Wealth Wednesday -Nigeria’s Market Strength Underpinned by Policy Reforms as Global Rate Cuts and Energy Risks Shape Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. Nigerian markets continue to display resilience, with sectoral indices largely positive and investor sentiment supported by policy reforms and fresh capital inflows. On the global stage, central banks are signaling a pivot toward monetary easing, while commodity markets remain volatile amid structural shifts in supply chains. These developments are reshaping investor strategies across equities, fixed income, and energy markets.

Nigerian News & Market Update

NAMA pushes for tariff hike, airlines kick:

The Nigerian Airspace Management Agency DG, Farouk Umar, says the flat ₦11,000 charge per flight paid by airlines since 2008 is no longer sustainable given rising costs of maintaining aviation infrastructure. He noted that while airlines frequently increase fares, they resist fee reviews, leaving the Nigerian Airspace Management Agency (NAMA) unable to recover costs for safety-critical systems. Airlines warn that higher charges could worsen their financial struggles and further raise ticket prices. Stakeholders, however, stress the need for a balanced approach that ensures safety, cost recovery, and industry sustainability. - Punch

CBN sets six-month deadline for successor bank chiefs:

The CBN has mandated Nigeria’s biggest banks to secure approval for a new CEO six months before the incumbent’s exit and announce the successor three months prior. The directive aims to ensure smooth leadership transitions, strengthen governance, and safeguard financial stability in systemically important banks, aligning with global best practices. - Punch

Federal Government Unveils $3.14billion Agric Investment Scheme With FAO:

The Federal Government has launched a $3.14 billion agricultural investment portfolio under the FAO’s Hand-in-Hand Initiative, focusing on tomato, cassava, maize, dairy, and fisheries. Backed by $1.75billion public and $1.39billion private investment, the plan aims to lift 4.1 million Nigerians, boost per capita income by $657, and sequester 1.2m tonnes of carbon. With expected returns above 14%, the initiative targets food security, poverty reduction, job creation, and climate resilience. The Food and Agriculture Organization of the United Nations (FAO) and VP Shettima hailed the move as a game-changer, especially through irrigation, digital innovation, and strong public-private partnerships. - Leadership

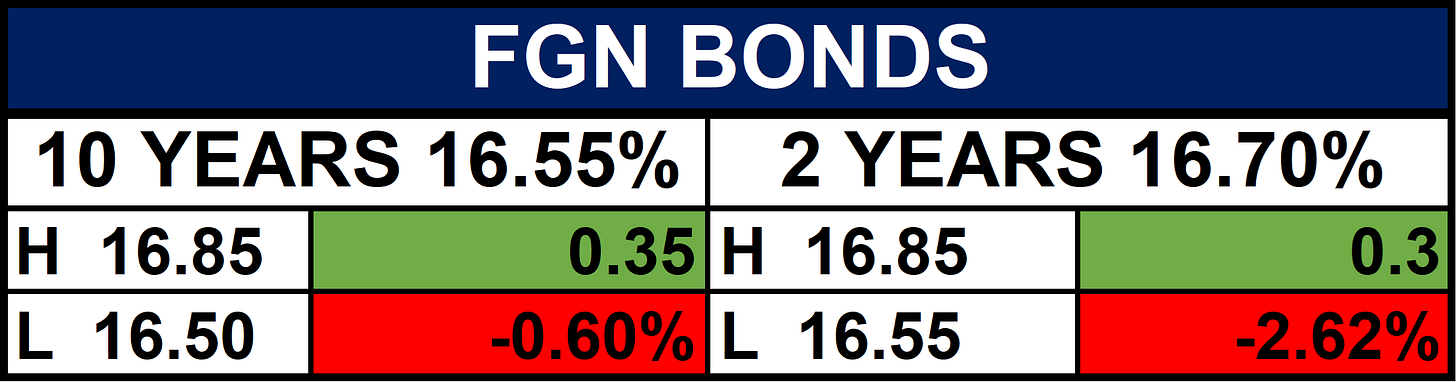

Investors Take Profit on Bonds as Real Interest Rate Hits 7.38%:

