Wealth Wednessday

Ranora Daily - Your daily source for reliable market analysis and news.

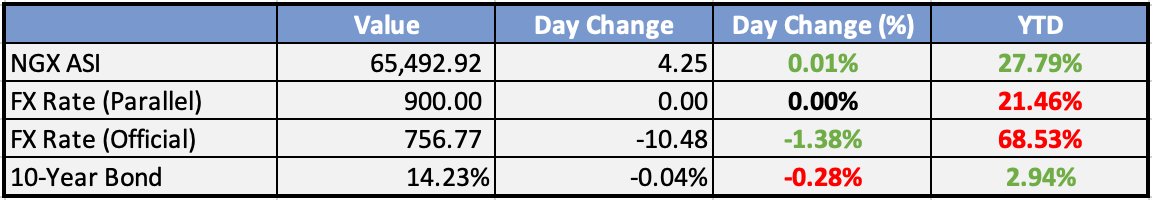

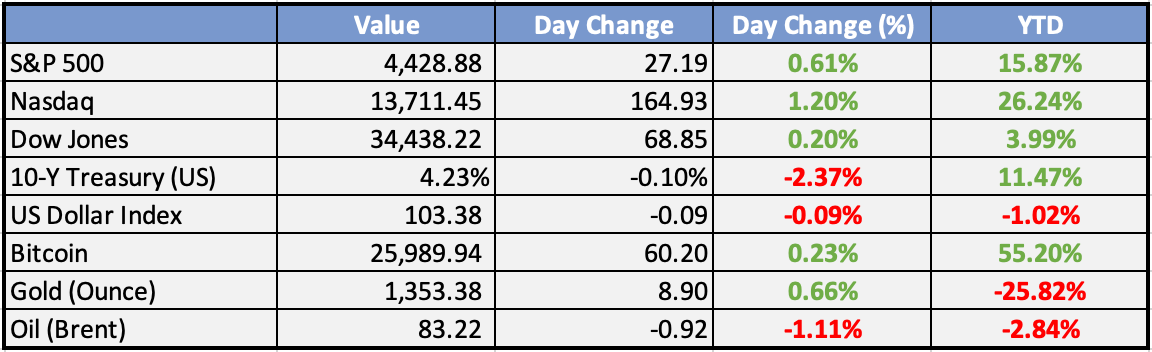

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

FG ignores 17-year-old concession fee debts, renews terminal leases - The Guardian

The Nigerian Federal Government renews terminal leases despite ignored concession fee debts and violated contract terms. Lack of legislative support for 2006 port concessions and unclear regulations enable non-compliance. Political forces and vested interests are allegedly influencing the renewal process, triggering concerns about transparency and fair oversight.

Bagudu becomes minister amidst US asset probe - BNR

Atiku Bagudu, the newly appointed minister of budget and planning, is facing a probe by the US Department of Justice over allegations of money laundering and embezzlement. The probe is ongoing, and Bagudu has denied any wrongdoing. He has said that he is cooperating with the authorities and that he is confident that he will be cleared of all charges.

Global

US existing-home sales slide on higher rates, lean inventory - Bloomberg

US existing home sales dropped 2.2% in July, reaching a six-month low due to homeowners holding onto affordable mortgages. High mortgage rates and limited inventory are affecting the market, leading to higher prices and an uncertain recovery timeline.Iran aims to boost oil output, complicating OPEC+ and US efforts - Bloomberg

Amid easing diplomatic tensions with the US and growing exports to China, Iran plans to increase oil production, targeting 3.4 million barrels per day by summer's end. This surge could complicate OPEC+ efforts to stabilize oil prices, as Iran's exports are on the rise.BRICS divisions re-emerge ahead of critical expansion debate - Reuters

BRICS leaders convened to strategize the group's future, focusing on potential expansion and reducing reliance on the U.S. dollar. Amid tensions from the Ukraine conflict, China and Russia aim to counter Western dominance through strengthening the bloc.

Weekly Investment Watchlist

Market Commentary

Asia and Australia:

Asia equities were mostly higher on Wednesday in a quiet session. Hong Kong had a volatile day, slightly higher, while mainland bourses were down sharply.

Overseas funds have been fleeing mainland China equity markets for the thirteenth straight session, shedding more than CNY10 billion via Stock Connect.

Various Chinese ministries, including CSRC, MoF, NDRC, and State Taxation Administration, have jointly issued preferential tax and fee policies to drive capital market development.

Japan’s PM Kishida is planning to extend energy subsidies, providing a mild boost to growth and price outlook.

Japan’s flash manufacturing PMI remained in contraction at 49.7 in August, edging up from 49.6 in the previous month.

Baidu’s revenue outperformed as its ChatGPT-style AI awaits Beijing’s approval.

Bank of Korea (BOK) is set to hold rates amid increasing risks to economic growth.

Europe, Middle East, Africa:

European equity markets were higher, with defensives outperforming and healthcare being the star performer. Cyclicals lagged, with energy being the main decliner.

The current flash composite PMI for the Eurozone indicates that the private sector is contracting, with little hope for improvement in the near future due to high policy rates and rising yields.

The UK’s flash PMIs for August showed a very weak picture for the economy, with the composite PMI hitting a 31-month low of 49.9. Manufacturing was at 42.5, and services were at 48.7, indicating a falling private sector output at the fastest rate since January 2021.

Bank of England (BoE) analysis indicated that the share of non-financial UK companies facing debt stress is expected to rise to 50% by the year-end.

The Americas:

After poor Flash PMI numbers from Japan, Europe, and the UK, attention is on the US PMI numbers. A softening in the services number could indicate the Fed’s tightening is beginning to work, potentially leading to a softer job market.

Foreign investors are selling short-dated Treasuries, suggesting the case for an additional yield rise. Higher long-term yields are being anticipated due to Treasury’s $1 trillion issuance.

Analysts are sharing views on Jackson Hole, with most seeing rates as being too high. The Jackson Hole speech could potentially temper this view, benefiting risk assets. The speech is expected to leave the door open for further rate hikes.

The Week Ahead:

Monday:

China PBOC Interest Rate Decision

Tuesday:

US Existing Home Sales Change (MoM)(Jul)

Wednesday:

S&P Global/CIPS Composite PMI (Aug) PREL (UK)

Retail Sales (MoM)(Jun) (Canada)

S&P Global Manufacturing PMI (Aug) PREL(US)

Consumer Confidence (Aug) PREL (EU)

Thursday:

ECB Monetary Policy Meeting Accounts (EU)

Durable Goods Orders (Jul)

Friday:

GFK Consumer Confidence (Aug) (UK)

Investment Tip of The Day

Stay Informed About Global Economic Conditions: Regularly analyze global economic indicators like GDP growth, inflation rates, and unemployment figures. Understanding macroeconomic trends provides insights into potential investment opportunities and risks.