Wealth Wednessday

Ranora Daily - Your daily source for reliable market analysis and news.

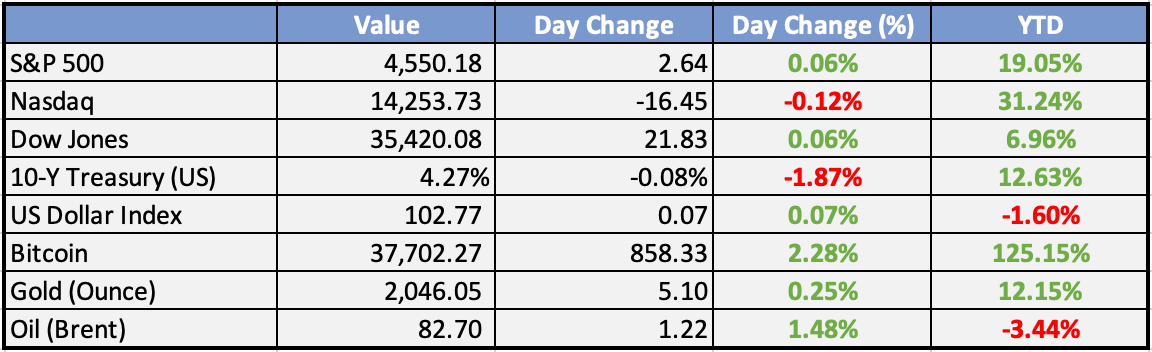

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

FG seeks Senate’s approval for $8.69bn, 100m Euro facilities - Nigeria Business News

Senate President, Godswill Akpabio, has at Senate plenary session read a letter from President Bola Ahmed Tinubu seeking approval of $8,699,168,559 and €100 million loans as part of the federal Government’s 2022-2024 external borrowing plan

Nigeria, Angola reject OPEC’s oil quota cut - Punch

Nigeria and Angola have opposed a reduction in their crude oil production quotas by the Organisation of Petroleum Exporting Countries.

Global

US Mortgage Applications for Home Purchases Rise for Fourth Week - Bloomberg

Mortgage applications for home purchases increased for a fourth week, the longest stretch of gains since March, as borrowing costs eased. The MBA's index of purchase applications rose 4.7% to a two-month high. The contract rate on a 30-year fixed mortgage fell four basis points to 7.37%, the lowest since mid-September.

Oil gains ahead of OPEC+ meeting as Black Sea shutdowns support - Reuters

Oil prices rose on Wednesday, with Brent crude futures climbing 86 cents, or 1.1%, to $82.54 a barrel at 1031 GMT, while U.S. West Texas Intermediate (WTI) crude futures gained 93 cents, or 1.2%, at $77.34 a barrel. The rise was driven by investor expectations that OPEC+ will extend or deepen supply cuts, as well as supply disruption caused by a storm in the Black Sea and lower U.S. inventories.

Global GDP growth to fall to 2.7% in 2024 - OECD

The global economy is projected to grow by 2.9% in 2023, and then slow slightly to 2.7% in 2024 before recovering to 3.0% in 2025. Asia is expected to remain the main driver of global growth in 2024-25, just as it has been in 2023.

Daily Market Commentary

Overview

Dovish Fed comments lead to multi-month lows in US bond yields.

US dollar weakens, boosting AUD to 0.6650, its highest since August 1.

Currencies/Macro:

US dollar declines against all G10 currencies.

EUR/USD rises from 1.0935 to 1.1009; USD/JPY falls from 148.83 to 147.33.

AUD reaches 0.6666, highest since August 1.

Fed governors Waller and Bowman express varying degrees of hawkishness.

Chicago Fed president Goolsbee notes progress on inflation outside the food sector.

Mixed economic indicators, including house price data and consumer confidence.

ECB’s Nagel reiterates concerns about high inflation.

BoE Deputy Governor Ramsden cautions against premature rate cut pricing.

Interest Rates:

US 2yr treasury yield falls from 4.89% to 4.74%; 10yr yield from 4.39% to 4.33%.

Market expects no change in Fed funds rate on December 14; 70% chance of rate cut by May 2024.

Australian 3yr government bond yields fall; no hike expected next week, 50% chance by February 2024.

New Zealand rates markets project unchanged OCR on November 29 and in February; 40% chance of rate cut in May 2024.

Commodities:

Crude markets rebound despite OPEC deadlock concerns.

January WTI contract rises to $76.38; January Brent contract increases to $81.56.

Security risks reported in shipping lanes near Yemen and Somalia.

US natural gas futures settle at two-month lows; loaded LNG vessels face potential disruptions.

Metals surge as lower US dollar boosts sentiment.

Copper rises 1% to $8,451; nickel surges 4% to $16,730.

Gold jumps 1.3% to $2,040, up 2% for the week.

Iron ore shows signs of China’s NDRC intervention, impacting prices.

Day Ahead:

Eurozone: Slight improvement expected in economic confidence (November, market forecast: 93.6pts).

US: Low growth anticipated in wholesale inventories (October); small upward revision expected in second estimate of Q3 GDP.

Federal Reserve’s Beige Book provides regional economic insights.

Cleveland Fed president Loretta Mester scheduled to speak.

The Week Ahead:

Monday:

Tuesday:

US CB Consumer Confidence increased in November to 102.0

Wednesday:

Prelim GDP q/q (US)

Thursday:

Core PCE Price Index m/m (US)

Unemployment Claims (US)

Friday:

ISM Manufacturing PMI (US)

Investment Tip of The Day

Stay Cautious of Concentrated Positions: Be mindful of concentrated positions in individual stocks or sectors. Diversify to reduce the impact of poor performance in a specific area.