Nigeria’s August inflation fell to 20.12% from 21.88%, widening the real interest rate to 7.38% and making FGN bond returns more attractive. Despite this, investors trimmed holdings in the secondary market, taking profits and reassessing positions ahead of new bond supply and possible monetary policy easing. The FGN bond market saw mild activity, with modest demand for 2029–2033 maturities, while average yields rose by 17 bps to 16.65%. In contrast, Nigerian Eurobonds rallied, with yields dropping 16 bps to 7.76%, reflecting stronger foreign investor confidence. - Dmarketforces

Upstream Sector Attracts $18.2billion Investment, Unlocks 1.4bn Oil Barrels:

Nigeria’s oil and gas sector is seeing a strong revival, with rig count rising from 8 in 2021 to 43 in 2025 and over $18.2 billion in new investments committed. According to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) chief Gbenga Komolafe, reforms under the Petroleum Industry Act (PIA) and Tinubu’s energy agenda have attracted major projects like Bonga North ($5bilion) and Ubeta Gas ($500million), alongside 28 new field development plans. These efforts are expected to add 591,000 barrels of oil/day and 2.1 BSCFD of gas, moving Nigeria closer to its 3 million barrels/day production target while boosting energy security and economic growth. - Leadership

Cornerstone Insurance unveils Cici:

Cornerstone Insurance Plc has launched Cici, an AI-powered virtual assistant designed to enhance customer engagement and streamline insurance services. Accessible via WhatsApp, Cici can provide policy details, assist with claims, detect fraud, and answer queries 24/7 in multiple languages. The platform uses generative AI for context-aware, personalized conversations, improving operational efficiency, scalability, and customer experience. The insurer highlighted that Cici reduces call center workload, automates repetitive queries, and supports expansion to new products and regulatory updates. - TheNation

Afreximbank, MDGIF sign pact to mobilise $500milion for gas projects:

Afreximbank and the Midstream and Downstream Gas Infrastructure Fund (MDGIF) have partnered to raise $500 million for developing Nigeria’s gas infrastructure. The agreement, signed at the Intra-African Trade Fair 2025, aims to accelerate midstream and downstream projects, expand gas utilization, reduce flaring, and drive industrialization. Afreximbank will provide credit risk guarantees, project preparation support, and capacity-building, while MDGIF will mobilize capital and structure bankable projects. The initiative aligns with the Petroleum Industry Act and President Tinubu’s economic agenda. - DailyTrust

