Wealth Wednesday - Nigeria’s Market Confidence Strengthens on Banking, Energy, and Industrial Gains Amid Global Trade and Policy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market update. Nigeria’s financial landscape saw renewed optimism as FirstBank’s $718million arbitration win boosted investor confidence, while power generation rose to 4,871MW and the FG sealed a $400million steel plant deal to spur industrial growth. However, falling oil prices threaten government revenue amid production shortfalls. Globally, South Korea struck a major trade deal with the U.S., Japan resisted pressure to halt Russian LNG imports, Canada signaled the end of its rate-cut cycle, and Poland upheld its ban on Ukrainian grain imports.

Nigerian News & Market Update

OML Dispute- First Bank Victory Against GHL to Boost Investors’ Confidence:

FirstBank’s $718 million arbitration victory over GHL strengthens its balance sheet, boosts profitability, and restores investor confidence in Nigeria’s banking sector. - dmarketforces

Energy supply to 11 DisCos soars to 4,871MW:

Nigeria’s power supply to the 11 DisCos increased to 4,871MW on October 27, 2025, reflecting improved generation and grid performance. - Thenation

Nigeria’s Revenue Threatened As Oil Dips On Russian Sanctions Worries, OPEC+ Output Hike:

Falling oil prices driven by OPEC+ output talks and Russia sanctions doubts threaten Nigeria’s revenue, already below budget projections amid declining crude output. - Channels

FG, Firm Sign $400million Agreement To Establish Integrated Steel Plant In Ogun:

Nigeria’s Steel Ministry and China’s Stellar Steel signed a $400 million deal to build a modern steel plant in Ogun State, boosting industrialisation, jobs, and self-sufficiency in steel production. - Channels

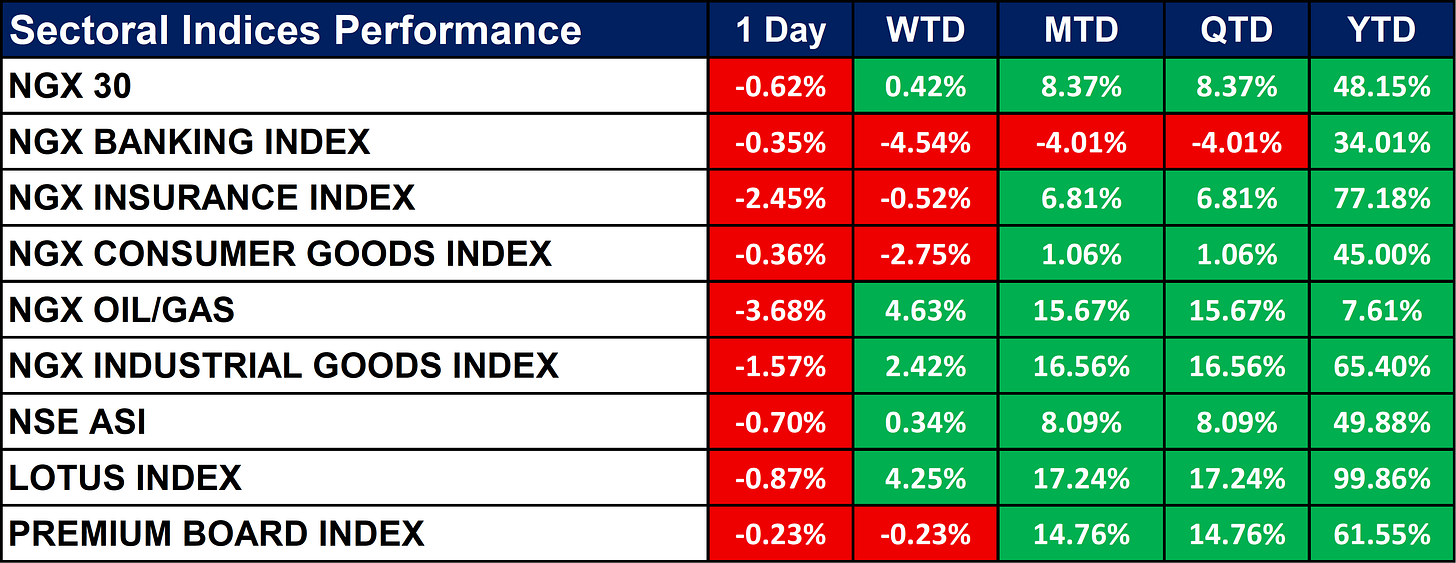

Nigeria Sectoral Indices Performance

The table below shows that Most NGX sector indices declined on the day, led by Oil/Gas (-3.68%) and Insurance (-2.45%). Despite daily losses, monthly and quarterly returns remain strong Industrial Goods (+16.56%) and Lotus Index (+17.24%) lead. Year-to-date, all indices show solid gains, with the Lotus Index (+99.86%) and Insurance (+77.18%) as top performers.

