Wealth Wednesday - Nigerian Markets Steady on Strong Capital Raises and Tax Reform While Global Trade & Energy Tensions Mount

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market brief. Nigerian markets show resilience as key domestic players secure significant capital boosts and structural reforms advance, while global developments in trade policy and energy markets create potential cross‑border investment dynamics. Investors could expect continued focus on banking sector strength, fiscal reforms like e‑invoicing, and CBN liquidity signals domestically, alongside watching geopolitical trade tensions and energy deal flows globally that could influence commodity prices and risk sentiment. This newsletter will help you gauge shifts across equities, fixed income, and broader macro drivers shaping both local and international market conditions.

Nigerian News & Market Update

NAHCO signs new ground handling deals:

NAHCO strengthens revenue visibility by securing multi-year ground handling contracts with major international and regional airlines, extending service agreements through 2028. - Punch

M&P completely exits Seplat Energy:

Seplat Energy’s founding shareholder M&P exits fully as Heirs Energies and Heirs Holdings acquire a combined 20.07% stake, reshaping the company’s ownership structure. - Punch

UBA closes rights issue, raises ₦157.84billion:

UBA successfully raises ₦157.84billion from a fully subscribed rights issue, reinforcing its capital base and signaling strong investor confidence. - Punch

Fidelity Bank raises ₦259billion in private placement:

Fidelity Bank raises ₦259billion via private placement, lifting eligible capital to ₦564.5billion and surpassing the ₦500billion regulatory requirement for international banks. - Punch

CBN Raises ₦2.7trillion from OMO Bills, Rates Still Look Good:

CBN allotted ₦2.7trillion in the Open Market Operations (OMO) bills at near-19.4% yields, reflecting strong investor demand and continued tight liquidity management in the money market. - Dmarketforces

Tax reform gains ground as NRS, NITDA accredit new e-invoicing firm:

Nigeria’s tax reform gained momentum as NRS and NITDA accredited Pillarcraft Cloud Solutions to support the rollout of the national e-invoicing system. - TheSun

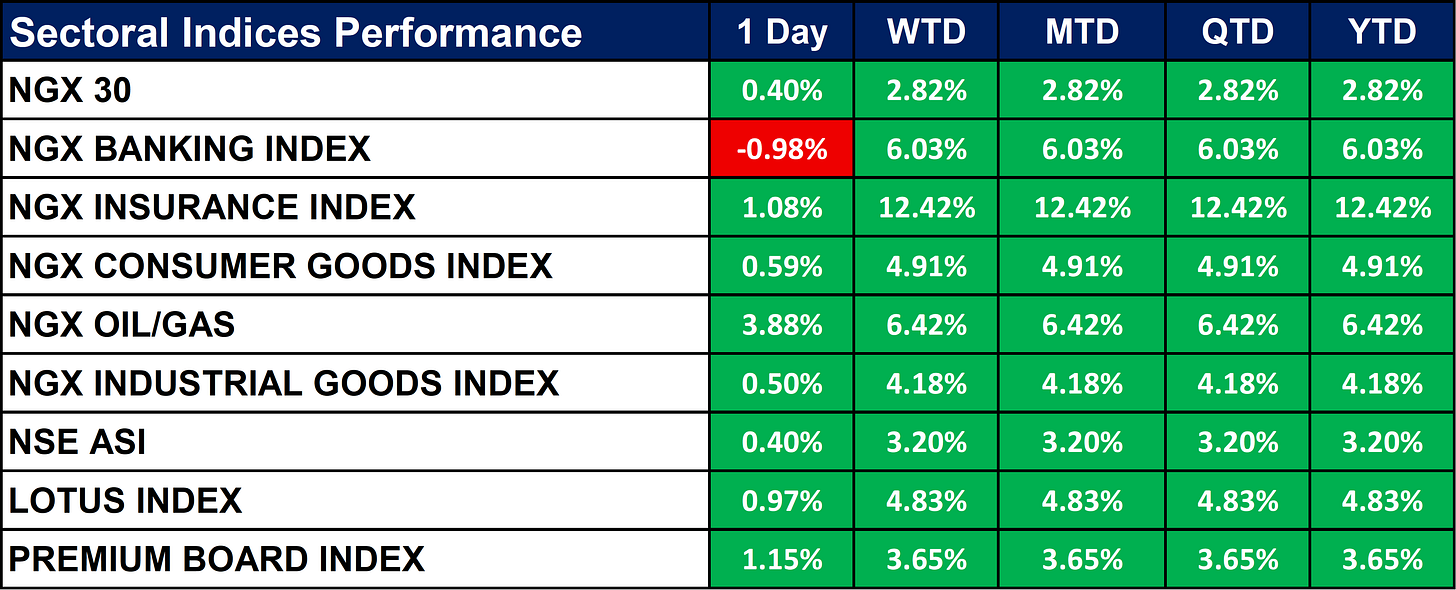

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equity market showed broad-based gains with the NGX 30 and NSE ASI up 0.40%, while the NGX Banking Index slipped 0.98% despite strong weekly and year-to-date growth. Sector leaders included the NGX Oil/Gas Index, rising 3.88%, and the NGX Insurance Index, up 1.08%, highlighting strength in energy and insurance stocks. Overall, most sectoral indices posted positive weekly, monthly, quarterly, and YTD returns, reflecting continued market resilience and investor confidence.

