Wealth Wednessday

Ranora Daily - Your daily source for reliable market analysis and news.

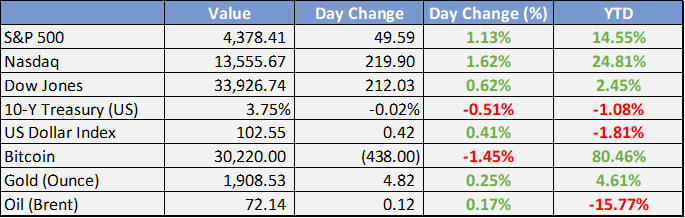

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

50+CEO join forces in new WEF initiative to transform airports into clean energy hubs - Business News Report

The World Economic Forum and Airports Council International have launched the Airports of Tomorrow initiative to transform airports for net-zero aviation, focusing on operational changes, sustainable fuels, capital mobilization, and clean energy infrastructure.Korea to invest in Oil refinery, cyber space, other sectors in Nigeria - Business News Report

The Republic of Korea intends to invest in Nigeria, prioritizing agriculture, energy, natural resources, cyberspace, biotechnology, and oil refinery. The Korean delegation aims to strengthen economic cooperation and explore investment opportunities in these sectors.

Global

US consumers are feeling more optimistic.

The Conference Board’s index of consumer confidence rose to its highest level since January 2022 in June.

Consumers’ view on current conditions jumped to its highest in nearly 2 years while their 6-month outlook also improved.

Inflation expectations fell to their lowest since 2020.

Even so, 69% of consumers still think a recession is likely within the next 12 months.

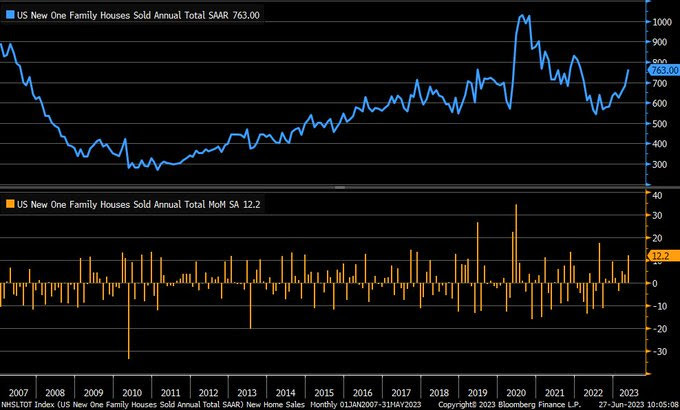

Sales of new US homes increased for the 3rd consecutive month in May, jumping by the most (12.2%) since August 2022 (chart).

The median sales price fell 7.6% YoY to $416,300.

Meanwhile, Case-Shiller home prices similarly rose for the 3rd straight month with prices increasing 0.5% in April.

Despite falling on an annual basis for the first time in 11 years, home prices are just 2.4% below their June 2022 peak

.

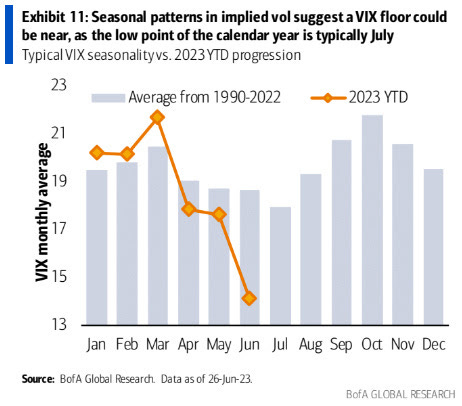

The Volatility Index (VIX) remains near its lowest levels since February 2020.

Fear over a drop in stock prices just ain’t what it used to be.

However, this month has seen more VIX call options traded than any other month on record and as BofA strategist write, “seasonality suggests a VIX floor could be near–even if the catalyst higher remains elusive”.

Are current levels of complacency in line for a reversal?

No recession: President Joe Biden believes the US economy will avoid a recession - Bloomberg

President Joe Biden stated that the US economy is currently strong and he does not anticipate a recession. He made these comments at a private fundraiser in Maryland, ahead of an economic policy speech in Chicago focused on his vision for the economy, termed "Bidenomics."

US dollar to maintain dominance over next decade, say central banks - Financial Times

OMFIF research shows reserve banks anticipate a gradual decline in the US dollar's global reserve share over the next decade, from 58% to 54%. Central banks consider alternatives, with the euro expected to benefit, but inflation control raises concerns.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Latest Bloomberg poll shows PBOC seen lowering the 1-year MLF rate 5 bp and seven-day reverse repo rate 10 bp in Q4.

Australian monthly inflation fell to 5.6% y/y in May from +6.8% in April, undershooting consensus for a 6.1% read. Inflation fell to lowest since April 2022, driven largely by drop in fuel prices.

Profits at industrial firms in China declined 18.8% y/y in Jan.- May, slower than 20.6% drop in first four months of 2023.Profits for May alone fell 12.6% y/y,versus a 18.2% y/y drop for April.

Japanese policymakers and business leaders appear far more sanguine about recent yen weakness than they were last year, a sign they see declines as temporary. There is some speculation of an intervention if the Yen falls too low but, at this point it’s still speculation.

Samsung beefs up chip foundry business as it looks to challenge TSMC.

Europe, Middle East, Africa

Hawkish members of the ECB Governing Council are looking towards a faster pace of balance sheet reduction to ensure it meets its inflation aim, even as it closes in on terminal rate.

Eurozone money supply data shows impact ECB tightening having on credit conditions. M3 money supply growth up 1.4% y/y in May versus consensus 1.5% and prior 1.9%.

Italian inflation cools to 14-month low. June Italian CPI cools to +6.7% y/y vs consensus of +6.7% and prior month reading of +8.0%. On the month, CPI in at +0.1% in June vs consensus +0.1% and prior +0.3%.

UBS to cut more than half of Credit Suisse workforce.

Meloni government picks ECB's Panetta as Bank of Italy Governor.

The Americas

Biden administration is considering new restrictions on exports of AI chips to China. Commerce Department could act as soon as early July to stop shipments of chips made by Nvidia and other chip makers to China.

Boeing says China has resumed ~90% of commercial operation of 737 MAX fleet as of the end of June.

Canadian CPI rose 3.4% y/y in May, roughly matching consensus and down from 4.4% in April. Marks lowest annual pace of headline inflation since June 2021.

Money-market funds exiting RRP and buying bills.

The Week Ahead:

U.S Economic Events

Tuesday

US June Consumer conference board comes in at 109.7; est: 104

US May new home sales come in at 763k; est: 675k

US May durable goods orders come in at +1.7%; est: -1.0%.

Wednesday

8:30 am Advanced U.S. trade balance in goods

9:30 am Fed Chair Powell speaks

Thursday

2:30 am Fed Chair Powell speaks

8:30 am Initial jobless claims

10:00 am Pending home sales

Friday

8:30 am PCE index

8:30 am Core PCE index

8:30 am PCE (year-over-year)

8:30 am Core PCE (year-over-year)

9:45 am Chicago Business Barometer

10:00 am Consumer sentiment (final)

Investment Tip of The Day

Review and update your financial goals and milestones. As your circumstances change, it's important to adjust your goals to reflect new priorities and aspirations. Regularly revisit and refine your goals to stay on track.