Wealth Wednesday - Navigating Volatility: Nigeria’s Energy Shift and Bank Resilience Amid Global Market Uncertainty

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

This week in Wealth Wednesday, Nigeria faces rising CNG prices due to subsidy cuts, while Tier-2 banks show strong performance ahead of the 2026 recapitalisation. New offshore oil licences aim to boost production, and NNPC has appointed new communication heads to strengthen stakeholder relations. Globally, bond yields have surged amid inflation fears and fiscal concerns, though weaker U.S. job data eased pressure slightly. Markets now await the OPEC+ decision on oil output and upcoming economic data that could shape interest rate expectations.

Nigerian News & Market Update

CNG price hits ₦450/SCM as FG withdraws subsidies:

The Nigerian government has increased the price of Compressed Natural Gas (CNG) from ₦230 to ₦450 per standard cubic metre (SCM) due to reduced subsidies. Commercial drivers still pay a subsidised rate of ₦380/SCM, while trucks pay the full price. The government is expanding CNG infrastructure, with 60 stations now operating and 100 more planned, but long queues and rising costs are causing concern. Many fear that the high cost and limited availability may discourage CNG use, despite efforts to promote it as a cheaper alternative to petrol. - Punch

SBM report shows Tier 2 banks show resilience ahead of CBN 2026 recapitalisation deadline:

A report by SBM Intelligence shows that Nigeria’s Tier-2 banks like Fidelity and FCMB are performing strongly despite economic challenges and the upcoming 2026 CBN recapitalisation deadline. Fidelity's stock rose over 1,100% in five years due to strong earnings and digital growth, while FCMB posted solid Q1 2025 results with a 41% rise in earnings. The report predicts more mergers and alliances among Tier-2 banks to stay competitive, but warns that consolidation could bring risks like job losses and integration issues. - DailyTimes

How new exploration licences will improve Nigeria’s oil production:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has signed a Production Sharing Contract with TotalEnergies and South Atlantic Petroleum for offshore oil exploration in OPL 2001 and 2002. The project aims to boost deepwater oil production, attract investment, and enhance energy security. If fully implemented, it could add up to 810,000 barrels per day to Nigeria’s output. However, challenges like funding gaps, infrastructure issues, and underutilised deepwater assets still need to be addressed. - DailyTrust

NNPC Ltd appoints Odeh new Spokesperson, Adewunmi Chief Relations Officer:

The Nigerian National Petroleum Company Limited (NNPC) Limited has appointed Mr. Andy Odeh as Chief Corporate Communications Officer and Mrs. Morenike Adewunmi as Chief Relations Officer. Odeh brings over 30 years of experience in communications and business administration, notably from his 26-year career at Nigeria LNG, where he led major public relations and community development initiatives. Adewunmi is a seasoned legal professional with over 25 years in the oil and gas sector, primarily at Shell, specializing in stakeholder management and regulatory compliance. These appointments underscore NNPC’s focus on improving communication and stakeholder engagement. - TheSun

