Wealth Wednesday - Nigeria’s Corporate Capital Raises and Banking Reforms Drive Market Sentiment Amid Global Energy and Policy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update, where we bring you the latest developments shaping Nigeria’s corporate landscape, capital markets, and global economic trends. Expect insights on major rights issues, leadership transitions, banking sector reforms, and sectoral equity performance, alongside key global policy and energy updates influencing market sentiment. This edition equips investors with actionable perspectives on opportunities and risks across equities, fixed income, and commodities.

Nigerian News & Market Update

Champion Breweries opens ₦15.91billion rights issue:

Champion Breweries has opened a ₦15.91billion rights issue to existing shareholders to fund its planned acquisition of the Bullet brand as part of a broader two-phase capital raise. - Punch

16 Banks Successfully Recapitalised Ahead of Deadline – CBN:

The CBN says 16 banks have already met the new recapitalisation requirements ahead of the March 2026 deadline, with the ongoing reforms aimed at strengthening the resilience and risk-bearing capacity of Nigeria’s banking sector. - Dmarketforces

VFD Group ₦50.6billion Rights Issue extended to December 26:

VFD Group has secured SEC approval to extend its ₦50.67billion rights issue to December 26, 2025, allowing more shareholders to participate as part of its strategy to strengthen capital and support long-term growth. - Businessday

Energy& LLP Acquires Stake In Falcon Corp:

Energy& LLP, a subsidiary of EverCorp Industries, has acquired an equity stake in Falcon Corporation, strengthening the company’s capacity to expand gas infrastructure and advance Nigeria’s domestic gas development. - Leadership

Unilever Nigeria appoints Uchenna Nwakanma as Executive Director:

Unilever Nigeria Plc has appointed Uchenna Nwakanma as Executive Director effective November 13, 2025, strengthening its leadership with his extensive R&D and FMCG innovation experience across Africa. - TheSun

IEI announces leadership transition:

International Energy Insurance Plc announced the resignation of MD/CEO Olasupo Sogelola and appointed Dr. Joyce Odiachi as Acting Managing Director to guide the company through its ongoing transformation and recapitalisation phase - TheNation

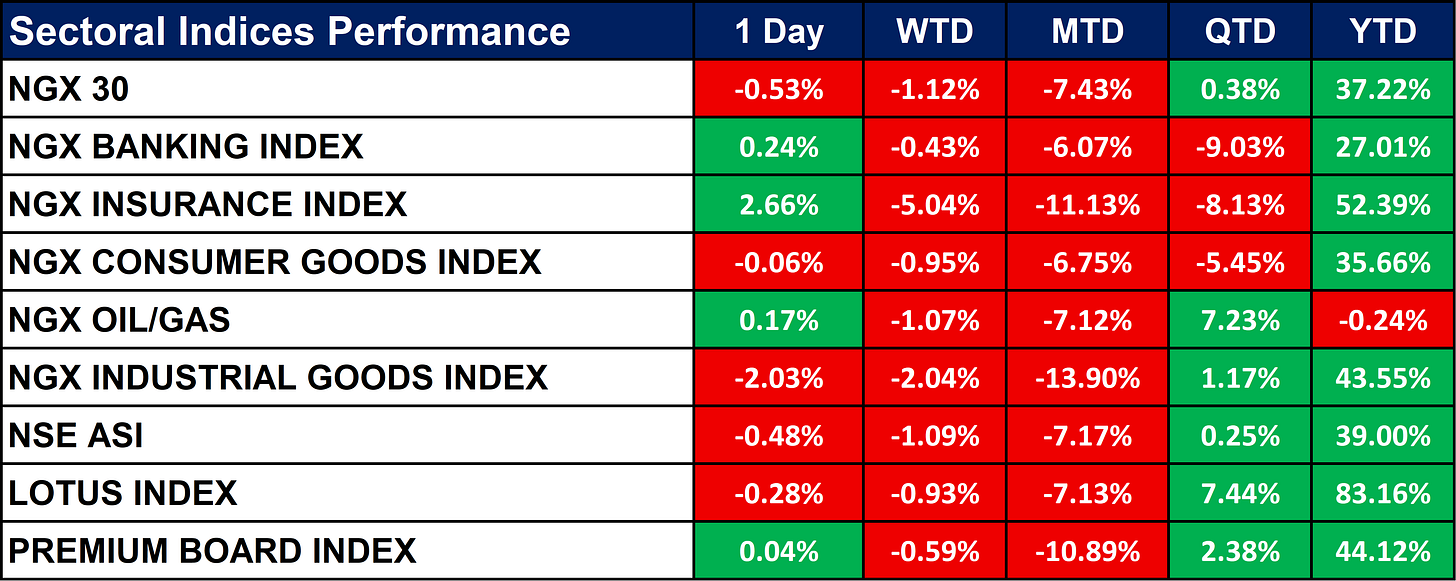

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities market saw a mixed performance with the NGX Insurance Index (+2.66%) leading gains, while the NGX Industrial Goods Index (-2.03%) and NGX 30 (-0.53%) declined. Most sector indices remain down for the month, with the Industrial Goods (-13.90%) and Insurance (-11.13%) sectors underperforming. Year-to-date, the market is strong, led by the Lotus Index (+83.16%) and Insurance

Fixed Income (FGN Bonds)

Global News & Market Update

Britain eases opposition to new oil, gas permits, holds firm on taxes:

