Wealth Wednesday - Nigeria’s Eurobond Yields Rise, FG Launches ₦4trn Power Bond as Global Trade, Sanctions and Commodity Shifts Shape Markets

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. Nigeria’s Eurobond yields rose to 8.27%, reflecting cautious investor sentiment. The government’s ₦4trillion bond for power and ₦28billion metering plan aim to boost liquidity and infrastructure. Zenith Bank’s oversubscribed recapitalisation and Access Bank’s Pan-African Payment and Settlement System (PAPSS) integration highlight banking sector strength. The NGX 30 gained 0.07%, led by insurance and industrial stocks. Globally, markets were mixed amid trade tensions, Russia sanctions, and stronger demand for safe-haven assets.

Nigerian News & Market Update

Nigeria’s Eurobonds Yield Rises to 8.3% Ahead of $1.1billion Repayment:

Nigeria’s Eurobond yields rose to 8.27% as investor confidence weakened. The government plans to repay $1.1billion and raise $2.3billion in Q4. Analysts expect continued bearish sentiment amid declining oil prices and global uncertainties. - dmarketforces

Federal Govt. Rolls Out ₦4trillion Bond To Settle Gencos’ Arrears:

The Federal Government approved a ₦4trillion bond to clear debts owed to GenCos and gas suppliers, aiming to restore stability and investor confidence in the power sector. - dmarketforces

Access Bank Integrates Pan-African Payment, Settlement System Into App:

Access Bank integrated the Pan-African Payment and Settlement System (PAPSS) into its AccessMore app to enable faster, cheaper cross-border payments and boost intra-African trade. - Leadership

Our recapitalisation exercise achieved 160% subscription – Zenith Bank:

Zenith Bank marked its 160% oversubscribed recapitalization, crediting NGX’s X-stream platform for the success. Its share price nearly doubled, and the bank pledged strong dividends and continued investor value. - Dailytrust

DisCos get ₦28billion bailout for free meter rollout:

The Nigerian Electricity Regulatory Commission (NERC) approved ₦28billion for free metering of Band A and B customers, directing DisCos to complete installations by December 2025 to cut energy theft and improve billing accuracy. - Punch