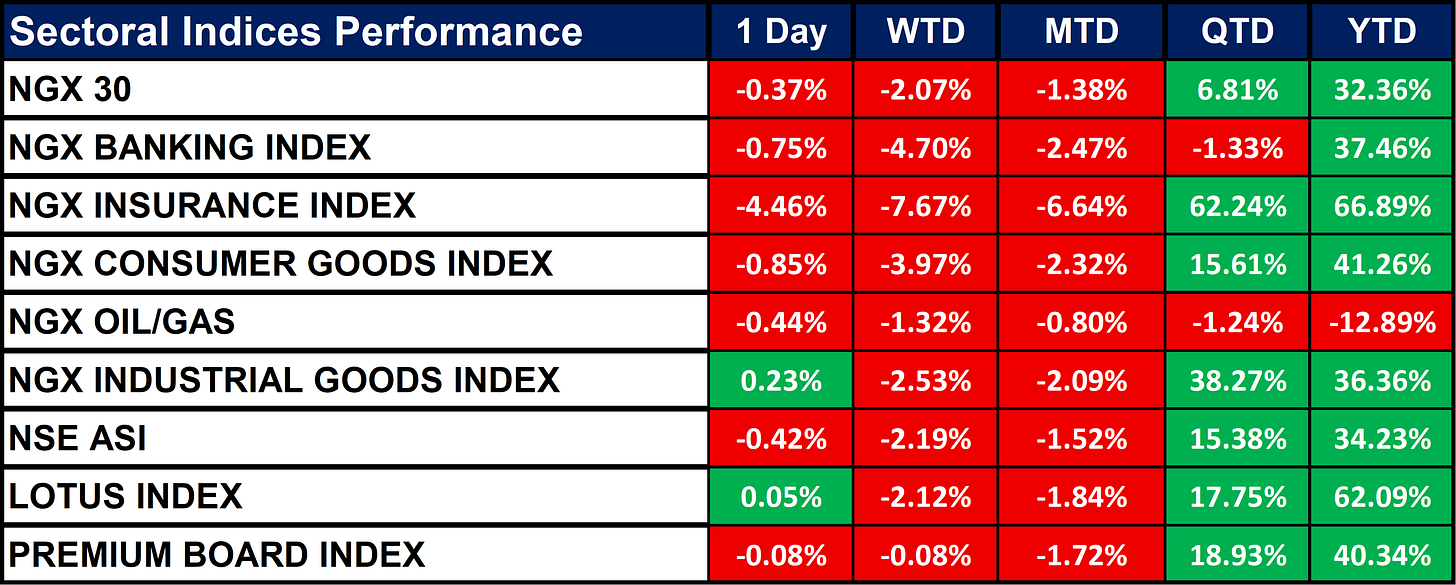

Nigeria Sectoral Indices Performance

The table below shows that most Nigerian sector indices fell in the short term, with Insurance and Banking seeing notable 1-day and weekly losses but strong year-to-date gains. Industrial Goods and Lotus indices showed slight daily gains. The Oil/Gas sector declined consistently, including a negative year-to-date performance. Despite recent drops, the overall market and many sectors maintain positive quarterly and yearly growth, indicating longer-term strength.

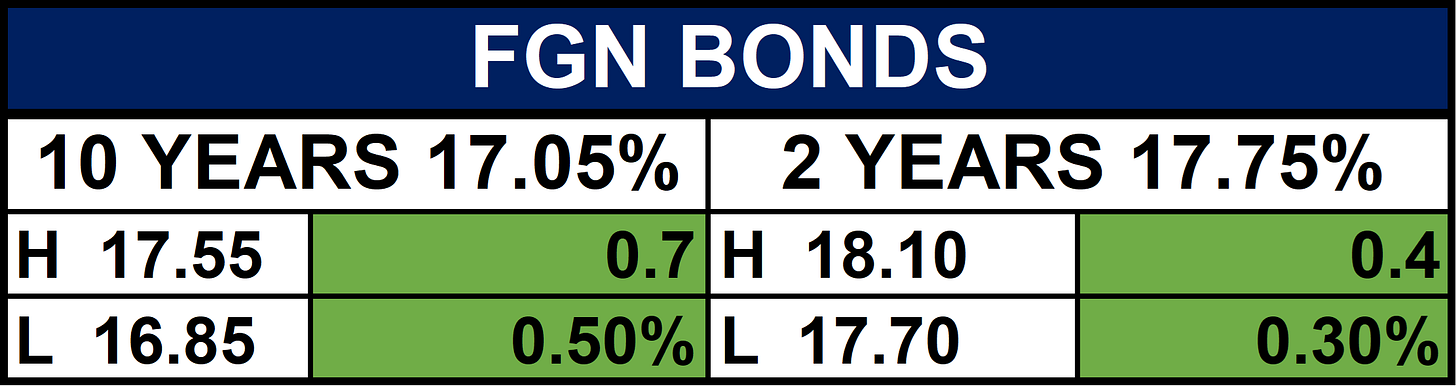

Fixed Income (FGN Bonds)