Britain will allow limited new oil and gas production linked to existing fields but will keep its 38% windfall tax until 2030, supporting renewables funding while North Sea output declines. - Reuters

Ghana central bank delivers third big rate cut as inflation tumbles:

Ghana’s central bank slashed its policy rate to 18%, marking a cumulative 1,000 bps cut in 2025 as inflation sharply declines and economic conditions improve. - Reuters

Britain cuts tax-free allowance for cash savings to spur investing:

Britain will cut the tax-free cash ISA limit to £12,000 from 2027 to push savers toward stock market investing and support economic growth. - Reuters

Abu Dhabi’s GSU to launch $1 billion energy projects in Yemen:

The UAE will invest $1 billion in solar, wind, and power network projects to rebuild Yemen’s battered energy sector. - Reuters

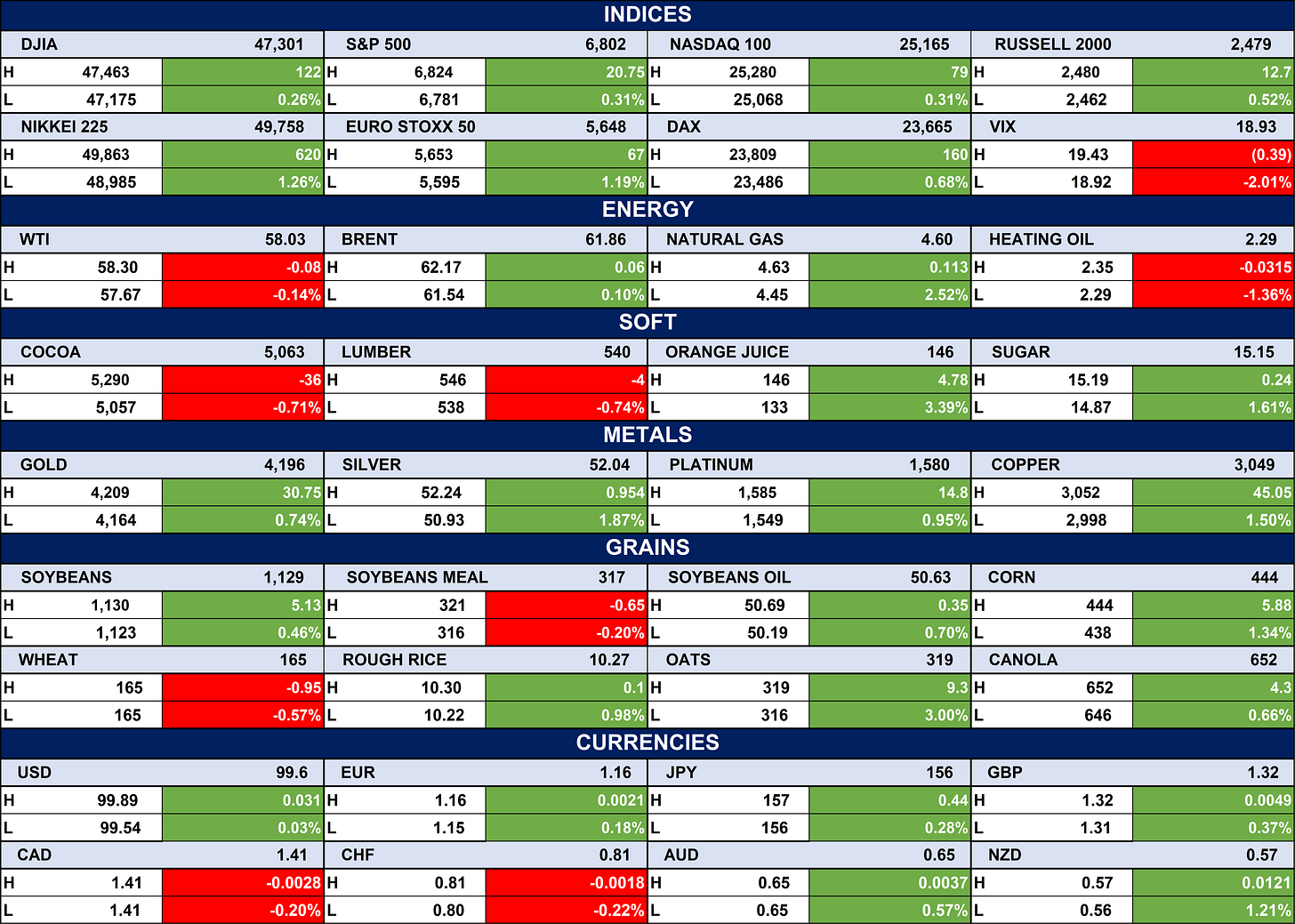

Indices, Commodities & Currencies

The table below depicts that the Major equity indices are broadly higher, with the S&P 500, Nasdaq 100, and European benchmarks all showing modest gains, while the VIX is notably lower. Energy markets are mixed: natural gas and Brent are slightly up, while WTI and heating oil edge down.

Most commodities including metals, grains, and softs show small, mostly positive moves, with silver, orange juice, and corn among the stronger performers.

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian markets may see selective gains in sectors benefiting from corporate capital raises and strong leadership appointments, while global policy shifts including energy taxation in the UK and rate cuts in Ghana could influence foreign capital flows and investor sentiment. Cautious positioning in underperforming industrials and monitoring global commodity trends will be key for informed investment decisions.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.