Wealth Wednesday -Nigerian Market Gains Amid Fuel Relief and Strong Sectors, While Global Volatility Persists on Oil, Inflation, and Policy Uncertainty

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market briefing. Nigerian markets are stabilizing after recent disruptions, with fuel supply set to ease following NUPENG’s suspended strike, while the CBN pushes for stronger diaspora reserves. Sectoral indices show resilience, led by Insurance and Industrial Goods, though insider share sales at Sovereign Trust Insurance have raised boardroom confidence questions. Globally, investors are balancing geopolitical tensions that lifted oil prices against oversupply concerns, persistent inflation in Norway, and softening demand signals in the U.S. Producer Price Index. Meanwhile, Ghana posted strong GDP growth, Turkey secured LNG deals, and India is opening up its bond market further to foreign investors.

Nigerian News & Market Update

NUPENG suspends strike as Dangote accepts union’s demands:

The Nigeria Union of Petroleum and Natural Gas Workers (NUPENG) has suspended its two-day strike after reaching an agreement with the Federal Government and the Dangote Group for refinery workers to unionize. The strike had caused widespread fuel scarcity, price hikes, and transport disruptions across several states, but fuel loading is expected to resume immediately, easing the shortages. - Punch

Sovereign Trust Insurance insiders sell ₦2.3billion shares:

Sovereign Trust Insurance Plc disclosed insider share sales worth over ₦2.3billion, involving directors and related parties. Key transactions included 200million shares (₦590million) sold by Non-Executive Director Abimbola Oguntunde, 80million shares (₦236million) by Executive Director Ugochi Odemelam, and 500m shares (₦1.49billion) by former Chairman Oluseun Ajayi, alongside sales by Tripple Tees Endowment Ltd. In total, over 830million shares were disposed of between mid-August and early September 2025, prompting concerns about board confidence, though analysts note such sales may also reflect diversification or liquidity needs. - Punch

Excess Liquidity in Banking System Tightens Short-Term Rates:

Excess liquidity in Nigeria’s banking system has kept short-term interest rates relatively low, with limited activity in the money market. Interbank borrowing eased as funds were parked in the CBN’s standing deposit facility, while system liquidity fell to ₦1.875trillion from ₦1.96trillion. NIBOR declined across maturities, supported by a ₦600billion Open Market Operations (OMO) maturity, with the overnight rate dropping to 26.81%. However, NT-Bills yields inched higher, with the average rising to 18.75%, reflecting weak investor sentiment in the secondary market. - dmarketforces

CBN targets $1billion diaspora reserve by 2026, hails banks’ role:

The Central Bank of Nigeria (CBN) plans to boost diaspora reserves to $1billion by 2026, up from the current $600million inflows. CBN Governor Olayemi Cardoso announced this at the CIBN Annual Banking and Finance Conference, noting that a framework is in place and urging banks to drive the initiative. The conference, themed “The New Economic Playbook: The Intersection of Banking, Policy and Technology,” gathered stakeholders to discuss strategies for strengthening Nigeria’s financial system. - TheSun

