Wealth Wednesday - Nigeria’s Reform Momentum Meets Shifting Global Energy and Growth Dynamics

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market brief, where Nigerian markets remain resilient amid policy reforms, fresh investments in mining, energy, and infrastructure, and improving medium-term growth prospects. Key corporate actions, regulatory changes, and sector developments signal ongoing repositioning across energy, industrials, and utilities. Globally, oil demand expectations, trade realignments, and cooling growth in key economies set the tone for risk sentiment and commodity trends.

Nigerian News & Market Update

FG unveils gold refinery, advances $600million lithium plant:

Nigeria has begun operations at a high-purity Lagos gold refinery and is set to commission a $600million lithium processing plant as part of its push to add value locally and position itself as a key global minerals hub. - Punch

FG enforces 0.5% levy on fuel wholesalers:

The Federal Government has begun enforcing a 0.5% levy on the wholesale price of petroleum products and natural gas, making compliance mandatory for fuel suppliers under new downstream regulations. - Punch

SAHCO seals fresh deals, expands airline portfolio:

SAHCO expanded its airline portfolio in 2025 by signing multiple domestic, regional and international carriers, while strengthening safety certifications and setting growth-focused priorities for 2026. - Punch

Presco Appoints Adewale Arikawe As New Non-executive Director:

Presco Plc has appointed Adewale Arikawe as a non-executive director and Group CEO of SIAT, tasking him with overseeing its subsidiaries and driving strategic growth across the group. - Leadership

TotalEnergies to sell 10% stake in Renaissance JV assets in Nigeria:

TotalEnergies has agreed to sell its 10% non-operated stake in Nigeria’s Renaissance JV oil licences to Vaaris, while retaining economic rights to key gas assets supplying Nigeria LNG. - Businessday

World Bank upgrades Nigeria’s growth outlook to 4.4% for 2026:

The World Bank has upgraded Nigeria’s economic growth forecast to 4.4% for 2026 and 2027, citing stronger services activity, agricultural recovery, reforms, and higher oil output. - Premiumtimes

Eko Disco gets MD:

Eko Electricity Distribution Company has appointed Wola Joseph-Condotti as its new CEO, following the resignation of Rekhia Momoh, amid renewed investor interest in the power distribution sector.- TheNation

