Wealth Wednesday - Nigeria Holds FX Stability Amid Oil-Sector Uncertainty as Global Energy and Trade Dynamics Evolve

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. In Nigeria, CBN’s FX support kept the naira stable, PenCom expanded pension rules to FCY, while oil unions opposed asset sales and NUPRC halted TotalEnergies’ $860million divestment. Globally, oil exports from Iraq are set to resume, Indonesia’s palm oil exports gain momentum, India’s GST reforms support growth, and Argentina rallied on U.S. backing.

Nigerian News & Market Update

CBN Sells $52million to Banks to Maintain Exchange Rate Stability:

CBN sold $52million in FX intervention, keeping the naira stable around ₦1,487/$ within a ₦1,482–₦1,495 range. Nigeria’s reserves rose to $42.14billion, up $104million in one day. Analysts expect the naira to hold steady amid strong external reserves. - dmarketforces

PenCom Releases Guidelines on Foreign Currency Pension Contributions:

The National Pension Commission (PenCom) introduced Foreign Currency (FCY) pension guidelines, letting Nigerians abroad and FX earners contribute and withdraw in dollars, expanding CPS coverage and inclusion. - dmarketforces

PENGASSAN, NUPENG oppose proposed sale of national assets, PIA amendment:

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) and the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG) opposed FG’s plan to sell Joint Venture( JV) oil stakes and amend the Petroleum Industry Act (PIA), warning it could cripple the Nigerian National Petroleum Company Limited (NNPCL) and future revenues. They urged Tinubu to stop the move and focus on raising oil output and investments. - TheSun

NUPRC cancels TotalEnergies $860 million Nigerian onshore oil business sale:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) cancelled TotalEnergies’ $860million sale of its 10% SPDC JV stake to Chappal Energies over unmet obligations. The deal involved 15 oil licences and infrastructure, which now stay with TotalEnergies. The sale was part of its plan to exit Niger Delta onshore oil and shift to cleaner energy. - PremiumTimes

