Wealth Wednessday

Ranora Daily - Your daily source for reliable market analysis and news.

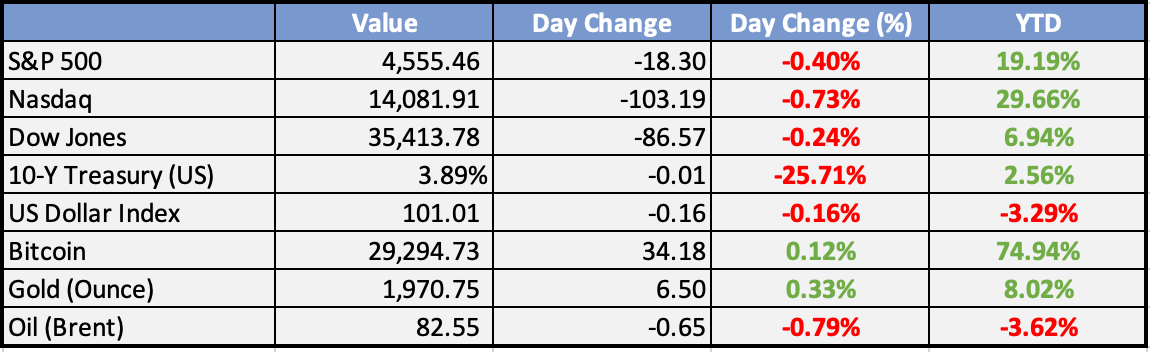

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Nigerians demand reforms as Tinubu submits ministerial list - Punch

Nigerians have reacted with mixed reactions to the ministerial list submitted by President Muhammadu Buhari. Some have called for reforms, while others have welcomed the list. The list includes a number of familiar faces, as well as some new names.NLC mobilises for nationwide strike over fuel subsidy removal - The sun

The Nigeria Labour Congress (NLC) has said that it will mobilize for a nationwide strike if the government goes ahead with the removal of fuel subsidy. The NLC argues that the removal of subsidy will lead to an increase in the price of fuel, which will have a negative impact on the lives of ordinary Nigerians.CBN vows to tackle forex pressure, raises lending rate - Punch

The Central Bank of Nigeria (CBN) has raised its benchmark lending rate by 100 basis points to 13% in an effort to tackle forex pressure. The CBN said that the increase in the lending rate is necessary to attract foreign investors and reduce the demand for foreign currency.IMF Retains Nigeria’s 2023 Growth Projection at 3.2% - This Day

The International Monetary Fund (IMF) has retained Nigeria's 2023 growth projection at 3.2%. The IMF said that the growth outlook is supported by the recovery in oil prices and the implementation of structural reforms. However, the IMF warned that the outlook is subject to downside risks, including the war in Ukraine and the impact of rising interest rates.CBN raises monetary policy rate less than expected - Nigeria Business News

The Central Bank of Nigeria (CBN) raised its benchmark interest rate by 50 basis points to 13% in an effort to control inflation. The decision was made at the Monetary Policy Committee (MPC) meeting held on July 26, 2023. The MPC noted that inflation has remained elevated in recent months, reaching 17.71% in June 2023.

CBN vows to tackle forex pressure, raises lending rate - Punch

The acting Governor of the Central Bank of Nigeria, Folashodun Shonubi, assured that the bank would address the exchange rate pressure as the naira continues to slide against the dollar, intervening in the market to stabilize the situation.

Global

The International Monetary Fund (IMF) sees global GDP expanding by 3% in 2023.

That’s up from its estimate of 2.8% in April but down from last year’s 3.8%.

It left its projection for 2024 growth unchanged at 3%.

Despite the upgrade, the IMF warned that risks remain “tilted to the downside”.

Those risks include tighter credit conditions, waning savings, and a weak recovery in China

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Greater China equity markets rebounded significantly Tuesday, recovering from multi-month lows reached on Monday. The Hang Seng gained 4.1% and the Shenzen Index up 2.5%. Traders focused on politburo officials’ pledge to ramp up policy support by boosting consumer demand, giving greater help for property sector.

South Korea GDP slightly ahead of expectations, but details soft. GDP expanded 0.6% QoQ in Q2, compared to consensus 0.5% and follows 0.3% in the previous quarter. However, private consumption and gross fixed capital formation were both negative.

Sri Lanka rupee sinks as interest rate cuts, loosening of import controls weigh

Cereal shortages may fuel inflation in India as rice, corn and wheat prices rise substantially

Europe, Middle East, Africa

The German Ifo business climate survey for July sees further deterioration to 87.3 versus consensus 88.0 and prior 88.5.

Most recent ECB bank lending survey showed record drop in company loan demand to all-time low since start of survey in 2003. Credit conditions tightened more than expected in Q2.

The BoE quarterly update on its Asset Purchase Facility (APF) projected a net loss of ~£100B by 2033 based on prevailing market rate path.

UK pledges crackdown on harmful ads on Google and other web platforms

The Americas

Growing US labor supply helping to limit wage growth, making it easier for Fed to achieve soft landing

JPMorgan’s Kolanovic sticks with bearish call on US stocks, citing weak breadth and lagged effect of policy tightening

General Motors reports Q2 EPS beat $1.91 ex-items vs FactSet $1.86; Revenue beat $44.75B vs FactSet $42.13B; Raises Net Income forecast by close to $1B.

Verizon Communications reports Q2 EPS beat $1.21 ex-items vs FactSet $1.17; Revenue miss $32.6B vs FactSet $33.30B

The Week Ahead:

Monday:

Tuesday:

US Consumer confidence came in at 117; est: 112 (2 year high).

House Price Index

Wednesday:

MBA Purchase Index

New Home Sales

Building Permits Final

Thursday:

Initial Jobless Claims

Friday:

Core PCE Price Index YoY

Investment Tip of The Day

Stay updated on trends and developments in the financial technology (fintech) sector, as technological innovation can create investment opportunities in areas such as digital payments and online banking.