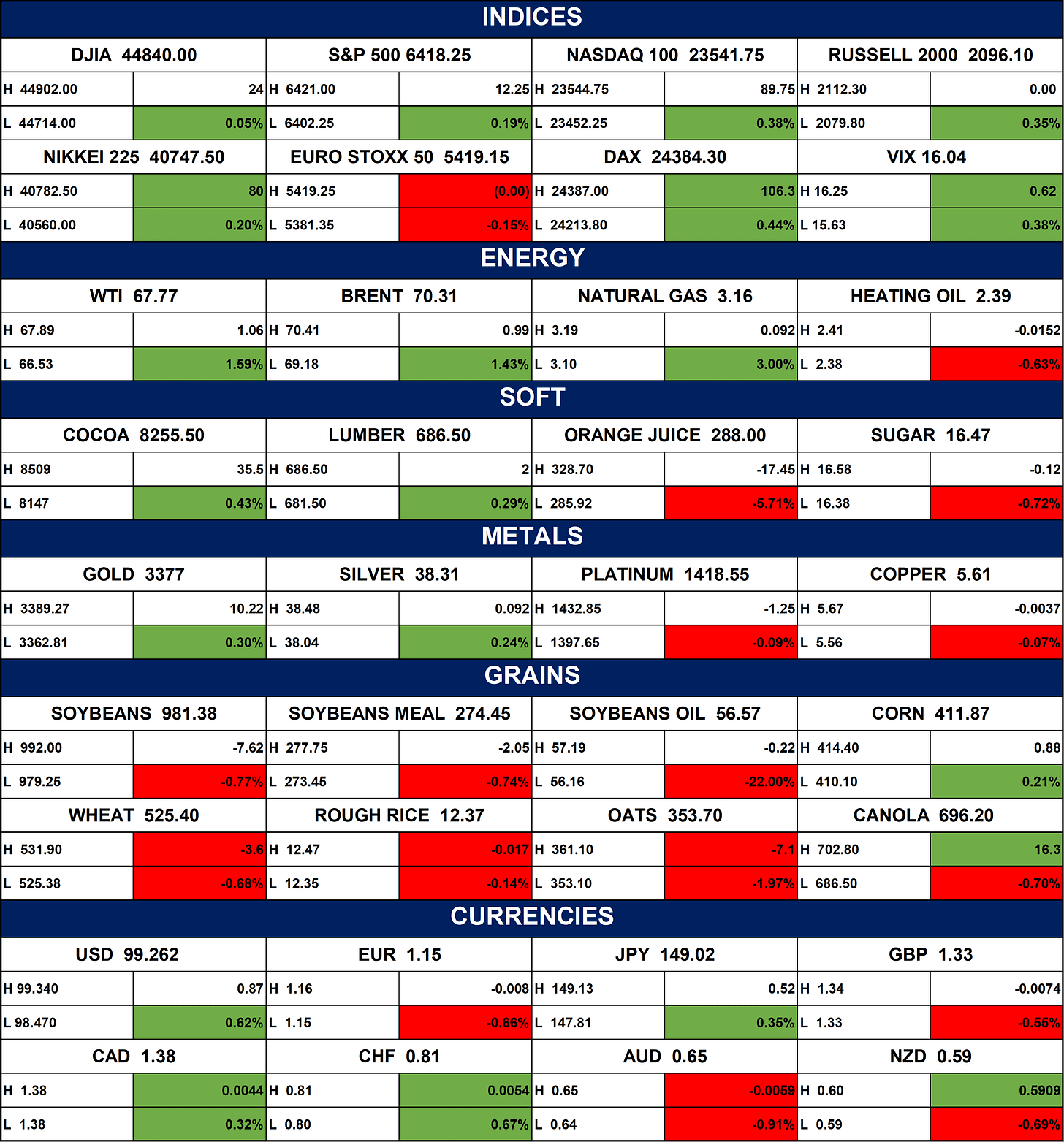

Indices, Commodities & Currencies

The table below depicts that the Global markets posted mixed results. Equities showed slight gains in the U.S. and Japan, while tech and European indices dipped. Oil and natural gas prices rose sharply, signaling strong energy demand. Precious metals edged higher, but soft commodities and grains were mostly down, with orange juice and soybeans leading the declines. The U.S. dollar strengthened against major currencies, reflecting investor caution and a risk-sensitive environment.

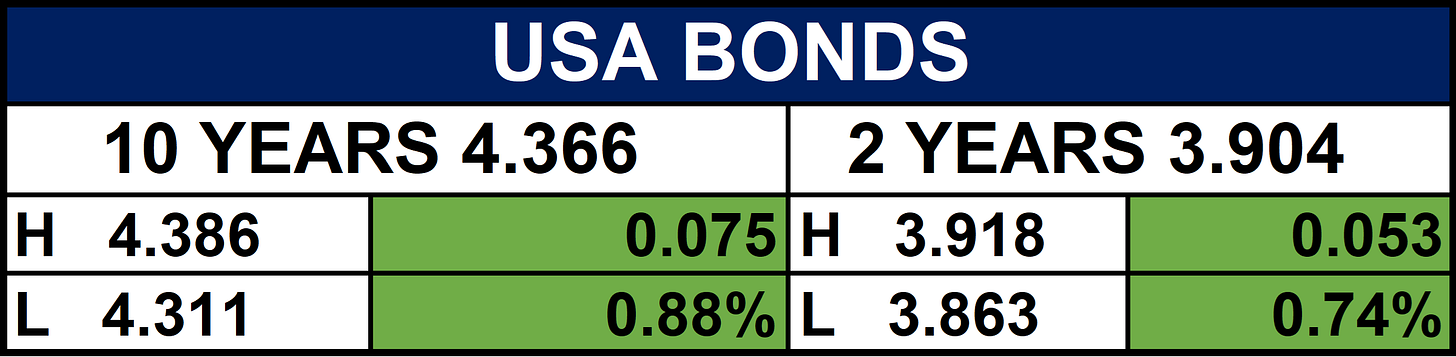

Fixed Income (USA Bonds)

Events

Conclusion

Earnings optimism is fueling market gains, especially in Nigeria’s banking and consumer sectors. However, rising geopolitical tensions like Trump’s tariffs on India and upcoming Fed decisions call for caution. Investors should focus on strong sectors, monitor fuel price regulations locally, and globally keep an eye on tech earnings, Fed signals, and trade shifts.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.