Wealth Wednesday - Nigeria’s Fiscal Moves Meet Global Market Tailwinds as Inflation Eases and Energy Deals Accelerate

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update, Nigeria’s markets opened with major funding actions from the DMO and CBN, alongside notable leadership shifts in the corporate sector. This edition highlights how these policy moves may influence liquidity, yields, and sentiment across fixed income and equities. We also scan global macro signals from Russia’s shifting reserve strategy to easing UK inflation to frame broader risks and opportunities for investors.

Nigerian News & Market Update

DMO Announces ₦460billion Reopened FGN Bonds:

The Debt Management Office (DMO) is auctioning ₦460 billion in reopened FGN bonds (2025 settlement) to boost domestic borrowing through medium-to-long-term instruments. - Channels

CBN Opens ₦700billion Treasury Bills Auction on S4 Platform:

The CBN is auctioning ₦700 billion in Treasury bills across all standard tenors, with strong demand expected amid high liquidity and steady yields. - Dmarketforces

Dangote Sugar Appoints Thabo Mabe As Group Managing Director:

Dangote Sugar Refinery has named Thabo Mabe as its new GMD/CEO-designate, succeeding Ravindra Singhvi effective December 1, 2025. - Leadership

Linkage Assurance Launches Mobile App:

Linkage Assurance Plc has launched a new mobile app to enhance digital access and customer experience, starting with motor insurance services. - Thisday

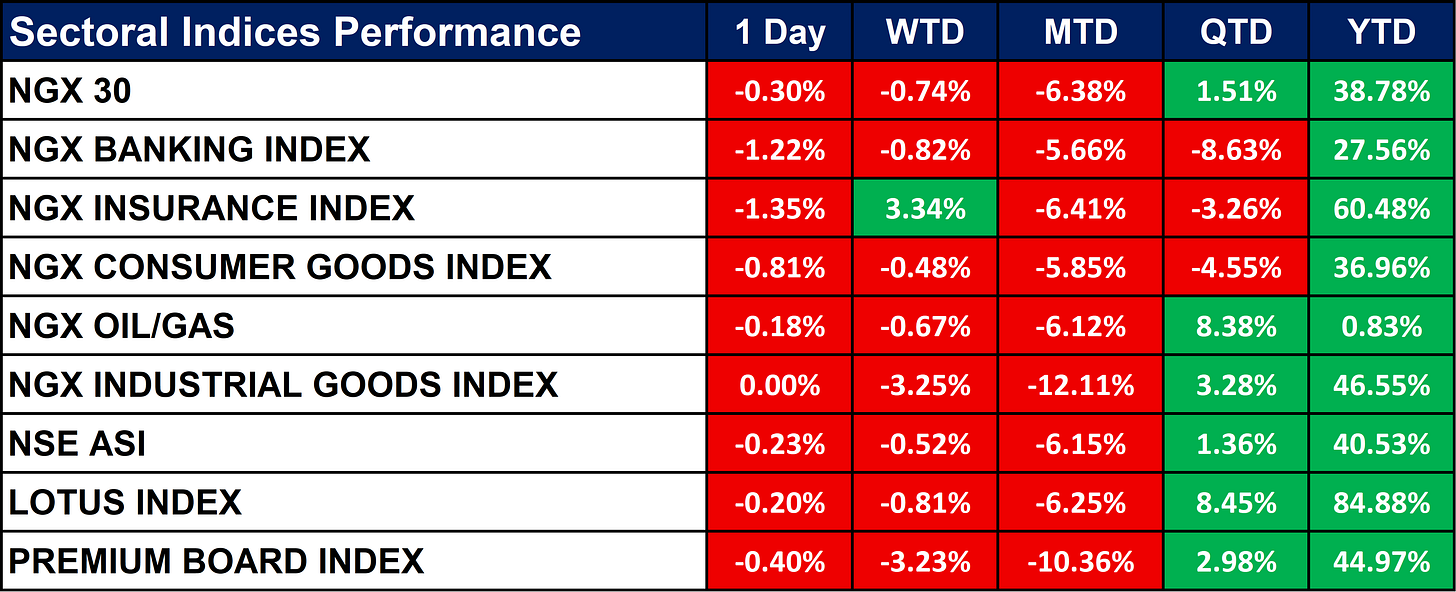

Nigeria Sectoral Indices Performance

The table below shows that the NGX market closed broadly negative, with all major indices posting declines on a 1-day, week-to-date, and month-to-date basis.

