Wealth Wednessday

Ranora Daily - Your daily source for reliable market analysis and news.

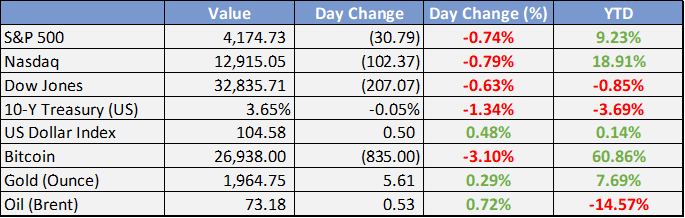

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

FCCPC to clamp down on filling stations hoarding fuel - Business News Report

The Federal Competition and Consumer Protection Commission, with other government agencies, will enforce compliance with regulated fuel prices, aiming to prevent market distortion and protect consumers. Violators face penalties, and consumers are urged to report violations.

Petrol scarcity worsens, black market sells for N800/litre - The Sun

Tinubu's administration started chaotically as oil marketers shut down, causing long queues and stockpiling of petrol. Marketers exploit the situation, creating scarcity and selling petrol at exorbitant prices. The capital city faces fuel queues and black market exploitation, with prices reaching as high as N800/litre.

FG Will Not Place Price Cap On Fuel Price – NMDPRA - Daily Trust

Nigerian petroleum regulator CEO confirms no price cap on petroleum products, urges marketers to open stations. Market will determine prices based on delivery, as directed by NNPCL. Regulatory authorities will ensure compliance with regulations.

Release $802m to foreign carriers - The Nation

NAHCO Chairman calls on government to release trapped funds of foreign airlines held by CBN, emphasizing fairness and credibility. Urges increased confidence for foreign investors in Nigeria.

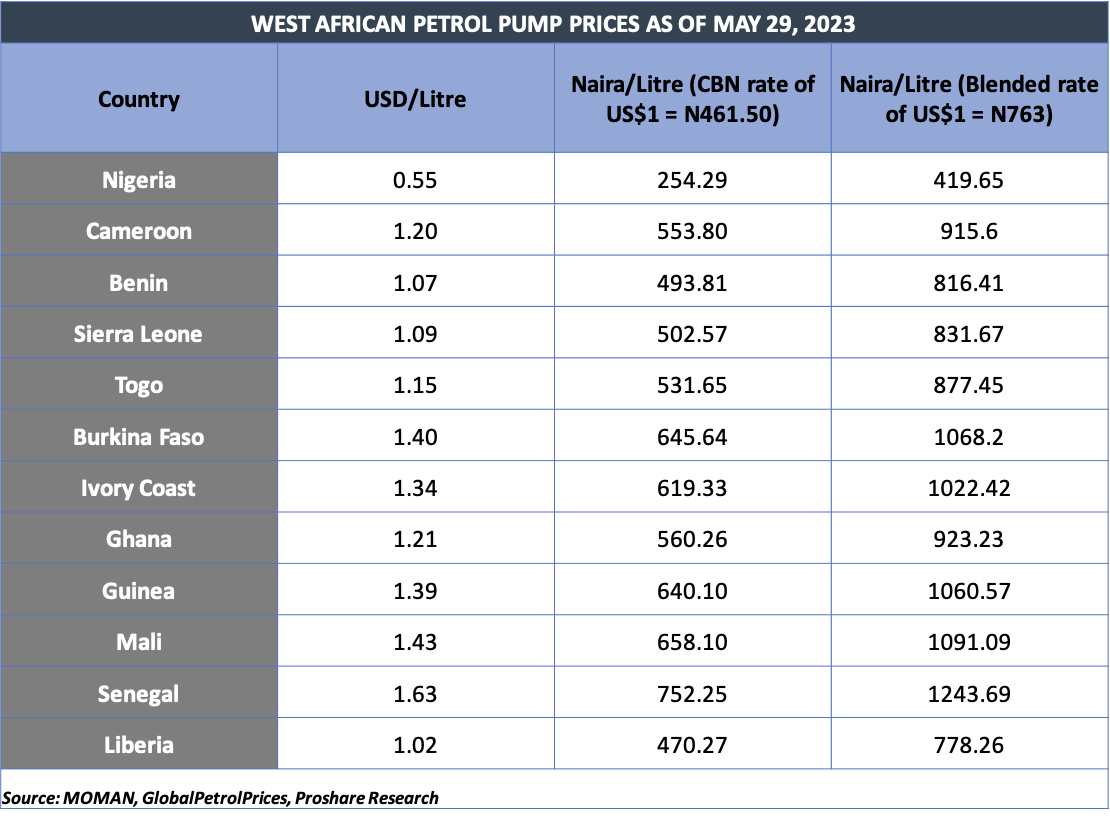

Subsidy Removal Causes Disruption in Nigeria’s Oil Retail Market.

