Wealth Wednesday - Markets Steady Amid Strong Earnings and FX Stability, But Trade Tensions Loom

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. This week, we highlight strong corporate earnings, stable FX reserves in Nigeria, and rising investor inflows driving market confidence. However, global uncertainties persist especially U.S. trade tensions with countries like India and South Korea, and ongoing geopolitical shifts. Locally, Nigeria’s crude production continues to improve, non-oil exports are growing, and FX reserves have hit a 7-month high all signs of strengthening fundamentals. Globally, expectations of a U.S. Fed rate cut and cautious optimism in equities are shaping investor sentiment. Stay tuned for how these factors could influence short-term market direction.

Nigerian News & Market Update

Nigeria surpasses OPEC’s target for second consecutive month:

Nigeria’s crude oil production rose to 1.507 million barrels per day (bpd) in July 2025, surpassing the organization of the petroleum exporting countries (OPEC)'s quota for the second consecutive month. This maintains Nigeria’s position as Africa’s top oil producer, ahead of Algeria. According to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), actual production may be closer to 1.78 million bpd, driven by improved security. Meanwhile, gas production increased to 7.58 billion scf/day in June, but crude and condensate sales fell to 21.68 million barrels from 24.77 million in May. - DailyTrust

NPA to Sustain Ports Efficiency as Non-oil Exports Expand to $3.225billion:

Nigerian Ports Authority (NPA) is enhancing port efficiency and sustainability to boost Nigeria’s export growth, following a 19.6% rise in non-oil exports in H1 2025. It also launched the Nigerian-owned vessel MV Ocean Dragon for regional shipping, focusing on operational improvements and government-aligned goals. - Thisday

Nigeria’s FX Reserves Up 9.4% to $40.29billion, Highest Since January:

Nigeria’s foreign exchange reserves rose to $40.29 billion in August 2025, the highest in over seven months, driven by strong oil prices, growing remittances, and foreign investment. Analysts expect reserves to remain stable, supporting naira stability and Nigeria’s ability to meet external debt obligations. Projections suggest reserves could reach $43 billion by year-end, bolstered by ongoing economic reforms and improved balance of payments. - Thisday

NSDC Seals Deal with Operators, to Produce 400,000MT Sugar Annually:

Nigeria’s National Sugar Development Council (NSDC) has signed deals with four companies to build sugar factories producing a combined 400,000 tonnes annually, aiming to cut sugar imports and boost self-sufficiency. Projects are spread across Oyo, Niger, Adamawa, and Bauchi states. The council also partnered with a Chinese firm on a $1 billion plan to build five sugar estates. 2025 is designated as a year of “accelerated development” in the sector. - Thisday

FMDQ confirms plans to launch equity market competing with NGX:

Financial Markets Dealers Quotations (FMDQ) plans to launch an equities market, challenging NGX’s dominance. It reported a ₦23.2 billion profit in 2024, driven by treasury income. New offerings include long-dated FX futures, depositary receipts, and a digital deal platform. Its depository holds ₦1.28 trillion in securities. - Nairametrics