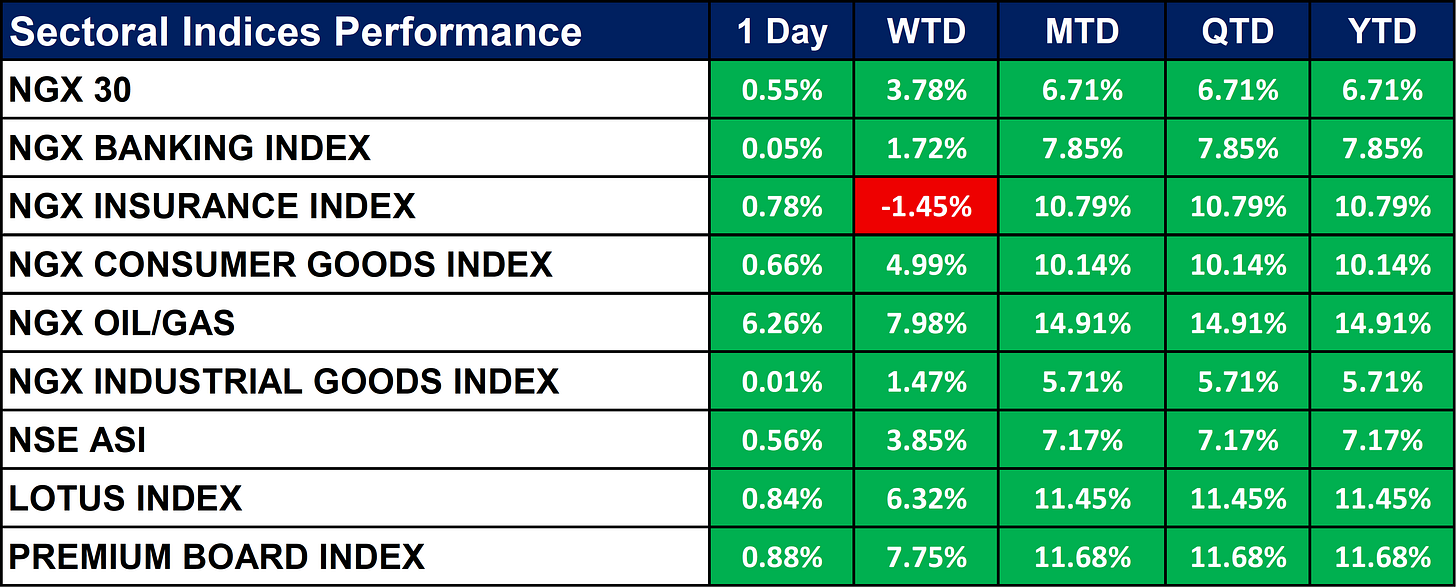

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices closed broadly positive, with Oil & Gas leading gains on strong 1-day, WTD, and YTD performance. Consumer Goods, Insurance, and Premium Board indices also recorded solid MTD and YTD advances, reflecting sustained investor interest. Banking and Industrial Goods posted modest short-term gains but maintained healthy medium-term growth trends.

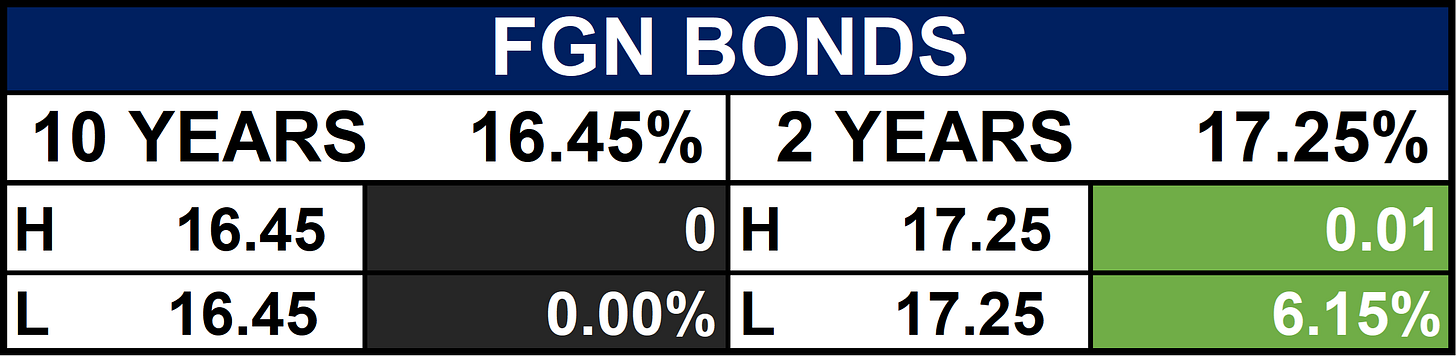

Fixed Income (FGN Bonds)

Global News & Market Update

In first look at 2027, OPEC forecasts ongoing oil demand growth:

OPEC expects global oil demand to grow by about 1.34 million barrels per day in 2027, maintaining a robust outlook and diverging from forecasts that warn of a major supply glut. - Reuters

Venezuelan oil exports to China set to drop as US blockade limits cargoes:

Venezuelan oil exports to China are set to fall sharply from February as a U.S. blockade and vessel seizures disrupt shipments, though China’s stockpiles cushion the immediate impact. - Reuters

Indian Oil buys its first Ecuadorean oil via tender, sources say:

Indian Oil Corp has bought its first Ecuadorean Oriente crude cargo via tender for March delivery, as it diversifies supply to offset disruptions to Russian oil imports caused by sanctions. - Reuters

China’s vehicle sales, exports set to cool in 2026:

China’s vehicle sales and exports are set to slow in 2026, with overall auto sales growth forecast at 1% and EV growth cooling to 15.2% amid weak domestic demand and geopolitical uncertainties. - Reuters