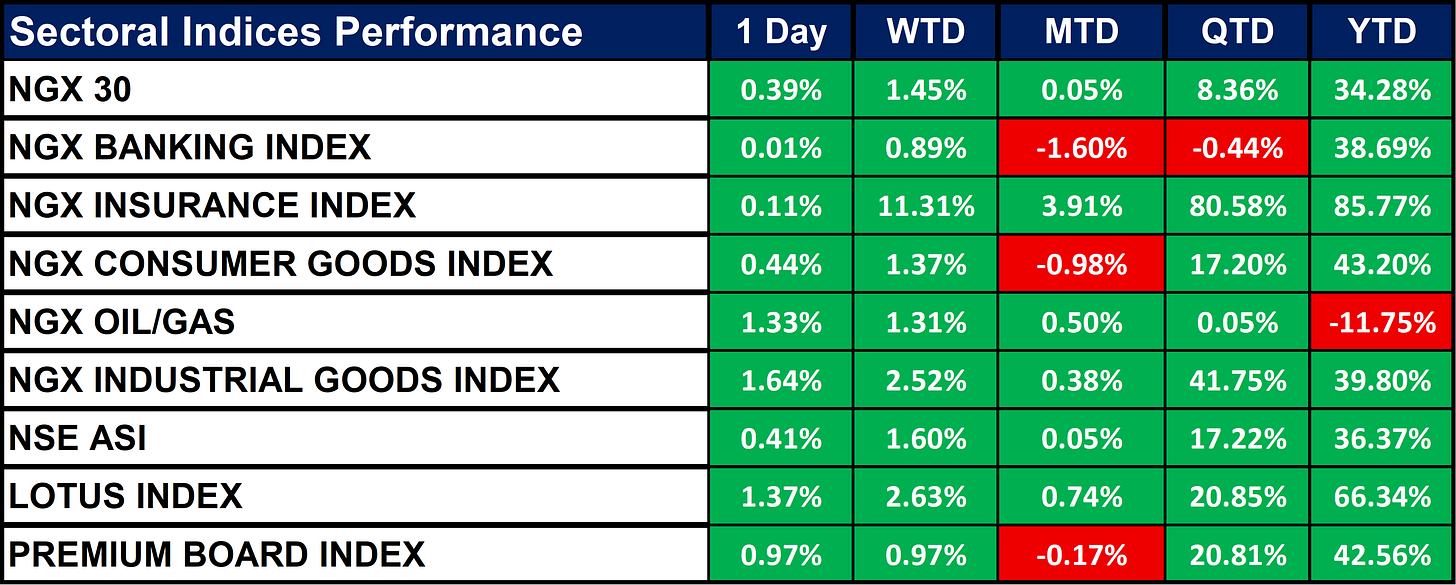

Nigeria Sectoral Indices Performance

The table below shows that the NGX sector indices show broad gains across most sectors. Insurance (+85.77% YTD), Lotus (+66.34% YTD), and Industrial Goods (+39.8% YTD) are the strongest performers. The Oil/Gas index (-11.75% YTD) is the only major laggard. Overall, the market remains positive with the NSE ASI up 36.37% YTD, reflecting solid momentum led by Insurance and Industrial sectors.

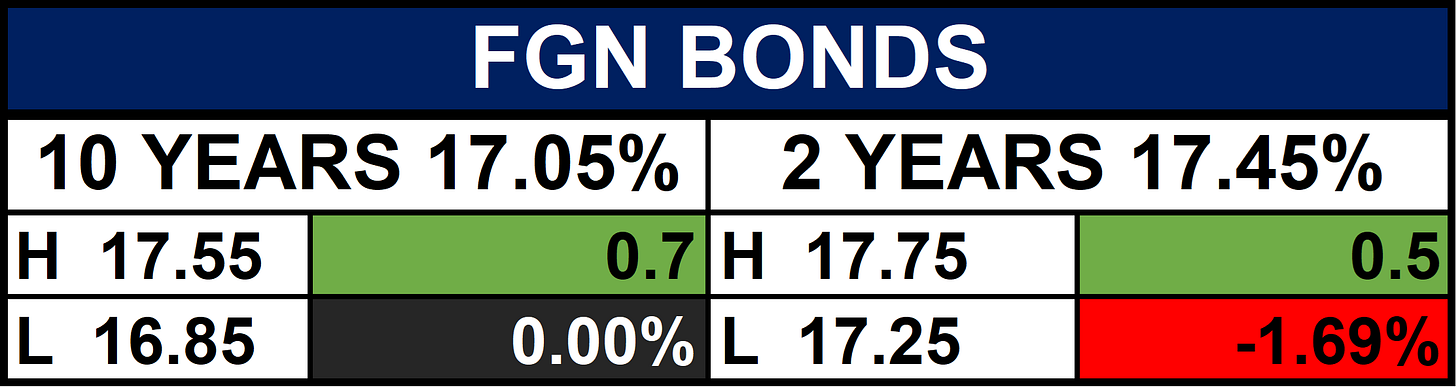

Fixed Income (FGN Bonds)

Global News & Market Update

Oil prices up $1 after Israeli attacks, but oversupply caps gains:

Oil prices gained about $1 on geopolitical tensions Israel’s strike on Hamas leaders in Qatar, Poland downing Russian drones, and U.S. calls for tougher sanctions on Russian oil buyers but gains were capped by a bearish supply outlook. U.S. crude, gasoline, and distillate inventories rose sharply, highlighting weak demand, while OPEC+ output growth adds further pressure. Analysts note that while geopolitical risks briefly support prices, the surplus and slowing economic activity remain dominant, keeping the market under downward pressure. - Reuters

Bacterial greening disease infects nearly half of Brazil's citrus belt:

Nearly 48% of Brazil’s citrus belt is infected with citrus greening disease, spread by the Asian citrus psyllid, marking the eighth straight year of rising infections. The disease, which causes bitter, misshapen fruit, has slashed Brazil’s orange output to 230.9million boxes in 2024/25, its lowest in years, though a rebound to 314.6m boxes is expected next season. Greening has already caused billions in losses globally, killing over 60million trees across Asia and Africa, and remains a major threat to Brazil, the world’s largest orange producer and exporter. - Reuters

Norway's underlying inflation casts doubt on rate cut:

Norway’s core inflation held at 3.1% in August, unchanged from July, but adjusted data showed underlying inflation closer to 3.5%, above expectations. The crown strengthened slightly on the news, raising doubts over whether Norges Bank will proceed with an expected rate cut at its September 18 policy meeting. Analysts noted that higher-than-expected price pressures, partly masked by increased government daycare subsidies, could push the central bank to delay easing despite having cut rates in June for the first time in five years. - Reuters

Ghana's economy grows 6.3% in Q2 2025, driven by services sector:

Ghana’s economy grew 6.3% year-on-year in Q2 2025, up from 5.7% a year earlier, driven mainly by a 9.9% surge in the services sector, which contributed four percentage points to overall growth. Non-oil GDP rose 7.8%, with agriculture expanding while oil output contracted. Inflation eased to 11.5% in August, the lowest since 2021, moving closer to the government’s 11.9% year-end target, as the country recovers from its recent economic crisis. - Reuters

