Wealth Wednesday - Nigerian Ratings Boost, Oil Output Milestone, Power-Sector Reform & Global Policy Signals Shape Market Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market brief, where we unpack major shifts across Nigeria’s insurance, oil, power, and liquidity landscape. This edition highlights NEM Insurance’s rating upgrade, NNPC’s production milestone, the FG’s power-sector bond move, and liquidity changes from the CBN. We also track global policy decisions from Indonesia’s commodity tariffs to Fed and BoC rate signals shaping investor positioning worldwide.

Nigerian News & Market Update

GCR upgrades NEM Insurance rating to AA+(NG):

NEM Insurance’s financial strength rating has been upgraded to AA+(NG) by GCR, driven by stronger market position, robust capitalisation, and solid earnings performance. - Punch

NNPC sets 36-year oil production record at 355,000bpd:

NNPC E&P has achieved a 35-year production record, hitting 355,000 barrels per day and signalling strong progress in Nigeria’s upstream recovery.- Punch

FG begins N4tn GenCos debt repayment with bonds:

The Federal Government has launched a N590bn first-tranche bond to begin repaying the N4tn debt owed GenCos, marking a major step toward resolving Nigeria’s power sector liquidity crisis. - Punch

Market Liquidity Rises by 32% as CBN Turns Down OMO Bets:

Market liquidity surged as CBN rejected ₦1.3trillion OMO subscriptions, despite high demand, keeping the financial system in a strong surplus position. - Dmarketforces

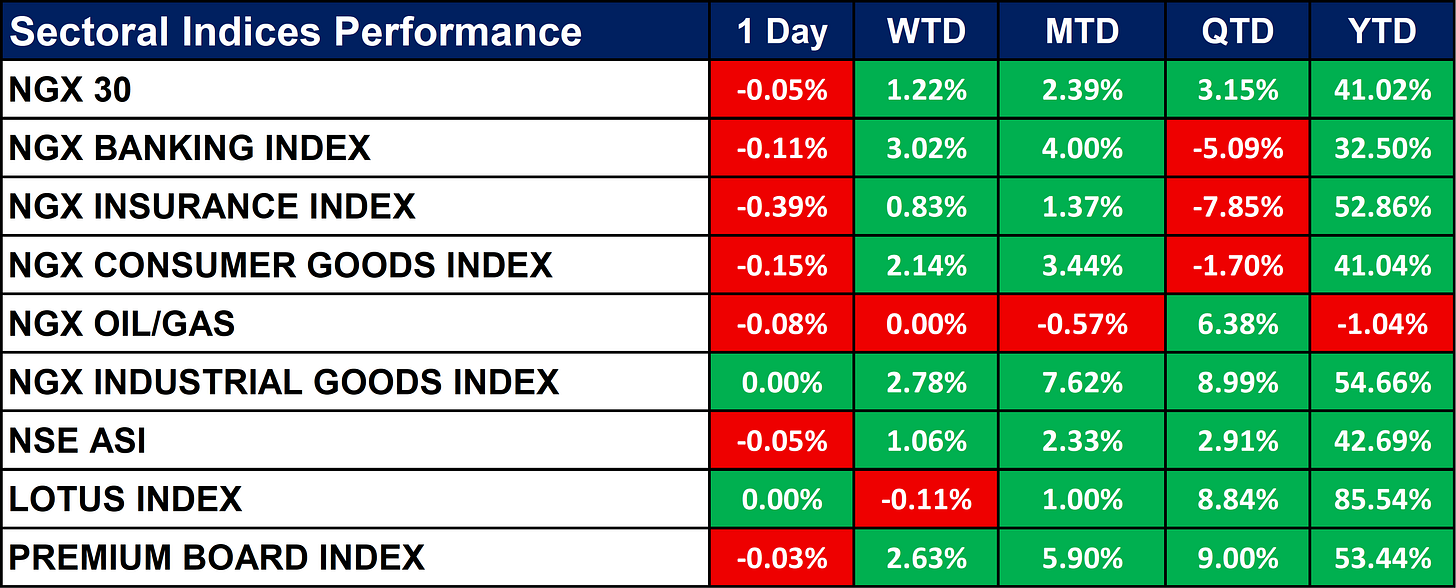

Nigeria Sectoral Indices Performance

The table below shows that the market was broadly negative on the day, with most NGX sector indices posting mild declines. Week-to-date and month-to-date performance remain positive across nearly all sectors, led by Industrial Goods and Consumer Goods. Year-to-date, the market shows strong gains overall, with standout performances from the LOTUS Index (+85.54%) and Insurance (+52.86%).