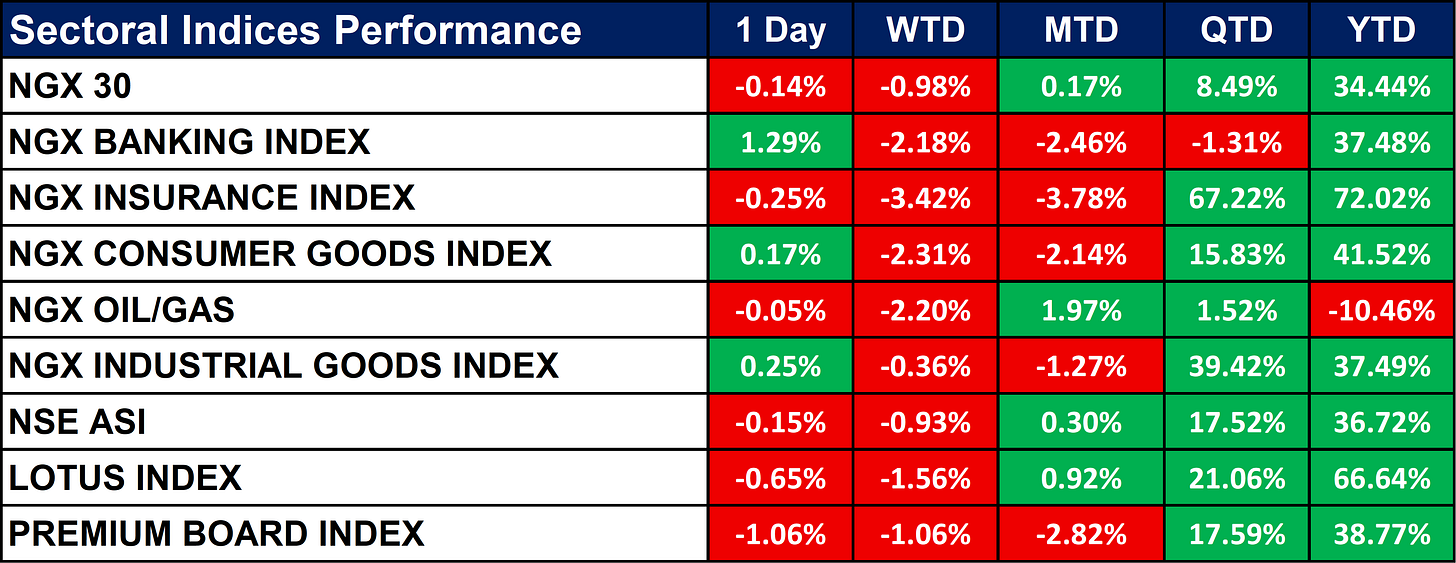

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices reflect short-term weakness but strong long-term performance. Most sectors posted daily and weekly declines, showing near-term market pressure. However, year-to-date returns remain robust, with Insurance (+72%) and Lotus Index (+67%) leading gains, while Oil/Gas (-10%) is the only major laggard.

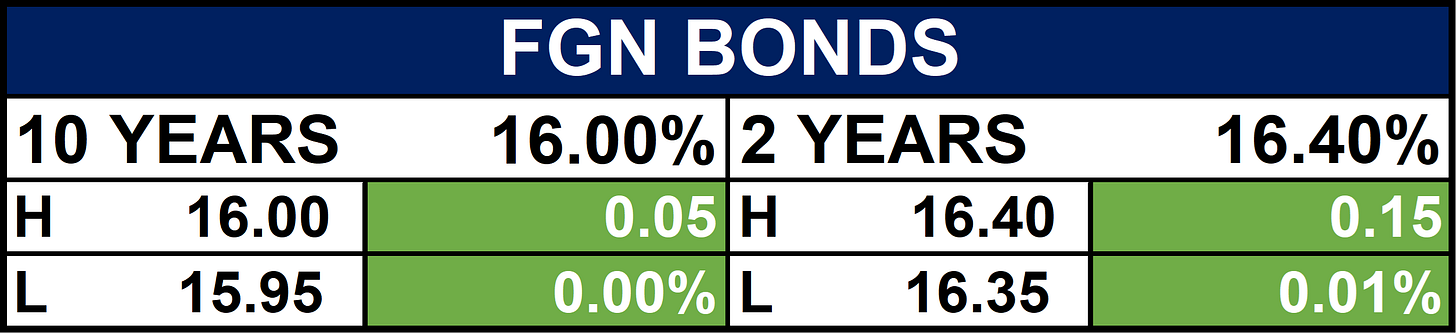

Fixed Income (FGN Bonds)

Global News & Market Update

Eight oil companies reach agreement with Iraq, KRG to resume oil exports:

Eight oil firms in Iraqi Kurdistan agreed with Baghdad and KRG to restart 230,000 bpd exports halted since March 2023. The deal protects existing contracts, ensures payments, and tackles $1bn arrears owed to producers. Exports via the Iraq-Turkey pipeline are set to resume soon pending final sign-off. - Reuters

Indonesia’s palm oil exports to EU to climb on trade pact, regulatory reprieve:

Indonesia’s palm oil exports to the EU may rise to 4m tons in 2026, helped by a trade pact and delay of the EU deforestation law. The law, meant to start in Dec 2024, was postponed, giving producers more time to comply. Exports to India are also increasing, though competition from cheaper soybean oil could limit growth. - Reuters

India tax reforms to ease retail prices, boost consumption, RBI bulletin says:

India’s Goods and Services Tax Return (GST) reforms are set to cut retail prices and drive consumption growth, the RBI said. Despite U.S. tariffs, the economy remains resilient with 7.8% GDP growth and an S&P upgrade. Tax relief and earlier rate cuts are expected to fuel stronger demand and investment in H2 2025. - Reuters