Despite short-term weakness, several indices remain strong year-to-date, led by the Lotus Index (+84.88%), Insurance (+60.48%), and Industrial Goods (+46.55%).

Quarter-to-date performance is mixed, showing pockets of resilience in Oil & Gas, Lotus, Premium Board, and Industrial Goods, despite broader selling pressure.

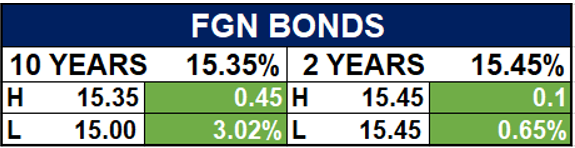

Fixed Income (FGN Bonds)

Global News & Market Update

Russia’s central bank says its operations with gold are increasing:

Russia’s central bank is increasing domestic gold transactions for the National Wealth Fund as sanctions and rising market liquidity shift its reserves toward yuan and gold. - Reuters

Exclusive: Ukraine will not limit wheat exports in 2025/26, says deputy minister:

Ukraine says it will not restrict wheat exports in the 2025/26 season due to a larger harvest and slower early-season export pace. - Reuters

TotalEnergies, Chevron lead race to buy stake in Galp’s Mopane in Namibia:

TotalEnergies and Chevron are leading the race to acquire a 40% operating stake in Galp’s massive Mopane oil field in Namibia. - Reuters

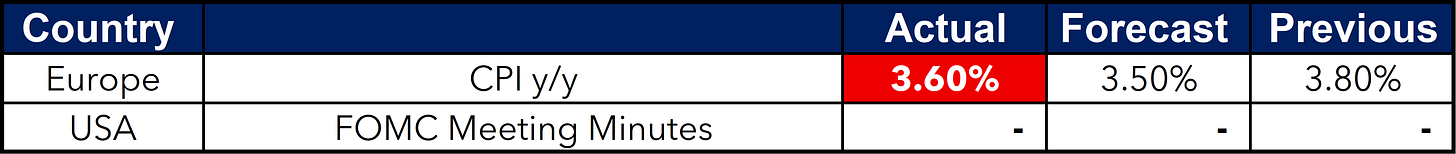

UK consumer price inflation eases to 3.6% in October:

UK inflation eased to 3.6% in October, boosting expectations of a Bank of England rate cut in December. - Reuters

IMF approves fresh, smaller $24 billion credit line for Mexico:

The IMF approved a new two-year, $24 billion flexible credit line for Mexico, reflecting stronger economic resilience and replacing a larger previous line. - Reuters

Russia set to reach OPEC+ quota by end of 2025 or early 2026, Novak says:

Russia expects to meet its OPEC+ oil production quota by late 2025 or early 2026 as output continues to rise. - Reuters

