Wealth Wednesday - Nigeria’s Energy Reforms, Bank Recapitalisation and Market Liquidity Drive Optimism Amid Global Trade Realignments and Oil Market Rebalancing

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. Nigeria’s energy and financial sectors continue to show resilience, with fresh upstream licensing rounds, strong liquidity in the money market, and growing investor confidence reflected in recapitalization milestones. Globally, trade dynamics are shifting as Europe leans on Eastern markets, Vietnam edges toward a new U.S. deal, and OPEC anticipates a balanced oil outlook all shaping sentiment across commodities and equities. Investors could expect continued optimism in Nigeria’s energy reforms and cautious positioning in global markets amid evolving trade and oil supply trends.

Nigerian News & Market Update

Tinubu okays NUPRC’s 2025 oil block bids:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has announced the commencement of the 2025 oil and gas licensing round from December 1, 2025, aimed at unlocking undeveloped fields, boosting upstream production, and attracting new investments into Nigeria’s petroleum sector. - Punch

Money Market Rates Steady, Banks Boost Deposit at SDF to ₦3.5trillion:

Despite heavy liquidity mop-up efforts, Nigeria’s money market stayed flush with cash as banks parked ₦3.5 trillion at the CBN’s Standing Deposit Facility, keeping rates steady amid strong investor demand for treasury bills. - Dmarketforces

FG reviews 215 gas projects, eyes $20billion investment:

The Federal Government, through NMDPRA, has identified 70 high-impact gas utilization projects worth over $20 billion under the Decade of Gas Initiative to boost industrial growth, energy security, and job creation across Nigeria. - DailyTrust

Standard Chartered confirms compliance with CBN’s ₦200billion minimum capital requirement:

Standard Chartered Bank Nigeria has met the CBN’s ₦200 billion minimum capital requirement ahead of the March 2026 deadline, reaffirming its confidence in Nigeria’s economy and commitment to driving sustainable growth. - Tribune