Global News & Market Update

China launches anti-dumping probe into dichlorosilane imports from Japan:

China has launched an anti-dumping investigation into Japanese dichlorosilane imports, a key chipmaking chemical, amid worsening trade and political tensions with Japan. - Reuters

Indonesia may seize another 5 million hectares of palm oil plantations in 2026:

Indonesia plans to seize an additional 4–5 million hectares of palm oil plantations in 2026 as part of a military-backed crackdown on illegal operations, potentially tightening global palm oil supply and pushing prices higher. - Reuters

US seizes Venezuela-linked, Russian-flagged oil tanker after weeks-long pursuit:

The U.S. seized a Russian-flagged oil tanker linked to Venezuela after a weeks-long pursuit, intensifying its global blockade of sanctioned Venezuelan oil exports. - Reuters

Quantum planning Lukoil asset deal that could involve Chevron:

Private equity firm Quantum Energy Partners is planning a bid, potentially with Chevron, for Lukoil’s international assets in what could be one of the largest post-sanctions energy deals. - Reuters

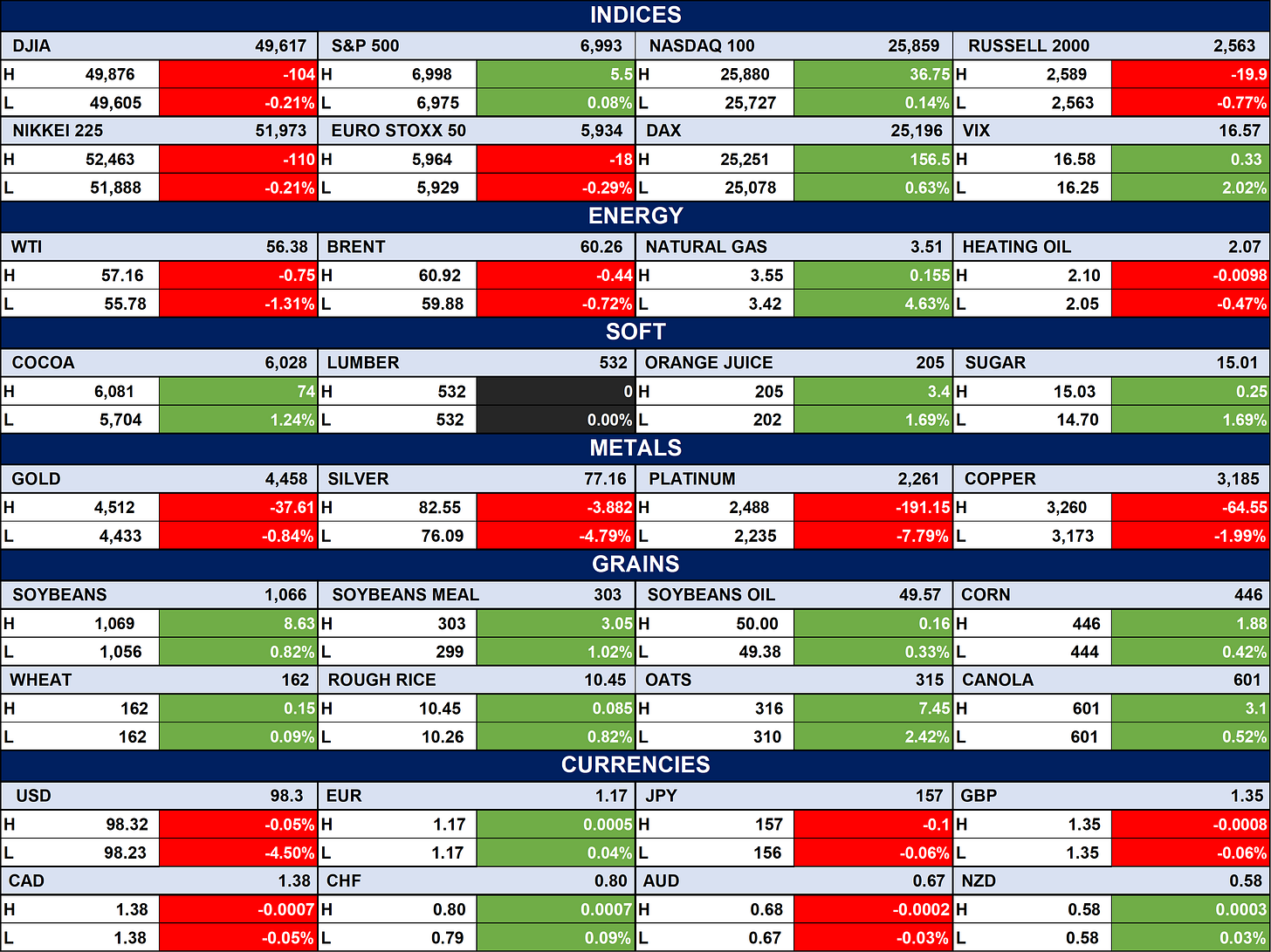

Indices, Commodities & Currencies