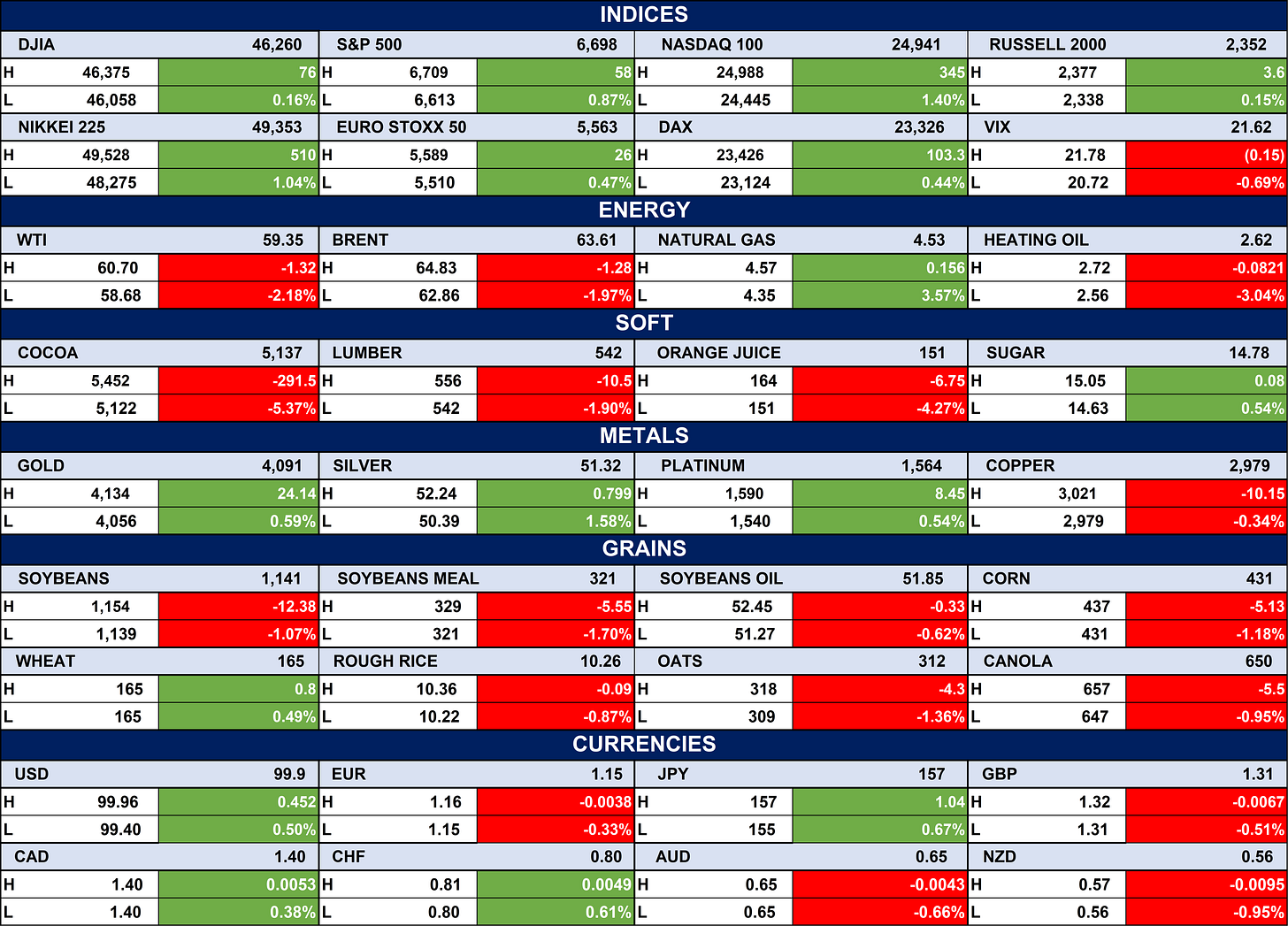

Indices, Commodities & Currencies

The table below depicts that the Global equity indices traded mostly higher, with the S&P 500, Nasdaq 100, Nikkei 225, DAX, and Euro Stoxx 50 all posting gains, while volatility (VIX) eased slightly. Energy markets were mixed oil prices (WTI, Brent) slipped, but natural gas advanced, while soft commodities like cocoa and orange juice recorded notable declines. Metals posted modest gains across gold, silver, and platinum, whereas grains were broadly weaker, and major currencies showed limited movement with slight dollar strength.

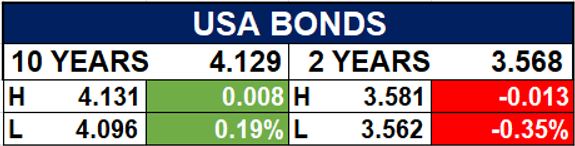

Fixed Income (USA Bonds)

Events

Conclusion

Overall, the mix of fresh domestic auctions and improving global inflation trends suggests near-term stability in fixed-income pricing but sustained selectivity in risk assets. Investors should watch liquidity flows from the CBN and DMO issuances, as they are likely to shape yields and equity sector rotation in the coming sessions.

Globally, softer inflation and shifting commodity dynamics could support emerging-market inflows, offering Nigerian investors tactical opportunities in oil, commodities, and FX-linked instruments.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.