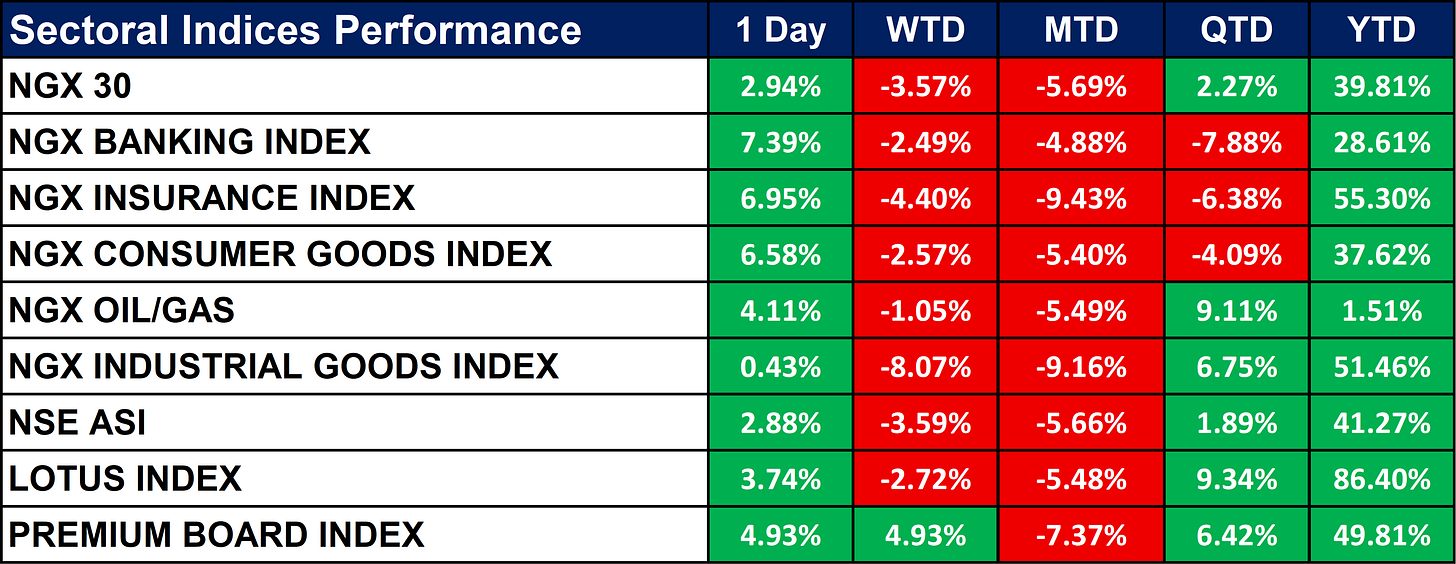

Nigeria Sectoral Indices Performance

The table below shows that the NGX market rebounded strongly, gaining 2.88% led by Banking (+7.39%) and Insurance (+6.95%) sectors.

Despite the daily rally, most indices remain negative month-to-date, reflecting earlier market weakness. Year-to-date performance remains positive across all sectors, with the Lotus Index (+86.40%) and Insurance (+55.30%) leading gains.

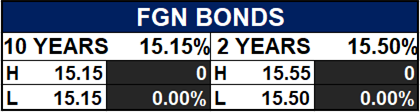

Fixed Income (FGN Bonds)

Global News & Market Update

German exports get welcome boost from Eastern Europe, says business group:

Germany’s exports to Central and Eastern Europe rose 2.35% to €216 billion in the first nine months of 2025, offsetting declines in trade with China and the U.S., as business leaders urge the EU to deepen regional ties and remove trade barriers. - Reuters

Vietnam eyes tariff deal soon, as US seeks to cut huge trade deficit:

Vietnam is pushing to finalize a trade deal with the U.S. that balances tariffs and market access as both sides seek to reduce America’s trade deficit and strengthen economic ties. - Reuters

OPEC expects balanced oil market in 2026, moving further away from deficit projection:

OPEC’s latest report projects global oil supply and demand will balance in 2026 due to increased OPEC+ and non-OPEC output, narrowing earlier deficit forecasts despite the IEA’s expectation of a major surplus. - Reuters

Guinea aims for global high-grade iron ore leverage with Simandou launch:

Guinea plans to maintain high global iron ore prices as production begins at its $20 billion Simandou project, aiming to supply premium green steel markets and assert greater control despite China’s dominant ownership and influence. - Reuters

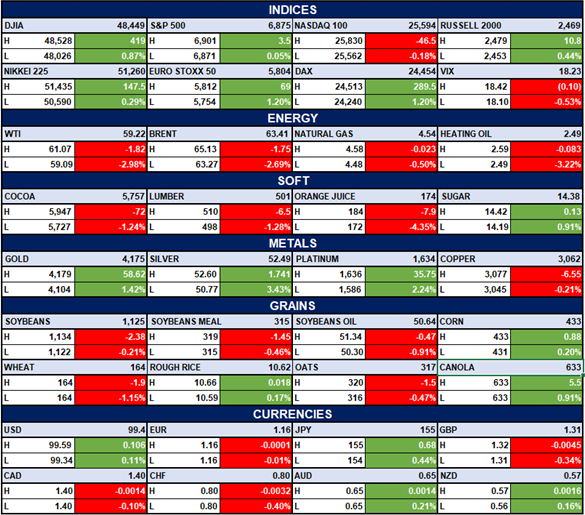

Indices, Commodities & Currencies

The table below depicts that the Global indices mostly advanced, led by the DAX (+1.20%), while NASDAQ 100 dipped slightly (-0.18%).

Energy prices declined sharply, with WTI (-2.98%) and Brent (-2.69%) falling as oil markets weakened. Metals gained broadly silver (+3.43%) and gold (+1.42%) rose, while most agricultural and soft commodities traded lower.

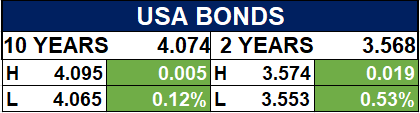

Fixed Income (USA Bonds)

Conclusion

Looking ahead, sustained investor confidence in Nigeria’s banking and gas sectors could spur capital inflows and market stability, while global commodity prices may fluctuate as OPEC’s production plans and trade realignments unfold. Investors should watch for short-term oil price corrections, potential upticks in industrial activity, and renewed opportunities in fixed-income and equity markets driven by policy consistency and global demand shifts.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.