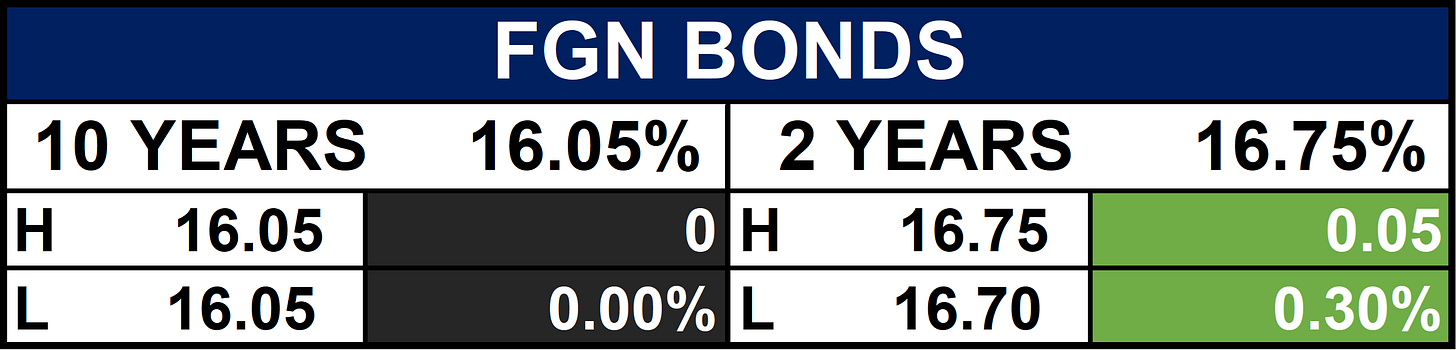

Fixed Income (FGN Bonds)

Global News & Market Update

Indonesia to levy gold export duties from December 23:

Indonesia will introduce new gold export duties of 7.5%–15% from Dec. 23, aiming to generate about $180 million in revenue next year. - Reuters

Share of China-made copper in LME stocks grows on higher exports:

Chinese-made copper dominated LME inventories in November, rising to 85% of available stocks due to profitable export arbitrage. - Reuters

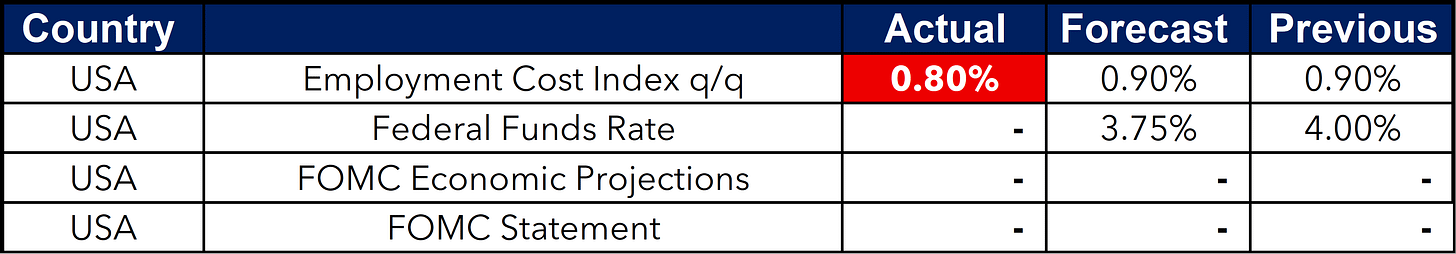

Fed expected to lower rates, but may signal a coming pause:

The Fed is expected to cut rates by 25 bps today but may signal a more cautious, hawkish outlook for future cuts due to divided views and uncertain economic data. - Reuters

Bank of Canada keeps key policy rate unchanged:

The Bank of Canada held its key rate at 2.25%, saying inflation is near target but uncertainty remains high amid volatile trade and uneven economic growth. - Reuters