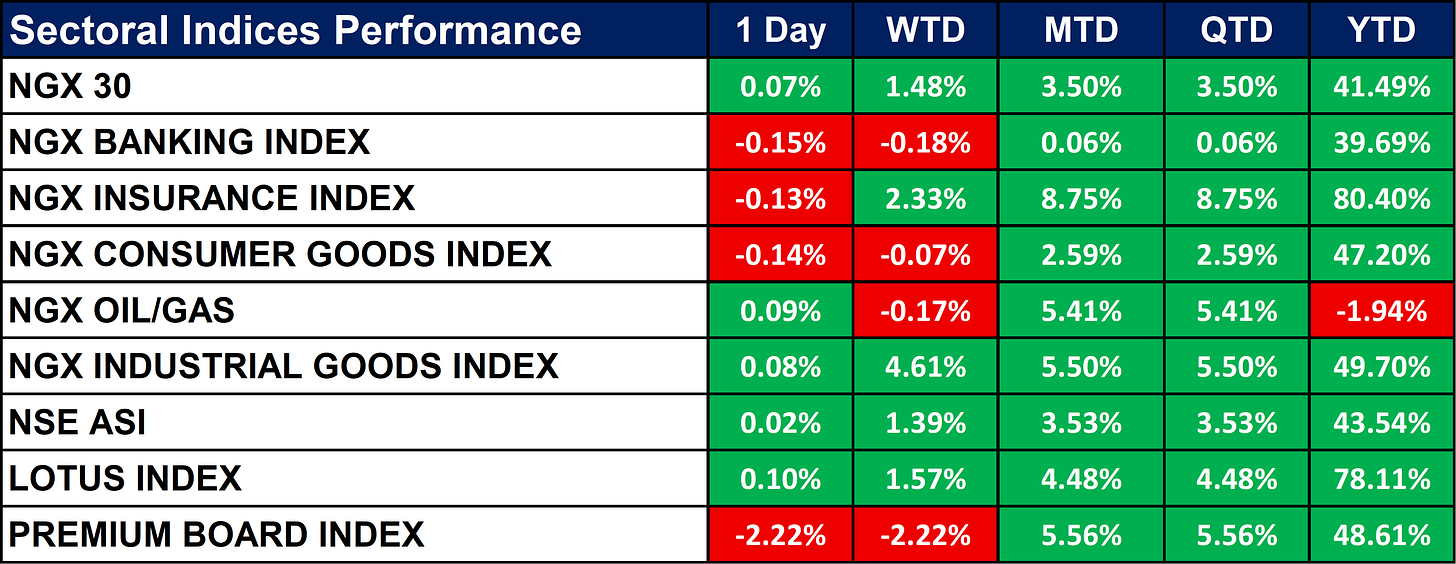

Nigeria Sectoral Indices Performance

The table below shows that the NGX market closed slightly positive, up 0.02%, driven by gains in industrial (+4.61%) and insurance (+2.33%) indices.

The oil/gas sector rose 0.09% but remains down 1.94% YTD, while the premium board fell 2.22%. Overall, insurance (+80.40% YTD) and Lotus (+78.11% YTD) remain the year’s best performers.

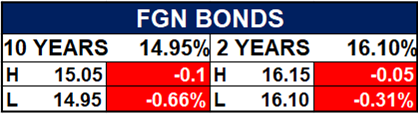

Fixed Income (FGN Bonds)

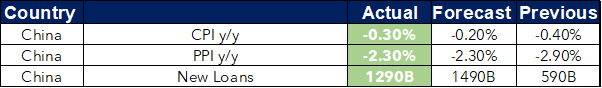

Global News & Market Update

Japan, Spain, South Korea warn over unsustainable copper processing fees:

Japan, Spain, and South Korea warned that plunging copper processing fees threaten global smelters’ sustainability and urged a return to fair Treatment Charge / Refining Charge (TC/RC) levels to stabilize the supply chain. - Reuters

Italy to apply extra levy on Chinese goods to safeguard its own fashion industry:

Italy will impose an extra levy on Chinese imports to protect its fashion industry and curb cheap fast-fashion competition.- Reuters

India’s trade deficit widens to 13-month high on gold imports, US tariff impact:

India’s trade deficit hit $32.15billion in September, driven by higher gold and silver imports and falling U.S. exports due to tariffs. - Reuters

UK sanctions Russia’s Lukoil and Rosneft, targets shadow fleet:

Britain sanctioned Lukoil, Rosneft, and 51 shadow tankers to cut Kremlin revenues and restrict Russian oil exports. - Reuters

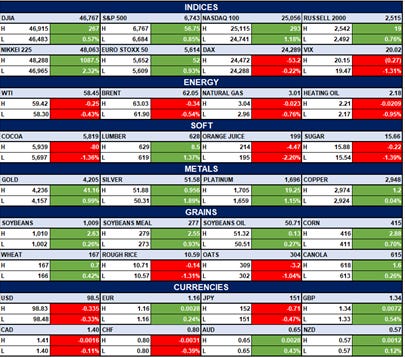

Indices, Commodities & Currencies

The table below depicts that the Global equities closed mixed, with the S&P 500 (+0.85%) and Nasdaq (+1.18%) higher, while DAX (-0.22%) and VIX (-1.31%) fell.

In commodities, WTI oil (-0.43%) and natural gas (-0.76%) declined, while gold (+0.99%) and silver (+1.89%) rose. Among currencies, the USD weakened against the EUR (+0.24%) and GBP (+0.54%), reflecting softer dollar sentiment.

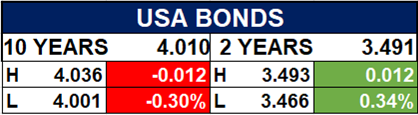

Fixed Income (USA Bonds)

Events

Conclusion

Going forward, Investors may expect continued volatility as fiscal tightening and global trade tensions weigh on markets. In Nigeria, new bond issuances and power reforms may support liquidity, though rising Eurobond yields and weak oil prices pose risks. Globally, inflation and geopolitical shifts will drive sentiment. A defensive, selective approach favoring strong banks, insurers, and moderate-duration bonds remains key for balancing growth and stability.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.