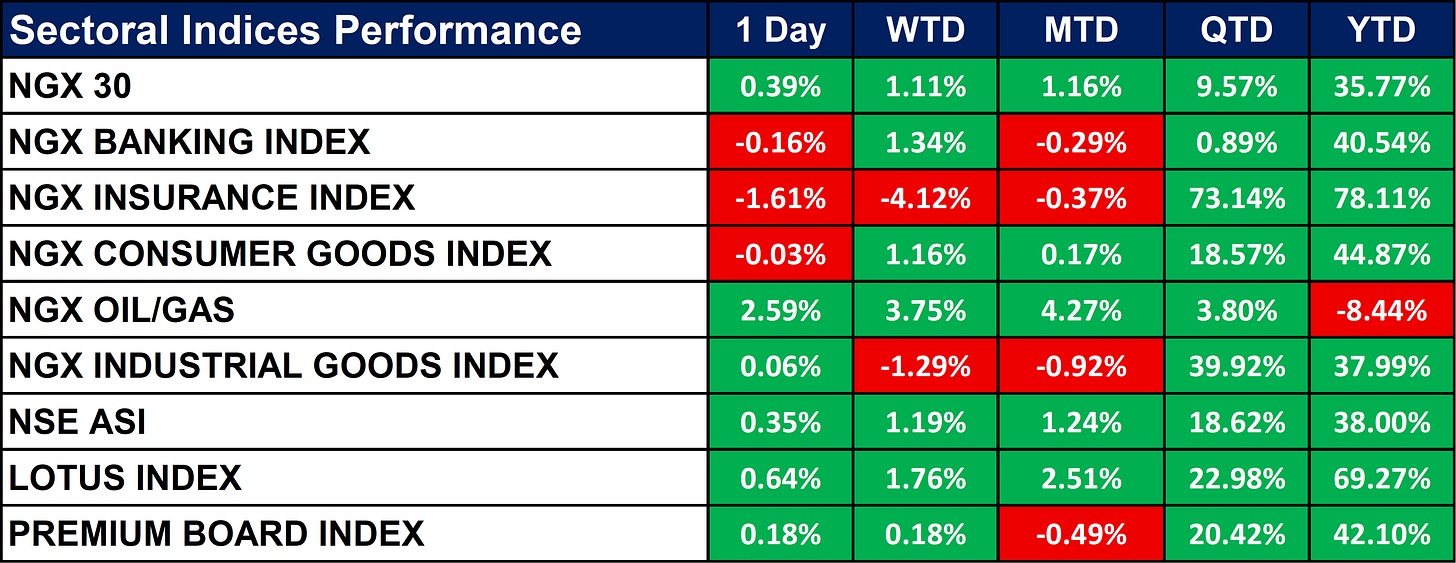

Nigeria Sectoral Indices Performance

The table below shows that the market stayed positive with the NSE ASI up 0.35% daily and 38% YTD. Insurance (+78.1% YTD) and Lotus (+69.3% YTD) remain the strongest performers, while Oil & Gas is the only sector negative YTD (–8.4%) despite recent gains. Banking is flat short term but still +40.5% YTD, while Consumer and Industrial Goods show steady strength. Overall, the NGX remains bullish with sectoral rotation in play.

Fixed Income (FGN Bonds)

Global News & Market Update

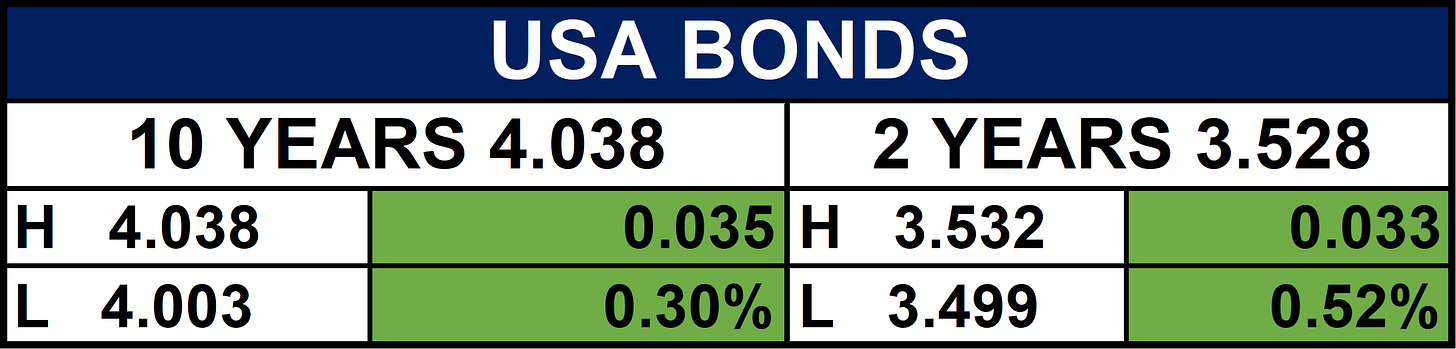

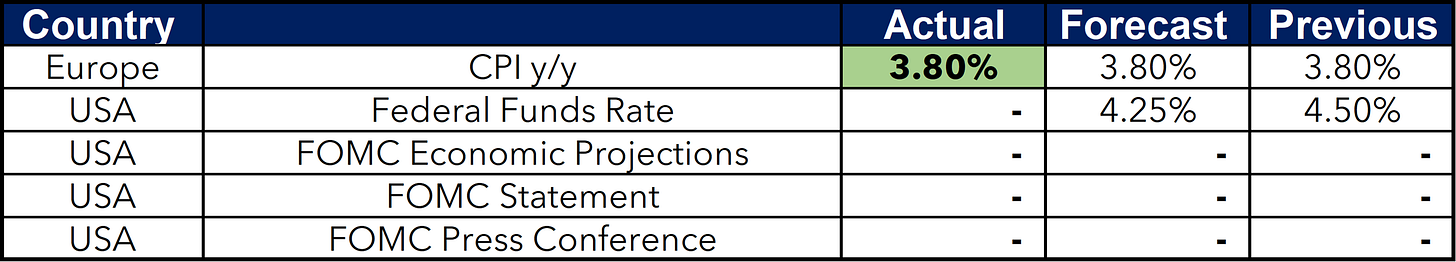

Fed expected to cut rates, update views of Trump economic plan with new projections:

The U.S. Federal Reserve is expected to announce a quarter-point interest rate cut at a politically charged meeting, amid President Trump’s pressure for larger reductions. The decision may see dissents from some policymakers, while updated economic projections extending through 2028 will reflect recent softer employment growth and inflation risks from import tariffs. The Fed has kept rates at 4.25%-4.50% since December 2024, and investors anticipate gradual cuts through year-end, balancing slowing labor markets against persistent inflation concerns. - Reuters

India's rice stocks hit record, wheat at four-year high:

As of September 1, 2025, India’s government-held rice stocks reached a record 48.2 million tons, up over 14% from last year, far exceeding the target of 13.5 million tons. Wheat stocks also hit a four-year high at 33.3 million tons, above the 27.6 million-ton target. Strong rice inventories support higher exports, with India expected to ship a record 22.5 million tons this year, while abundant wheat supplies give the government flexibility to curb price spikes during the festival season in October. Storage challenges may arise as the new paddy crop arrives next month. - Reuters

Vitol, Sunoco take first gasoline cargo from Nigeria's Dangote to the US, sources say:

Vitol and Sunoco have received the first U.S. gasoline shipment from Nigeria’s Dangote refinery, marking a key milestone for the 650,000 barrels-per-day facility. The cargo, delivered on the tanker Gemini Pearl, was purchased from Mocoh Oil and largely sold to Sunoco at its Linden, New Jersey facility. Additional Dangote gasoline shipments are scheduled for the U.S. in the coming days via Glencore and Mocoh Oil. However, the refinery’s gasoline unit may shut down for 2–3 months for repairs, potentially limiting further exports temporarily. This signals Dangote’s growing role in reshaping global fuel trade and reducing Nigeria’s fuel import dependence. - Reuters

China threatens to shut down polysilicon plants if new energy standards can't be met:

China is proposing strict new energy standards for polysilicon, a key material for solar panels. Plants failing to meet the baseline energy consumption of 6.4 kgce/kg will be given time to upgrade, but those still not meeting the stricter 5.5 kgce/kg limit will be forced to shut down. The restructuring could cut China’s effective polysilicon production capacity by 16.4% to 2.4 million metric tons per year. The standards are in draft form, open for public feedback, and expected to be implemented within 12 months. - Reuters

Bank of Canada cuts rates to three-year low, cites risks to economy:

The Bank of Canada cut its key policy rate by 25 basis points to 2.5%, a three-year low, citing a weak labor market, economic contraction, and reduced inflationary pressures. The move, unanimously approved, responds to over 100,000 jobs lost recently, a high unemployment rate, and uncertainty from U.S. and China tariffs. The central bank signaled it will continue monitoring risks, with markets pricing in a possible additional rate cut in October. - Reuters

Ukraine, US launch fund for critical minerals projects with $150 million investment:

Ukraine and the U.S. International Development Finance Corporation (DFC) will each contribute $75 million to a joint investment fund under a minerals deal first signed in April. The fund will support Ukraine’s reconstruction and economic recovery, focusing initially on energy, infrastructure, and critical minerals projects. Half of Ukraine’s revenue from new mineral extraction will go into the fund, with profits shared between Kyiv and Washington. The government plans to implement three major projects by the end of 2026, with American partners particularly interested in gas projects. - Reuters

Indonesia central bank makes another surprise rate cut, independence concerns grow:

Indonesia’s central bank, Bank Indonesia, cut its benchmark 7-day reverse repurchase rate by 25 basis points to 4.75%, marking its sixth rate reduction since September 2024. The move aims to support economic growth amid slowing domestic demand, weak credit uptake, and political uncertainty following protests and the sacking of the finance minister. BI also lowered its overnight deposit and lending facility rates. While the rupiah strengthened slightly and the stock market hit a record high, concerns remain over central bank independence and fiscal discipline. Further rate cuts are expected as policymakers prioritize growth support. - Reuters