Global News & Market Update

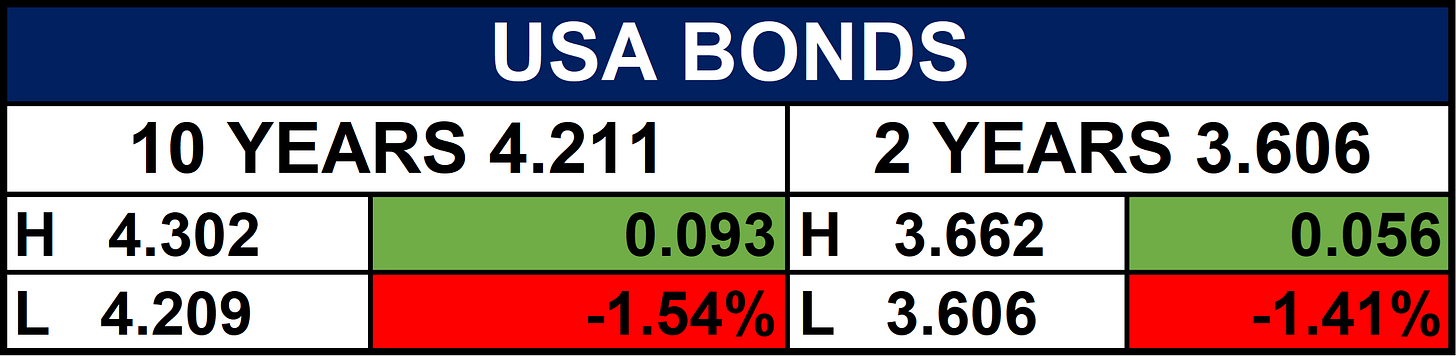

30-year Treasury yield touches 5% briefly, then retreats on weak jobs data:

U.S. Treasury yields dropped on Wednesday after job openings data came in weaker than expected, suggesting a cooling labor market. The 30-year yield fell to 4.907%, while the 10-year dropped to 4.223%. Earlier, yields had risen due to concerns over a court ruling on Trump-era tariffs and threats to Federal Reserve independence, including attempts to remove Governor Lisa Cook. Investors are now watching upcoming U.S. labor reports for further signals on the economy and interest rates. - CNBC

Global bond sell-off reflects unease over budgets and central banks:

Global bond markets are under pressure as long-term yields in the U.S., Japan, U.K., France, and Germany hit multi-year highs. This is driven by concerns over high government debt, inflation, central bank credibility, and reduced demand for bonds. Analysts warn that rising borrowing costs could hurt economic stability, with some suggesting that fiscal austerity may help restore investor confidence and lower yields. - CNBC

Sterling edges up off four-week low as traders assess impact of bond selloff:

Sterling rebounded slightly on Wednesday after hitting a four-week low, as markets took a breather following a sharp global bond selloff driven by fiscal concerns. Britain's 30-year bond yields hit their highest since 1998, intensifying pressure on the pound. Traders are cautious ahead of Finance Minister Rachel Reeves's upcoming budget, expected to include tax hikes. Despite a boost in UK services sector activity, concerns remain over the UK’s high debt and sluggish growth. Analysts are divided on whether the pound will remain stable if bond yields continue to rise. - Reuters

OPEC+ to consider further oil output hike on Sunday, sources say:

The Organization of the Petroleum Exporting Countries Plus (OPEC+) will meet on Sunday to consider further increasing oil production in October to regain market share. Since April, the group has already raised output by 2.5 million barrels per day, but oil prices remain high around $68 per barrel due to sanctions on Russia and Iran. While some members support more increases, others suggest pausing. A final decision is yet to be made. - Reuters

