Wealth Wednesday - Nigeria Drives Industrial Revival Amid Fiscal Tightening as Global Markets Weaken on Geopolitical Risks

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. Nigeria’s economic landscape remains active, with the Federal Government pushing industrial revitalisation, rising domestic borrowing, and strong monetary tightening as the CBN’s OMO rates near 20%. Corporate headlines highlight Dangote’s refinery stake sale and Enko Capital’s $100million Africa-focused credit fund. Globally, geopolitical tensions persist as Russia conducts nuclear drills and the EU reconsiders sustainability laws under U.S. and Qatari pressure, while oil prices climbed 2% on stronger U.S. demand.

Nigerian News & Market Update

FG eyes 540MW power from Akwa Ibom aluminium plant:

The Federal Government plans to revive Aluminium Smelter Company of Nigeria (ALSCON) to supply 540 MW to the national grid, create 15,000 jobs, and boost Nigeria’s aluminium and power sectors. - Punch

CBN Offers 19.84% Interest on Nigerian OMO Bills:

The CBN sold ₦827 billion in OMO bills at rates up to 19.84%, amid strong ₦1.1 trillion investor demand and tight system liquidity. - dmarketforces

Dangote to sell 10% stake in refinery, targets 1.4mbpd expansion:

Dangote plans to sell a 5–10% stake in his refinery and partner with Middle Eastern investors to fund its expansion to 1.4 million barrels per day, making it the world’s largest. - Businessday

Enko’s Private Credit Fund Targets Africa’s Economic Growth With $100million:

Enko Capital raised $100 million for its Africa-focused private credit fund to finance mid-sized businesses, close the continent’s credit gap, and drive sustainable economic growth. - Leadership

IEI Plc charts bold recovery path:

IEI Plc announced a ₦22.5billion recapitalisation plan to strengthen its finances and market position after repaying a ₦14billion loan, securing ₦2billion in share deposits, and relisting on the NGX. - Thenation

FG’s domestic borrowing hits ₦6.17trillion in 6 months, over ₦13trillion to be raised by year-end:

The federal government borrowed ₦6.17 trillion domestically in H1 2025 to fund budget deficits, pushing total public debt to ₦152.4 trillion amid weak revenues and rising fiscal pressure. - Thesun

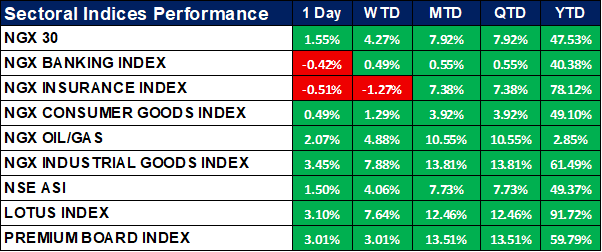

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities advanced, with the NSE ASI up 1.50% and broad gains across most sectors. Industrial goods (+3.45%) and oil/gas (+2.07%) led the rally, while banking (-0.42%) and insurance (-0.51%) lagged.

Year-to-date, the Lotus Index (+91.72%) and Insurance Index (+78.12%) remain the strongest performers.

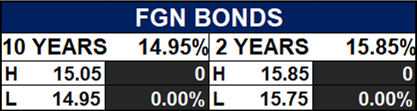

Fixed Income (FGN Bonds)

Global News & Market Update

Russia holds nuclear drills, Ukraine seeks Swedish jets as Trump delays summit:

Russia conducted major nuclear weapons drills as Ukraine pursued plans to buy Swedish Gripen jets, while a planned Putin-Trump summit on the war was delayed amid ongoing heavy attacks. - Reuters

US to announce recipients of plutonium for reactors by year-end:

The U.S. Energy Department plans to allocate 19.7 metric tons of surplus plutonium to companies by year-end for conversion into nuclear reactor fuel, despite safety and proliferation concerns. - Reuters

Brazil gets to maintain $4 billion in legal deposits after partial victory in Tupi field dispute:

Brazil won a partial ruling in its Tupi oil field dispute, retaining 22.2 billion reais ($4.1 billion) in legal deposits against the Petrobras-Shell-Petrogal consortium. - Reuters

Italy to get 4 billion euros in 2026 from banks, insurers:

Italy plans to raise €4 billion from banks and insurers in 2026 to fund tax cuts and spending, as part of a broader €18.7 billion budget plan supporting middle-income earners and industry. - Reuters

EU plans changes to sustainability law as US, Qatar increase pressure:

The European Parliament agreed to revisit its corporate sustainability law after U.S. and Qatari pressure, amid warnings the rules could disrupt LNG trade and hurt EU industry competitiveness. - Reuters

Oil rises about 2% on higher US demand, trade talk optimism:

Oil prices rose about 2% as U.S. demand strengthened and optimism grew over potential U.S. trade deals with China and India. - Reuters

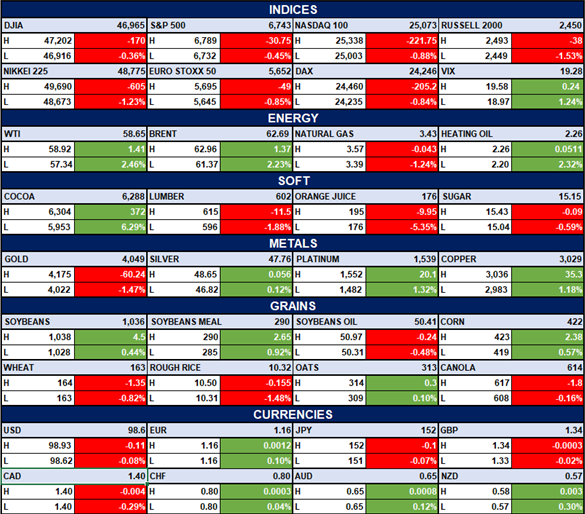

Indices, Commodities & Currencies

The table below depicts that the Global markets were mostly lower, with major indices like the Dow (-0.36%), S&P 500 (-0.45%), and Nasdaq (-0.88%) falling on weak sentiment. Energy prices climbed as WTI (+2.46%) and Brent (+2.23%) rose on stronger demand outlooks. Cocoa (+6.29%) and grains saw modest gains, while metals were mixed and major currencies traded largely flat.

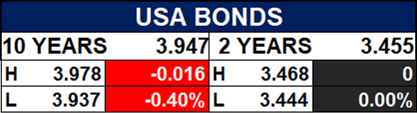

Fixed Income (USA Bonds)

Events

Conclusion

In conclusion, domestic reforms and global energy shifts continue to define investor sentiment, with Nigeria’s equities posting gains led by industrial and oil/gas sectors, even as global markets trade cautiously amid macroeconomic uncertainty.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.