Argentine assets rally as Bessent details strong US support:

Argentina’s markets surged after U.S. pledged support with a $20billion swap deal and bond purchases. The peso and stocks gained sharply, easing financial risks. The move strengthens Milei ahead of the October elections. - Reuters

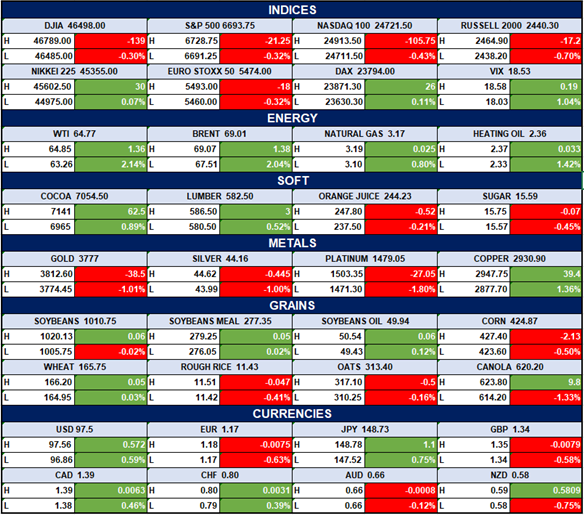

Indices, Commodities & Currencies

The table below depicts that the Global markets showed mixed performance. U.S. indices such as the S&P 500, NASDAQ, and Russell 2000 posted declines, while the DJIA and DAX recorded slight gains. In commodities, energy prices (like Brent and WTI crude) moved higher, but precious metals (gold, silver, platinum) saw notable drops. Grain markets were mixed, with soybeans rising while corn and oats fell. Currency markets remained relatively stable, with minor fluctuations in the USD, EUR, and JPY.

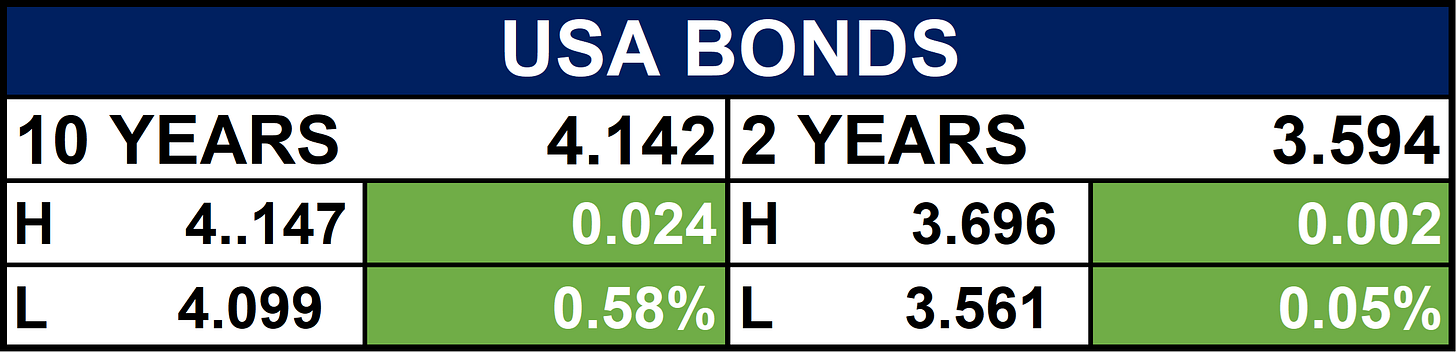

Fixed Income (USA Bonds)

Events

Conclusion

Investors may expect short-term volatility in Nigerian equities due to oil policy uncertainties but strong YTD sectoral performance highlights resilience. Globally, energy markets remain a key driver, while reforms in India and support for Argentina may boost EM sentiment. Staying diversified across FX, energy, and resilient equities will be critical in the weeks ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.