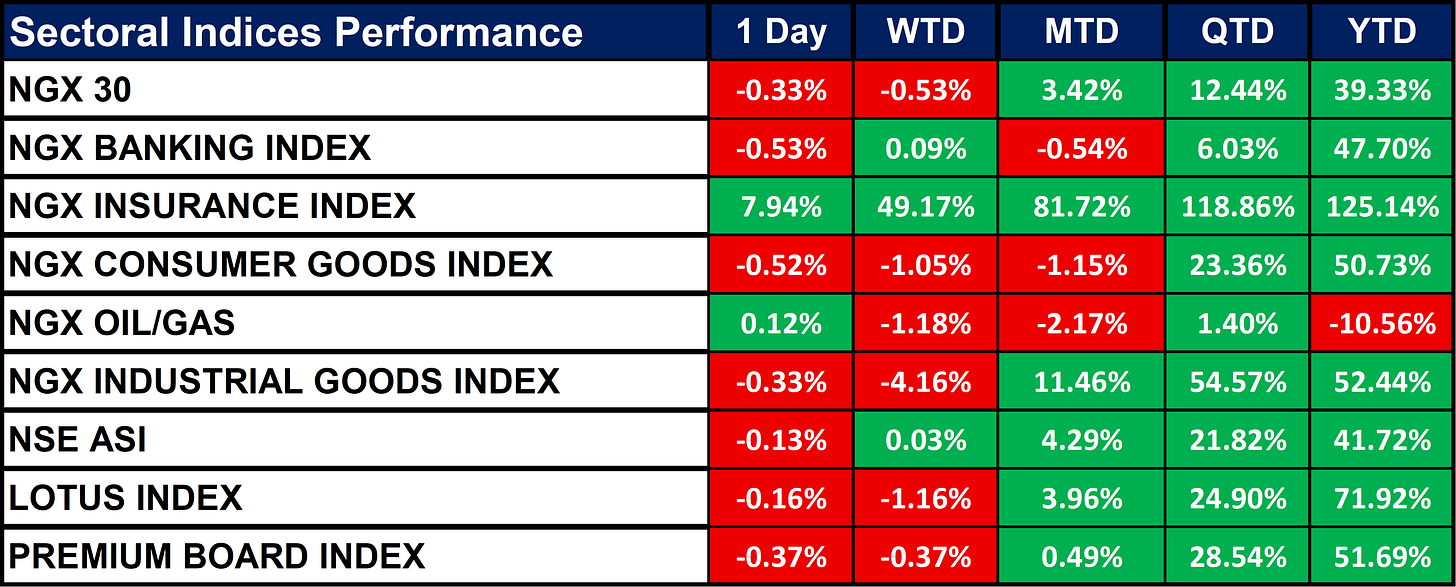

Nigeria Sectoral Indices Performance

The table below shows that the market showed mixed short-term performance but strong gains over longer periods. NGX Insurance led with significant growth across all timeframes, while Oil/Gas lagged, especially YTD. Other sectors had modest short-term declines but solid quarterly and yearly gains.

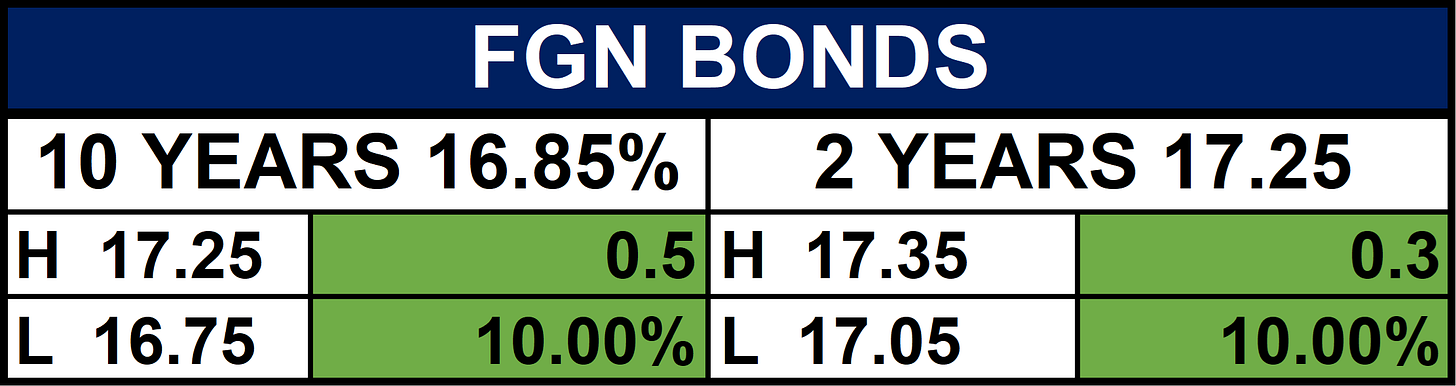

Fixed Income (FGN Bonds)

Global News & Market Update

Dollar extends weakness as anticipation mounts of Fed interest rate cut:

The U.S. dollar fell for a second day as soft July inflation data and political pressure from President Trump boosted expectations of a Fed rate cut in September. The dollar index dropped to its lowest since July 28. Treasury Secretary Bessent called for aggressive rate cuts, while Trump criticized Fed Chair Powell and hinted at legal action. The euro, pound, Aussie, and kiwi all gained. Meanwhile, Ether hit a near four-year high of $4,734, driven by increased adoption and investor confidence. - Reuters

Gold gains on weak dollar, investors ramp up Fed rate cut bets:

Gold prices rose by 0.5% to $3,362.92/oz, driven by a weaker dollar, falling U.S. Treasury yields, and expectations of a September Fed rate cut following mild inflation and weak jobs data. Markets see a 97% chance of the rate cut. While gold remains bullish long-term, analysts expect short-term consolidation. Silver also gained 1.6%, while platinum and palladium saw slight changes. Geopolitical developments may further impact prices. - Reuters

Oil edges up after US warning on Russia sanctions:

Oil prices recovered slightly after U.S. Treasury Secretary hinted at possible new sanctions on Russia if Trump-Putin talks fail. Brent rose to $66.18 and WTI to $63.19. Earlier losses were driven by the International Energy Agency (IEA) raising supply forecasts and lowering demand outlook. Organization of the Petroleum Exporting Countries Plus (OPEC+) sees tighter markets in 2026, but analysts remain cautious about near-term oil prices. U.S. crude inventories rose by 1.52 million barrels last week, though official data is awaited. - Reuters

Indian rupee rises the most in a month on broad dollar weakness:

The Indian rupee strengthened by 0.31% on Wednesday, its biggest gain in over a month, after soft U.S. inflation data increased expectations of a Fed rate cut in September. The dollar weakened, boosting emerging market currencies. Market sentiment was also affected by potential legal action by President Trump against Fed Chair Powell and anticipation surrounding the upcoming Trump–Putin summit, which may impact tariffs on Indian goods. Other Asian currencies, including the rupiah, ringgit, and won, also posted gains. - Reuters

European shares near two-week highs on Fed rate cut hopes:

European stocks hit a two-week high as soft U.S. inflation data raised hopes of a Fed rate cut. The STOXX 600 rose 0.5%, led by tech and defense stocks. German inflation eased to 1.8%. Glanbia jumped 12.6% on strong results, while Evolution and Beazley dropped on legal and forecast issues. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global equities mostly rose, led by the DJIA, Russell 2000, and European indices, while NASDAQ and Nikkei dipped. Crude oil fell, but natural gas gained. Softs declined sharply, especially orange juice and cocoa. Metals rallied across the board. Soybeans and related grains rose, while wheat and corn slipped. The USD weakened, while EUR, GBP, AUD, and NZD strengthened.

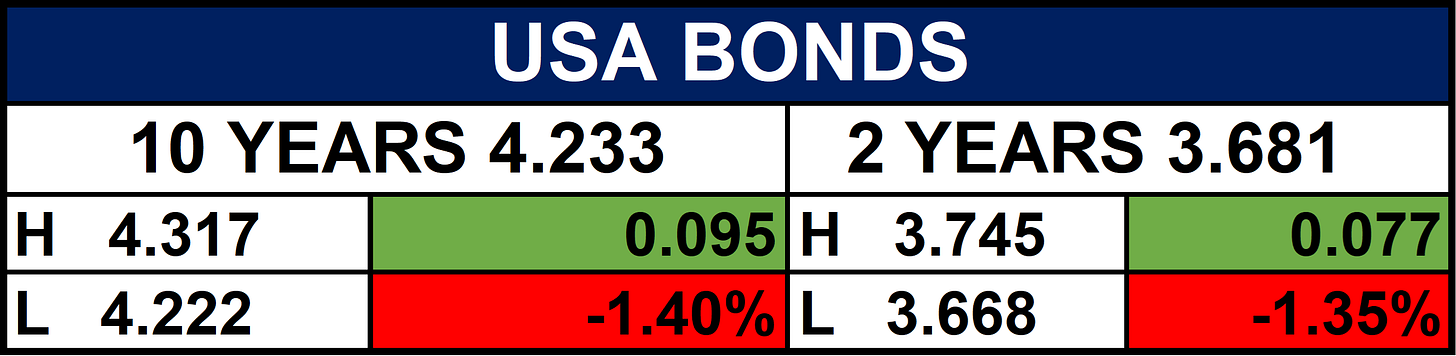

Fixed Income (USA Bonds)

Events

Conclusion

While local market conditions remain favorable, investors should stay alert to global trade developments and geopolitical risks, especially U.S. tariff moves with India and South Korea. These may introduce short-term volatility. Watch for upcoming earnings reports and macroeconomic data to gauge market direction in the coming weeks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.