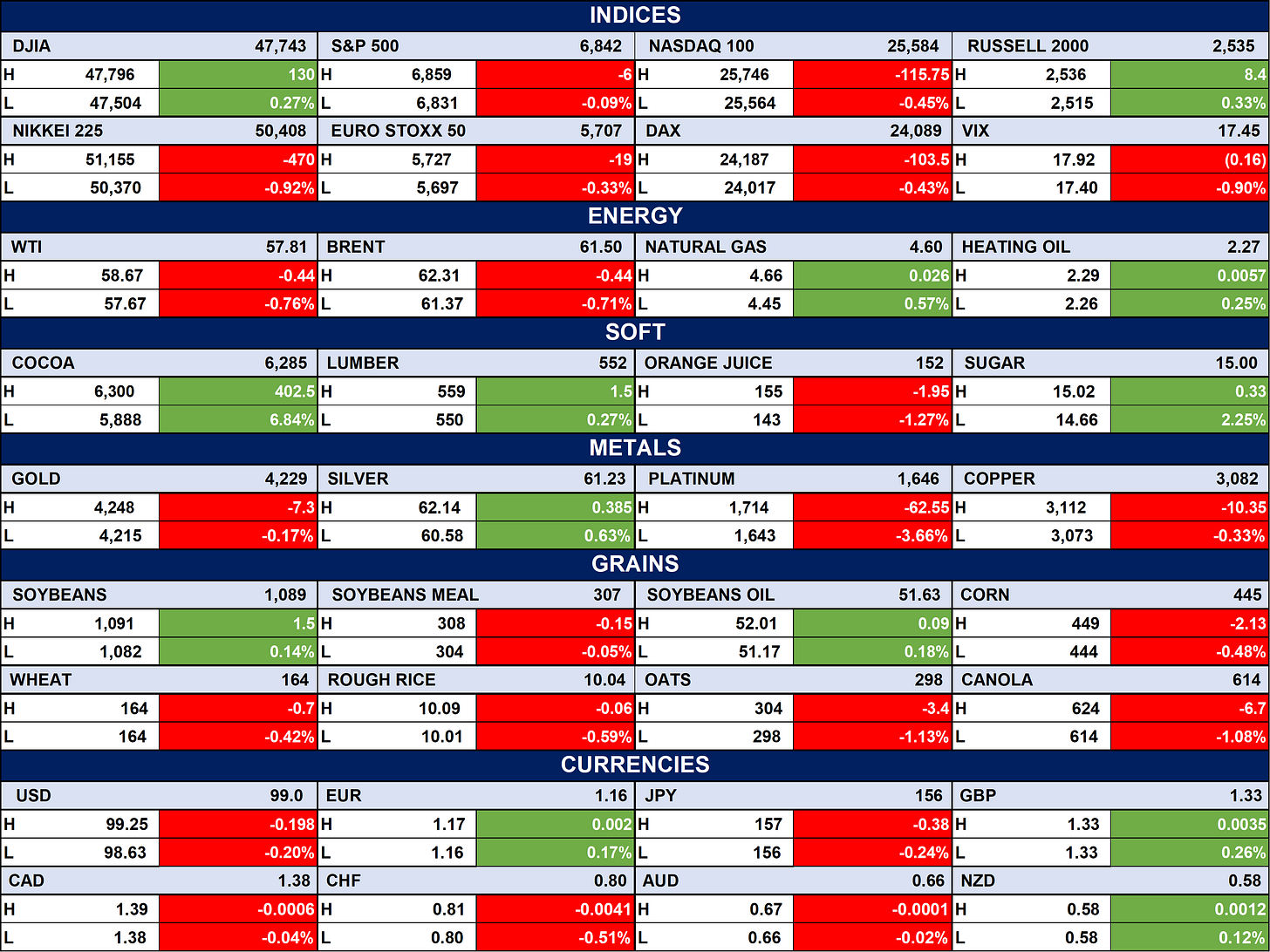

Indices, Commodities & Currencies

The table below depicts that the Equities showed mixed performance, with U.S. indices slightly lower while the Russell 2000 posts a small gain; volatility (VIX) is marginally down. Commodities are broadly mixed: energy prices are slightly lower, metals show mild weakness, while soft commodities like cocoa and sugar edge higher. Currencies trade mostly flat to slightly weaker, with minor moves across USD, EUR, JPY, and GBP.

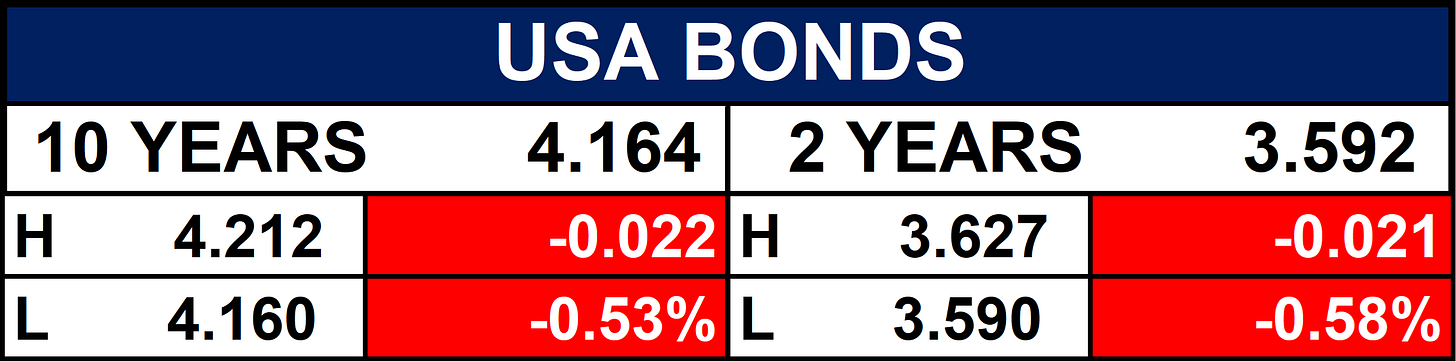

Fixed Income (USA Bonds)

Events

Conclusion

As domestic reforms gain traction and global central banks shape rate expectations, investors should prepare for market recalibration across fixed income and equities.

Nigeria’s improving fundamentals, coupled with global policy uncertainty, may create selective opportunities in energy, financials, and high-yield instruments.

Staying attentive to liquidity trends and policy signals will be key to anticipating short-term volatility and capturing emerging market moves.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.