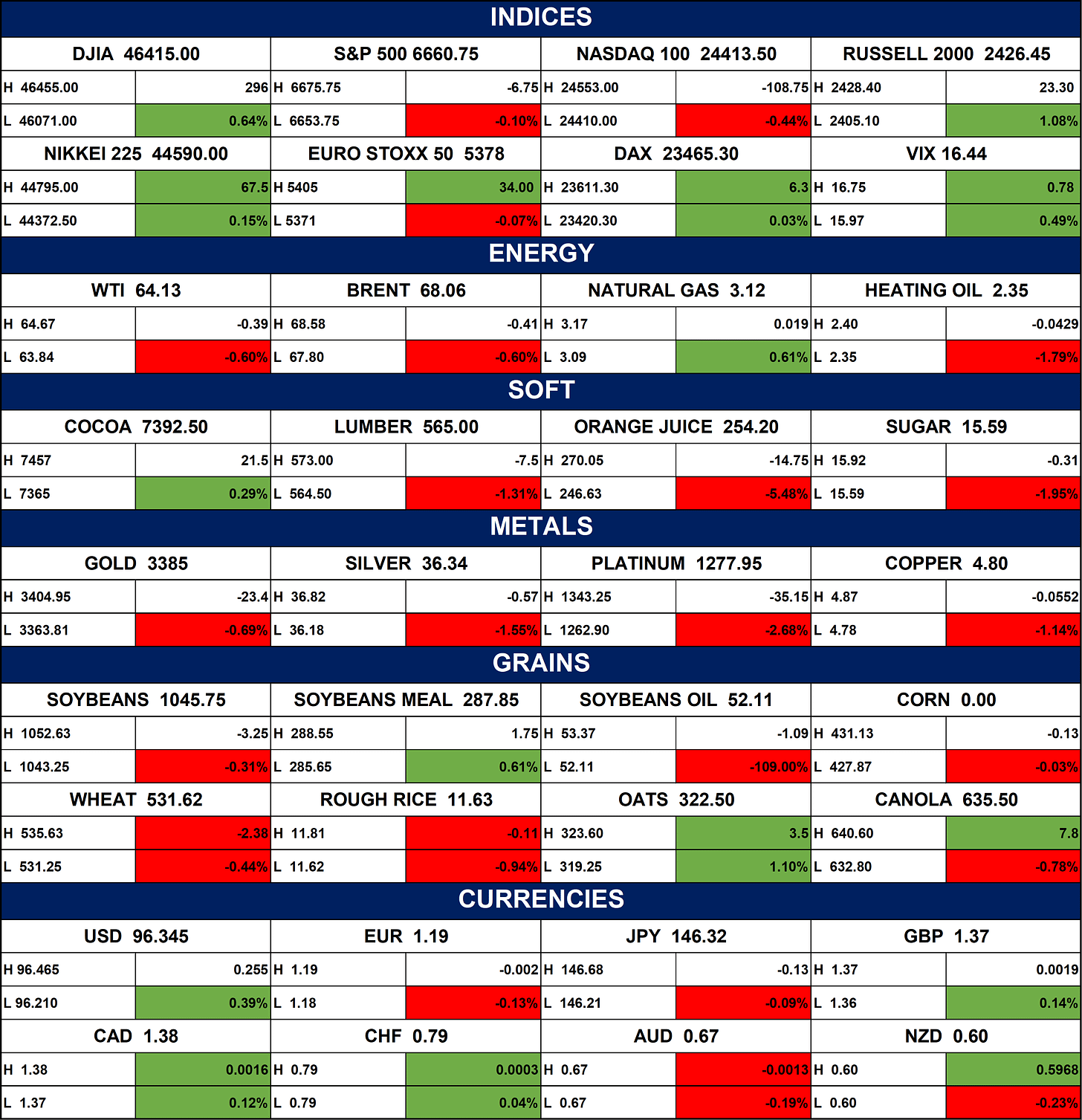

Indices, Commodities & Currencies

The table below depicts that the Global markets were mixed, the Dow and Russell 2000 gained, while the Nasdaq slipped and Europe stayed flat. Oil prices fell, though natural gas edged higher. In commodities, cocoa rose, but orange juice and sugar dropped sharply. Metals were weak across the board, led by platinum. Grains were mostly lower, with oats and soybean meal as exceptions. In currencies, the U.S. dollar strengthened, while the euro, yen, and Aussie weakened.

Fixed Income (USA Bonds)

Events

Conclusion

Nigerian equities may sustain gains into Q4 2025, led by insurance, banking, and consumer goods, but oil & gas weakness, policy risks, and global uncertainties around tariffs, regulations, and energy projects suggest investors should stay selective and prepared for volatility across equities, bonds, and commodities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.