The table below depicts that the Global markets showed mixed performance as U.S. indices were slightly lower with the DJIA down 0.21% and S&P 500 modestly up 0.08%, while the NASDAQ 100 and DAX recorded gains of 0.14% and 0.63% respectively. In commodities, energy and grains largely advanced with WTI and Brent crude slightly down, but natural gas, soybeans, and corn posting solid gains, whereas metals like gold, silver, and platinum fell sharply. Currency markets were relatively stable, with the USD mostly flat, minor gains in EUR and CHF, and slight declines in JPY and GBP, reflecting cautious investor sentiment amid mixed global economic signals.

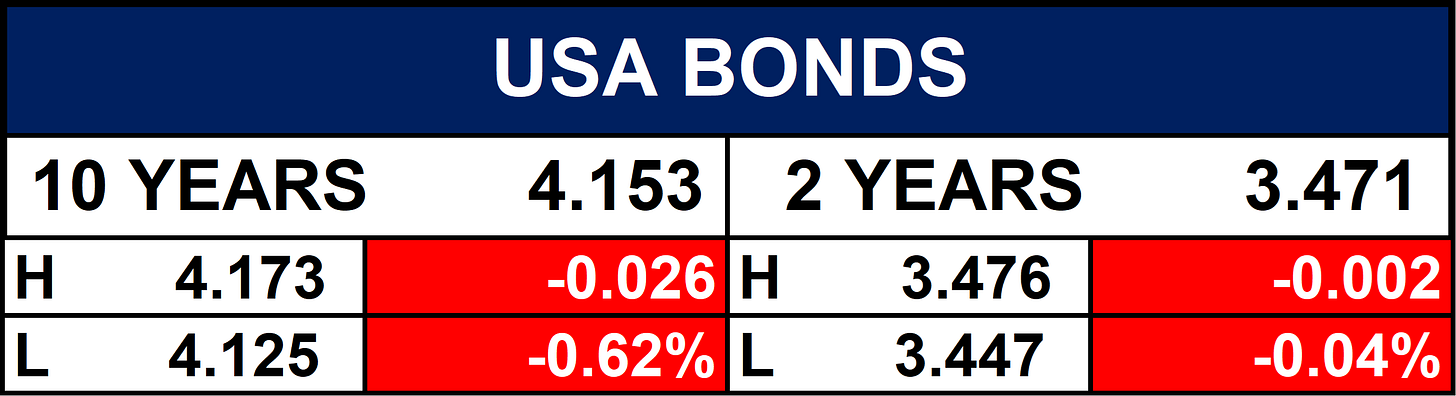

Fixed Income (USA Bonds)

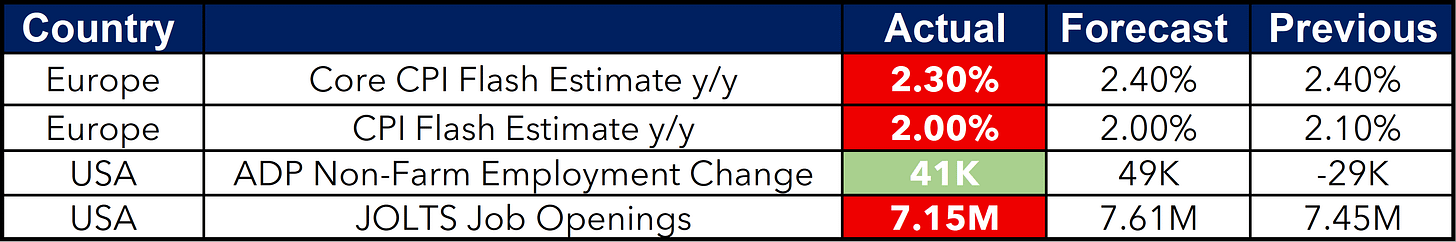

Events

Conclusion

Given strong rights and private capital raises in Nigerian banks and tax system formalization, the domestic market may see improved investor confidence and tighter liquidity conditions ahead; globally, escalating trade probes and strategic energy asset negotiations suggest volatility in supply chains and commodity prices that could impact earnings and portfolio positioning going into the next quarter.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.