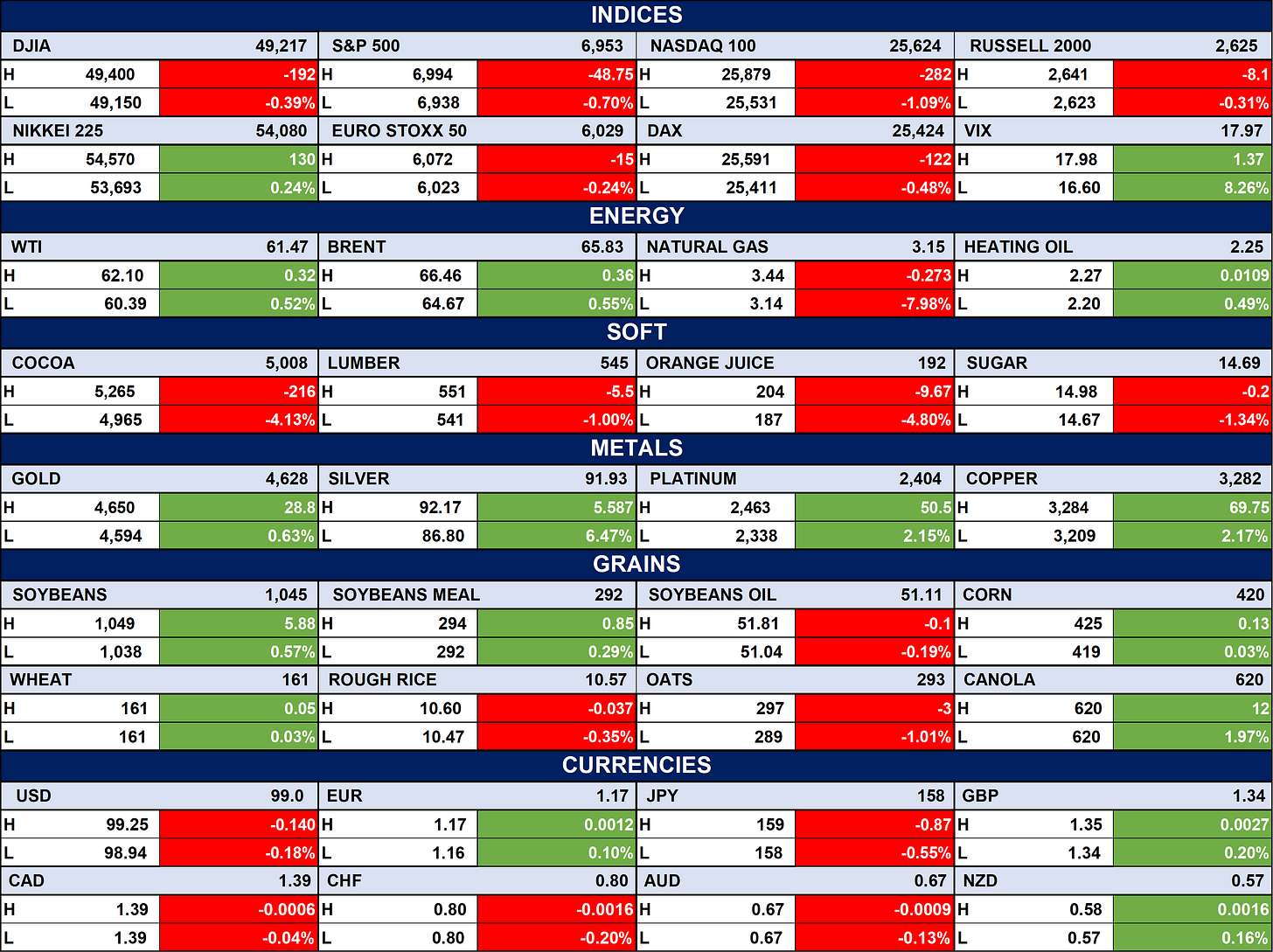

Indices, Commodities & Currencies

The table below depicts that the Global equities closed broadly lower, with losses across U.S. indices and most European markets, while Japan’s Nikkei 225 posted modest gains. Energy prices were mixed as WTI and Brent edged higher, but natural gas declined sharply, and soft commodities showed broad weakness. Metals and select grains were firmer, while currencies were mixed with a softer dollar against major peers amid elevated market volatility.