Turkey secures 15 billion cubic metres of LNG for to diversify gas supply:

Turkey has secured 15 billion cubic metres (bcm) of LNG supply for 2026–2028 through deals signed by state energy firm BOTAS with eight international companies at the Gastech 2025 conference in Milan. Key suppliers include BP, ENI, Shell, Hartree, Cheniere, SEFE, JERA, and Equinor, with contracts ranging from one to three years. The agreements, covering a significant share of Turkey’s annual gas demand, aim to boost supply security, flexibility, and predictability in the country’s energy portfolio. - Reuters

India to ease norms for foreign investors buying only government bonds from February 2026:

India’s markets regulator SEBI announced that from February 8, 2026, foreign investors who invest exclusively in government bonds will be exempt from disclosing investor group details, citing the low-risk nature of these securities. The rule change, first proposed in June, comes as foreign interest in Indian government bonds rises following their inclusion in major global indices like JPMorgan and FTSE Russell. - Reuters

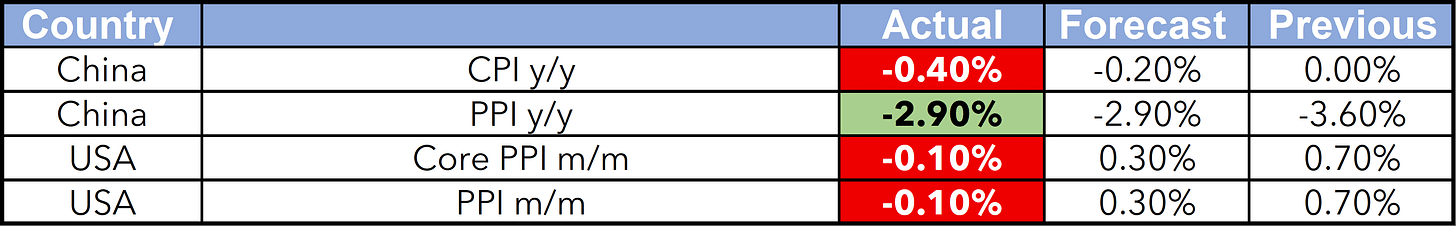

US producer inflation cooler in August; hints at softening demand:

U.S. producer prices fell 0.1% in August, driven by weaker trade services margins and mild goods price increases, suggesting businesses may be absorbing some tariff costs amid soft domestic demand and a weak labor market. Annual PPI rose 2.6%, down from 3.1% in July. The data reinforces expectations of a Federal Reserve rate cut next week, as inflation pressures remain subdued while job growth has nearly stalled. Markets reacted with higher stocks, a softer dollar, and lower Treasury yields. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed: U.S. equities were flat, Japan’s Nikkei gained, while Germany’s DAX slipped. Oil prices rose, natural gas fell, and soft commodities like cocoa and sugar advanced. Metals and most grains weakened, with only small gains in soybean oil and canola. The U.S. dollar eased, while euro, pound, and commodity-linked currencies strengthened.

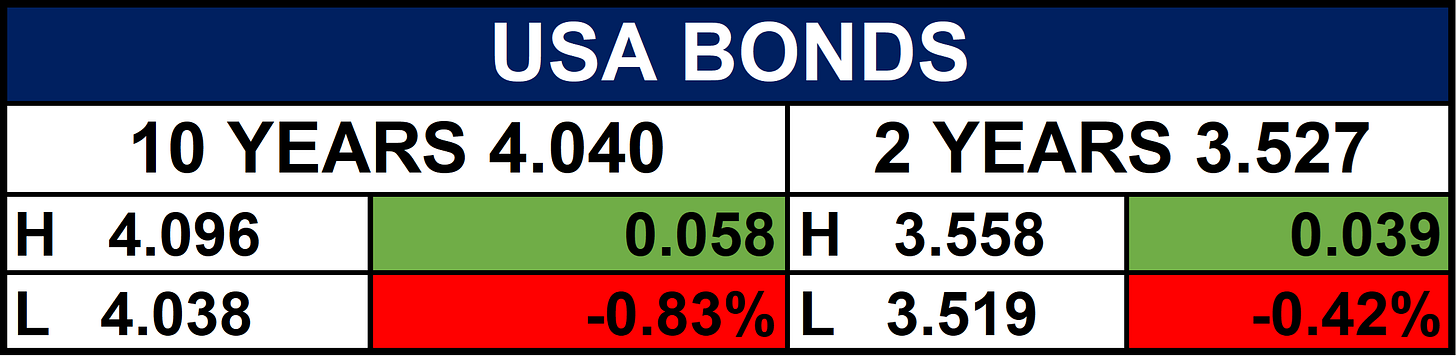

Fixed Income (USA Bonds)

Events

Conclusion

Markets face volatility but offer opportunities. Nigeria’s easing fuel shortages and strong sector performance may lift confidence, though liquidity and insider sales pose risks. Globally, oil prices are influenced by geopolitics but capped by oversupply, while uncertain central bank policies in Norway and the U.S. add pressure. Investors should stay focused on energy, financials, and defensive sectors.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.