Subsidy removal disrupts Nigeria’s oil retail market, causing petrol prices to jump to around N600 per litre (US$1.3 per litre) from N195 per litre. This double-fold increase in prices, accompanied by long queues, has led to higher transport fares. (See Table below for price comparison)

Global

Today, the House of Representatives will vote on the debt limit deal.

Both President Biden and House Speaker McCarthy are confident they have enough votes to pass it.

The latter, however, faces a small cohort of Republicans who would see him ousted from his position.

According to the Congressional Budget Office (CBO), the deal would trim government spending by $1.5 trillion over the next decade.

The bulk of those reductions come in the form of discretionary spending cuts.

US home prices increased for the second straight month as the Case-Shiller National Home Price Index rose 0.4% in March.

All 20 cities tracked by the index showed price gains.

This reflects the lack of supply being faced by homebuyers as owners remain reluctant to part with low mortgage rates.

On a year-over-year basis, prices increased by 0.7%–the smallest annual gain since May 2012.

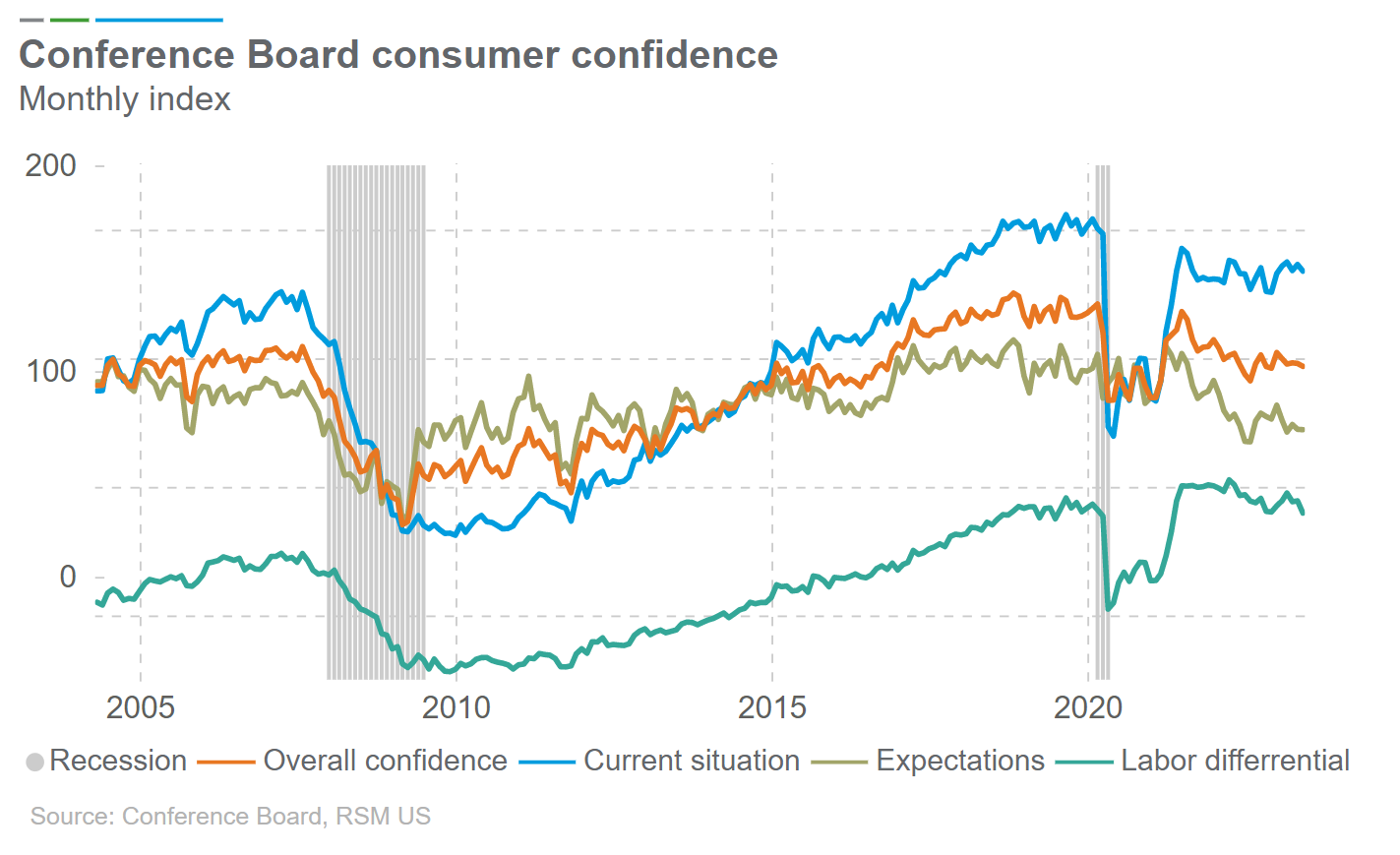

The Conference Board’s index of consumer confidence in April dipped to its lowest since November.

Both current and future expectations declined, as did consumers’ assessment of current employment conditions.

In fact, the labor market differential—which measures those who say jobs are “plentiful” vs. those who say they are “hard to get”—fell to its lowest in 2 years.

This could foreshadow a slowdown in May’s jobs gains (NFP data due Friday).

On the other hand, consumer appetite for buying big-ticket items (cars, homes, major appliances, etc.) increased, suggesting a solid spending outlook.

Restart of Student Loan Payments Included in Debt-Ceiling Deal - Bloomberg

An agreement forged by President Joe Biden and House Speaker Kevin McCarthy would end the moratorium on monthly bills.

Nvidia became the first-ever chipmaker to cross the $1 trillion mark yesterday, albeit briefly.

Semiconductor stocks are enjoying their best monthly performance in over 20 years thanks to the hype around AI.

A group of AI executives, however, may be pouring cold water on the market’s excitement.

Over 350 AI professionals—including Sam Altman and the “godfathers” of AI—signed a one-sentence statement published by the Center for AI Safety:

Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war.

When US lawmakers vote on the debt-limit deal today, they’ll also be voting on fast-tracking the Mountain Valley Pipeline.

As part of the deal, permits for the West Virginia natural gas pipeline would be expedited and environmental reviews curtailed.