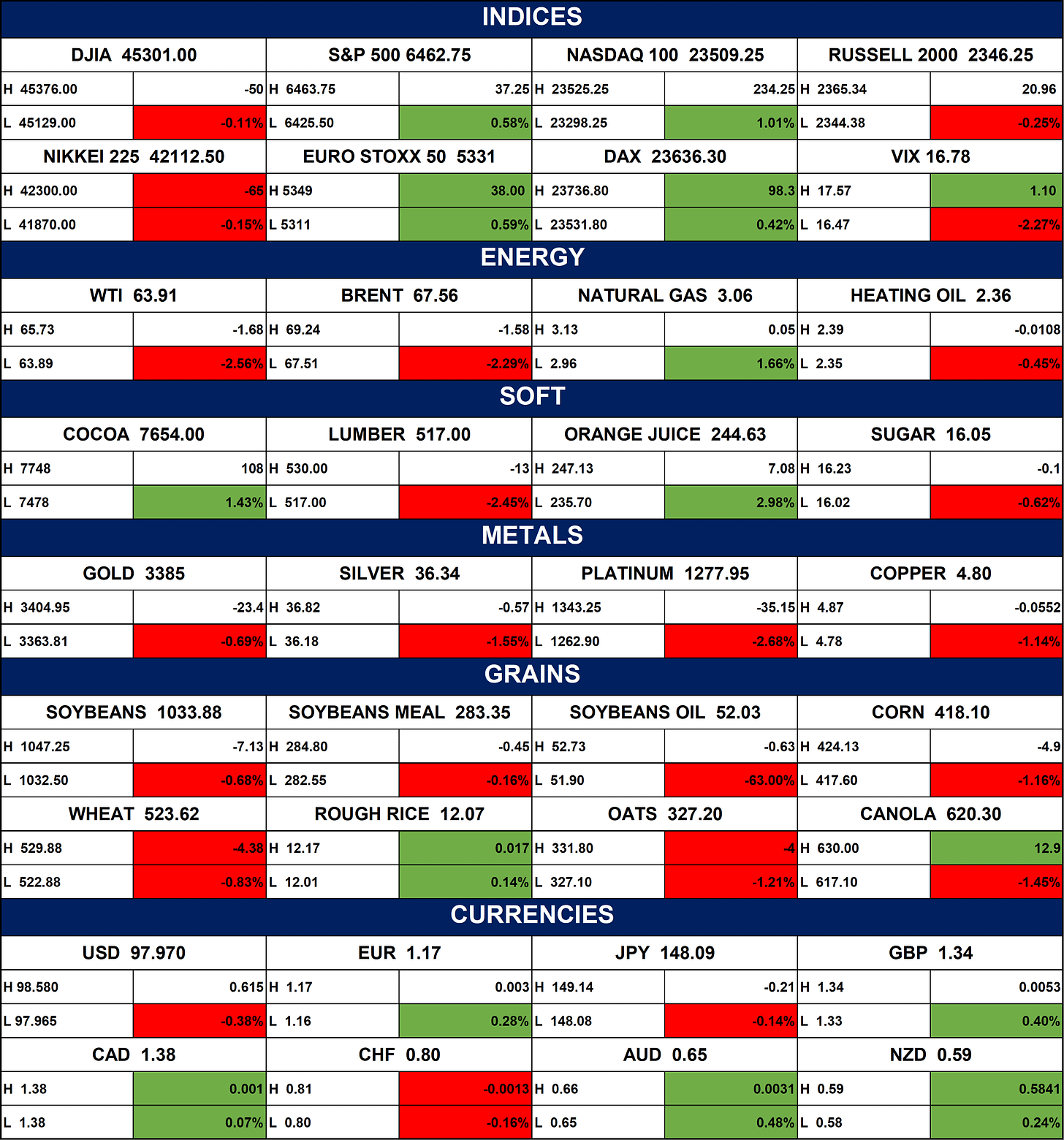

Indices, Commodities & Currencies

The table below depicts that the markets were mixed as tech stocks drove gains in the U.S. with the NASDAQ and S&P 500 up, while the Dow and Russell 2000 fell slightly. European indices rose modestly, and Japan’s Nikkei dipped. Oil prices dropped sharply, weighing on the energy sector, while natural gas saw a modest rise. Commodities showed mixed results, with some softs gaining but metals and grains mostly declining. The U.S. dollar weakened, boosting major currencies like the euro, Australian, and New Zealand dollars. Overall, market volatility eased, reflecting reduced investor fear.

Fixed Income (USA Bonds)

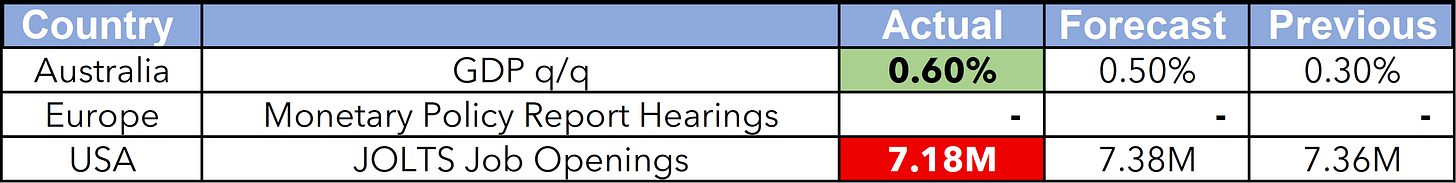

Events

Conclusion

Nigeria’s push for energy diversification and strong Tier-2 bank performance may support investor confidence, though rising costs and consolidation risks persist. Globally, bond market volatility and inflation fears are keeping investors cautious, with upcoming U.S. jobs data and the OPEC+ meeting likely to influence market direction. Safe-haven assets like gold are gaining appeal, and markets are expected to remain volatile amid economic and geopolitical uncertainty.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.