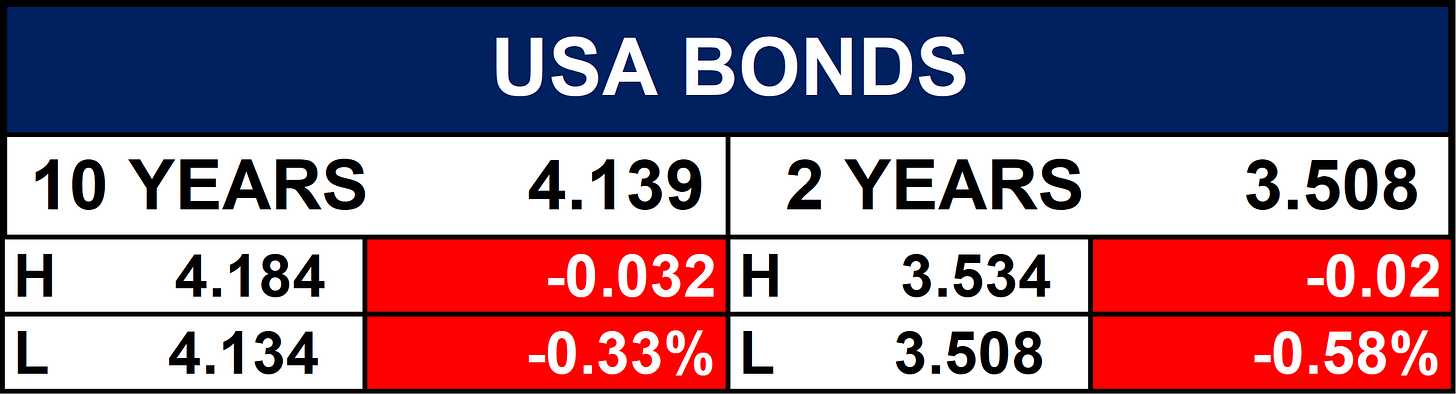

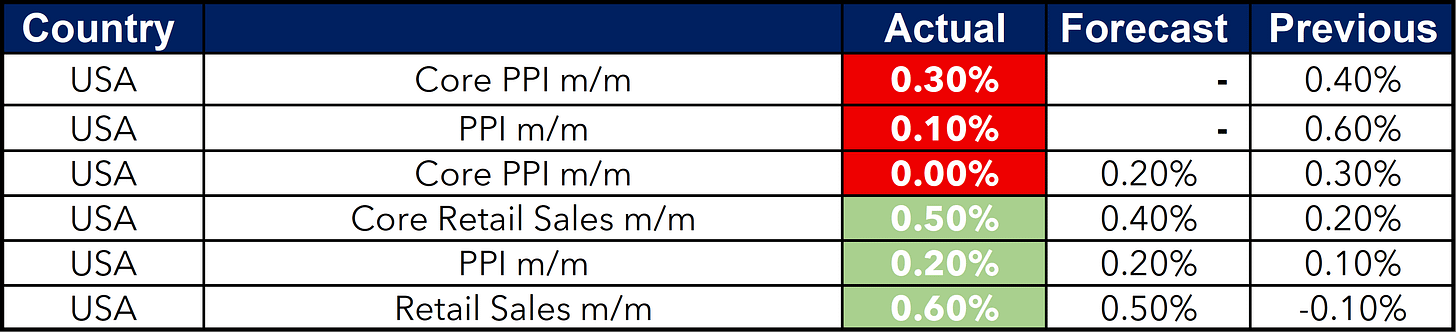

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, investors may see continued interest in Nigeria’s real sector, energy, and select equities as reforms and capital inflows support growth expectations. However, regulatory enforcement, oil market volatility, and global demand shifts could influence asset pricing and capital flows in the near term. Portfolio positioning may increasingly balance domestic reform optimism with global macro and energy-market risks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.