The $6.6 billion pipeline is near completion but has faced several years of legal delays.

Pipeline proponents say the project is vital to US domestic energy security while critics argue it would undermine the country’s transition away from fossil fuels and harm marginalized communities

Big Tech vs. small caps

The ratio of Nasdaq 100-to-Russell 2000 is now retesting the peak of the tech bubble levels."

Weekly Investment Watchlist

Market Commentary

Asia and Australia

China’s Official manufacturing PMI was 48.8 in May, below consensus 49.5. - still in contractionary territory. The Caixin PMI data is to be released later today.

Bank of Thailand raises base rate 25 bps to eight-year high at 2%.

Japan’s Industrial production fell 0.4% m/m in April against expectations of a 1.4% gain.

Japan’s Retail sales fell 1.2% m/m vs consensus forecast of a 0.5% rise.

Australian monthly CPI inflation rose to 6.8% y/y in April from 6.3% in March, higher than consensus 6.4%.

China launched a team of three, including the nation’s first civilian astronaut, into orbit on Tuesday in the first crewed mission since the completion of its space station late last year

Europe, Middle East, Africa

France inflationary pressures declining visibly. May CPI was 5.1% vs 5.5% expected and 5.9% prior - weakest data in over a year.

German April import prices declined 7% y/y vs (5.8%) expected and (3.8%) prior, the most since the Covid crisis in 2020.

UK business confidence registers first drop in three months - The Lloyds Bank Business Barometer fell 5 points in May to 28%

EU banks provided more detail on CRE exposure with Q1 results. Average CRE prices declined ~20% from 2022 peak.

The Americas

Cleveland Fed President Mester sees no compelling case to wait before next rate hike

Economists see GOP big spending cuts measure of the debt-ceiling pact as "modest" with little impact likely on the economy

The Week Ahead:

Monday - Markets Closed

Tuesday

S&P Case-Shiller home price index (20 cities) rose 0.4% in March

US Consumer Conference board comes in at 102.3; est 99.

Wednesday

8:15 am ADP employment

10:00 am Job openings

Thursday

8:30 am Initial jobless claims

8:30 am U.S. productivity

9:45 am IS&P U.S. manufacturing PMI

10:00 am ISM manufacturing

Friday

8:30 am U.S. employment report

8:30 am U.S. unemployment rate

8:30 am U.S. hourly wages

8:30 am Hourly wages year over year

Investment Tip of The Day

Identify long-term trends that could shape the future economy and investment landscape. Examples include demographic shifts, technological advancements, and changing consumer preferences. Position your portfolio to benefit from these trends.