Wealth Wednesday - Nigeria Secures Fresh Funding, Expands Energy Investments as Global Markets Trade Mixed

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update, where we unpack key developments shaping Nigeria’s economy, capital markets, and the global investment landscape. In this briefing, we spotlight major policy and funding updates in Nigeria including fresh capital injections, energy sector moves, and Eurobond issuance alongside key global macro shifts across commodities, inflation, and trade. Expect insights to help investors assess market direction, sector performance, and cross-border forces influencing near-term investment positioning.

Nigerian News & Market Update

FG seals $500million World Bank loan to boost agriculture:

The Federal Government has secured a $500million World Bank loan to boost Nigeria’s agricultural value chains, enhance food security, and transform smallholder farming into profitable agribusiness. - Punch

Transafam Power relocates four turbines to Delta:

Transcorp has relocated four turbines from Afam to Delta State to boost power generation amid gas supply challenges, as it targets higher capacity and improved performance across its power and hospitality businesses. - Punch

NNPC eyes 20% stake in Dangote refinery:

The Nigerian National Petroleum Company (NNPC) plans to increase its stake in the $20billion Dangote Refinery to 20% to boost Nigeria’s refining capacity and strengthen its role in the downstream oil sector. - Punch

Banks Step Up Placement with CBN as Excess Liquidity Hits ₦4.6trillion:

Banks increased their placements with the CBN as excess system liquidity rose to ₦4.6trillion, driving lower Treasury bill yields and keeping money market rates relatively stable. - dmarketforces

NNPCL Reiterates 2mb/d Oil Production By 2027, $60billion Fresh Investment By 2030:

The Nigerian National Petroleum Company (NNPC) says Nigeria’s oil output is now 1.7mbpd, targeting 2mbpd by 2027, backed by new investments and expanded partnerships. The firm plans to attract up to $60billion by 2030 to boost oil, gas and cleaner energy projects. - Channels

Nigeria issues $2.25 billion dual-tranche Eurobond to fund 2025 deficit:

Nigeria has launched a dual-tranche Eurobond (10-year and 20-year) to fund the 2025 budget deficit and refinance debt, with coupon guidance of about 9.125% and 9.625% respectively. - Businessday

Niger Delta Foundation, Okomu Oil Seal ₦1.2billion Deal For Prosperity In Edo Communities:

The Foundation for Partnership Initiatives in the Niger Delta (PIND) and Okomu Oil signed a ₦1.2billion partnership to drive peacebuilding, livelihoods, and sustainable development in Okomu’s host communities in Edo State. - Leadership

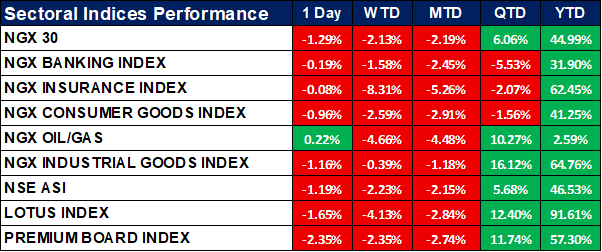

Nigeria Sectoral Indices Performance

The table below shows that the NGX market closed lower as most sector indices recorded declines, with the NGX 30, Banking, Consumer Goods, and Industrial Goods indices all down on a 1-Day and Month-to-Date basis.

The Oil & Gas index was the only gainer for the day, rising 0.22%, though still negative WTD and MTD. Despite recent declines, Year-to-Date performance remains strong across most indices, led by the Lotus Index (+91.61%) and Industrial Goods Index (+64.76%).

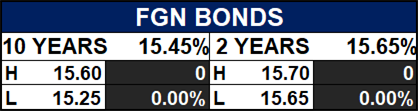

Fixed Income (FGN Bonds)

Global News & Market Update

Vitol, Delfin LNG and IRH sign 20-year LNG supply agreement:

The International Resources Holding (IRH) signed a 20-year deal with Delfin LNG and Vitol for 1 million tonnes per annum (mtpa) U.S. LNG supply, with Vitol delivering the volumes to IRH’s trading arm. - Reuters

Ukraine imports gas via Balkans from Greece to keep system running after Russian strikes:

Ukraine has resumed gas imports via the Transbalkan pipeline to keep its energy system running after Russian attacks severely cut domestic gas production. - Reuters

Ghana inflation slows for 10th straight month in October:

Ghana’s inflation dropped for the 10th straight month to 8% in October its lowest since 2021 driven mainly by falling food prices. - Reuters

China eyes $4 billion dollar bond, term sheet shows, orders top $65 billion:

China plans to issue up to $4billion in dollar bonds its largest in four years amid easing U.S.–China trade tensions. - Reuters

Beijing lifts some tariffs on US farm goods but soybeans stay costly:

China will suspend some retaliatory tariffs on U.S. farm goods after recent talks, but U.S. soybeans remain less competitive due to a 13% tariff and cheaper Brazilian supplies. - Reuters

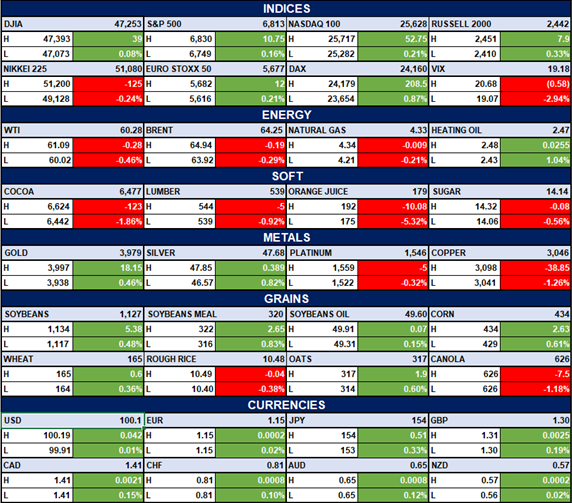

Indices, Commodities & Currencies

The table below depicts that the Global equities were mostly positive, with major indices including the Nasdaq 100, S&P 500, and DAX posting gains, while volatility (VIX) edged lower. Energy commodities were mixed as WTI and Brent slipped, but Natural Gas ticked up slightly; soft commodities saw sharp declines, particularly Orange Juice and Cocoa. Metals was mixed and grains broadly strengthened. Most agricultural commodities posting gains, while currencies traded largely flat with mild movements across major pairs.

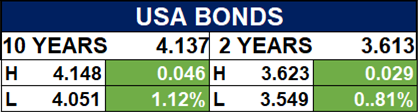

Fixed Income (USA Bonds)

Events

Conclusion

Overall, Nigeria’s market remains driven by increased capital injections, power and oil sector reforms, and renewed access to global financing factors that could spur medium-term market resilience despite short-term volatility. Globally, easing trade tensions, strengthening LNG agreements, and slowing inflation across emerging markets may support improved risk sentiment. Investors should watch for sustained foreign inflows, policy-driven sector rotations, and commodity price movements that could shape market direction in the coming weeks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.