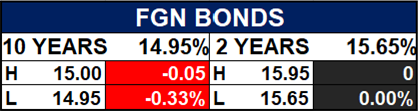

Fixed Income (FGN Bonds)

Corporate Action

Global News & Market Update

South Korea gives details of trade deal struck with the U.S.:

The U.S. and South Korea reached a trade deal cutting auto tariffs to 15% and establishing a $350 billion investment fund with safeguards to protect South Korea’s forex market. - Reuters

Japan PM pushed back against US request to ban Russian energy imports, sources say:

Japan’s Prime Minister Sanae Takaichi told U.S. President Trump that ending Russian LNG imports, which supply 9% of Japan’s needs, would be difficult due to energy security concerns. - Reuters

Bank of Canada trims key interest rate, hints at end to cuts:

The Bank of Canada cut its key interest rate to 2.25%, signaling a likely end to its easing cycle amid slower growth forecasts and efforts to keep inflation near 2%. - Reuters

Poland to uphold ban on imports of some Ukrainian food products:

Poland will maintain its ban on Ukrainian grain and seed imports despite new EU trade rules to protect local farmers from cheap competition. - Reuters

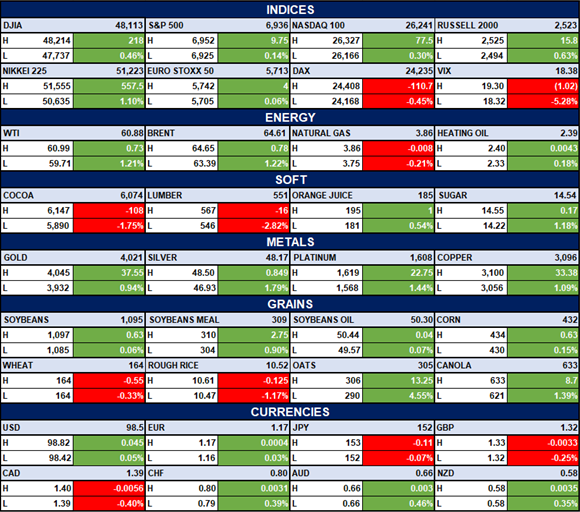

Indices, Commodities & Currencies

The table below depicts that the Global markets are mostly positive major indices like the DJIA, Nikkei 225, and S&P 500 show modest gains, while DAX and VIX decline. Energy commodities (WTI, Brent) rise over 1%, but natural gas slips slightly.

Metals and most grains trend upward, while soft commodities like cocoa and lumber fall; currencies remain mixed with slight USD and EUR gains.

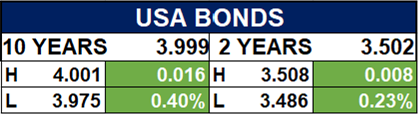

Fixed Income (USA Bonds)

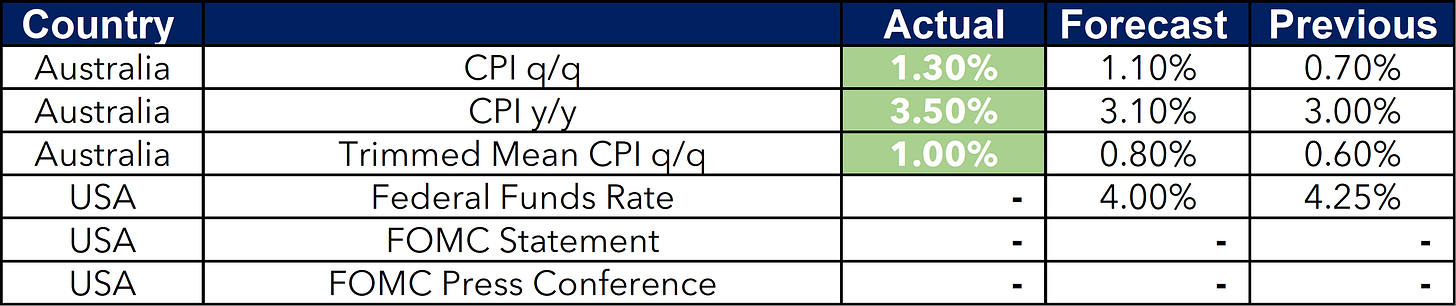

Events

Conclusion

In conclusion, Investors should watch for short-term volatility from oil price weakness and global policy shifts, but Nigeria’s strengthening industrial outlook and global trade stability could support medium-term market gains.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.